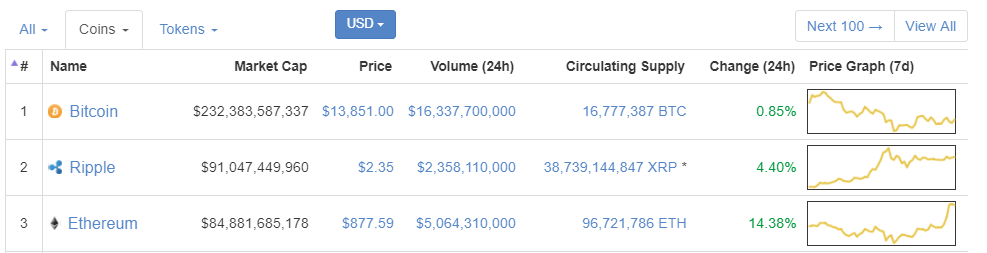

Ripple is now the second biggest cryptocurrency by market capitalization. The digital currency saw a record surge on Saturday after a number of Japanese financial institutions said they were adopting it. Ripple now has a market cap of more than $85bn displacing ethereum from the second spot.

Ripple Vs Ethereum

Ethereum now has $74bn in market capitalisation. Each unit now sells for $3.5 on bitfinex gaining close to 58,900% in value since the start of 2017 when it was selling at $0.006. This by far outpaces bitcoin’s 1400% gain in 2017. XRP has gained over 1000% in just three weeks. Prices were around $0.24 at the beginning of December.

Ripple’s surge is almost always tied to that of the flagship bitcoin. In many cases, it has exceeded it.

Ripple’s surge was at its highest on Friday when it gained more than 50%, a momentum it maintained throughout the weekend. At one point its total value stood at $100bn.

Cryptocurrency markets briefly surged on New Year by about 10% before falling flat in the course of the day.

“Proud to be ending 2017 with incredible momentum on a number of fronts! A huge, heartfelt thank you to the amazing @Ripple team, our great partners and an incredibly supportive $XRP community,” Brad Garlinghouse, Ripple’s CEO said in a Twitter post.

The digital currency is tailored for the financial world and is set to make cheaper and quicker global transfers of money possible.

Ripple is already working with banks and other financial institutions to make this become a reality. Transfers of any currency are now possible within four seconds. Sending money is as easy as buying XRP is a London exchange and sending it across the world where the receiver can convert it to the local currency.

Banks Adopting Ripple

Over 100 financial institutions have already adopted the payment processing network including large players like JP Morgan, HSBC and Standard Chartered.

It is estimated that cost savings from using the network will be more than 60% if banks adopt both the software and the XRP cryptocurrency or 30% if they adopt the software alone. The third generation blockchain technology it uses allows for much faster transfers. Bitcoin and ethereum networks perform dismally in terms of speed.

For instance takes between 10-30 minutes to process a transaction on bitcoin and about 15 minutes on ethereum. Ripple on the other hand can process transactions in three seconds and it can handle more than 1500 transactions per second. This sets it on course to replace the old SWIFT system the technology which has dominated bank transfers for several years now. It typically takes about five days to complete a transfer with the SWIFT system.

Ripple’s transaction fees are affordable making it suitable for everyday transactions. Bitcoin is however burdened by high transaction fees as its value rises.

Ripple provides clear utility and a working business model in a market rife with wild speculations. The network is expected to bag even more partnership with financial institutions in the coming days and the rally is set to continue. For wallet information, read buyripple.com‘s guide.