Blockchain technology “will revolutionize banking and financial services as we know it,” Pierre Gramegna, Minister of Finance of Luxembourg, told the audience during a panel session at the World Economic Forum’s 10th Annual Meeting of the New Champions in Tianjin, People’s Republic of China.

“I think it is possible that blockchain will replace the word ‘Internet’. By the time our children have children, the only time they will see the word ‘Internet’ is in science and history books,” Gramegna said.

Blockchain technology was one of the main topics covered during WEF’s three-day event that featured some 200 panel discussions. Echoing WEF’s annual meeting in Davos, Switzerland in January, the Annual Meeting of the New Champions 2016 focused on the theme ‘The Fourth Industrial Revolution and Its Transformational Impact.’

Over 1,700 business leaders, policy-makers and experts from over 90 countries participated in the forum, which tackled the digital revolution that has been occurring since the middle of the last century.

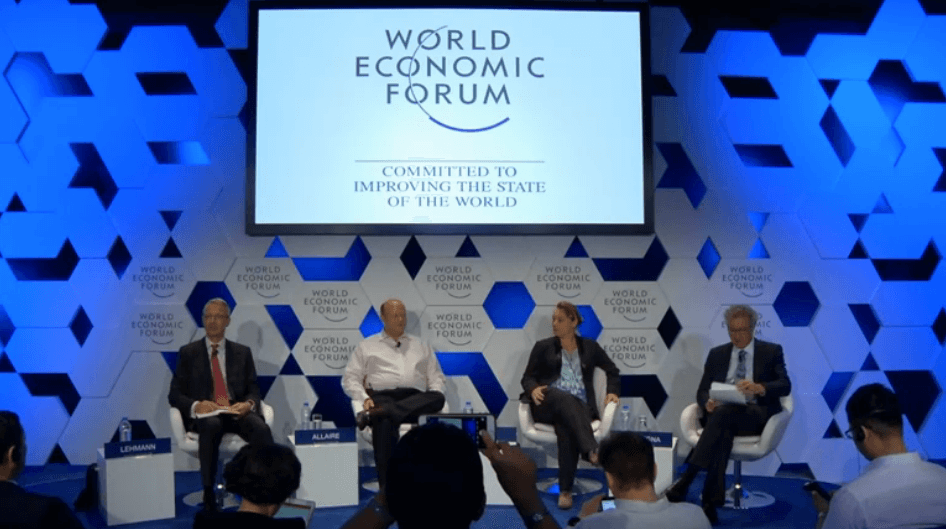

During the ‘Unblocking Blockchain‘ panel session, Gramegma, alongside Axel Lehmann, UBS’ group chief operating officer, Leanne Kemp, founder and CEO of Everledger, and Jeremy Allaire, founder and CEO of Circle, discussed the potential impact of blockchain technology on financial services.

UBS, which released a whitepaper on the topic on Sunday, “believes that blockchain technology could have a tremendous impact on the financial services and beyond,” Lehmann told the audience.

All major banks have expressed interested in blockchain technology as an innovation that could potentially help them save billions in operational costs by enabling an unprecedented level of automation and efficiency. But the possibilities go well beyond the financial and banking industry.

UK-based Everledger utilizes blockchain technology to track diamonds through the supply chain to assist in the reduction of fraud and black market activity. “I would like to see blockchain being applied to big problems, the proliferation of counterfeit goods and financial inclusion,” Kemp said.

In the next decades, Kemp believes that blockchain technology could well become the open protocol that powers transactional trust.

“People tend to over focus on what the technology is today […] There has been a overly narrow focus on financial services,” Allaire told the audience. “I think the impact goes way beyond financial services.”

He explained:

“[For] any business function or any societal function that involve fiduciaries, you can build a globally distributed piece of software that is tempered-proof, secured and auditable.

“And that means that you can change an enormous number of parts of society, you can change how finance works, the nature of accounting, insurance, commercial law, governance, how public and civil societies work… […] All these are systems that can be moved to blockchain technologies in the next five to ten years.”

Luxembourg’s stance on blockchain technology

Although there are still regulatory and taxation issues to be addressed, Gramegna agrees that blockchain will reshape the financial and banking sector.

“The way blockchains function will make the way delivering financial services much faster, much cheaper, with less intermediaries. One aspect where we see this already happening a lot is payments services,” Gramegna said.

Being the European hub for e-commerce, embracing blockchain technology and virtual currencies “was a natural development,” he said.

Luxembourg has been a front-runner in the realm of the digital economy, having become couple years ago the first nation to legalize the use of digital signatures, for instance.

“You need a regulator who is keen for innovation; which doesn’t happen all the time. The regulator is there to apply the rules, fully and in an equal manner; but, at the same time, the regulator can be innovative,” Gramegna said.

So far, Luxembourg has given licenses to two virtual currency companies, including Bitstamp, which became in April the first nationally licensed bitcoin exchange in the world.