NEO’s price is currently at a crossroads as its price is trying to beat the $39.6 pivot point

Fundamentals and past price performance

Initially known as Antshares, NEO was considered China’s first-ever public blockchain when it was launched in early 2014. The project subsequently rebranded itself into Neo three years later and is now seen by some as the Chinese version of the Ethereum blockchain.

NEO’s recent price gain can be attributed to the overall crypto market price gain, as well as it getting closer to NEO’s testnet rollout on 31 March.

Fasten your belts, the flight begins#neo #Neo3 🚀🚀🚀 pic.twitter.com/C4TfAS1gmU

— Dr crypto ⚡ (@007forevers) March 3, 2021

NEO managed to lose 3.07% week-over-week. When compared to other cryptocurrencies, both BTC and ETH outperformed it just slightly as they posted smaller losses (1.20% and 2.71%, respectively). NEO is currently the 33rd-largest cryptocurrency by market cap, boasting a market value of $2.82 billion.

At the time of writing, NEO is trading for $39.60, which represents a price increase of 9.71% when compared to the previous month’s value.

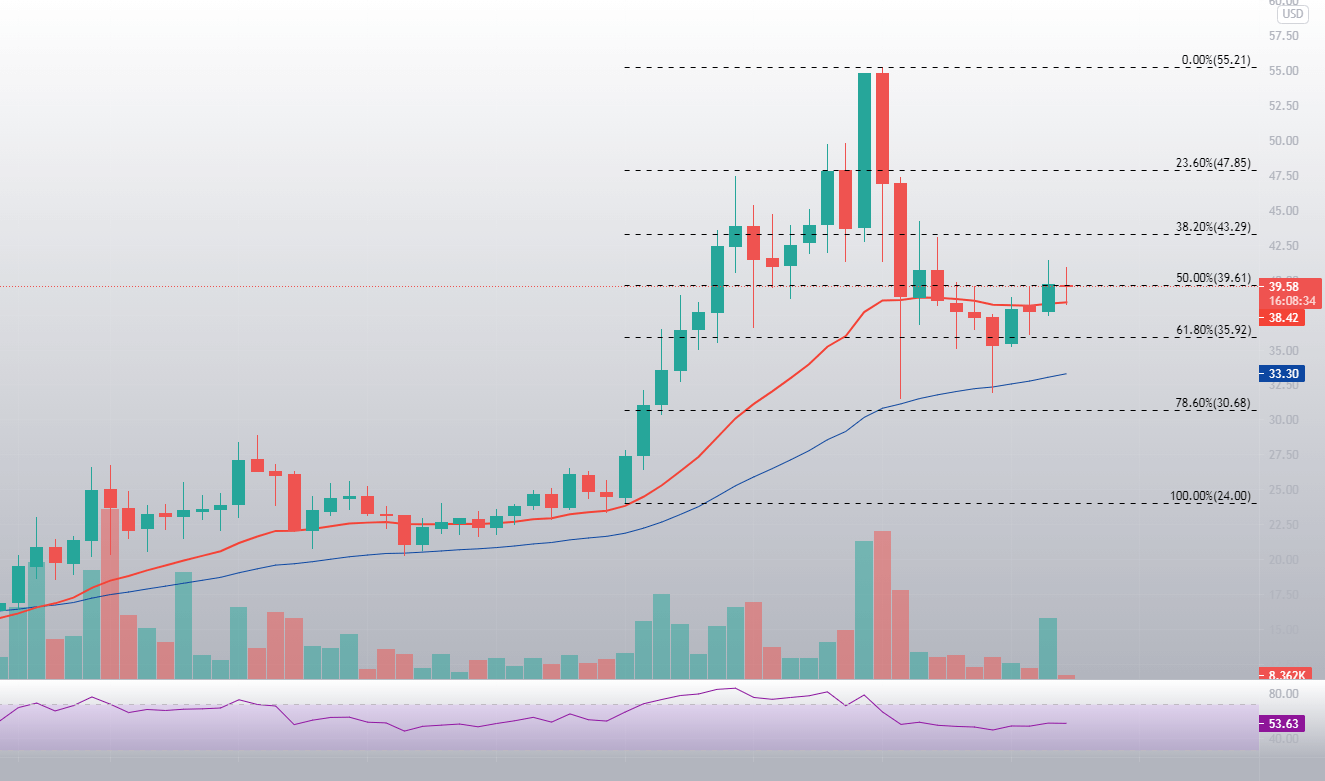

NEO/USD daily chart price analysis

NEO has been in retracement mode ever since it hit its $55 high on 21 February. However, the cryptocurrency managed to find support in the 50-day EMA and push itself back up.

