The Best Altcoins to Buy in 2025

Figuring out the best altcoin to buy can be a difficult choice as literally every other crypto aside Bitcoin is an altcoin and has different characteristics, technologies, and potential.

The crypto industry is littered with stories of people who lost money because they bet on the wrong project. We don’t want this to be you so we put this guide together to walk you through the best altcoins to buy.

While there are far more than 15, our list comprises projects at the forefront of their sectors, that have an edge over others in their class. We explore what they are, what they do, and why they are good choices. Use this guide as a map to explore potentially successful projects.

The Best Altcoins in 2025

The Top Altcoins to Buy Reviewed

What is an Altcoin in Crypto?

An altcoin is any crypto that isn’t Bitcoin. The term was coined at a time where most other cryptos were imitations of Bitcoin that sought to stand in for its limitations, and while the categorization now includes cryptos that are nothing close to Bitcoin alternatives, the moniker remains.

These days, we have major altcoins, fondly called major alts, like Ethereum, which has a market cap exceeding $1 billion, and minor alts, like GMX, with a market cap under $1 billion.

What are the Different Types of Altcoins?

Altcoins can be categorized in various ways. One of these ways is by the nature of the projects they belong to. For example, Ethereum is a Layer 1 altcoin because its ecosystem is a layer 1 blockchain network.

Note that tokens of platforms like layer 1s and scaling solutions like Arbitrum and Optimism are often called Platform tokens.

In the same vein, Apecoin would be a Metaverse altcoin because it is the primary token within an ecosystem that features a metaverse. Because all cryptos aside Bitcoin are called alts, APE would simply be called a Metaverse crypto or token.

Dogecoin would be a meme coin, while tokens that relate to Decentralised finance applications are termed DeFi coins.

Altcoins can also be categorized based on their functions within their respective ecosystems. This categorization includes four types of tokens.

Security tokens: These tokens represent an investment or part ownership in a platform or company. They are comparable to stocks and are often regulated under the same laws as traditional securities in countries with legal crypto frameworks.

Utility tokens: These tokens carry out specific functions or purposes within an ecosystem. For example, Alt Signal’s ASI token is required to gain access to its trading tools, serving as a utility token in that regard.

Governance tokens: These tokens give their holders the right to vote on proposals and the future of their platforms. It is similar to stocks in the sense that common stocks give their holders the right to vote, however, governance tokens do not have investment incentives.

Transactional tokens: This categorization changes depending on who you ask in the crypto space, however, they are tokens that are used as units of account or to carry out transactions. A good example are stablecoins like USDT or DAI.

Why You Should Invest in Altcoins

Growth Potential

The most common reason people invest in altcoins is the growth potential. While Bitcoin has proven to be profitable long term, the ship for outsized gains has sailed for the premiere crypto. At this point, achieving a 10x return is a tall order for Bitcoin, but not for altcoins.

Smaller altcoins can easily return 5x – 10x their value within a relatively short period. For example, the meme coin Pepe, returned more than 10000x its value within 21 days of launch. However, note that this should not be considered a norm amongst crypto investments.

Diversification

Altcoins present an opportunity for investors to diversify their portfolios by investing in crypto assets other than Bitcoin. While a crash in Bitcoin’s price weighs on the entire market, altcoins tend to recover much faster than Bitcoin.

Besides, the larger the market cap of an altcoin, the smaller the effect of a downtrend on its price as investors are more willing to hold on to large market cap alts with fundamental value.

For example, a 2% drop in Bitcoin’s price could cause a 5% drop in Ethereum’s price, depending on market conditions.

However, the same drop could cause a 20% drop in PEPE’s price as it has a much smaller market cap.

How Do You Choose the Best Altcoins to Buy?

Focus on Utility

If investing for future profit is your goal, then this should be a priority. To gauge utility, you need to look past the token itself and focus on the platform or dApp. Dive into the white paper to understand what problems the platform solves and how it solves it.

Projects with strong use cases tend to last longer than those without. Also, ensure the project’s solutions are sustainable. For example, the DeFi platform, Ohm, ran an unsustainable model in 2021 that eventually crashed.

Determine Predominant Narrative

Narratives move markets, especially in crypto assets. Early in 2023, AI cryptos rallied because the success of ChatGPT spurred an AI narrative. If you can determine the predominant narrative and its effect on the market, you can get in early on the tokens that fall within its scope.

