The trend of decentralization became evident shortly after Bitcoin unveiled the advantages of a system not controlled by a central authority. This is how the concept of Decentralized Finance or DeFi was born, which takes the idea of cryptocurrencies one step further, breaking down complex and bureaucratic financial processes to adapt them to a more friendly and accessible digital environment. In this article, we look at the top 4 cryptocurrencies focused on DeFi.

What are DeFi and what relationship do they have with cryptocurrencies?

The definition can include many edges, but in general, Decentralized Finance refers to any open ecosystem that allows the construction of decentralized financial tools, applications or services. A Coinbase article defines them as stepping up to traditional cryptocurrencies, as they provide an alternative to any financial service offered today, including savings, loans, trading, insurance, custody, and more.

These DeFi applications are not necessarily controlled by a central company that profits from them, but are usually built on the basis of a decentralized technology such as blockchain or Tangle, where network participants unite without restrictions, causing these crypto projects to be more democratic and innovative.

To provide this type of service, DeFi-based crypto projects not only use blockchain technology, but they combine it with smart contracts, decentralized applications (dApps) and other DeFi protocols and technologies.

In this way, the dream of obtaining a loan without intermediaries like a financial institution or of exchanging fiat currencies with very low commissions becomes a reality. We show you which cryptocurrencies have started implementing them below.

Ethereum: the father of DeFi projects

Ethereum’s smart contracts and the possibility of creating new projects and tokens on its ecosystem have made ETH the undisputed father of DeFi crypto projects.

In addition to having the 2nd largest cryptocurrency in the industry by market capitalization, the open source Ethereum ecosystem is home to almost 20% of tokens across the industry and Ethereum is the ‘hub’ of more than 1000 crypto assets, that today, are listed on cryptocurrency exchange platforms. A Ledger post in late 2019 claims Ethereum houses a total of over 200,000 ERC20 tokens.

Most of these digital assets embrace the programmatic potential of Ethereum smart contracts to build decentralized applications for smart finance. Yesterday, the ETH developers announced that the testing phase for the Ethereum 2.0 release will begin on August 4th, which could possibly cement ETH as the great father of DeFi as it will provide more power and scalability on the network.

If we add the capitalization of all the Ethereum ERC20 tokens – according to EthScan – the Ether would get 38 billion dollars more than its current capitalization of 30b USD; However, it would still not be enough to reach Bitcoin in the ranking of cryptocurrencies.

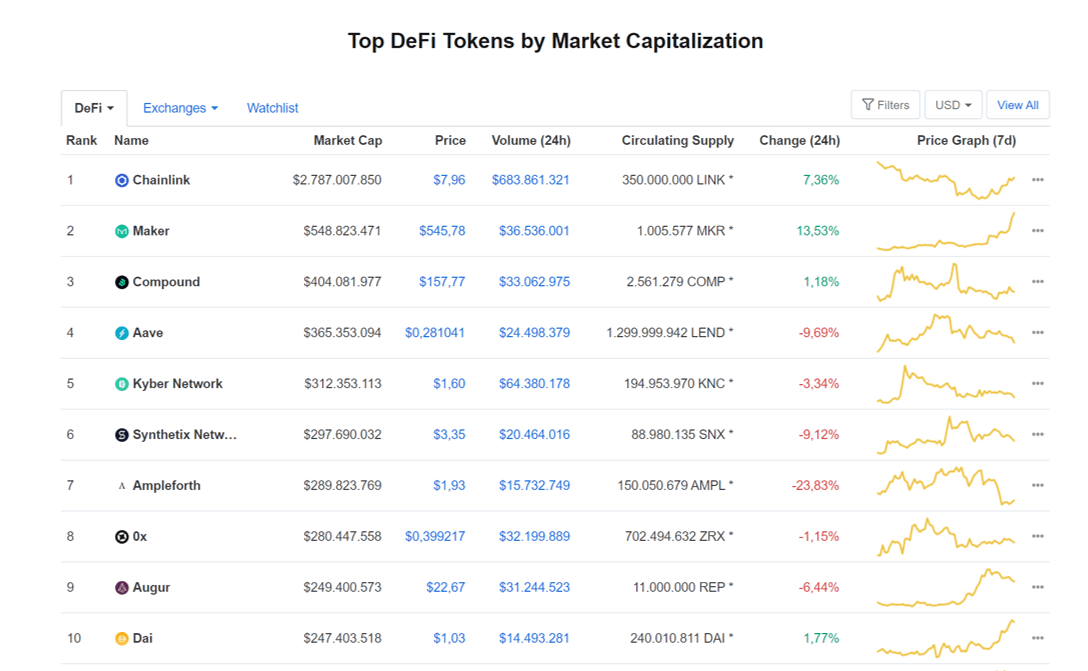

- Quick tip: CoinMarketCap allows you to filter DeFi tokens on the top left of the top of cryptocurrencies. That way, you can track DeFi projects with positive prospects.

DAO Maker: decentralized system for a stablecoin that is kept at bay through a complex DeFi system

Maker and its stable cryptocurrency DAI (with a recent multi-backed version, MCD which is pegged to to the US Dollar) highlight the potential of a robust smart contract structure.

Unlike other stable cryptocurrencies where there is a bank that backs each token with real fiat currencies in a 1: 1 ratio, Maker’s decentralized autonomous organization (DAO) stabilizes the value of the DAI dynamically through a system of incentives for staking assets that act as guarantee elements.

Compound: a window to loans with DeFi

Through a simple premise, Compound has clearly demonstrated how the concept of Decentralized Finance can be implemented in the cryptocurrency industry. This project offers a dApp that enables peer to peer interaction between lenders and borrowers.

Those who choose to contribute loan assets earn interest that generates a passive income attractive enough to encourage participation. Meanwhile, borrowers can place cryptocurrency savings as collateral for borrowing, the interest rate of which dynamically adjusts according to supply and demand online.

Chainlink: the bridge to connect systems to the real world

We close the list with the token that leads the list of DeFi projects by market capitalization. LINK has gained enormous popularity in a short time, but also a bit of controversy. One of the primary goals of this ecosystem is to serve as a bridge to connect any ‘crypto’ ecosystem with external application development interfaces (APIs).

Thus, different companies can build their own application with smart contracts that do not remain isolated, but interact easily with the traditional financial system. According to the Chainlink website, its oracle network provides a reliable, transparent and tamper resistant option to contribute to the growth of DeFi.

Its position at the top of the “DeFi” list on CoinMarketCap has raised controversy, as some detractors from the project have accused CoinMarketCap of receiving incentives from LINK to create the DeFi token list with biased methodology. The allegations were categorically denied by Gerald Chee, director of research at CoinMarketCap.