How & Where to Buy Theta (THETA) in 2024

...

Theta is a media and entertainment-focused blockchain that launched in 2019. It enables a decentralised network of users to share their computer storage and bandwidth in return for rewards. The network’s native cryptocurrency, THETA, is used for governance and staking.

If you want to know how to buy Theta, you’ve come to the right place. We’ll go through the buying process, discuss the best Theta platforms, and provide information on everything else you need to know, from payment options to wallets.

Where to Buy Theta (THETA) - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended places to buy Theta.

Best Places to Buy Theta (THETA) - Key Metrics

Best Places to Buy Theta (THETA) - Why They Made the list

Best Places to Buy Theta (THETA) Reviewed

How to Buy Theta

The easiest way to buy Theta is to purchase it online from a crypto exchange. Exchanges make it easy to buy and sell Theta and other cryptocurrencies directly from your smartphone, tablet or computer. Check out our recommended platforms below and follow the steps to safely buy Theta.

1. Choose a platform

You can look at factors such as fees, ease of use, and features when deciding which platform to choose. The in-depth reviews in this guide will go through all these things, but if you want to dive in straight away, click on the links below to sign up with our recommended brands, which we believe are the best platforms.

2. Create and fund an account

You will need to fill in a few personal details to create an account. Regulated platforms have a KYC process, which means you will need to provide a picture of your photo ID to verify your identity. After that, you can choose your preferred payment method on the deposit page to fund your account.

3. Buy Theta

Search the platform for the trading pair for Theta and your deposited currency. Create a market order to buy Theta immediately at the current price, or use a limit order to set a price to buy at in the future. Just enter the amount you wish to purchase and click the “Buy” button.

What is Theta and What’s Its History?

Launched in 2019 by Mitch Liu and Jieyi Long, Theta is a blockchain network for decentralised video streaming, edge computing, and data delivery. Anyone can join the network of Theta Edge Nodes by downloading the app. They can then earn Theta’s other token, TFUEL, by relaying video streams to support platforms such as THETA.tv.

An important aspect of Theta’s infrastructure is the Metachain, a highly scalable and customisable network of blockchains designed to support emerging Web 3.0 media and entertainment businesses. It is capable of hosting DAOs, DEXs, NFTs, and much more.

The Theta Network has a dual token design. While Theta Fuel (TFUEL) functions as a gas token to pay for on-chain operations and reward Edge Node relayers, Theta Token (THETA) is the project’s governance token and can be staked to secure the network and earn TFUEL.

Theta’s unique multi-layer consensus mechanism comprises thousands of community-run Guardian Nodes that seal the blocks proposed by 20 to 30 Enterprise Validator Nodes. Some of the partners currently running Enterprise Validator Nodes include Google, Samsung, and Binance.

What Payment Methods Can I Use to Buy Theta?

There are many different ways to buy Theta. Let’s take a look at some of the most popular payment methods.

Credit card

Credit cards are fairly widely accepted, providing a convenient way to buy Theta and pay later or in installments. The fees involved are the main drawback to using credit cards—there’s a 1.8% fee for credit card deposits on Binance. The best place to use a credit card is eToro, where deposits are free.

Bank account

Using your bank account to make a deposit is often the cheapest method. You can do so for free on eToro and Capital.com, or for a £1 fee on Binance. If your platform supports Faster Payments, as Binance does, then you can receive your funds and start trading with them almost immediately.

PayPal

PayPal is a fast and safe payment method but is less widely accepted by crypto platforms, especially in the UK. You can use PayPal to make a deposit on eToro without any fees.

Skrill

Skrill is a digital wallet provider that makes paying online fast and simple. It is not an accepted deposit method on Binance, but you can use it to make free deposits on eToro or Capital.com. Skrill can also be used to make EUR, USD, CHF, and GBP deposits on Bitpanda.

Ways to Invest in Theta

You can use different strategies to invest in Theta, depending on your goals, skills, and amount of free time. Some of the most common are detailed below.

Buy and Hold Theta

This is the simplest strategy there is—anyone can buy Theta and hold onto it, regardless of how much skill or free time they have. This is a popular Theta investment strategy as there is a fixed supply of Theta, so it won’t be devalued by inflation in the same way that fiat currencies are.

