Polkadot is recovering from recent losses, but the cryptocurrency is still struggling to overcome its short-term resistance levels near $24.50.

The cryptocurrency market continued its recovery from its recent dip, with Bitcoin rising by 4% to currently trade around $40,000 per coin. Ether is also rallying and is closing in on $3,000 again.

Polkadot is also recovering, with the cryptocurrency’s price rising by 9.5% in the last 24 hours. However, it continues to struggle to break past its short-term resistance level, hampering its rally. Despite that, some experts are bullish on Polkadot’s long-term price potential.

Still standing by, peak high bull cycle prediction; #Bitcoin to $350,000-450,000#Ethereum to $10,000-17,500#Polkadot to $250-350#Chainlink to $250-350#Cardano to $10-20#Zilliqa to $5-7#Elrond to $500-750#DIA to $50-75

Some might be conservative.

— Michaël van de Poppe (@CryptoMichNL) May 26, 2021

DOT price outlook

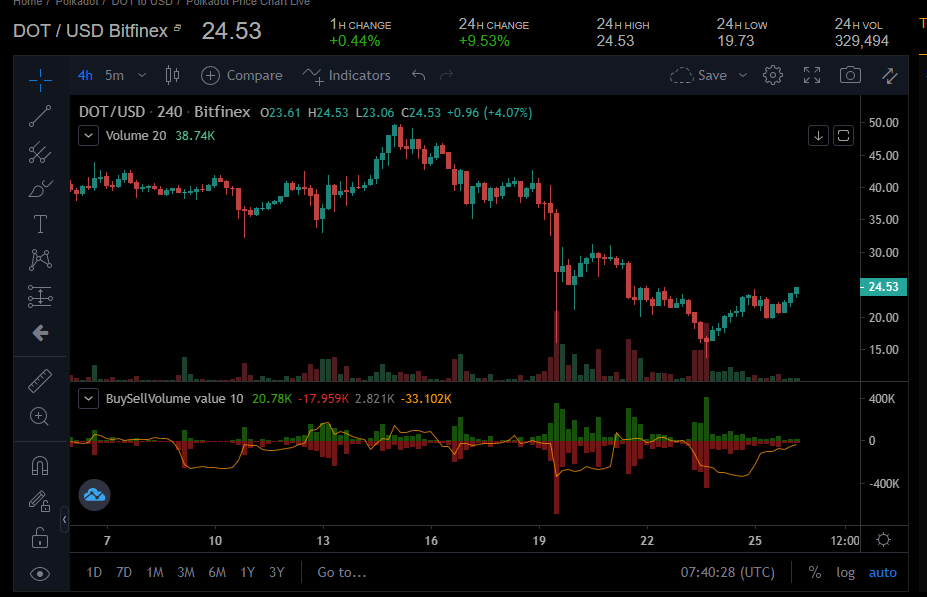

Polkadot is one of the best performers amongst the leading cryptocurrencies over the past 24 hours. DOT is currently up by nearly 10% against the USD over the past 24 hours. However, it has found it hard to break past the short-term resistance levels near $24.50.

If the DOT/USD pair surpasses that resistance level, it would give the bulls the needed momentum to target the next resistant point at $28.58. An extended rally could see DOT surpass $30 soon. However, it is still some way off from its all-time high of $50 achieved earlier this month.

DOT/USD 4-hour chart. Source: Coinalyze

DOT’s technical indicators are still bearish, but this is understood considering the cryptocurrency’s price is down over the past week. If DOT/USD cannot overcome the short-term resistance level and continues to trade around $23, speculators could suspect that more bearish activity can be produced.

However, cautious sellers in the market with bearish perspectives may want to wait for smaller reversals higher within Polkadot to activate their short positions. They could aim for support as a take-profit plan. DOT could slip below the $20 mark if the bears regain control of the market.