Bitcoin (BTC)

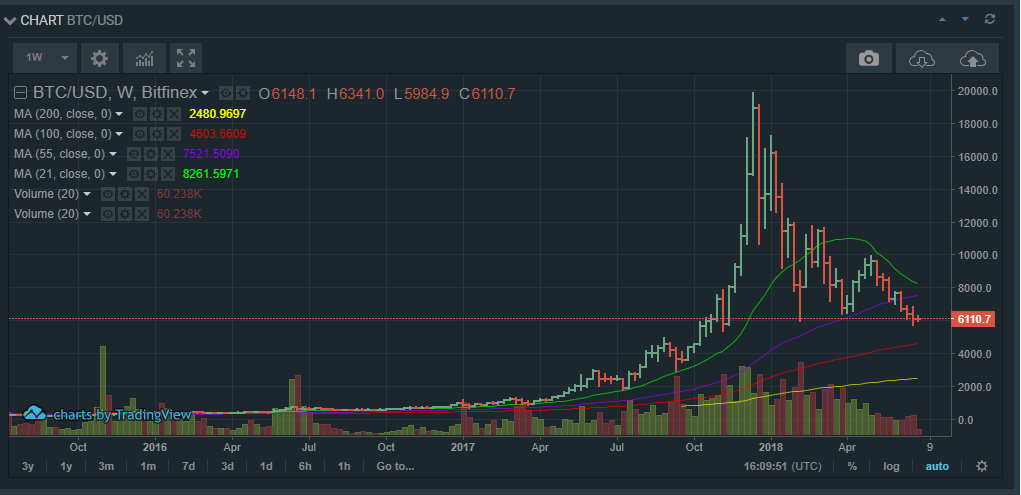

In the week, bitcoin (BTC) is still bearish with $4400 being the next major support level along the 100-day moving average. In the last 24 hours, bitcoin has beeen unable to break above yesterday’s bearish candle that saw it close at $6070.

There is no buying momentum in the market, and bitcoin will most likely be headed lower. If it breaks below $6000 in the next 6 to 12 hours, Bitcoin will most likely test $5700, a price level that has offered support in the last one week.

To refine the entry, one needs to pay close attention to the 12-hour chart, where bitcoin is trading along an intra-day support level at $6094.

To refine the entry, one needs to pay close attention to the 12-hour chart, where bitcoin is trading along an intra-day support level at $6094.

To make an entry into bitcoin (BTC) it is best to wait until it breaks clear of this price level, and trades below $6000. A sell order at this price offers a good risk/reward ratio, with $5800 as the first profit target in the next 24 hours.

However, given the huge volatility of the crypto market, it also makes sense to watch the volumes. If there is an upsurge in buying volumes within the next 12 hours, a buy entry would be ideal with $6200 as the target.

Ethereum Classic (ETC)

Ethereum Classic (ETC) is still one of the better performers in the market, even as the rest of the market stays bearish. It is supported by the news of an upcoming Coinbase listing sometime in the near future.

Looking at the Ethereum Classic weekly chart, the price has formed a clear ascending pattern, indicative of an early bull run. However, this might not hold considering that in the last 3 weeks, Ethereum has been unable to push above $16.2, which was the high for the last bearish candle a month ago.

The fact that it has not sustainably broken above this level, means that the rally might be short-lived, and ETC might be pulled down by Bitcoin (BTC)’s bearish sentiment.

The fact that it has not sustainably broken above this level, means that the rally might be short-lived, and ETC might be pulled down by Bitcoin (BTC)’s bearish sentiment.

In the day charts, ETC looks set to head lower. It is trading in a range below the last major bearish candle for June 22nd. This means that there is a high likelihood of Ethereum classic breaking to the downside, with $12.66 as the next support level.

However, if volumes increase and Ethereum classic surges upwards, it is likely to test $17, which is the first resistance level to the upside.

IOTA (MIOTA)

In the weekly charts, IOTA (MIOTA) has broken below long-term support at $1.03. That’s an indicator that it is likely to be headed lower, with the first support level being $0.80.

Looking at the day charts, IOTA (MIOTA) is trending downwards, but the momentum is declining. This is an indicator that IOTA (MIOTA) could possibly reverse in the next 24 hours, and test $1.17, which is the first resistance level to the upside.

However, if there are no volumes to push it up, it could break lower and test $0.80 in the day. At this point it is all about volumes.