XLM remains capped below $0.45, but it could flip higher to target levels of $0.80—$1.00 in June

Stellar price is oscillating around $0.38 at the time of writing, with the price down 8% in the past 24 hours. Over the past week, XLM is down nearly 9%, with monthly performance also in the red by about 23%. Nonetheless, XLM is still a profitable coin and is up on a year on year basis by 369%.

A look at the markets shows that most major coins are trading lower over the past week. The downturn follows the recent price weakness that wiped billions off the total crypto market capitalisation, which currently stands at $1.71 trillion. Data from CoinGecko shows that the market cap of all cryptocurrencies is down 4.9% over the past 24 hours.

Stellar (XLM) price up to May 2021

On 1 January, the price of XLM was around $0.14. By 13 February it had climbed to over $0.60 against the US dollar, before another uptrend over April and early May saw the cryptocurrency pop to highs just shy of $0.80.

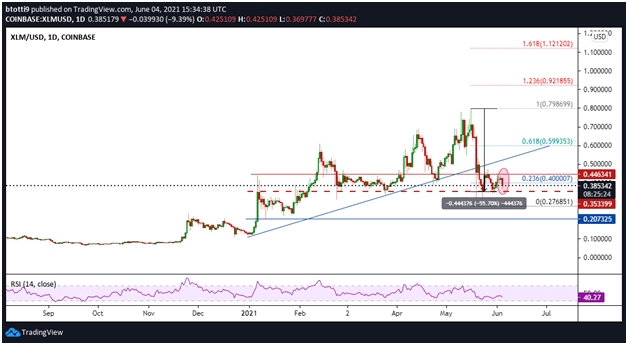

The past few weeks have been rough not only to Stellar but to all major coins. As Bitcoin tumbled from highs above $60k to touch $30,000, the XLM/USD pair lost about 55% of its value to drop to $0.27. A brief rebound pushed the price to $0.43, but the bearish pressure seen over the tail end of May remains as Stellar has recoiled off the resistance line(red) as shown in the chart below.

XLM/USD price chart showing 55% drop. Source: TradingView

Stellar (XLM) price and the broader market

In May, Stellar price fell largely due to negative market sentiment driven mainly by negative news from China and FUD related to Tesla CEO Elon Musk.

Markets reacted negatively after Musk tweeted that the electric car company would not be accepting Bitcoin payments. The reaction then centred on Bitcoin mining and its perceived impact on the environment.

China added to the bloodbath with a ban on institutional crypto transactions, before another report on a crackdown on mining dampened sentiment even further.

As a result, most major cryptocurrencies, including XLM are trending near the oversold territory. For Stellar investors, the current price level is 55.7% off the all-time high of $0.87 reached in January 2018.

Stellar Price Forecast

Stellar lacks clear direction despite the recent seller dominance. For that, I lean bullish on Stellar Lumens because the price seems to have found support, while the fundamental outlook suggests continued growth even as prices dropped.

Investors looking to position themselves for the next couple of weeks should, however, take note that Stellar price is delicately balanced between $0.35—$0.45 at the time of writing. Is it poised to go higher? A look at the market suggests this should be the case, although, with crypto prone to wild price movements, a dip past recent lows could still happen.

A conservative price prediction for Stellar could be around the $0.60 level for June. However, if fresh buying picks momentum over the next two weeks, I’d suggest legitimate targets from around $0.80 to the coveted $1.00 level.

XLM price: technical outlook

Stellar is within a symmetrical triangle pattern with the support line at $0.35 offering a buffer zone. If the price rebounds off the trend line as shown on the 4-hour chart, the breakout target would be $0.50, which means a price gain of about 55%.

XLM/USD 4-hour price chart as seen on TradingView.

If you glimpse the 4-hour chart, you can see several technical indicators are looking to flip off the oversold line. The Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD) and the Williams %R all suggest improvement in the technical view.

If investors manage to push prices beyond the $0.50 supply wall, Stellar’s (XLM) price could retest the $0.67 (61.8% Fib level of the decline from $0.80 high to $0.28 low). This will then open up room for our next target at $0.80 as mentioned, which is likely to see a minor resistance if it is reached. Beyond this, a clear path should open for a retest of $1.

If a contrary picture materialises, Stellar’s price might remain choppy between $0.45 and $0.25.

What might drive Stellar price in June

News and partnerships

Stellar Lumens news is one of the factors that might influence the price. The cryptocurrency has already featured in two major news developments—both great partnerships that could spur further adoption of the XLM coin and usage of the underlying blockchain technology.

One of the main developments recently was a potential use of the Stellar Lumens network by the Ukrainian government for the issuance of a Central Bank Digital Currency (CBDC). This announcement saw XLM price jump nearly 70% in early May.

Another development is from the partnership with German real estate giant Vonovia. With more than 400,000 properties under its management, the company is set to use Stellar Lumens’ blockchain for a digital bond.

Wyre, a regulated Money Service Business (MSB) that launched its services in 2013, announced on 3 June that its Wyre Savings API would be available for businesses that leverage Stellar-based assets. The firm seeks to bridge the gap between legacy banking and crypto, which the seamless savings feature it offers could grow further with Stellar’s global reach.

Wyre has partnered with @StellarOrg to offer new yield-earning savings products leveraging the network’s Stellar #USDC token! This gives developers easy on/off ramps and Savings-as-a-Service functionality to bring the masses into crypto into crypto 🚀https://t.co/4YPJkL3Omi

— Wyre (@sendwyre) June 3, 2021

Institutional interest and network growth

Institutional interest in crypto has also extended to XLM, with investor holdings at more than 68,910,000 XLM at asset management firm Grayscale. That’s more than $28.94 million worth of XLM in institutional hands on just this one platform.

Overall, network growth has seen addresses increase fifteen-fold in three years, from less than 250k in 2018 to over 4 million in May 2021. Such an increase highlights Stellar’s continued importance in helping the unbanked around the globe access cross-border remittances.

If sentiment across the crypto market flips bullish in the coming days, the upside forecast for XLM will certainly strengthen. This outlook, therefore, means that XLM could rise towards $0.80—$1.00 from its current price level at $0.38 in June.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.