LINK, the native cryptocurrency of Chainlink—a decentralised oracle network connecting smart contracts to real-world data—has recently entered the Top 5 ranking of cryptocurrencies by market capitalisation, according to CoinMarketCap data. The crypto coin has soared significantly over the past 6 months, gaining a colossal 900% in 2020 (year-to-date data at the time of writing). Find out 4 reasons why Chainlink has gained unprecedented bullish momentum this year and why LINK could be the next big thing in the crypto industry.

Strong Technical Outlook: the Perfect Arena for Bulls

Chainlink was one of the top-rated ICOs during the biggest bull market for the cryptocurrency industry back in 2017. The initial coin offering was held in September 2017, with the project raising more than $32 million, according to ICODrops. However, the hype for LINK peaked about a year ago when Coinbase confirmed its listing on their portfolio.

LINK holds one of the biggest ROIs (Return of investment) in the crypto sphere, appreciating more than 9,000% from its ICO price. In a nutshell, after less than three years, early investors multiplied their initial capital by up to 160.

By taking a quick look at the candlestick chart for Chainlink (LINKUSD), the bullish trend is quite clear and has been seemingly unstoppable since March 2020, with the daily candles outlining a sleek parabolic upward trend.

However, there are some warning indicators on the RSI, which signals an overbought condition on the daily chart that may lead to a correction soon. We’ve conducted technical analysis on cryptocurrencies on the rise recently, including LINK. It might help to get a broader summary of the technical levels of interest.

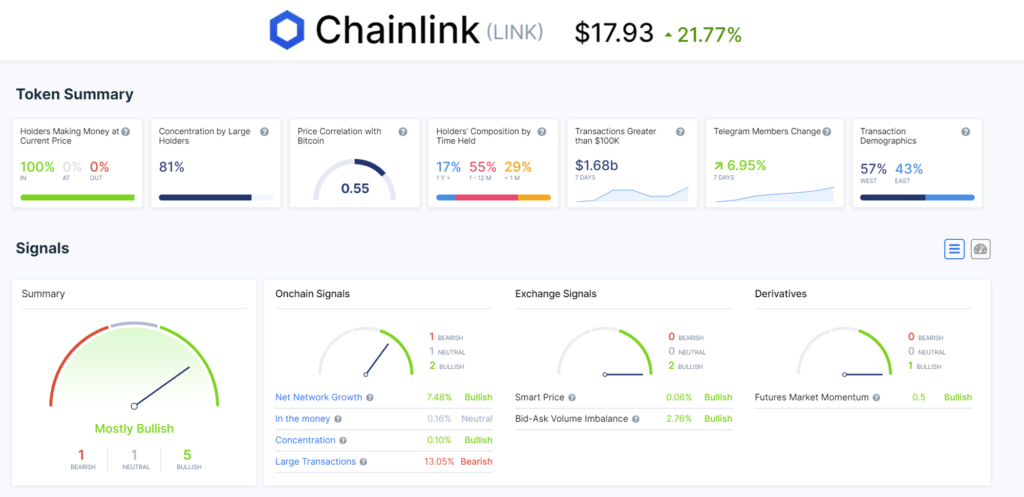

Apart from the typical technicals, IntoTheBlock uses alternative indicators that combine technical, sentiment and fundamental outlooks for different key factors. The scrutinised data shows one of the most robust profiles for a cryptocurrency at the moment, including social growth, multiple bullish signals for LINK, and strong “onchain signals” as shown below:

The King of DeFi

Chainlink is officially the king of decentralised finance—according to the brand new “Top DeFi Ranking” by CoinMarketCap. DeFi, or decentralized finance, is a new concept that has been surfing recent financial trends, and has been referred to by multiple analysts as the next ICO bubble.

DeFi is an abstract but exciting concept believed to change the way we see financial services. Can you picture an open and decentralised ecosystem where anyone can create or use any financial tools, applications or services? That’s what DeFi is, and it might be providing an alternative to everything in this vertical, including trading, custody, savings, loans, banking, insurance and more.

One of the reasons why LINK is going up is because it is one of the few DeFi projects that has clearly understood what’s needed — creating nonstop partnerships with key players to build this new ecosystem. One of the main goals of Chainlink is to serve as a bridge to link “smart contracts to real world data, events and payments,” easing the interaction between crypto blockchains and financial services.

Why is Chainlink pumping right now?

From our Chainlink analysis, there doesn’t seem to be a single factor that can be attributed to the recent explosion of LINK’s price to its all time highs. However, a recent streak of partnerships during this time frame seems to support the price action as the use cases for the oracle network become palpable.

The astonishing list of partners ranges from crypto-related companies such as Binance (Smart Chain for Building DeFi), Elastos, its integration with Zilliqa and collaboration with key names in the financial industry, like SWIFT.

That is not all, however; Chainlink has managed to partner with the database and cloud computing giant Oracle, with the ambition to bring together “every startup in the Blockchain.” Chainlink announced yet another integration this month, after forging a partnership with Provide, a popular company dedicated to enterprise blockchain adoption.

A Glance to the Future of Chainlink

It may seem like the bubble is about to explode, but the truth is that Chainlink has just started to build the foundations for its long-term vision. As one of the DeFi pioneers, the Ethereum-based ecosystem might become one of the standards to decentralise the financial system.

One of its plans for the future consists of an expanded ecosystem that would work with multiple networks (it only interfaced with smart contracts from the Ethereum Blockchain in the beginning). In 2019, Chainlink launched a Mainnet to get data in and out of Ethereum smart contracts.

DeFi is already creating a vast environment that we might not be able to understand until it’s put into practice. Concepts like the “Polkadot parachain” have arisen with the just-announced integration between Chainlink and the Plasm Network, which can essentially pave the way for further adoption of the LINK ecosystem.

No one knows what the future holds for Chainlink, but as it remains in the spotlight, it’ll be a great opportunity for bold traders that want to go beyond Bitcoin and Ethereum.