What is the prediction for Zcash price in June? Can ZEC/USD reach $200, or will it drop below $100?

Zcash (ZEC) price has bounced 15% in the past 24 hours and trades around $140, just 8.9% lower than its weekly open at the time of writing. The Zcash price is, however, 54% down over the past 30 days to highlight the massive bleeding witnessed across the crypto market in May.

Despite the price crash, Zcash remains in positive territory on the year-on-year timeline with 167% gains.

For ZEC holders, the price uptick seen on the day is welcome after a week of correction. The upside reflects the overall sentiment in the wake of positive news for Bitcoin from El Salvador, where the benchmark cryptocurrency has been approved as legal tender.

Specifically, though, privacy coins like ZEC and Monero (XMR) are flying in a week where the US Justice Department announced it had seized 63.7 BTC paid as ransomware to cyberattackers who had compromised the company Colonial Pipeline.

Zcash price remains highly volatile and fresh declines are possible, but can bulls build on the rebound in coming weeks to end June on a high? This Zcash price prediction looks at the fundamental and technical outlook for the privacy coin, with forecasts suggesting potential price points for June 2021.

Zcash Price Forecast for June 2021

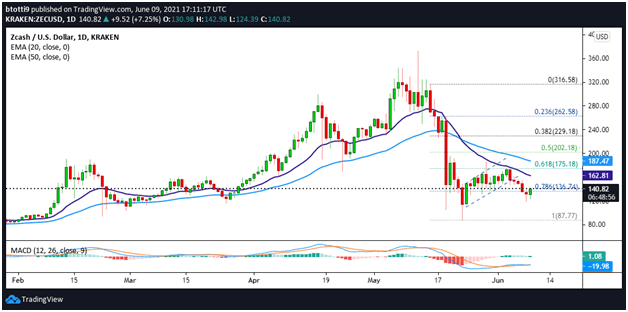

Zcash Price Daily Chart

The ZEC price is printing a bearish outlook despite the 15% uptick seen on the daily chart. The cryptocurrency’s 30% correction from 4-8 June has put the price below $170, with bears revisiting the $118 zone.

The ZEC/USD pair currently trades below the daily 20 and 50 exponential moving averages (EMAs). The two are acting as resistance levels at $162 and $187, which bulls need to breach if they are to regain the upper hand.

Looking at the two major technical indicators of the RSI and the MACD, we see that sellers remain largely in control. The Relative Strength Index is ticking below 50 while the moving average convergence divergence indicator remains within the negative zone.

As the daily chart below shows, Zcash price’s retracement took it below the 50% Fibonacci retracement at $202.18. The extended sell-off even saw it complete the 61.8% Fibonacci retracement at $175.18, after which bulls have found it difficult to rebound.

Currently, buyers are looking to recapture the 78.6% Fibonacci retracement level at $136.74. A breakout above this level will see an extension of the buying pressure and possibly bring ZEC/USD towards the key targets at the 20 and 50 EMA. The main prize is at the $200 level (just below the 50% Fib level).

The hint of a bearish flag pattern is likely to hinder bulls in the short term. If bears violate the support zone around $136, a new downtrend could appear and push ZEC towards $114 and then $87.

ZEC/USD price on the daily chart. Source: TradingView

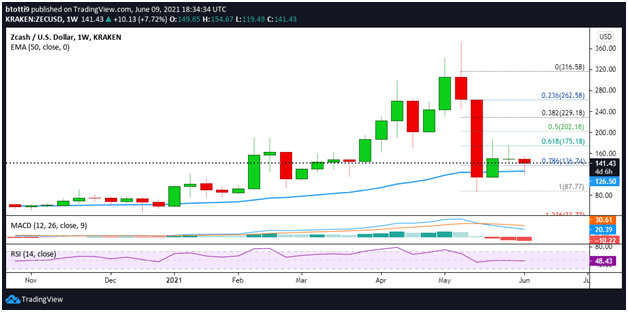

Zcash Price Weekly Chart

On the weekly chart, ZEC/USD recently formed a double top pattern that culminated in a bearish correction as witnessed in late May and early June.

After declining below the 20 and 50 weekly exponential moving averages, the price is back above the longer-term metric. However, there’s a strong bear presence near the 20 EMA as seen on the weekly chart, with the Doji candlestick of the last week of May suggesting exhaustion among bulls.

An attempt to use the dip as a buying opportunity for ZEC/USD has not held as the price has retraced even lower. The breakdown below the 78.6% Fibonacci retracement level added to the pressure, with $120—$100 becoming the main support region.

A look at the weekly RSI and MACD indicators suggests that the selling trend continues to persist. The RSI is flatlining below 50, while the MACD sports a bearish crossover and is increasing within the negative zone.

If bulls fail to hold above $140, there is a likelihood that prices will dip beneath the key support area around $136. The main targets below this demand zone are at the 50 EMA ($126.50) and the horizontal line at $114.

ZEC/USD price on the weekly chart. Source: TradingView

What Might Drive Zcash Price in June?

Volatility in the crypto market is still extreme and that is likely to continue impacting Zcash prices. But as investors might already know, volatility also comes with opportunities. If Zcash price declines, it could be a ‘buy the dip‘ opportunity as happened when ZEC crashed 45% during the April crypto bloodbath.

Note that, like other cryptocurrencies and financial instruments, the price of Zcash can fluctuate due to different reasons impacting sentiment within the market.

In June, and for much of 2021, one of the key factors likely to impact ZEC prices is regulation. Policy and regulations are not a new thing in the crypto sector, but every other day something happens with regard to governments seeking to tighten oversight over the crypto industry.

A regulatory crackdown such as the one being pursued by China has had a negative influence on market sentiment before, sending prices plummeting. Zcash, being a privacy-focused coin, is increasingly under the radar of regulatory authorities concerned about money laundering, tax evasion and other illegal activities. Talking of privacy and regulation, Zcash is looking to revamp its network to make it even more secure and resistant to third-party snooping.

However, news has the power to suddenly impact markets by dramatically shifting sentiment. Positive news often sees a bullish flip for prices, while negative news has often been the catalyst for a meltdown.

Global economic or financial crises can also impact the price of Zcash going forward. Crypto has often benefited from the economic outlook of leading economies in the world. If countries dive into printing money as had happened after the coronavirus pandemic, panic sets into the traditional markets as the capital is diverted into cryptocurrency. Money might also flow into other assets from ZEC, impacting prices.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.