Aave price prediction for June covering current price, events likely to influence price and technical analysis of AAVE

Aave is a decentralised finance protocol that allows users to lend and borrow cryptocurrencies. As a lender, you will earn interest by depositing digital assets into specially created liquidity pools where borrowers can take out flash loans using the liquidity and crypto as collateral. Aave is a term that means ghost in Finnish. It was launched in November 2017 as ETHLend before rebranding to Aave in September of the following year. The platform’s native token is AAVE which serves as a governance token allowing owners to participate in the future development of the protocol and offers holders access to discounted fees.

The DeFi boom has seen demand for platforms such as Aave skyrocket. Currently, the project allows people to borrow and lend in about 20 cryptocurrencies meaning that users have a greater amount of choice. One of the platform’s flagship products is flash loans which are taunted as the first uncollateralized loan option in the DeFi space; however, they must be paid back within the same transaction. Another exciting thing about Aave is how borrowers can alternate between fixed and variable interest rates. This piece will explore the current price of AAVE, events likely to move its price and what pro traders think of its charts.

What is the Current Price of Aave?

Aave 1 year price chart: Source Coinmarketcap

Aave is the leading lending protocol based on Ethereum today, with over $12 billion total value locked. This popularity brought good fortunes upon its native token AAVE, which has grown 5x over the past seven months and currently trades at about $323 at the time of writing. The price is still 52% down from its all-time of $666 registered over three weeks ago. As an asset, AAVE remains one of the most profitable projects with an ROI of over 60,700% and this shows how popular this platform has become within the cryptocurrency space. As you will see in the section below, there are plenty of reasons why Aave is likely to see more gains over the rest of the month and by the end of the year.

Where to buy Aave today

What Events Might Move the Price Of Aave In June?

This section will cover factors that are likely to influence the price of AAVE in June.

Continued Interest In DeFi

DeFi craze kick-started the ongoing crypto market bull run. Since the start of last year, the sector has seen a 5600% growth despite the recent market slump. Aave leads the sector with 15.28% of the total value locked on Ethereum. DeFi has made it easy for most people to access financial services that were out of their reach in traditional finance markets due to bureaucracy and bias. Currently, there is so much interest in DeFi as more individuals come up with noble platforms solving various problems that plague the traditional financial market. This continued interest should serve Aave well since it is already the market leader. As more people get into DeFi and platforms such as Aave to lend and borrow, expect to see this interest reflected on the native token’s price.

The Continuation of The Market Bull Run

The crypto market may have dipped to the tune of $900 billion. However, many experts believe the bull run isn’t over just yet. Institutional and retail interest in digital assets is still strong, and the market is likely to pick up momentum soon. When this happens, expect to see the price of AAVE revisit its all-time high.

Investors Buying The Dip

Most experts feel the bull run is still on, and savvy investors will know these dips present opportunities to accumulate tokens on a discount. Judging by the trading volume of this token, there is a lot of buying going on and as more traders buy the dips, then expect this action to push the price up over June.

