Aave is among top DeFi tokens to see massive price gains as Bitcoin finds resistance at $38,000

DeFi tokens are rallying as investors increase the amount of money locked in the sector for short term gains.

Maker (MKR) is up 34% to trade around $2,258 and could rally higher if the upside momentum seen across the sector continues over the weekend.

Compound (COMP) is another token seeing massive price gains on the day. The COMP/USD pair has surged 24% in the past 24 hours to touch intraday highs of $484, with weekly gains now at 96%. Elsewhere, Synthetix (SNX) has spiked over 15% to trade above $21.00.

AAVE/USD rallies on increased accumulation

Aave (AAVE) is one of the biggest gainers in the market today, with the AAVE/USD pair up 22% to see bulls target strengthening near $500. This comes after bulls rallied to an intraday high of $547 on Binance.

As AAVE price skyrocketed to test a new high, analysts at on-chain analytics firm Santiment noted that whale accumulation has significantly increased. Per the platform, accumulation by high-net-worth investors could be driving AAVE/USD as the overall DeFi sector booms.

“DeFi is alive and well in crypto, as AAVE has skyrocketed to a +33% gain in the past day. Aave whales, which we deem addresses holding 1,000 tokens or more (~$397k+ USD), have ballooned from 266 to 327 addresses this past month, fueling this rally.”

AAVE/USD daily chart. Source: TradingView

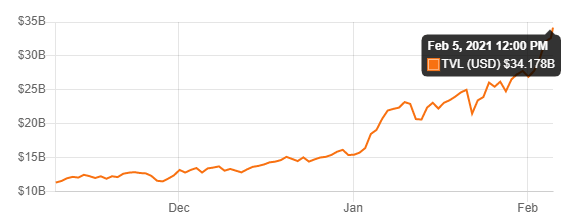

Over $34 billion locked in DeFi

According to the data provider DeFi Pulse, investors have locked a record $34.1 billion in decentralised finance projects. The total value locked (TVL) in liquidity pools has increased from $29.58 billion on 04 February, nearly $5 billion in 24 hours.

Aave has seen the most TVL spike in the past 24 hours, with the decentralised lending platform adding 13% more in value locked in smart contracts. Aave currently has a TVL of $5.59 billion, slightly lower than Maker that still dominates overall figures with $5.89 billion (17.28% of all TVL).

DeFi index chart showing a sharp increase in TVL. Source: DeFi Pulse

The positive DeFi outlook comes on the back of Bitcoin price failing to rally past the $38,000 level once again.

At the moment, BTC price is struggling to stay near $37,500, with the upside towards the all-time highs looking to have cooled off. The top cryptocurrency’s market dominance has also been dropping since touching highs of 73% in early January.

As of press time, Bitcoin’s dominance index stands at 60%. If BTC/USD continues to struggle or dips, the market might see increased buying pressure in the DeFi market. The outlook could however flip if the top cryptocurrency begins to surge and capital again shifts.