The quiet launch of Bitcoin in 2009 could not have predicted the construction of an industry that is valued today at more than 250 billion dollars. The decentralization features and ease of investing in cryptocurrencies have welcomed tens of thousands of traders, miners and “crypto enthusiasts”. Find out what the differences are between traditional markets and cryptocurrencies, and why they represent a unique opportunity.

24/7: Cryptocurrency markets never sleep

This is probably one of the main characteristics that attracts the attention of investors in traditional markets. To give a little context, the reference to “traditional markets” is mainly linked to the stock market, currency exchange (Forex), commodities and indices.

And there is a tradition: the exchange of shares, for example, dates back to the beginning of the 17th century, when the first shares were issued to the public in the Netherlands. For its part, the Forex market as it is known today, became official in the early 70s, as reported by FXGM. The exchange of currencies, however, has been done under other modalities and markets since before the Second World War.

Thus, despite having more than 10 years in circulation, Bitcoin represents the trump card of an extremely new and modern marketplace. One of the great advantages offered by cryptocurrencies is the possibility of trading at any time of the day, including weekends and holidays. This is due to the decentralized nature of cryptocurrencies and the operating model adopted by the platforms where they are traded, known as “exchanges”.

Unlike other financial instruments, a 24/7 structure is a breakthrough for those who want to profit at any time through short-term trading and even day trading. Forex pairs do not trade on weekends, while stocks and indices are usually available for only 7 hours a day.

In addition to exchanges, most brokers also allow 24/7 cryptocurrency trading, so there is no rest for bitcoins and altcoins.

Very low commissions and spreads

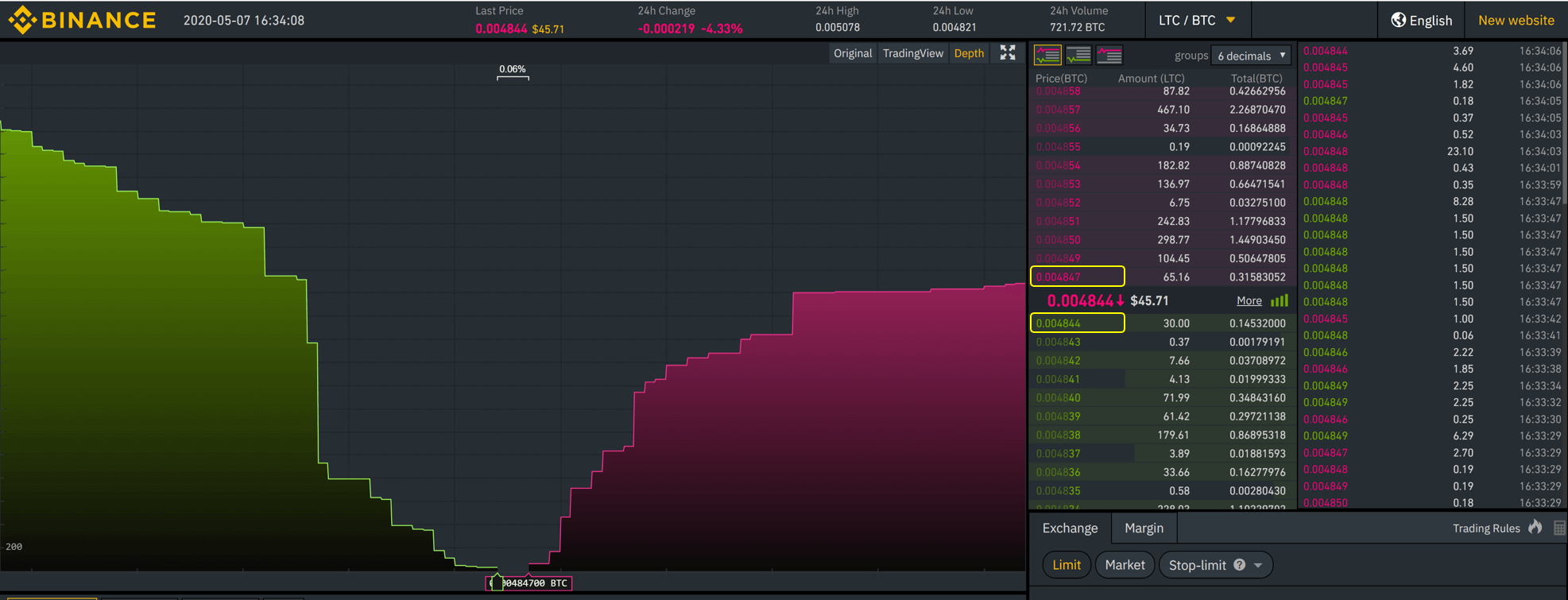

Although this strictly depends on the platform selected to operate, the commissions for the exchange and trading of cryptocurrencies are usually very low. This is especially true when trading real cryptocurrencies on exchanges, where transaction fees are usually in the order of 0.5%.

For their part, spreads —which constitute the difference between the purchase price and the sale price— are usually very small and even non-existent. This is another benefit for crypto, where the balance tilts positively towards Nakamoto’s model when we make a comparison of Bitcoin Vs. stocks.

It is important to note that this changes significantly when cryptocurrencies are traded at a broker, where contracts (CFDs or futures) are traditionally used for position placement. Although the cost is higher and similar to that of traditional markets such as listed funds or ETFs, it comes with benefits such as the use of advanced trading tools, like opening short positions or using leverage.

In any case, risk management and the balance of your investment expectations are always recommended elements. Some popular platforms for trading cryptocurrencies are listed below:

Versatility and use cases: taking advantage of cryptocurrencies

When an investor “buys” an ounce of gold or a barrel of oil, it is highly likely that his investment is based on a paper or contract, where the holder guarantees to pay the difference at the closing of the contract.

There are very few occasions where the investor receives a real gold bar or a barrel of oil at home. In contrast, exchanges and even brokers like eToro (through the eToro Wallet) deliver real cryptocurrencies that the user can transfer, spend, or exchange.

Some digital currencies like Dash or Reddcoin can be stored to generate passive income for the simple fact of becoming a sort of ‘shareholder’, a process known as staking. In the case of Tezos, its liquid participation test allows anyone with XTZ coins to “bake” them by freezing their funds through a delegation scheme. In exchange, he gets an annual commission of around 6%.

Another model that can be adopted is that of mining, which is the backbone of decentralization of digital currencies. The possibilities and use cases for cryptocurrencies are virtually limitless: cross-border and private transactions, value assigned to the Internet of Things (IoT), creation of digital content, optimization of supply chains and much more.