Note that narratives can be short and long-term. Some span for months (AI cryptos) while others span for years (scalability). Short-term investment made using long-term narratives may not always work as intended, so ensure you can gauge the strength and time frame of the narratives you choose to key into.

Gauge Developer Community/Adoption

The crypto industry has grown tremendously in the last few years, however, most crypto projects are still quite technical and not ready to be deployed on the scale of their web2 counterparts. This means that the developer community is still very dominant in crypto.

Hence, projects with active developer communities tend to perform better and last longer than projects without. Note that the presence of a thriving developer community depends on the nature of the project.

For example, a project like Audius, a decentralized music streaming platform, should have more artists than developers.

Institutional/Governmental Use

Institutional adoption is a sign that a project will more than likely be around for a long time and achieve growth. This is because institutions pay for services that aid their operations and will continue to do so, all things being equal.

For example, JP Morgan recently started testing an inbuilt blockchain system for the real-time settlement of interbank dollar transactions. If a public blockchain project were to offer this type of service to institutions, it will most likely be around for a long period as its solution is paramount to their operations.

How Do You Invest in Altcoins?

The emphasis here is on investing, not trading, so we stick to buying coins on exchanges.

You can go with decentralized exchanges like Uniswap or GMX that do not require KYC and are not usually geo-specific. Trading fees are usually cheaper on these decentralized finance exchanges than their centralized counterparts.

You’ll need a decentralized crypto wallet like MetaMask to connect to the Dexes and store your altcoins.

Alternatively, you can use centralized exchanges, especially if you are a beginner and not yet familiar with more technical blockchain concepts.

What About the Risks Involved With Buying Altcoins?

Substitution

The threat of substitution is the risk that a crypto project will be superseded by another that provides similar (or better) solutions. In this case, holders of the original project’s altcoin may see their investment lose value as users move over to the newer solution.

There is no shortage of substitutes where altcoins are involved. Multiple projects offer solutions to the same set of problems, oftentimes offering the same type of solution. You’ll need to check periodically to ensure the market has not moved from the project you’re invested in.

Regulations

Regulations can make or break even giant crypto-decentralized finance exchanges, especially in vital markets like the US, China, or Europe. Harsh regulations can stifle the growth of projects in certain regions or completely preclude them from reaching developers and token holders within those regions.

Keep an eye on crypto regulation in both your jurisdiction and the region where projects that have incorporated parent companies are situated. For example, while MetaMask is a decentralized wallet, its parent company, ConsenSys, is not. It can be subpoenaed in the US and (in extreme cases) forced to alter some features of its decentralized wallet.

There are a Few Critical Questions to Ask Yourself Before You Invest in Altcoins

Before buying altcoins, ensure you ask a few things.

Where am I on the market cycle? This question is paramount as even good altcoins lose value during bear markets. The best time to buy altcoins (crypto in general) is at the tail end of a bear market, which is usually a few months before the next Bitcoin halving.

Is this altcoin supported by a trend? While altcoins can increase in value even when not supported by trends, those that are go, up faster. Prevalent trends in the crypto markets are your friend.

How to Buy the Best Altcoins

This guide shows you how to buy the best altcoins on a cryptocurrency exchange.

1. Open an Account

Visit the exchange’s website and follow the steps top open an account. Alternatively, you can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Verify your account by setting up your profile and submitting KYC documents like a valid government ID and proof of residence document like a utility bill.

3. Make a Deposit

Once your account has been verified, deposit funds by using any of the available payment options. Choose a convenient method and set the amount you’d like to deposit.