AAVE Price Forecast in June

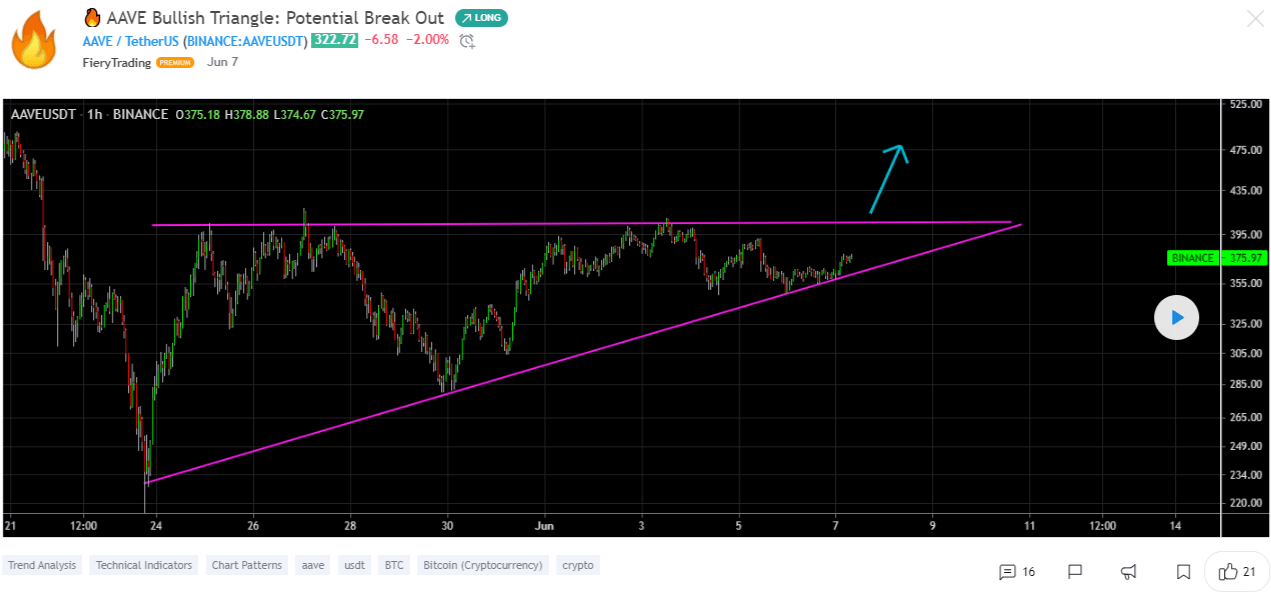

Aave trading analysis: Source TradingView

According to FieryTrading, during BTC’s erratic moves over the last couple of weeks, a bullish triangle has appeared on AAVE’s chart. After showing some consolidation at the triangle support yesterday, it seems that AAVE has now bounced off the support and is resuming its upward move. Be aware that AAVE is highly correlated to BTC. So before trading, check where the BTC price is headed. Also, wait for the price to break out of the triangle to confirm the break-out pattern.

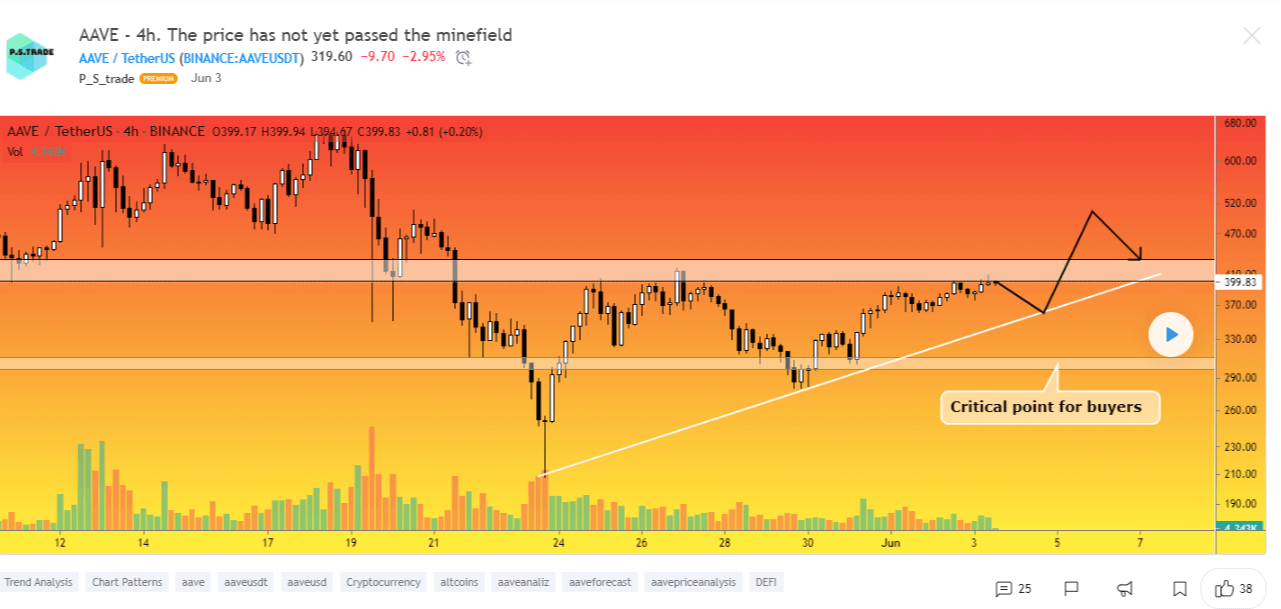

Aave trading analysis: Source TradingView

P_S_trade wonders what is more frightening for market participants at the moment—the past panic wave of the fall or the very passive recovery of the cryptocurrency market. Indeed, looking at the charts of most coins, you can see an attempt to start a new wave of growth that looks very dubious. Low trading volumes and a strong decline in volatility give the impression that coins will never recover their previous price level.

Based on the above chart of the AAVE coin, the analyst adds that we can see that a new wave of growth in the market began on May 29. The main reason is the complete exhaustion of sellers. The rise in the price without volumes to the range of $400-430 begins to hint that at least a local correction awaits the market with the target of $355. There is a local upward trend line at this mark, which separates the AAVE price from a fall to a strict range between $300—311. It is in this range that buyers are very interested.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.