While Bitcoin and Ethereum prices go into a brief lull, Chainlink, Aave and 0x have seen an uptick thanks to massive accumulation by whales

DeFi tokens like Compound’s COMP and Balancer’s BAL over the past week have each seen huge price surges to make decentralized finance and yield farming the new craze among Ethereum-based tokens.

However, data also shows that a spike in the prices of several ERC-20 tokens is aided by a massive accumulation spree by whales.

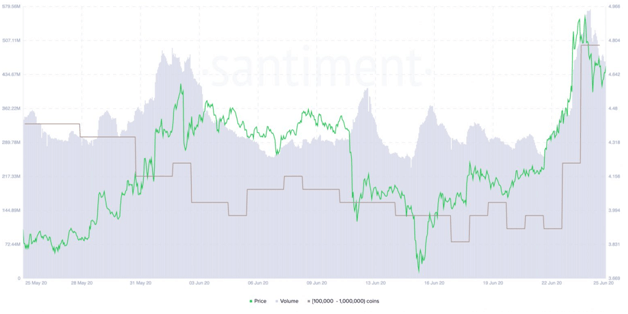

According to analytics platform, Santiment; Aave, Chainlink and 0x prices have all increased over the past several weeks, thanks to whale activity.

As per the platform’s metric, LEND/USD has gained more than 130% in June, ZRX/USD is currently more than 10% up, while LINK/USD has outperformed most major altcoins.

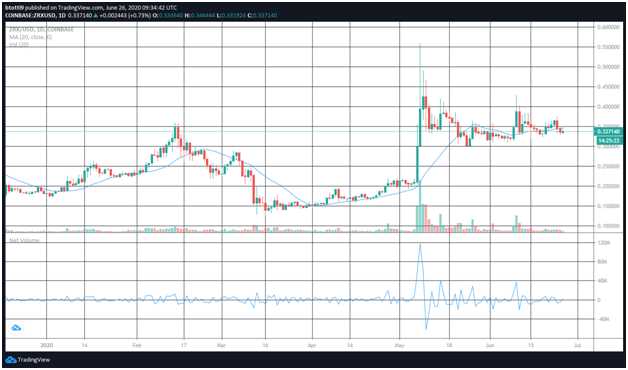

ZRX/USD price

ZRX is trading at $0.338 against the US dollar, just a percentage point lower on the day.

ZRX/USD recently saw its daily on-chain transaction volume spiked to a new all-time high at $104 million (that’s 300,334,000 tokens traded on the day).

Prices currently trade above the $0.25-$0.30 level that has been the key resistance area. There’s a bullish case if prices break resistance at $0.35 to open up $0.50. In the past 24 hours, about $17.5 million worth of the ERC-20 token have been traded.

LINK/USD price

Data from Santiment indicates that Chainlink whales have increased by 5% over the past week. About 15 more addresses now hold 100,000 to 1,000,000 LINK tokens.

For Chainlink, large buyers could be corporations that seek to benefit from the blockchain-based technology that allows users to merge data from legacy databases with emerging systems.

LINK/USD spiked more than 10% on Wednesday to see the token’s price hit a new all-time high. Struggles seen for top coins like Bitcoin and Ethereum have trickled down to this token and although the uptrend has lost a bit of steam, its price is likely to climb higher in the coming weeks.

LEND/USD market

While Compound dominates the DeFi scene with total value locked at over $650 million, Aave is fourth with more than $115 million in the token.

In the market, LEND/USD has been in an uptrend since the start of the year, with its price jumping from lows of $0.015 to highs of $0.164.

Although the value of the token has dropped to $0.125, there has been a spike in intraday trading volume from lows of $0.5 million to over $3.4 million.