The Best Utility Cryptos to Invest in 2025 | Utility Tokens and More

New cryptocurrency projects are being developed and launched faster than most investors can keep track of, with over 26,000 already launched. While the sheer amount of utility tokens and projects provides many great opportunities to investors, the last decade of involvement in the industry has taught us that the best utility tokens offer more attractive long-term gains than traditional cryptos.

What is a utility crypto token? What are the best utility cryptos? And how can I buy one? In this investment guide, we’ll answer those questions and compare the best utility cryptos, as well as the main advantages of each coin, and provide great tips for investors looking to make the most of their crypto investments.

The Best Utility Cryptos to Buy in 2025

The Best Utility Cryptos Reviewed

What are Utility Cryptos?

Utility cryptos also known as ‘user tokens’ are digital assets or tokens created to perform specific actions within the blockchain of a certain project often based on Ethereum’s ERC-20 standard. A major characteristic of utility tokens is that they are not minable, but pre-mined (created all at once) and distributed as the creators decide.

Unlike traditional cryptocurrencies like Bitcoin and Ethereum, utility cryptos are often created to give their holders access to products, services, and features within a blockchain network, including discounts, rewards, an exclusive payment method and voting rights. The top utility tokens cannot be classified as a security because they do not give holder rights of ownership to a project.

How Do You Use Utility Cryptos?

The use of a utility token is often limited to the blockchain which it was created for. This means that the usage of utility cryptos depends on the blockchain platform where they were created. Below are some of the major ways you can use utility cryptos:

Access To Services

One of the main ways many utility tokens are used is to grant holders access to the functionalities of a blockchain project. For example, holders of utility tokens are granted access to store or retrieve data from a decentralized cloud storage blockchain platform. Without the utility token, these services won’t be available.

Interoperability

For interoperable blockchains, the utility crypto of that network serves as the means of exchange, value transfer, and interaction between other networks. For example, users of the Chainlink blockchain must hold the LINK before they can interact with other supported networks.

Discounts and Rewards

This use of utility cryptos is common on centralized and decentralized exchange platforms. Cryptocurrency exchanges often issue utility tokens that grant holders access to exclusive discounts, lower trading fees, or extra benefits within their platforms. These privileges are not available to non-token holders.

Governance and Voting

As a member of a cryptocurrency platform, you can use their utility crypto to participate in the decision-making process of the platform via voting. Holders of utility cryptos are granted rights within a platform to vote on governance proposals and make changes to the protocol.

Are Utility Cryptos a Good Investment?

Utility cryptocurrencies are generally considered good investment options for investors seeking gains over long periods. However, as with every investment, how good an investment is in a utility token would depend on several factors.

The factors that determine how good an investment in a utility token would be are:

- The utility and demand of the crypto are key factors that influence its performance. Utility cryptos that aim to solve key problems and are in high demand are often considered better investments than those with next to no use cases.

- The development and adoption of the platform are essential factors in determining the value of a utility token over long periods. A utility token for a well-developed platform with a competent team would often provide a better investment than a struggling platform.

- Because cryptocurrencies are still in their early stages, the future potential of a platform can also determine how an investment in its utility token can be classified. Some projects are currently projected to grow in adoption, making their utility cryptos a good investment.

Things to Consider Before You Buy Utility Cryptocurrencies

Investors are always advised to do their own research and consider several factors in order to make informed investment decisions. Below are important factors to consider when buying utility cryptocurrencies:

The Project

Before buying a utility crypto, an investor should conduct thorough research to understand the project, its technology, the problem it aims to solve, the development team, and the roadmap. This would give the investor an idea of the overall viability of the utility crypto.

Security and Auditing

Investors should take out time to access the auditing of the platform and the security measures put in place to keep funds safe. Investors can look for platforms that rate the smart contract security audits and security of crypto projects to help avoid potential risks.

Liquidity

Liquidity here refers to the ease with which you can sell a utility crypto. Investors should assess the liquidity of even the best crypto utility tokens and its project to ensure it has adequate liquidity and is listed on reputable exchanges where you can sell the utility token.

The Tokenomics

The supply and demand characteristics (tokenomics) of utility cryptos play important roles in their success. Investors should consider the distribution, issuance, inflationary, or deflationary aspects to get an idea about its chances of success.

Risk Management

Another important factor investors should consider is their risk tolerance and investment strategy. Before investing, it is important to determine how much and for how long you want to invest in a project.

Utility Coins Vs Utility Tokens

While they are often used interchangeably, utility coins and utility tokens refer to different types of assets in cryptocurrency. Below are the major differences between utility coins and utility tokens:

|

Utility Coins |

Utility Tokens |

| Utility coins are independent digital assets operating on their own blockchain | Utility tokens are digital assets that operate on existing blockchains, the most popular being Ethereum |

| They can exist alone as alternatives to fiat currencies | They are created to work with a platform or a decentralized application (dApp) |

| They are often used as a means of value transfer within the network | Their basic function is to provide access to specific products and services |

| Examples are Ethereum and Binance Coin | Examples are Basic Attention Token, Maker, and Chainlink |

Things That Impact the Price of Utility Cryptos

The factors that impact the price of utility cryptos include:

- The level of utility and adoption of a platform impacts the price of its utility crypto. The higher the utility and adoption, the higher its price tends to be.

- Demand: the higher the demand for utility cryptos, the higher their prices tend to be.

- Investor sentiment and market trends are crucial factors that impact the prices of utility cryptos. Investors being bearish often translates to declining prices for utility cryptos.

- The presence of competing platforms and rivals often impacts the price of utility cryptos. However, platforms with unique use cases often perform better than the average platform.

- The sentiment of the broader cryptocurrency market also affects the price of utility cryptos.

How to Buy the Best Utility Crypto

Now we know the best utility crypto, how do you make your first ETH purchase?

Step 1: Find the Right Crypto Exchange

Ethereum (ETH) is one of the most popular cryptocurrencies today and is available on most crypto exchanges, both centralized and decentralized. However, you would need to find a reliable exchange that provides a safe, secure, and cheap way to purchase ETH. Also, check to ensure the exchange is supported in your country. For this review, we will purchase ETH on eToro.

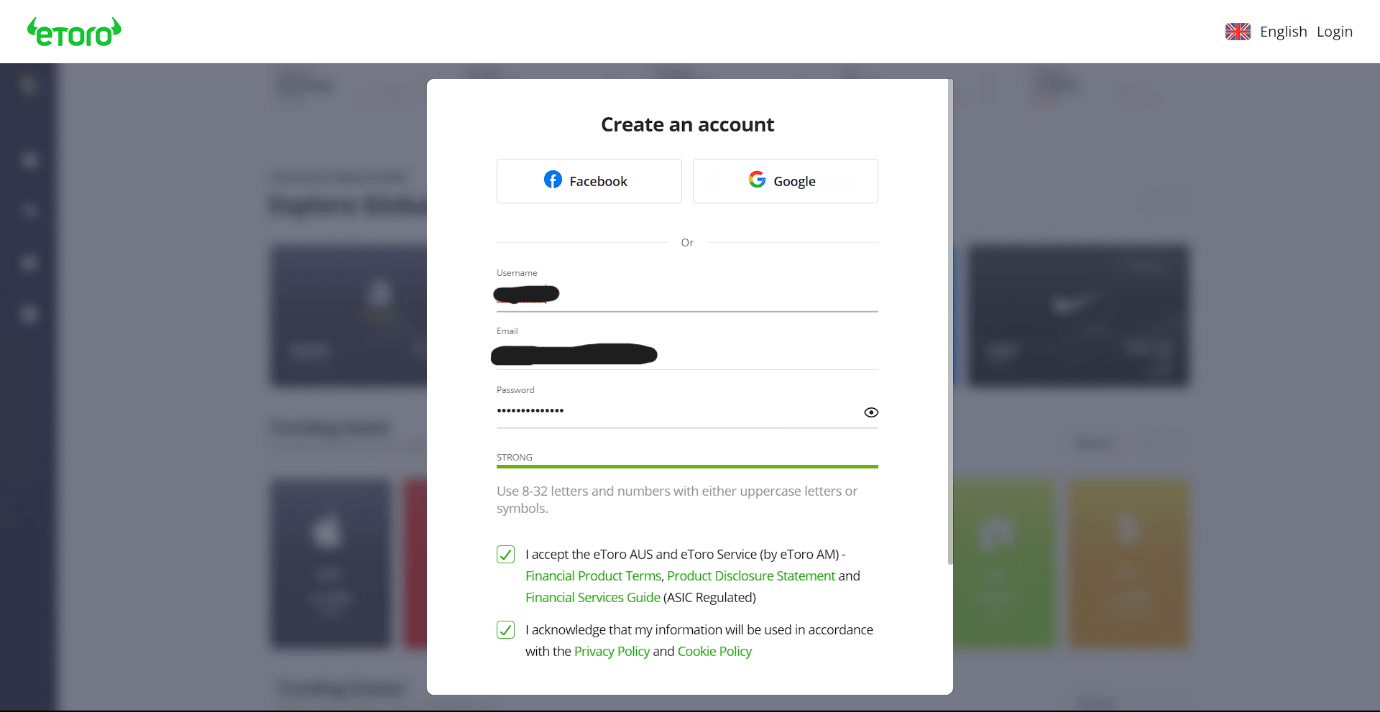

Step 2: Open an Account

To open an account, visit the official eToro website and click on the sign-up option. Fill in your email, preferred username, and password (recommended you use passwords with an uppercase, lowercase, number, and symbol). Alternatively, you can sign-up using your Facebook or Google accounts. Select the agreements and click on Create Account.

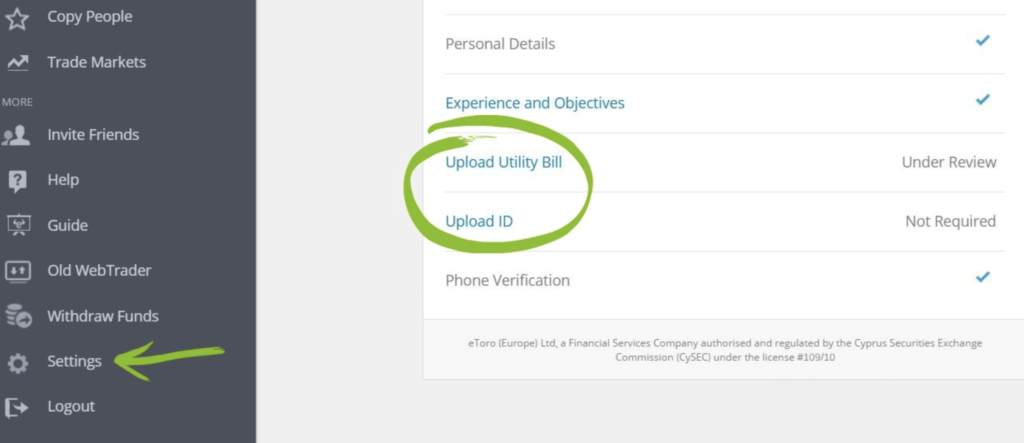

Step 3: Verify Your Account

eToro would send a six-digit verification code to your email to activate your account. After activating your account, eToro would require you to verify your account for extra security. To verify your account, you would be required to upload a valid proof of identity (passport, driver’s license) and proof of address (bank/credit card statement, internet bill). This can be found in the settings option.

Step 4: Make a Deposit

When your account has been verified, you can continue to make a deposit using one of the different options offered on eToro. To buy Ethereum (ETH) on eToro, you would need fiat in your account. You can deposit supported fiat currencies in your new eToro wallet using Credit/Debit Cards, bank transfers, PayPal, Neteller, Skrill, Rapid Transfer, and iDEAL.

Step 5: Purchase Crypto

Depending on the payment method available in your region, you can get your funds immediately or after several days. Once the fund is available on your eToro account, you can easily make your first ETH purchase. To do this, navigate to the Ethereum page, click on invest, choose how much ETH you want to buy, and make your first purchase.

Where to Buy New Coins

Emerging cryptocurrencies, unlike established ones, are usually purchased via their websites and not through exchanges. In order to be early and enjoy significant gains, new coins are purchased before they are listed on exchanges.

On the other hand, you can also purchase new and established cryptocurrencies on top exchanges when they are listed there. Nevertheless, purchasing via the project’s website by connecting a wallet might be the best bet. The subsequent paragraphs will explain how you can purchase new coins.

See below.

Step 1: Download A Wallet

MetaMask is one of the most popular software wallets in the crypto space. To buy a new coin, the first step is to download MetaMask and create a wallet. The created crypto wallet will allow you to participate in the Chancer presale as the liquidity you will need can be stored there.

Step 2: Buy Some Crypto

After downloading and creating a crypto wallet, you can now proceed to buy some cryptocurrencies to facilitate the purchase of CHANCER tokens. The cryptocurrencies you need to purchase to participate in the Chancer presale include BNB, BUSD, ETH, or USDT.

Step 3: Connect Your Wallet

To connect your newly created and funded wallet, first navigate to the Chancer homepage. Next, select the cryptocurrency you will be using to facilitate the transaction, either BNB, BUSD, ETH, or USDT, and specify the amount. Finally, click on “Connect Wallet” to link your MetaMask wallet to the website.

Step 4: Wait to Claim Your Crypto

Your purchased $CHANCER tokens will be available to claim only after the presale ends. The details about the token claim will be provided once the presale is close to its end. Once it is available for claim, you should navigate to the official website to claim yours.

Final Thoughts On The Best Utility Cryptos To Buy

Utility tokens are considered great investment opportunities because they offer the potential for solid long-term gains. The best utility crypto to buy is one that is part of a functional ecosystem with great adoption, thus, providing investors the potential for solid long-term gains. However, choosing the “best” utility crypto to buy would often depend on an individual’s investment goals, rather than its value proposition.

Methodology - How We Picked The Best Utility Crypto

Careful consideration and research were involved in choosing the best utility crypto. For this guide, we put into consideration the project in which it operates, the utility and use cases of the crypto, its market potential, the development team, platform security, regulatory compliance, its adoption rate, tokenomics, and supply of the tokens. These are the key factors involved in selecting the best utility cryptos. For more information about the process of selection, check out ‘How we test’ and ‘Why trust us’ to understand how we picked the best utility cryptos.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies