YouHodler Review 2025

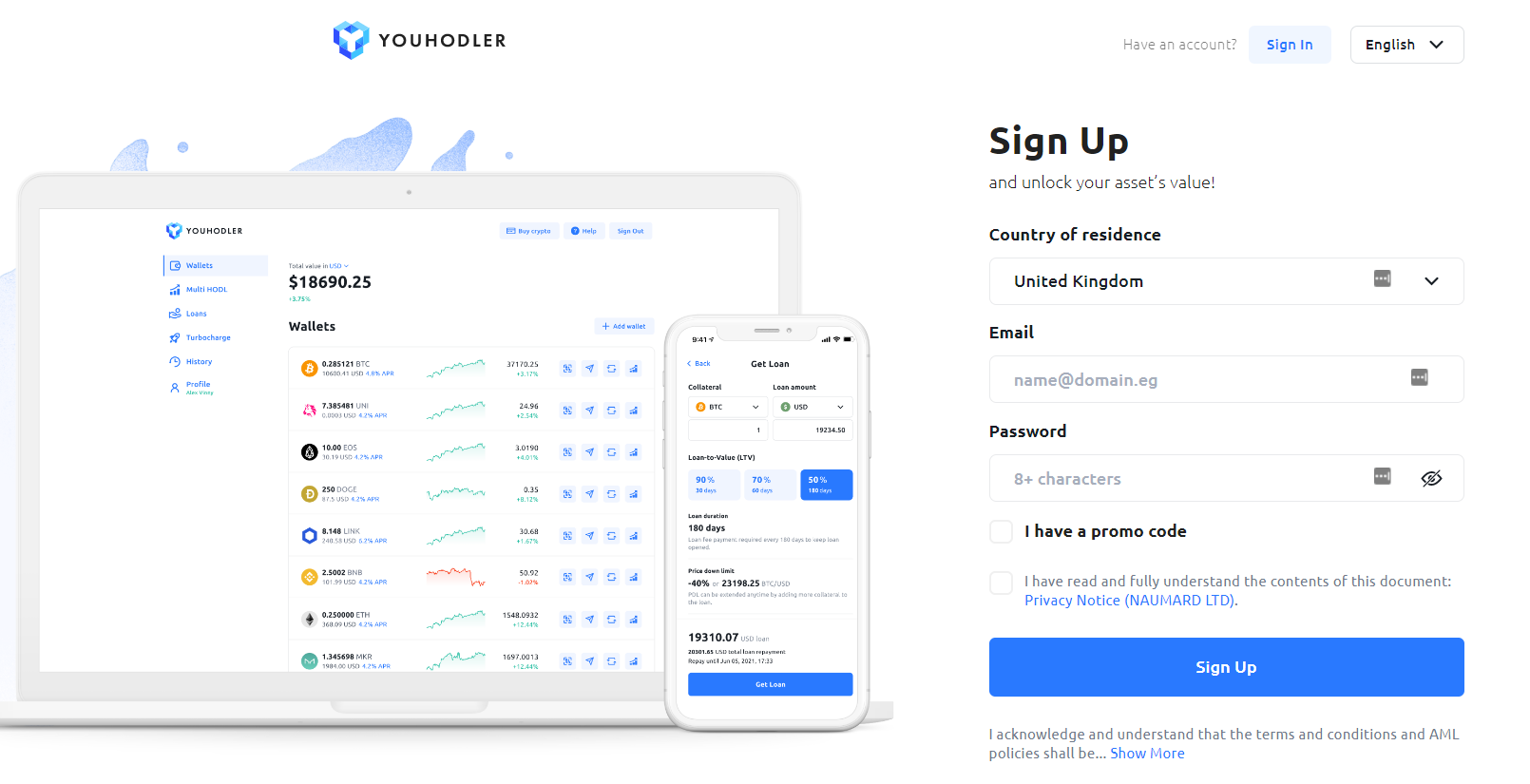

Launched in 2018, YouHodler is a Switzerland-based crypto platform that aims to unlock the benefits of crypto for its users. It is a crypto lending platform that offers crypto-backed loans, as well as an exchange, a wallet, and ways to earn interest on your crypto.

This review will take an in-depth look at the pros and cons of using YouHodler. We’ll explore everything from features and performance to fees and security. Keep reading to find out whether signing up to YouHodler is the right choice for you in 2025.

3 Steps to Sign Up to YouHodler

-

Create an account

Click the “Get Started” button on the YouHodler website. This will take you to the registration form, where you’ll need to fill in your country of residence, email address, and password. Tick the box to confirm that you have read the Privacy Notice, and click the “Sign Up” button.

-

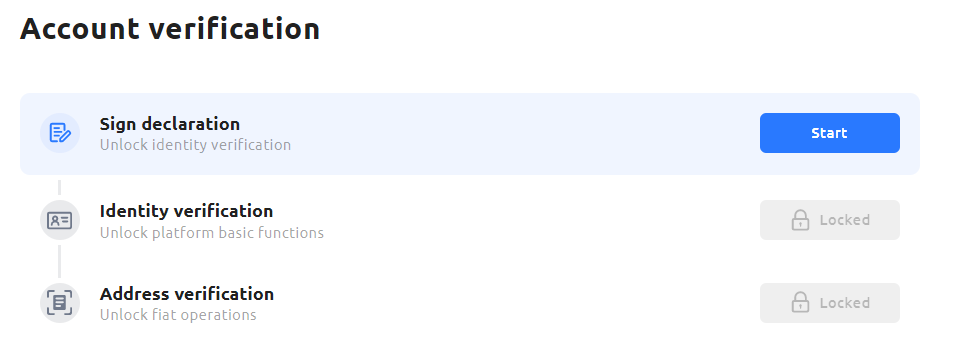

Verify your identity

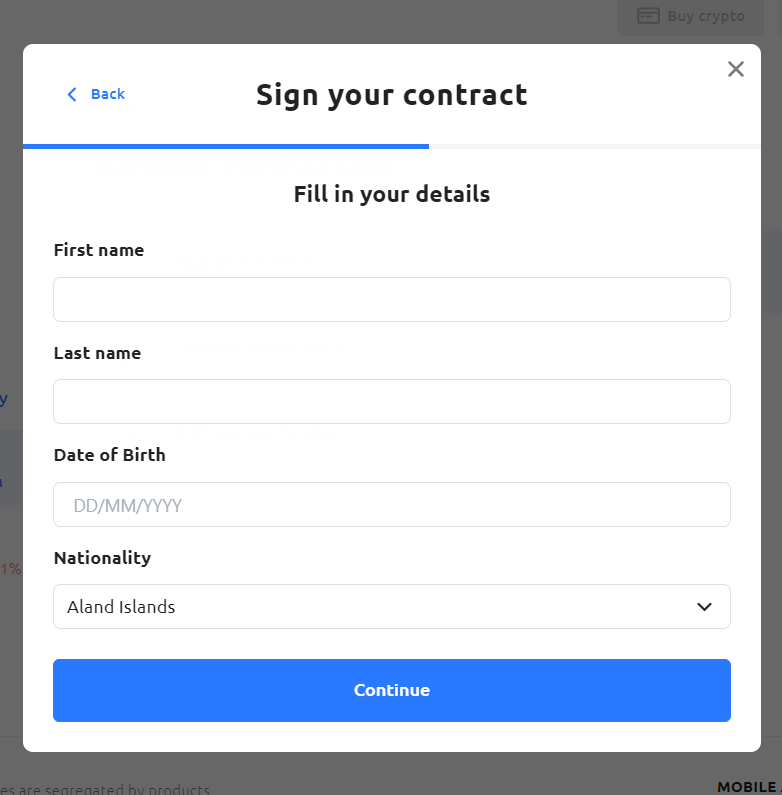

Go to your profile and click “Verify” under Account verification. Click the “Start” button next to “Sign declaration” and confirm whether or not you are a US person. You will then need to enter the verification code emailed to you, provide your phone number, and enter the verification code texted to you.

You will then need to provide your full name, date of birth, nationality, address, country of residence, and confirm that you are the sole owner of the funds in your account. Click “I accept and sign”.

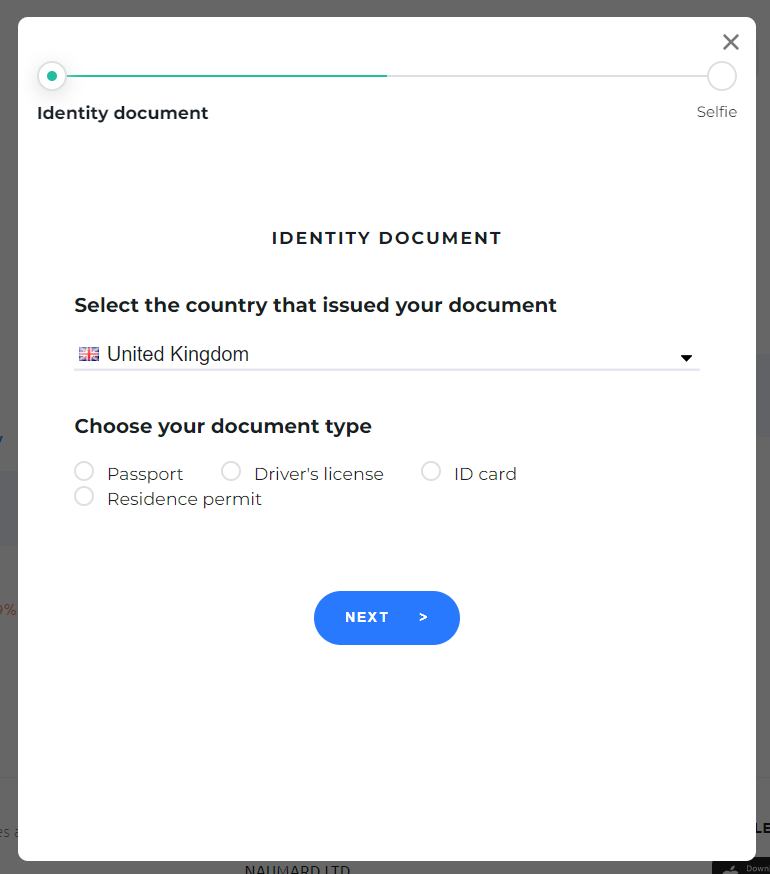

Next, click the “Start” button next to “Identity verification”. Choose your identity document, upload an image of it, and click “Next”. On the following page, click “I’m ready” to take a selfie with your webcam. You will likely be verified within a few seconds.

Click the “Start” button next to “Address verification”. Select your country of residence from the dropdown list, upload an image of one of the accepted forms of proof of address, and click the “Next” button. Once your document has been approved, you will have access to all the features on YouHodler.

-

Make a deposit

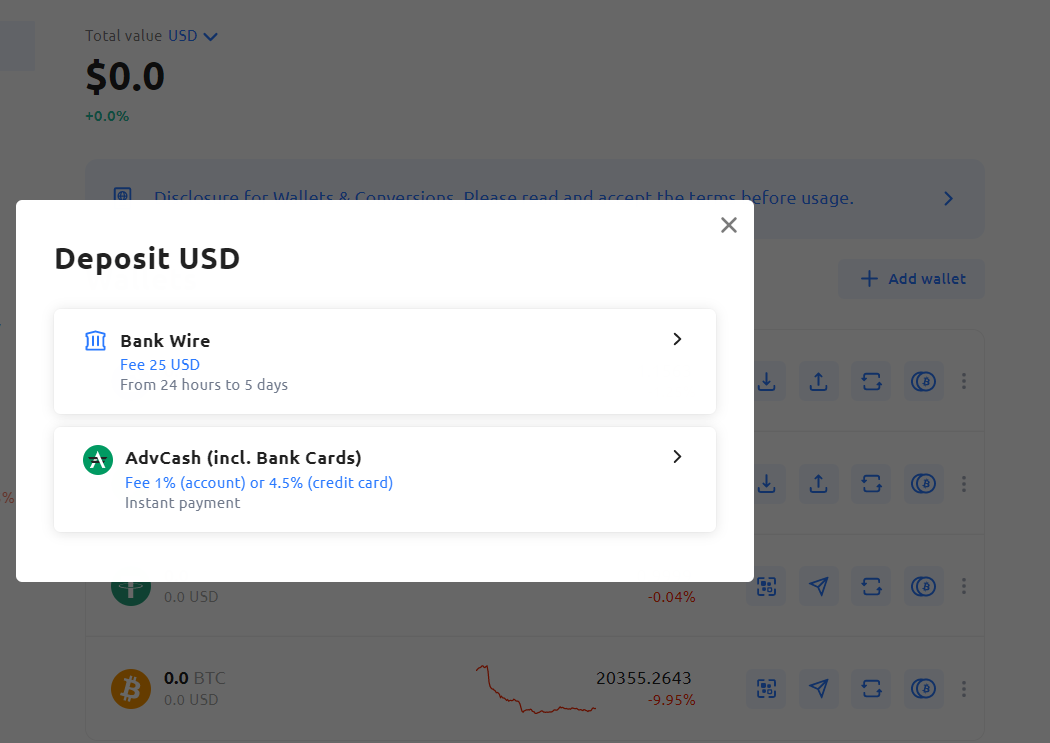

Go to the Wallets tab and click on the deposit button with the downward arrow next to your local currency. Click on your preferred payment method from the options available in your country, enter how much you wish to deposit, and follow the onscreen instructions to complete the payment with your chosen method.

YouHodler Pros and Cons

Pros

- Get crypto-backed loans

- Savings accounts providing up to 8% APR interest

- Tools to boost potential profits

- Swap crypto, stablecoins, and fiat on the exchange

- Regulated

- Strong security

- 24/7 support

Cons

- High deposit fees for some payment methods

- Unavailable in the US

YouHodler Compared

YouHodler is a popular all-in-one platform for crypto hodlers around the world. As well as an exchange where users can buy and swap more than 50 of the most popular cryptocurrencies and stablecoins, YouHodler provides a range of tools for making the most out of the crypto you hold, from staking and savings accounts to crypto-backed loans with the highest loan-to-value ratio on the market.

However, YouHodler isn’t the only crypto platform available. If you want to see what else is on offer, check out some of the most popular alternatives below.

History of YouHodler

YouHodler was founded in 2018 in Switzerland by CEO Ilya Volkov, who has more than 15 years of experience in trading, fintech, and commercial finance. The company is focused on crypto-backed lending, and its mission is to give people the tools they need to stop hodling passively and start making their crypto work for them.

In 2018, YouHodler became an active member of the Financial Commission’s Blockchain Association, a community that aims to advance self-regulatory efforts in digital currency trading and uphold the highest standards of business practices.

YouHodler Regulation and Security

As a member of the Blockchain Association, YouHodler is committed to adopting best practices, complying with all applicable laws, and making its platform safe and user friendly for customers.

YouHodler is currently licensed and regulated in Italy, with offices in Switzerland and Cyprus, and plans to expand its presence in Europe. Deals made by YouHodler fall under EU laws, and as such, the company is legally obliged to return cryptoassets to users.

Is YouHodler Safe?

YouHodler uses industry best practices when it comes to security. The platform uses Ledger Vault’s technology for cold storage of users’ crypto, and insures crypto assets against various risks. Fiat balances, meanwhile, are only stored at reputable banks in Europe.

YouHodler also employs the leading security measures when it comes to access rights, IT security checks, data protection, and data encryption. The platform offers the rare option for three-factor authentication (3FA), providing an extra layer of security. YouHodler also blocks bad actors from its platform as all crypto transactions are analysed by YouHodler’s partners, CipherTrace and Elliptic.

YouHodler Reputation

YouHodler has been operating since 2018 without suffering any theft of assets, and the platform takes its values of honesty, transparency, and regulation seriously. YouHodler has received an excellent rating on the review site Trustpilot, with customers praising its services.

The company is backed by an experienced team with expertise in fintech and technology development. YouHodler has also partnered with a number of reputable companies, including Acuant, Elliptic, Sumsub, and Ondato for compliance, and Ledger and Fireblocks for custody management.

Is YouHodler for Me?

Your experience level and investment goals will affect what you need from a crypto platform. Let’s take a look at how suitable YouHodler is for different types of users.

I’m a Beginner

YouHodler is a great place for those who are new to crypto. It provides a smooth interface that is easy to navigate. The buttons are clearly laid out, with your assets and their performance displayed transparently. There are useful tutorials under Help if you have any questions.

Buying crypto with your credit card is a very simple process on YouHodler—it only takes a couple of clicks. Beginners are also walked through the straightforward conversion process. You can deposit your crypto into savings accounts at the click of a button, and then automatically receive interest payments to your wallet each week.

I’m Advanced

YouHodler has plenty to satisfy the experienced user as well. The crypto loans come with advanced features, like take profit, increase loan-to-value, and extend price down limit to protect loans from margin calls. Meanwhile, the Turbocharge feature enables you to “clone” your loans.

There are also more advanced yield generation strategies, such as using Dual Asset to profit from DeFi, and implementing the barbell strategy with Multi HODL.

Wallets: Features, Supported Cryptocurrencies, and Security

YouHodler provides a free custodial multi-coin crypto wallet. The wallet is available for Android, iOS, and desktop operating systems, and it has a simple design to make it easy for anyone to manage their crypto holdings.

The functionality of the wallet is advanced, though, providing a one-stop shop for all your crypto needs. You can take out crypto-backed loans, earn interest on savings accounts, and access advanced trading tools, like Dual Asset, Multi HODL, and Turbocharge, all within your wallet.

The YouHodler wallet supports more than 50 of the most popular cryptocurrencies and stablecoins. Namely, these are: BTC, ETH, USDT, USDC, TUSD, DAI, BUSD, HUSD, EURS, LINK, UNI, COMP, MKR, SUSHI, YFI, SNX, OMG, PAXG, DOGE, LTC, XRP, XLM, ZRX, BNT, BNB, ADA, DASH, TRX, EOS, BCH, AAVE, DOT, HT, XTZ, BAT, USDP, REP, AVAX, BTT, 1INCH, FTT, NEAR, ZIL, EGLD, CAKE, FIL, ATOM, SRM, MANA, SAND, AXS, ILV, GALA, APE, GMT, and SOL.

These are secured by an advanced hot/cold wallet system, which incorporates Ledger Vault’s technology and cryptoasset insurance for up to $150 million. You can also withdraw your crypto to a private wallet at any time.

Fees and Costs of YouHodler

The first fees you’re likely to run into when using YouHodler are the deposit fees. These are $25 for USD SWIFT deposits, £20 for GBP deposits, and zero for other bank wire deposits. There is a 1% fee for deposits by AdvCash wallet, and a 4.5% fee for credit card deposits.

The withdrawal fees are at least $70 or 1.5% for USD SWIFT, at least £55 or 0.15% for GBP, and at least 15 CHF or 0.15% for CHF. Euro withdrawals carry a fee of €5 or €55 when using SEPA or SWIFT, respectively.

There are no fees for depositing crypto or stablecoins, and the crypto withdrawal fees are different for each coin.

There are no fees for using YouHodler’s savings accounts, and you can see what the conversion fee will be for any swap as this will be displayed in the conversion widget before you complete the transaction.

When using Multi HODL, there is a Rollover fee paid for every fixed period of time, which you can see in the Multi HODL detailed view. If the deal is profitable, you will also pay a profit share fee, the size of which depends on the coin, amount, and price.

When taking out a crypto-backed loan, there is a daily fee of 0.55% of the overdraft amount when collected from the wallet or 0.825% if the fee is added to the loan debt. Other costs you may incur when taking out loans include a close now fee of 1% of the overdraft amount, an extend price down limit fee of 1.5% of the additional collateral, and an increase loan-to-value fee of 1.5% of the increased amount.

Payment Methods & Limits

The payment methods YouHodler accepts are credit cards, AdvCash wallet, and bank wires in USD, EUR, GBP, or CHF. The minimum amount you can deposit by bank wire is 100 in whichever currency you use. When withdrawing, the minimum amount is 50 for EUR (SEPA), 100 for CHF, and 500 for USD, GBP, or EUR (SWIFT).

The minimum crypto deposit is $5 in crypto equivalent, and the minimum crypto withdrawal is $5 to $50, depending on the cryptocurrency.

Transaction Limitations

When buying crypto with a credit card, you can purchase a minimum of $30 and a maximum of $12,000.

The minimum loan amount is $100, which is also the minimum loan amount when using Turbocharge.

If you want to earn interest with a savings account, the minimum amount is $100 in crypto equivalent, up to an overall maximum of $300,000 across all currencies.

YouHodler: Performance, Features, and Functionality

YouHodler is the go-to platform for hodlers who want to make the most of their crypto investments. Let’s take a look at what the platform has to offer in terms of performance, features, and functionality.

Trading Platform

The YouHodler platform is web-based, though the YouHodler wallet app is also available for Android and iOS devices.

There are more than 50 cryptocurrencies and stablecoins supported, as well as the fiat currencies USD, GBP, EUR, and CHF. The platform is straightforward to use. It’s easy to buy crypto in a couple of clicks with the “Buy crypto” button.

You can also easily convert any fiat or cryptocurrency in your account to any other supported currency by clicking the Convert symbol next to your chosen currency.

You can view price charts for each cryptocurrency and customise the display and time period. However, there are no indicators available, and users can’t create limit orders, stop losses, or take profits when converting between currencies, as the trading functionality is fairly basic.

Educational Resources

The platform interface is pretty intuitive and straightforward to use, and the Help section provides a number of useful articles on using the platform and the different features available. There are also educational articles on general crypto and trading topics available on the blog.

Products

In addition to the exchange and wallet, YouHodler provides a range of other products to unlock the benefits of crypto.

Earn Interest

YouHodler users can easily earn interest on their BTC, ETH, USDT, and more than 50 other cryptocurrencies and stablecoins. The platform offers an 8% APR interest rate on stablecoins, and various rates on other coins, such as 3% on BTC, 4% on ETH, 7% on LTC, and 10% on DOT.

There are no limits on the duration that you can earn interest for, and the interest is automatically deposited into your account each week, meaning it compounds, so you can earn more than the stated APR. You can even use your savings funds as collateral for lending products.

Dual Asset

The Dual Asset product provides access to higher interest rates through yield generation strategies from decentralised finance (DeFi), but through a traditional fintech platform that is much easier to use than DeFi.

Unlike with DeFi protocols, you don’t need to set up a third-party wallet, stake both coins in a pair, or take on liquidity risk. You simply choose a currency pair from the list, select your input coin, and choose a staking plan. At the end of the duration, you get your initial investment back, in one coin or the other, plus a payout of up to 365% APR.

Multi HODL

Multi HODL provides a way to quickly and easily profit from market volatility in both directions. Execution is fast, and there is no fee for order placements and no profit share fee. The interface and pricing are made simple, and there is online support available 24/7.

All you have to do is select a coin and set your take profit and risk levels. You can close your position at any time if you want to take profit, and you can even use your savings account for trading while you continue to earn interest on those funds.

Crypto Loans

YouHodler lets you take out loans using any of the more than 50 supported coins as collateral. You can receive your loan in USD, GBP, EUR, CHF, stablecoins, or crypto and withdraw it instantly to a bank, credit card, or exchange. YouHodler offers a loan-to-value ratio of up to 90%, which is higher than competitors.

Buy or deposit crypto to your YouHodler wallet to use as collateral, and then choose your loan settings with the crypto loan calculator. The loan will be approved and processed instantly. The loan fee will be calculated daily, but you’re free to pay back your loan and recover your collateral at any time.

You can also react to market movements by using YouHodler’s advanced features to manage your loan conditions. These include increasing your loan-to-value ratio, setting a take profit price, and extending the price down limit to protect your loan from a margin call.

Account Types

YouHodler just offers one type of account for all users, and from this account, you can access all the products and features on the platform. You can deposit and trade crypto without completing the KYC process, but if you want to transact fiat and access the platform’s other features, you will need to complete the full KYC process.

Final Thoughts on YouHodler

YouHodler’s clear interface is designed to be intuitive and easy to use for investors of all abilities. It may not have as many advanced trading tools and products as some trading platforms, but YouHodler is designed for investors who want to generate profits on their crypto holdings, and it meets their needs perfectly.

The variety of products suits investors of all experience levels and risk appetites, whether they want to earn safe and stable guaranteed returns with a savings account or make higher-risk speculative bets with Multi HODL to potentially earn a much higher return. YouHodler also beats the rest of the market when it comes to the loan-to-value ratio of its crypto-backed loans.

YouHodler is a great option for anyone who wants to make more out of their crypto investments. Those who live in the few countries where YouHodler isn’t currently available may want to check out alternative platforms.