Ethereum (ETH) has sustained massive losses since the start of the week and risks dropping towards the $1,700 level if it maintains the recent trend

The cryptocurrency market resumed its downward trend yesterday, with Bitcoin and the other major currencies all suffering massive losses. Ether’s price is down by 5.70% over the past 24 hours and is trading just above the $1,880 mark.

The losses recorded yesterday came after a 5.17% slide on Monday. After falling short of the first major resistance at $2,133, Ethereum slid to a late intraday low of $1,917.40. Since then, it has sustained further losses and lost the crucial support level at $1,900.

With the cryptocurrency market still in a bearish trend, Ether risks losing more support levels and dropping below the $1,800 mark over the next coming hours.

ETH price outlook

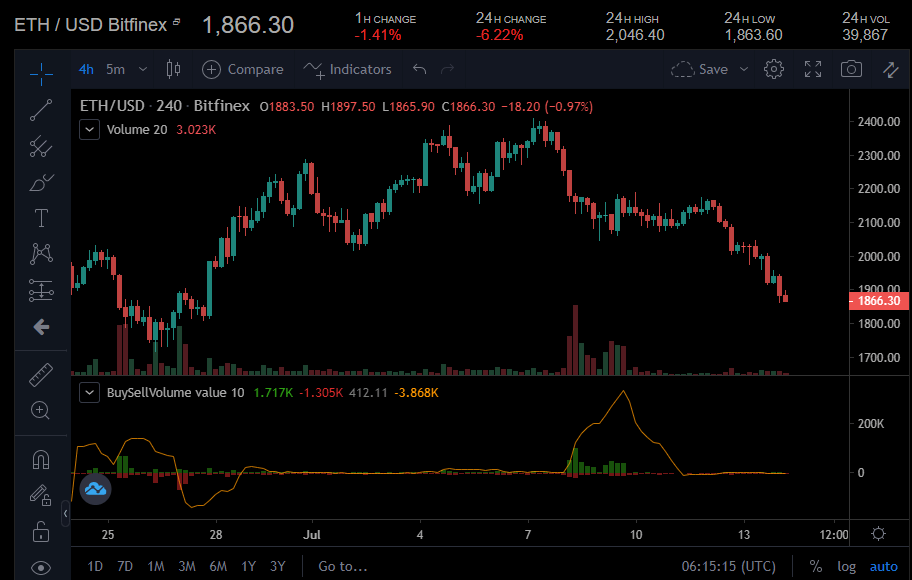

The ETH/USD 4-hour chart is currently looking bearish, suggesting that further losses could be on the card for the second-largest cryptocurrency by market cap. Currently, ETH is trading close to its 20-day simple moving average (1,894.68).

If the current bearish trend continues, then ETH would be forced to defend the next major support around the $1,800 mark. An extended market selloff would bring the 62% FIB Retracement Level ($1,724) into focus. However, ETH should be able to steer clear of sub-$1,800 levels, with the major support level at $1,838 available to limit the downside.

ETH/USD chart. Source: Coinalyze

However, should the market turn things around, ETH would be looking to break past the first resistance point at $1,900. An extended rally over the next 24 hours could see it pass the next resistance level at $1,969 and rally past the $2,099 mark.

For Ether to overcome the current bearish trend, it would need support from the broader cryptocurrency market. Even with an extended rally, yesterday’s high of $2,047.72 would likely cap any upside.