Trade Theta

The volatility of Theta’s price means traders can also buy and sell Theta on a much shorter time scale to generate frequent profits. Technical analysis skills come in handy for trading, and it requires a greater time commitment.

One way of trading Theta is through CFDs. These allow you to speculate on the price of Theta without actually purchasing it. You can trade Theta CFDs on Capital.com and Skilling.

Stake Theta

Anyone who wants to take part in Theta’s consensus process can download and run a Guardian node. As long as you have the minimum hardware requirements and can stake at least 1,000 THETA, you can earn staking rewards in TFUEL. Alternatively, THETA holders can delegate their tokens to a Guardian node to earn TFUEL passively. This can be done through a wallet such as the Theta Web Wallet or through a platform such as Binance.

How to Buy Theta - Step-by-Step Guide

It’s very simple to buy Theta on eToro . Here’s how.

-

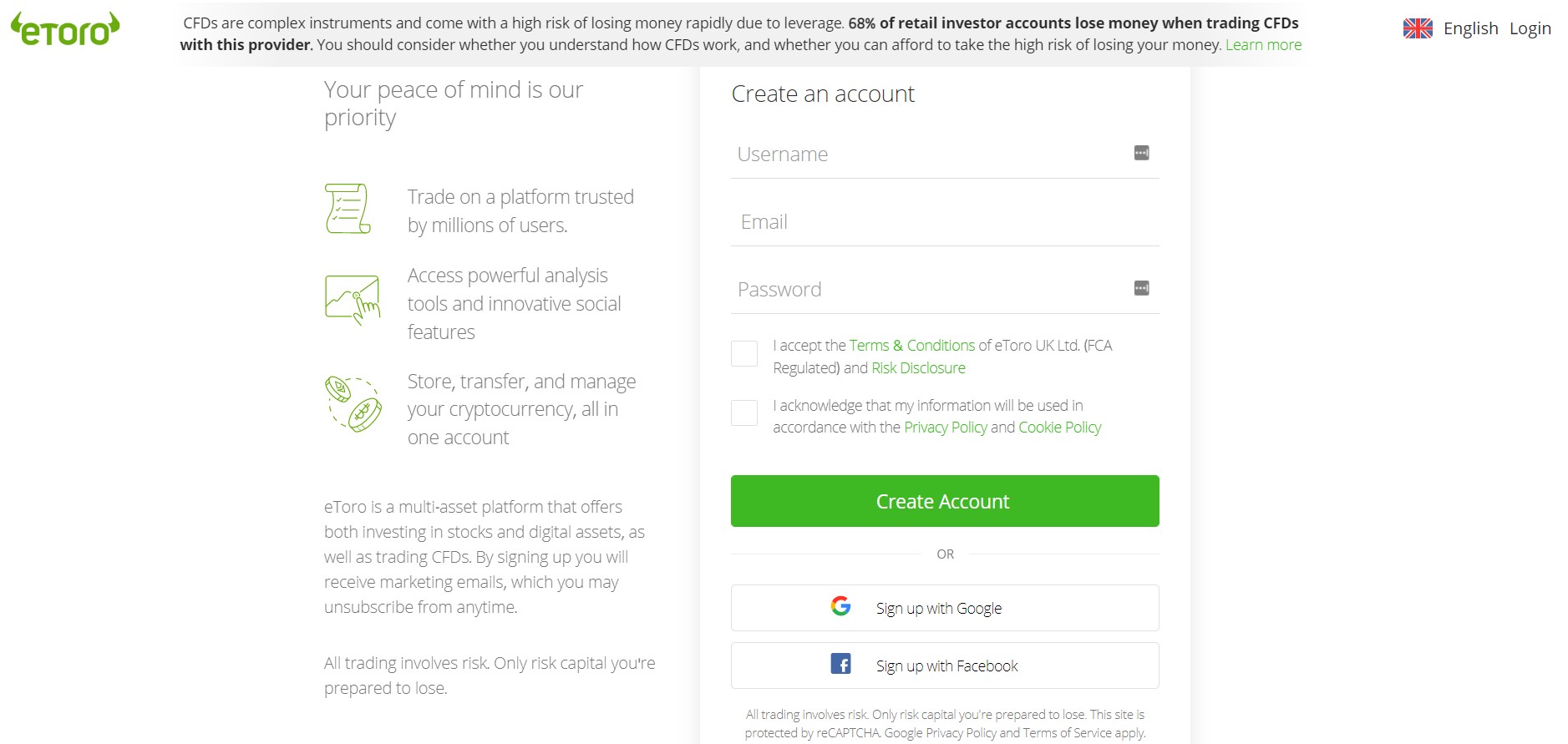

Create a free account

You will need to fill in the registration form with your email address, username, and password once you click on the “Join Now” button on the homepage. Tick the box to confirm that you accept the terms and conditions, and then click on “Create Account”.

-

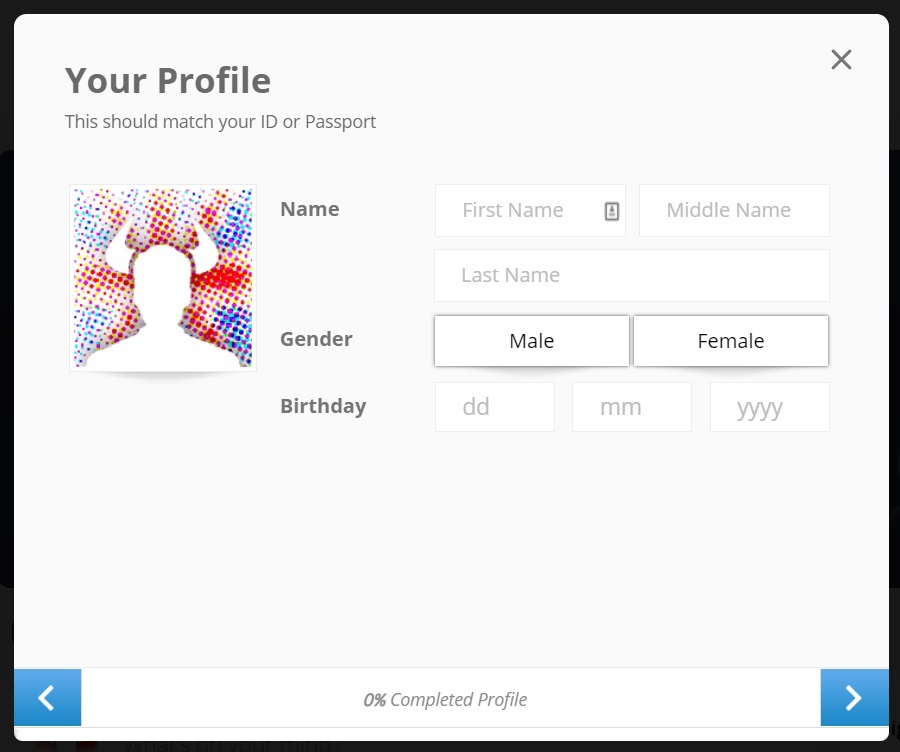

Verify your account

You can verify your email address by clicking on the link emailed to you. Then you will need to complete your profile by providing your name, date of birth, contact details, and proof of identity. You will also be asked questions about your investing experience.