The cryptocurrency is now at a crossroads, as it faces very strong resistance at the 50% Fib retracement level. This pivot point is crucial for NEO’s short-term trading, and the cryptocurrency will need to post a daily candle above it to remain bullish.

NEO’s current price push is supported by the 21-day EMA, which seems to hold its downside pretty well.

NEO/USD daily price chart. Source: TradingView

NEO’s RSI on the daily timeframe is slowly moving towards the overbought area, but is still far away from it. Its current value is sitting at 53.63.

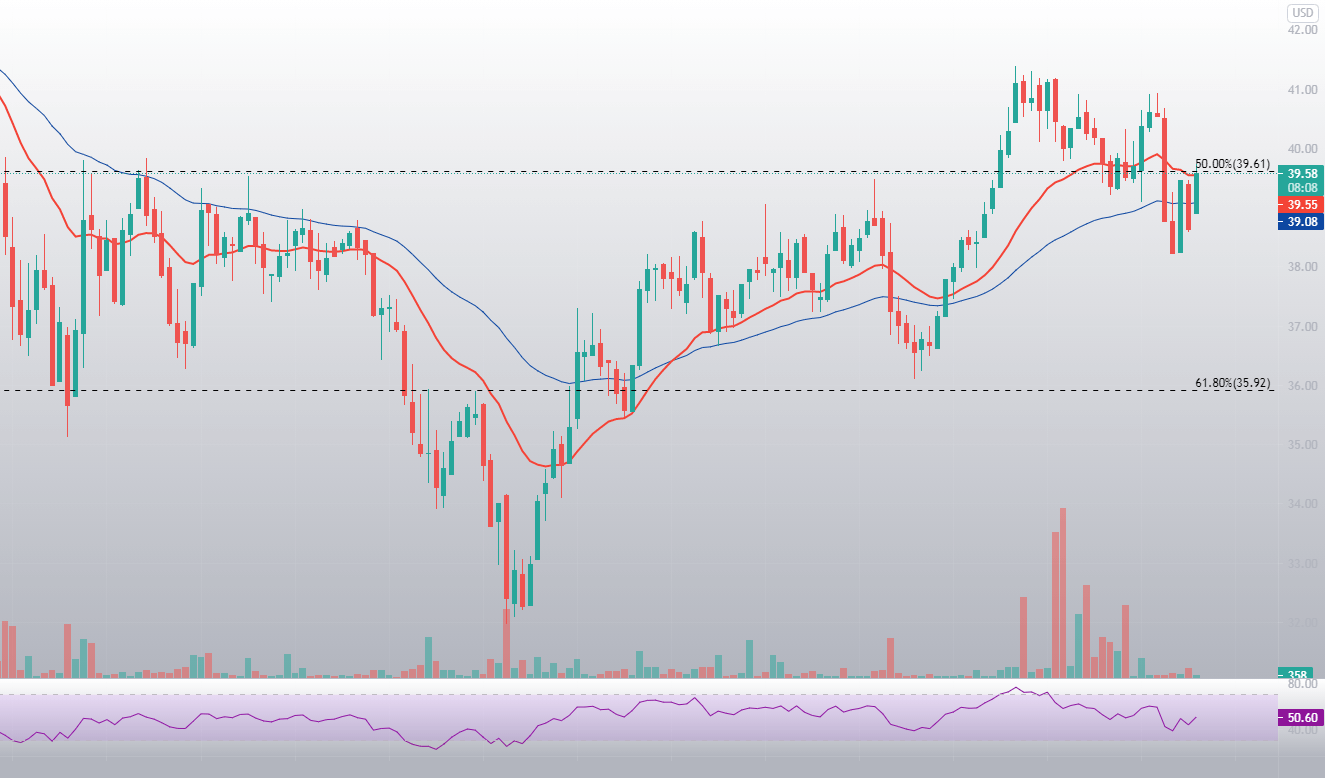

NEO/USD hourly chart price analysis

Zooming in to the hourly timeframe, we can see that NEO had a great few days of trading after it found support near $32. However, the recent push above the 50% Fib retracement level was unsuccessful so far, with the $39.60 level acting as the main turning point.

NEO/USD 1-hour chart. Source: TradingView

NEO’s push above the $39.6 mark (or its failure to do so) will determine its short-term trading future.