Bitcoin (BTC)

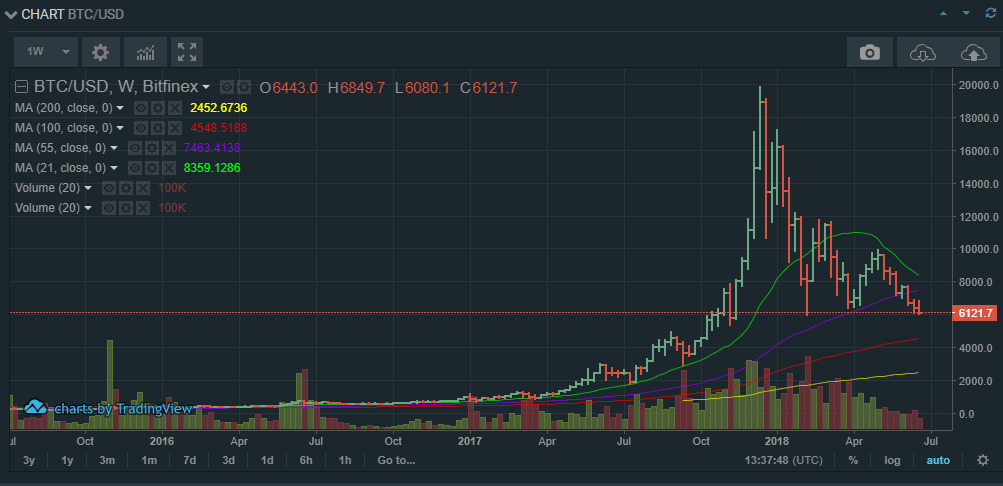

In the last 12 hours, bitcoin (BTC) has dropped from $6700 to its current price of $6300. This price level has offered major support in the last few weeks.

To make an investment in bitcoin with a 24 hour target, one needs to watch out for a break above or below $6300 -$6200. If bitcoin drops below this level, it will be headed lower towards $5800, which is the next support level on the weekly charts.

But, this will be fully dependent on trading volumes. If trading volumes continue to decline, the likelihood of bitcoin breaking lower towards the $5800 level will be quite high.

However, if there is an upsurge in volumes in the next 12 hours, and buying pressure increases, bitcoin could push higher, and could test $7600 in the next 24 hours.

To make a buy entry with a 24-hour target, it is best to wait it out until there is a clear upside break, and bitcoin hits over $6800. This would offer good potential for good returns with $7700 as the next target to the upside. A break below $6200 in the next 12 hours should be a signal to sell, with a target of $6000 – $5900 in the next 24 hours.

Ethereum Classic (ETC)

Ethereum Classic has been in the green all through the week, thanks to its recent listing on Coinbase. However, these gains seem to have been lost in the last 12 hours, mainly due to the decline in the price of bitcoin (BTC), the dominant crypto.

In the past 12 hours, Ethereum Classic has broken strongly below the 200-day moving average, and looks set to test $14.96 in the next few hours.

If it breaks below $14.96, which is the next support, along the 55-day moving average, it could easily drop further towards $12, which is the next major support level.

However, in the scenario that bitcoin reverses and market wide volumes increase, Ethereum Classic could easily reverse and retest $17, which is a major resistance level on the 200-day moving average. A break above this could see Ethereum Classic test the $18 resistance level

Therefore, for an entry into Ethereum Classic (ETC) with a 24-hour target, it is best to watch the volumes. If volumes drop and Ethereum Classic (ETC) drops below $14.96, then it would be time to sell. On the other hand, if it breaks above $17, this would be a good signal to buy with $18 as the target.

IOTA (MIOTA)

In the last 12 hours, IOTA (MIOTA) has broken out of the $1.18 -$1.13 range, and is currently trading at $1.04. By all indications, IOTA (MIOTA) looks set to break lower, and could test $0.96.

However, like all other cryptos, this is also dependent on the market direction of bitcoin (BTC). If bitcoin (BTC) reverses and gains bullish momentum, IOTA (MIOTA) could possibly reverse too and retest $1.7, which is the next resistance level to the upside.

In essence, it is all about volumes, and the price of bitcoin. If volumes remain low, then a sell entry into IOTA (MIOTA) would be ideal.

Disclaimer: This content is for information purposes only and is not intended as financial advice or any other advice. It is not an offer or solicitation to buy or sell nor is it meant as an endorsement or recommendation for any security. The information is general in nature and does not take into account your individual financial position. You should seek advice from a registered professional investment adviser and undertake due diligence before making investment decisions.