-

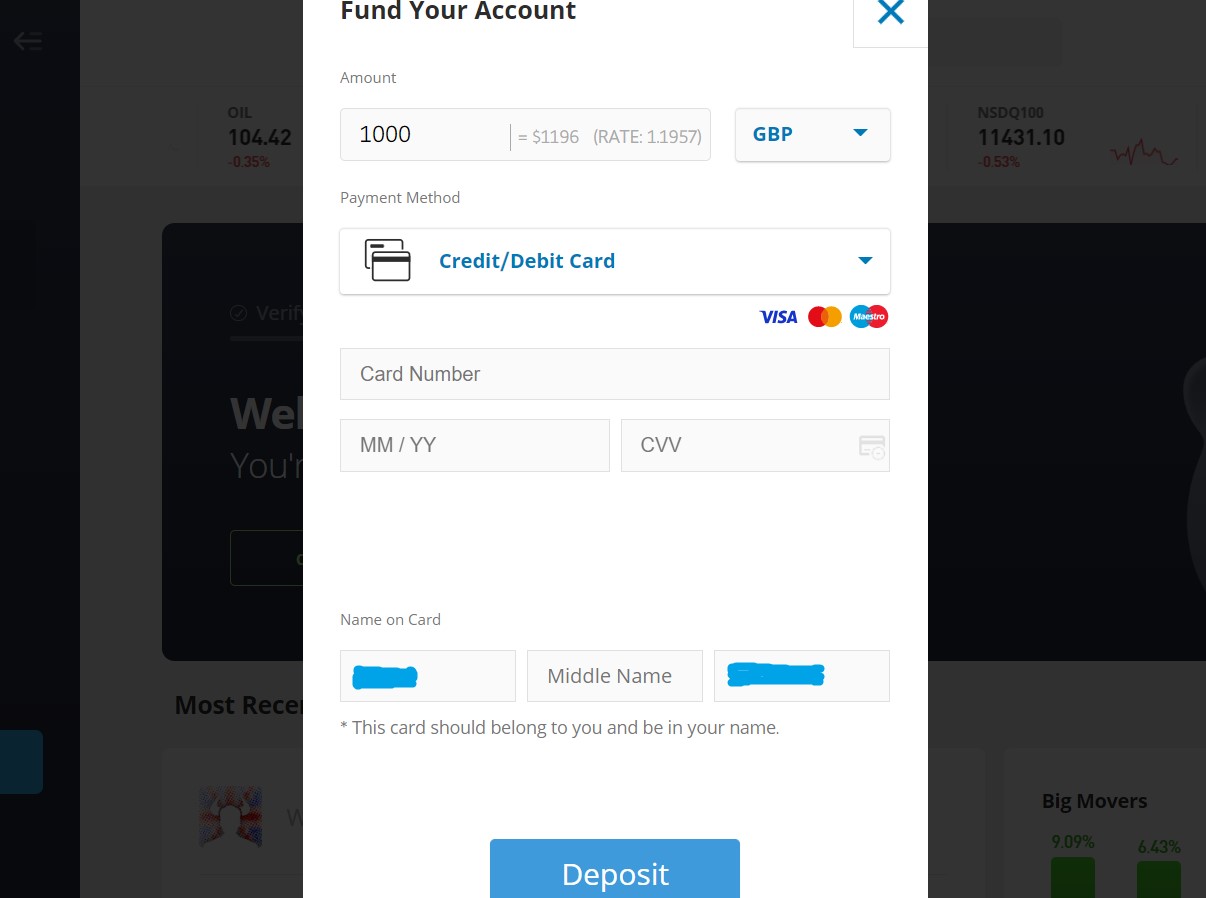

Make a deposit

Once you click on “Deposit Funds”, you can enter the amount that you want to deposit. Using the dropdown lists, choose your local currency and preferred payment method. Fill in any details required to complete the payment and click the “Deposit” button.

-

Buy Theta

Use the search bar at the top to find Theta and hit the “Trade” button. You can switch from Trade to Order at the top if you want to Buy Theta once it reaches a certain price. Otherwise, just fill in how much you want and click on “Open Trade”.

Choosing a Theta Wallet

There are many different types of Theta wallets to suit different needs. The information below should help you find the wallet that’s right for you.

Theta Software Wallets

-

Web wallet: Web wallets are the most convenient wallets for traders and small-time investors. They can be a target for hackers, however, which is why it is important to choose a secure and regulated platform, such as eToro, which provides a free web wallet.

-

Desktop wallet: Desktop wallets are downloaded onto your computer and tend to be fairly secure. The Theta Wallet is designed for desktops, while Atomic Wallet also supports Theta.

-

Mobile wallet: Mobile wallets are convenient apps that you can download onto your smartphone. The Theta Wallet app can be downloaded from the Play Store or App Store.

Physical and Hardware Wallets

-

Hardware wallet: These are popular with long-term holders and large-scale Theta investors as they are the most secure, albeit expensive. The most popular Theta hardware wallet is Ledger.

-

Paper wallet: You can create a paper Theta wallet with a private and public key generator—just write down or print the character string or QR code. This isn’t a safe way to store Theta, though.

Wallet Combinations

Using more than one wallet in combination can be useful if, say, you want to trade some Theta and buy and hold some Theta with a web wallet and hardware wallet, respectively. If you use the Ledger hardware wallet, you can also download the Ledger Live app to manage your coins more easily.

Is Theta a Good Investment? - What Makes Theta Unique?

Whether or not to invest in Theta is something you will need to decide for yourself, but let’s take a look at some of the things you may want to consider first.

There is a fixed maximum supply of THETA, all of which are already in circulation. This could make Theta a good long-term store of value as it won’t be devalued through inflation like fiat currencies are.

The project has a strong team behind it. The co-founders already had a lot of experience in industries such as gaming, video streaming, and virtual reality, and they are supported by a diverse team with previous experience at companies such as Amazon, Netflix, Vimeo, and Samsung.

Theta has also received strong support from enterprises. Investors in the project include Sony, Samsung Next, and Blockchain.com, while Theta’s Enterprise Validator Nodes are run by companies such as Google, Samsung, and Sony Europe.

Theta already has premium content partnerships with MGM Studios, Lionsgate, NASA, and others. What’s more, a number of popular video platforms have already integrated with Theta infrastructure, including Samsung VR, Cinedigm, GameTalkTalk, and World Poker Tour.

One reason Theta has garnered support is its groundbreaking technology. Its unique multi-level consensus mechanism is Byzantine Fault Tolerant and designed to have virtually no carbon footprint while it processes 1,000 transactions per second. The blockchain is also highly decentralised and resistant to censorship.

Many people choose to buy THETA for its functionality. It is a governance token so THETA holders can have a say in the running of the project. THETA can also be staked, providing its stakers with TFUEL rewards.

Video streaming is a very large and valuable industry, and Theta aims to make it cheaper and more efficient while solving some of the bottlenecks that currently exist. If you believe in Theta’s vision for the future of video streaming, then THETA could be a valuable investment.

Should I Buy Theta Now? - Things to Consider Before Buying Theta

The above section should help you decide whether to buy Theta or not, but here are a few more practicalities to consider.

Theta Fees & Regulations

Theta is a cheap blockchain to use, and the low fees for interacting with it are paid in TFUEL. However, if you are buying or selling THETA on a platform, your platform will likely charge a fixed or percentage fee on each transaction, regardless of which cryptocurrency is involved.

Your platform may charge other fees, too, such as deposit and withdrawal fees. These can vary depending on the payment method. Other fees to watch out for include account management fees, overnight fees, and inactivity fees.

Theta is not currently considered a security by the SEC, while in the UK, all cryptocurrencies are unregulated. It is perfectly legal to buy Theta in both countries, but crypto platforms have to comply with AML regulations. This means you will need to verify your identity to buy Theta on a regulated platform.

Buying Theta Safely & Securely

The safest way to buy Theta is through a platform that is regulated. These platforms often have the strongest security features, such as encryption, insurance, and offline storage. You should always enable two-factor authentication if you have the option.

Make sure you use a strong and unique password to create an account. It is best to update your passwords regularly. You should also be careful about any emails you receive and check that they are really from your platform to avoid scams.

Make sure you store your Theta somewhere safe. Spending money on a hardware wallet will provide you with the best security. Store your seed phrase in a safe place to ensure you will never lose access to your wallet, and never share your private key with anyone.

Theta Price

The price of Theta is affected by a great number of factors, many of which have been discussed in the previous section. Project news and developments can have an impact on Theta’s price, as well as the rest of the crypto market and the wider economy.

Theta’s price history has seen some dramatic surges, and its potential to revolutionise the valuable video streaming industry could mean strong price potential for the future, which is why it is popular with buy-and-hold investors. It is also more volatile than traditional financial instruments, making it suitable for trading too.

Traders and investors may aim to predict the price of Theta to help them decide when to buy or sell. The future price of Theta may be affected by long-term market cycles, new partnerships, the launch of new Theta-based dApps, hype, and broader economic conditions.

What Other Platforms Can I Buy Theta On?

There are a few other places where you can buy Theta. Some of the most popular platforms are discussed below.

Can I Buy Theta on eToro?

Yes. Theta is available on eToro, where deposits are free, and you can use CopyTrader to replicate the trades of other Theta traders. See the step-by-step guide above to find out how to buy Theta on eToro.

Can I Buy Theta on Coinbase?

No. If you’re wondering how to buy Theta on Coinbase, unfortunately, it isn’t currently possible as Theta isn’t listed on Coinbase.

Can I Buy Theta on Binance?

Yes. There are options for how to buy Theta on Binance—beginners can use the simple Buy Crypto feature, while more advanced users can access charts and indicators through the spot trading feature.

Can I Buy Theta on Crypto.com?

Yes. If you want to know how to buy Theta on Crypto.com, just download the app and go to your THETA wallet. Then you can enter how much you want and complete the payment.

Can I Buy Theta on Trust Wallet?

Yes. Once you download the app, how to buy Theta on Trust Wallet will be a simple process. Go to Theta, tap the “Buy Theta” button, and fill in your payment details for your desired amount.

Can I Buy Theta on Robinhood?

No. If you can’t work out how to buy Theta on Robinhood, that’s because Robinhood doesn’t support Theta trading.

Can I Buy Theta on Uniswap?

No. If you can’t work out how to buy Theta on Uniswap, that’s because Uniswap only supports Ethereum-based tokens.

Can I Buy Theta on MetaMask?

No. If you’re wondering how to buy Theta on MetaMask, unfortunately, this is not possible. However, you can add the Theta blockchain to MetaMask to store and transfer TFUEL and TNT-20 tokens.

Selling Theta

The right time to sell Theta depends on your strategy. If you opt for the buy and hold option, you will likely wait a long time before you sell. Meanwhile, if you use a trading strategy, you may be looking for a particular signal from a technical indicator to tell you when to sell.

The selling process is very similar to the buying process. On eToro, for example, it is just as straightforward. Just head to your portfolio, click on Theta, and click the “Close” button next to it. You can tick “Close only part of the trade” if you only want to sell some of your THETA.

On other platforms, you may have the option of creating a market sell order to sell immediately at the current price, or a limit sell order that lets you specify a price to sell at in the future.

Final Thoughts

There are a lot of aspects to consider when buying Theta, from which payment method to use, to when to buy it, to which strategy to employ. First and foremost, however, you will need to decide which platform to sign up with.

You have a few different options, but our top recommendation is eToro. This is because it is a reliable, regulated platform with unique features and competitive fees. You can see how easy it is to buy Theta on eToro from the step-by-step guide above.

Methodology - How we picked the best platforms to buy Theta

We have various quality control processes in place to give you a reason to trust us. We rigorously research and test the platforms we review in order to provide you with the best recommendations and help you make more informed investment decisions.

The things we test for on each platform we review include how to sign up to it, how to make a deposit, which assets are available, what types of trading are offered, fees charged, speed and interface, location and regulation, cross-platform compatibility, security, features and services available, educational resources, and customer support.

FAQs

Related Content

Cronos (CRO)

Celsius (CEL)

SushiSwap (SUSHI)

Hamster (HAM)

Stratis (STRAT)

Libra (LIBRA)

Top THETA Stories

Ethereum, THETA, Memeinator price prediction as bulls target more gains

27 February 2024 Ethereum, THETA, Memeinator price prediction as crypto rally resumes Ethereum is seeing huge institutional investor interest and…

Crypto price predictions: Solana, Theta Network, HOOK

27 January 2023 Solana price has formed a triple-top pattern and a head and shoulders. Theta Network has moved above…

Is there hope for Theta token as the year comes to an end?

6 December 2022 Theta token has lost 94% of its value from its ATH The cryptocurrency was rejected at the…

Is Theta token heading to $2 after the latest breakout?

11 August 2022 Theta Network offers a video streaming service akin to YouTube The token has been under bearish pressure…

Is Theta Network token now bullish after double-digit gains?

2 August 2022 Theta network has been touted as a next-generation video streaming platform The network faces competition from other…