4. Buy Crypto

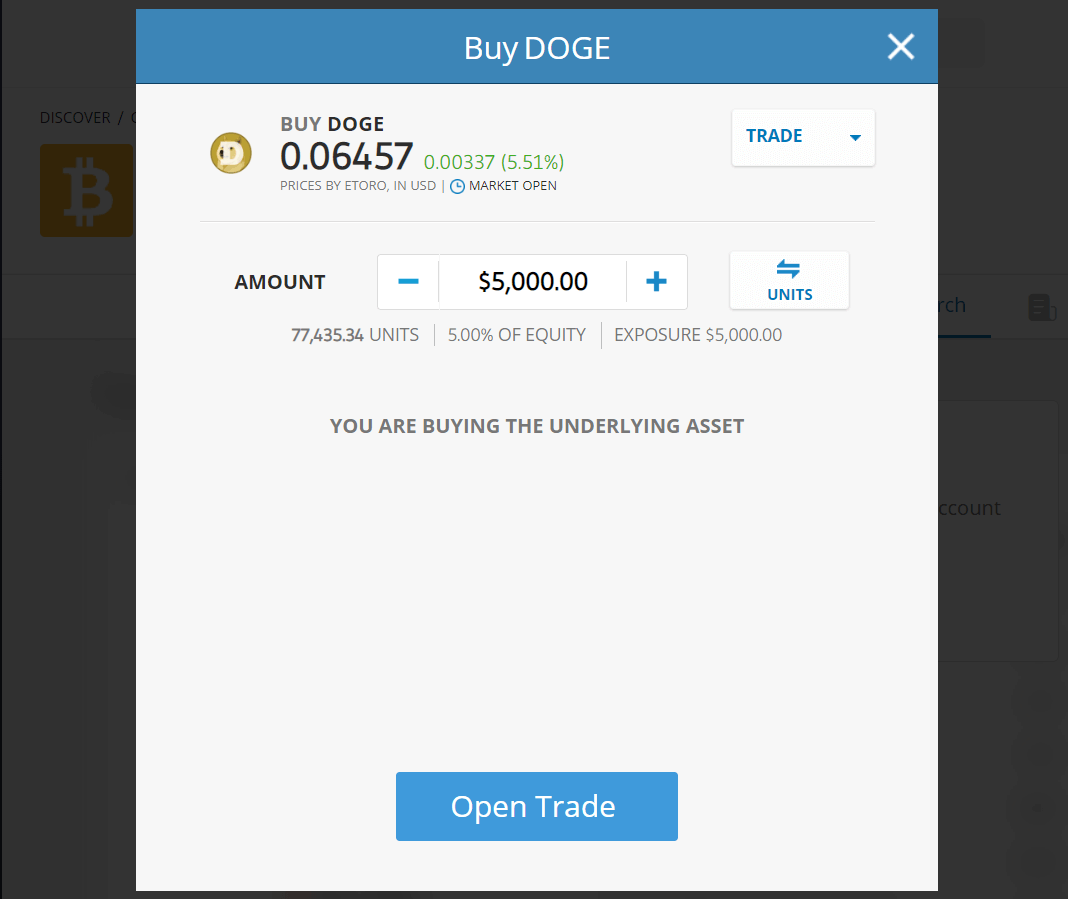

Once your account is funded, search for any of the cryptos mentioned in the Discover tab. An interface like the one below should load. You can then set your parameters and buy.

Where to Buy New Coins

To buy new altcoins like Chancer that aren’t yet listed on exchanges, you’ll have to purchase them directly on their websites using a crypto wallet like MetaMask. This guide walks you through that process.

Step 1: Download a Wallet

Download the MetaMask wallet app either on your phone or as a browser extension and create a new wallet. Write down your seed phrase and keep it safe and offline.

Step 2: Buy Some Crypto

You’ll need some ETH, USDT, or BNB to buy new coins. In the case of POODL, you’ll need SOL. You can get some on an exchange like eToro and transfer to your wallet or use a fiat onramp like Banxa.

Step 3: Connect Wallet

Navigate to Poodlana’s website and join the presale by connecting your wallet and buying POODL tokens using SOL.

Step 4: Wait To Claim

When the presale is over, you’ll be able to claim your tokens.

Latest Best Altcoin to Buy Project News

- Jack Dorsey courts controversy by claiming ETH is a security amid ongoing cases between the SEC, Binance.US, and Coinbase.

- Metacade’s CEO is focused on creating partnerships that improve community building as he rolls out a MetaStudio partnership.

- AltSignals ASI cryptocurrency presale reaches $585K as investors show interest in the company’s coming platform.

- Chancer platform seeks to disrupt the betting industry by providing a fully decentralised betting experience.

Final Thoughts on the Best Altcoin to Buy

We explored the best altcoins to buy and chose iDEGEN as the best choice because it taps into social and political narratives that have the potential to trigger truly viral growth.

Whichever altcoin you choose, remember to focus on utility, be aware of prevalent narratives, and gauge developer/community activity. Also look out for the threat of substitution and regulations.

Methodology - How We Picked the Best Altcoins

The cryptos covered in this guide were chosen through rigorous research. We paid attention to utility, reputation, community, and growth potential.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Chancer as the best betting protocol because it allows anyone to create predictive markets with custom rules and structures.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies