How to Mine Ethereum in 2025 - Complete Guide

Ethereum currently uses mining to add new coins to its circulating supply. The participants, known as miners, use the Proof of Work (PoW) mechanism to create a new block by solving complex mathematical equations, although, in the coming years, there is a plan for Ethereum 2.0 to transition to Proof of Stake (PoS). The first miner to solve each puzzle gets rewarded for creating the new block.

Other participants verify the block before it’s added to the blockchain. So, without miners, no one can create new coins on the network. You can mine Ethereum either on your own or through pool mining. In this tutorial, you’ll learn the best way to mine Ethereum profitably.

How to Invest in Mining Companies

Mining isn’t for everyone—acquiring the right hardware and powering it can involve a significant amount of effort and expense. What’s more, you may find yourself competing with industrial-scale mining operations, such as Riot Blockchain, Marathon Digital Holdings, and Argo Blockchain.

A simpler and cheaper way to profit from mining is to buy shares in one of these mining companies. This is easily done by signing up with a broker that offers mining company stocks. We’ve provided links to our preferred brokers for each of the mining stocks below.

Riot Blockchain (RIOT)

Riot Blockchain has Bitcoin mining facilities in New York and Texas, including North America’s single largest Bitcoin mining and hosting facility. The company aims to increase its capacity and hash rate by expanding its operations with the purchase of more mining machines.

Shares for Riot Blockchain are listed on NASDAQ under the ticker symbol RIOT. If you want to invest in the company, you can easily and safely purchase RIOT shares on our top recommended platform.

Marathon Digital Holdings (MARA)

Digital asset technology company Marathon Digital Holdings has been around since 2010, when it started collecting encryption-related patents. The company already has a sizeable fleet of Bitcoin miners and aims to build North America’s largest mining operation while keeping energy costs low.

You can invest in Marathon Digital Holdings by buying MARA shares. Make sure to purchase them on a regulated and reputable platform. The best and safest such platform that offers MARA shares is linked to below.

Argo Blockchain (ARB)

Argo Blockchain comprises a dynamic team of mining and blockchain experts that prize innovation. The company supports the development of blockchain technologies and advocates the use of renewable power sources to create a sustainable blockchain infrastructure.

Argo Blockchain is always aiming to improve the way it creates value for stakeholders and you can invest in the company by purchasing ARB shares. Click on the link below to sign up with our top recommendation for where to buy ARB shares.

Breaking Down Ethereum Mining

This section explores what Ethereum mining details. It offers tips that miners need to mine the coin profitably. We aim to give you all the essential information you need on this subject, including miners’ role in securing the Ethereum network and creating new blocks.

What is Ethereum Mining?

The Ethereum network allows miners to add new blocks after an average of around 15 seconds. As a reward, they receive 2 ETH plus gas. They can also get a bonus for updating the ledger and securing the network.

After successfully solving a mathematical problem, a miner broadcasts this new development to other network participants. If 51% or more of the participants agree that the answer is correct, the new block is added to the blockchain. Miners then start solving a new problem, and the process continues.

Due to decentralization, the Ethereum network gives participants much power to control the production of new coins. Nonetheless, the PoW mechanism reduces the risk of mismanagement. More than half of miners must validate all Ethereum transactions. This means millions of participants are required to make crucial decisions.

Why Ethereum Miners are Important

In the previous part, we have presented how the Ethereum mining process works. One thing stands out: miners validate transactions and secure the network. In particular, they prevent the double-spending problem.

In decentralized systems, some individuals can take advantage of a few loopholes in the network to duplicate transactions. This threat was responsible for the delayed adoption of cryptocurrency.

Blockchain technology ensures that all blocks are timestamped and assigned a unique hash (special number). Each of them also contains a timestamp of the previous block, eliminating the risk of changing when a transaction took place.

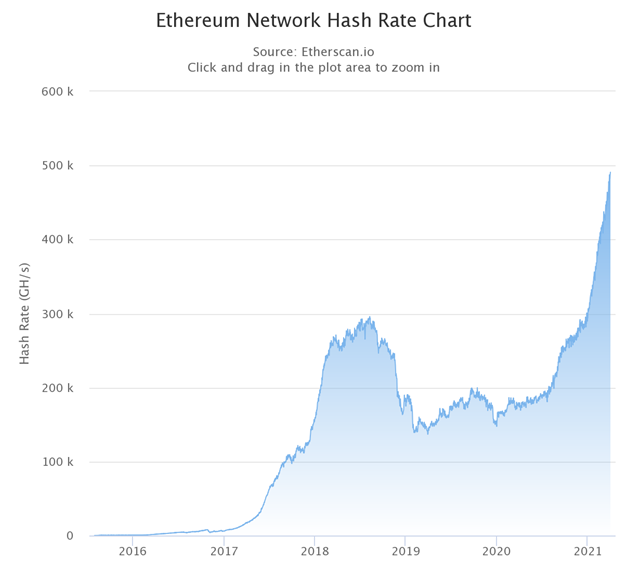

The hashrate boosts the reliability of the Ethereum network. When the number of miners on the network increases, its hashrate rises. It also increases the network’s security given that more participants are required to verify transactions and make critical security and managerial decisions.

The Ethereum network, therefore, depends on miners to be safe and continue building its blockchain. Miners, therefore, should get block rewards, bonuses, and more for their service.

Ethereum Mining Limitations

ETH is one of the few cryptos with a fixed issuance schedule. It issues two new coins into circulation for every block introduced on the network.

The number of active participants, transactions, and market price have no impact on the supply.

If the supply outpaces the demand, ETH could become an inflationary currency. However, the current limited issuance schedule of 2 ETH/block may minimize the risk.

In 2019, the fixed issuance schedule was 3 ETH/block. Two years earlier, it was 5 ETH/block. This means the issuance supply is steadily decreasing.

ETH doesn’t have a limited number of coins like Bitcoin. However, the supply is capped at 18 million ETH per year. So, it mimics fiat currency. However, since the annual limit doesn’t reflect the changing economic factors globally, the crypto could be exposed to inflation. It potentially has a fee-burning mechanism that takes away some coins from circulation to prevent this, and this could be implemented in July 2021.

Ethereum intends to transition to Proof of Stake (PoS), which is more cost-effective and energy-efficient than PoW.

This move is expected to reduce the issuance rate from about 5% to less than 1% per year from 2022. With no increase in the total supply under this new model, the price of ETH could increase as the mining difficulty goes up. Check out our Ethereum price prediction guide for a more detailed analysis of this.

Tip to Mine Ethereum Efficiently for Greater Profits

If you want to mine Ethereum efficiently for greater profits in 2021, you can invest in mining hardware and join one of the best mining pools. Alternatively, you can purchase a credible and affordable cloud mining service. If you choose to join an Ethereum mining pool, ensure it uses cheap electricity. For the latter, consider whether the reward share and the terms and conditions of the contract are acceptable.

Standalone Ethereum mining no longer works due to increased mining difficulty. Mining pools and cloud mining services with highly efficient machines and sources required to cushion you from huge losses are the only viable options.

Technical Aspects of Mining Ethereum Explained

In this section, we cover some of the technical aspects of mining Ethereum. We’ve selected those that you need to mine crypto profitably, like hashrate and processing power. This section explains the benefits of a higher hashrate within the Ethereum network and more.

Hashrate Simplified for Cryptocurrency

- What does hashrate mean?

In simple terms, hashrate is the number of attempts an Ethereum miner can make to create a new block within a given time. It can also be defined as the speed of mining. Hashrate determines the computing power of miners.

When the number of participants within the Ethereum network increases, the hashrate for the entire system also increases. However, as this happens, the proportional hashrate for individual miners drops.

- Why is a higher hashrate important?

As we have seen above, a higher hashrate for the network means two different things to the network and the participants. It means an increase in competition for miners. So, they can make limited successful guesses.

At the same time, it means the network is more secure. If a bad actor intends to attack the Ethereum network when the hashrate is high, they are likely to fail. It costs too much to control at least half of the miners at such times. In other words, a higher hashrate provides the best protection against 51% attacks and the ensuing problems. Moreover, it ensures speedy validation of transactions.

- How is hashrate measured?

Hashrate is measured in solutions (or hash) per second (h/s). It uses other prefixes like K (kilo), M (mega), G (giga), or T (tera), to denote orders of magnitude.

- 1Kh/s means 1 000h/s

- 1 Mh/s means 1 000 Kh/s or 1 000 000 h/s

- 1 Gh/s means 1 000 MH/s, 1 000 0000 Kh/s, or 1 000 000 000 h/s

- 1 Th/s means 1 000 Gh/s, 1 000 000 Mh/s, or 1,000 0000 000 Kh/s, or 1 000 000 000 000 h/s

The Ethereum hashrate currently stands at 482.703 TH/s. This figure has been calculated using the current average Ethereum network difficulty above 6,000 Th as of March 28, 2021.

Processing Power: CPU & GPU

Due to the high network difficulty, network participants no longer use central processing units (CPUs) to mine Ethereum. Their efficiency is about 5 Mh/s. The use of graphics processing units (GPUs) is on the rise since they can produce at least 68 Mh/s. GPUs can be used for many different hashing algorithms, as they are not specifically built for just one.

The Ethash PoW algorithm that the cryptocurrency uses is fairly ASIC-resistant. So, few miners have adopted application-specific integrated circuits (ASICs) despite their incredibly high processing power of up to 110 TH/s. Remember, these machines are custom-built, and can only be used for one hashing algorithm.

The emergence of Field-programmable Gate Arrays (FPGAs) signaled a major change in the mining of Ethereum. These are capable of 800 Mh/s, highly adaptable like GPUs, and affordable. However, the requirement to build the software and the digital circuit design has hindered its widespread adoption.

Hashrate needed to mine Ethereum profitably

As you can see below, mining Ethereum is harder today than ever before. The network difficulty has gone past the 6,000 Th mark for the first time, and the diagram suggests that it has been increasing steadily since July 2015.

Ethereum hashrate chart. Source: Etherscan.io

So, how much would it cost to mine one Ethereum today? Due to the increasing mining difficulty, you require a machine with about 15,500 Mh/s.

Some rigs with lower efficiency may also be profitable but for a short while.

To build a mining rig with the required efficiency, you need over 50 GPUs. If possible, you can alternatively use ASICs that are compatible with Ethereum since they are twice as efficient.

Pros and Cons of Mining Ethereum

Pros

- Pro miners make huge profits

- The value of Ethereum is increasing constantly at the moment

- It offers you an opportunity to make passive income

- As you verify transactions, you help to secure the network

- You can resell you mining rig

- You can mine using GPUs, ASICs, and FPGAs

Cons

- Setting up the right mining rig can be costly

- Standalone mining is unprofitable

- The rewards for mining Ethereum has been decreasing over the years

- When Ethereum moves completely to Proof-of-Stake, mining rigs will be worthless

DIY Ethereum Mining-How to Get Started

We provide a DIY guide to mining Ethereum in this section. We give you clear information on how to find the best mining hardware and manage your overhead costs. Besides, we help you to choose a suitable software and mining pool.

Best Mining hardware for Ethereum

GPUs (graphics processing units) remain the most efficient and reliable hardware for mining Ethereum. The network rejects most ASIC miners as many of them are designed to prevent smaller users from mining ETH.

Nvidia and AMD offer the best GPUs for mining Ethereum. You can use an online Ethereum profitability calculator to know how much you can earn with each of them.

Nvidia GTX 1070 Founders Edition remains one of the best GPU options. It consumes only 150 watts of power but can mine at between 27 MH/s and 31 MH/s. However, its price has increased to over $700 due to surging demand. You can find it on eBay or Amazon. If stock runs out, contact the manufacturer.

AMD RX 480 is also a popular GPU for mining Ethereum. Though this hardware is a generation behind AMD’s current product line, it’s better than the new version, RX 580, for ETH. The new hardware’s inflated price, poor cooling efficiency, and slightly higher power consumption make it less suitable for mining.

You can opt for the ASUS RX 580 8 GB Dual-Fan OC Edition. It provides double airflow and three-times quieter mining, and mines at approximately 29 MH/s. So, it’s a great alternative considering that the RX 480 is often difficult to find in the market.

Most miners buy the AMD RX 480 from gamers who no longer use it or are willing to sell them. This GPU miner works at 24.5 MH/s without overclocking. When overclocked, it achieves up to 28 MH/s. It consumes only 150 watts and costs about $600 on Amazon.

Other Costs to be Considered in Mining Ethereum

It’s important to consider power consumption. It could affect your profitability if left unchecked.

The exact cost depends on your hardware. For example, Nvidia GTX 1070 Founders Editions consume only 150 watts and mines between 27 MH/s and 31 MH/. Nvidia Titan V consumes 188 Watts and mines at between 70 and 82 MH/s.

Besides, the cost of electricity depends on the miner’s location. For example, the price is lower in China than in some parts of the world. Mining with household electricity supplies is often unprofitable in countries like the UK.

With the current mining difficulty and the GPU trends, it could take up to six months or more to mine a single Ethereum coin.

To build a mining rig with a hash rate of 15,500 Mh/s, you require about $100,000, depending on your location. This accounts for the cost of about 50 GPUs and electricity.

Mining Solutions/Services

Cloud mining can be a better alternative if you don’t want to keep noisy equipment in your warehouse or home. This involves renting someone else’s hardware to earn mining rewards without doing any of the work yourself.

CCG is one of the most popular cloud mining contract providers. It provides the highest hashrate and offers a choice of contracts to suit different aims and budgets.

If you want to mine yourself but lack the knowledge and skills required to mine Ethereum via mining pools, we’ve provided lots of information to help you. Mining pools are great since they combine many miners’ hardware, giving members an advantage over individual miners on the network.

As we have seen, before joining any Ethereum mining pool, you must buy the necessary hardware and install the software. For some, this is tedious. So, they need an alternative.

There are several motivations for seeking an alternative mining method. Whichever reason you have, you can join a cloud mining software service. It involves paying an expert miner to handle all the mining tasks on your behalf. In other words, you rent other people’s mining time, and they share the rewards with you.

This mining method relieves you from responsibility if any equipment is broken. Once you pay for the service, you have a right to ask for the agreed results. You need to be careful, though. Some companies can try to mislead you into believing their concealed lies.

They make appealing verbal commitments but ask you to sign contracts that put the responsibility of ensuring the equipment works as required on you.

Start Mining!

Other than suitable mining hardware and software, it would help if you had an Ethereum wallet to start mining. Like physical wallets, you use them to store your coins. The software gives your hardware access to the Ethereum network and the mining pool.

We mention pool mining here although it is possible to mine solo. The issue with solo mining Ethereum is that the current difficulty of solving the next block in the Ethereum blockchain is so difficult you will hardly stand a chance in being the one to solve it. The only way for mining solo to be plausible would be to start your own computer farm as this would give you the computing power required. Even still some people who have mining farms will still join a pool.

If you choose to join an Ethereum mining pool, you can consider Ethpool/Ethermine. These two sites contribute to a single pool and are one of the largest on the network.

Over 125,000 miners are on Ethermine. Close to 1,100 are on the other sister website.

Nanopool is another leading Ethereum pool mining software. It has over 80,000 miners. Dwarfpool is much smaller but charges a 1% fee on rewards.

Note that you should decide based on the pool size, minimum payout, electricity costs, and pool fees. Larger pools combine more hardware than smaller ones.

Before joining any mining pool, choose the right software. If you are a Microsoft Windows user, ETHminer, is ideal. It offers the option to earn per day or minute.

Claymore is another excellent Ethereum mining software. Currently, it supports dual mining. It’s also well-optimized and provides constant updates.

CCMiner is built using the C++ programming language. So, it’s compatible with most mining rigs. If you are a Mac user, Minergate is ideal. It also allows you to join an ASIC pool.

Where to Save My Coins after Mining

Now that you are ready to mine Ethereum, it’s time to think about where you’ll store your mined cryptocurrency.

After mining Ethereum, you need the best Ethereum wallet that offers advanced security to protect your coins from hacks. Always remember never to give your private key to others.

Here is a list of top recommended wallets for storing Ethereum (ETH).

Alternatives to Ethereum Mining

Mining isn’t for everyone—acquiring the right hardware and powering it can involve a significant amount of effort and expense. What’s more, you may find yourself competing with industrial-scale mining operations, such as Riot Blockchain, Marathon Digital Holdings, and Argo Blockchain.

A simpler and cheaper way to profit from mining is to buy shares in one of these mining companies. This is easily done by signing up with a broker that offers mining company stocks. You can get started by clicking on the link to our preferred partner below.

Riot Blockchain (RIOT)

Riot Blockchain has Bitcoin mining facilities in New York and Texas, including North America’s single largest Bitcoin mining and hosting facility. The company aims to increase its capacity and hash rate by expanding its operations with the purchase of more mining machines.

Marathon Digital Holdings (MARA)

Digital asset technology company Marathon Digital Holdings has been around since 2010, when it started collecting encryption-related patents. The company already has a sizeable fleet of Bitcoin miners and aims to build North America’s largest mining operation while keeping energy costs low.

Argo Blockchain (ARB)

Argo Blockchain comprises a dynamic team of mining and blockchain experts that prize innovation. The company supports the development of blockchain technologies and advocates the use of renewable power sources to create a sustainable blockchain infrastructure.

Top Ethereum Stories

Franklin Templeton launches a Bitcoin and Ethereum index ETF

20 February 2025 Franklin Templeton has launched EZPZ ETF tracking Bitcoin and Ether. The EZPZ ETF is the second US…

Hyperliquid launches its general-purpose EVM and unveils bug bounty program

18 February 2025 Hyperliquid has launched its general-purpose EVM dubbed HyperEVM. The HyperEVM integrates with Hyperliquid’s L1 consensus mechanism for…

Crypto recorded $1.3B in investment product inflows this past week

10 February 2025 Crypto investment products registered $1.3 billion in inflows last week Ethereum outpaced Bitcoin with $793 million compared…

Weekly price analysis: crypto prices reel from risk off sentiments

10 February 2025 The crypto market trended lower last week as US tariffs rocked the market, causing investors to flee…

Cboe seeks US SEC nod for spot Ethereum ETF options

6 February 2025 Cboe has submitted a 19b-4 filing to be allowed to list and trade options on spot Ethereum…