Ethereum is expected to break out of last week’s consolidation range that had capped prices between $230 and $248

With its ETH 2.0 launch date getting closer, Ethereum’s price is expected to spike to new highs. At the moment, bulls have the momentum, which could mean sellers are kept at bay if prices stay firm above $230.

If buyers keep entering the market, as has been observed over the past several weeks, the new price target would be $280. Long term, the price could double in 2020 to hit figures last seen in June 2018.

For now, the strategy is to watch out for a break above $250, as buyers are likely to attack this level with renewed effort following last week’s major statement.

On the daily charts, Ethereum bulls have to guard against a breakdown as witnessed last week. Keeping the daily candle above $245 provides a foothold to reach $250 and open up the possibility of reaching the coveted $300 — which will require increased volumes in line with the growth pattern established after the March 13 price crash.

Potential for a downside can be seen on the monthly candle where support remains at $216 with increased volumes. A correction such as that is unlikely in the short term if daily closes stay around or above $250.

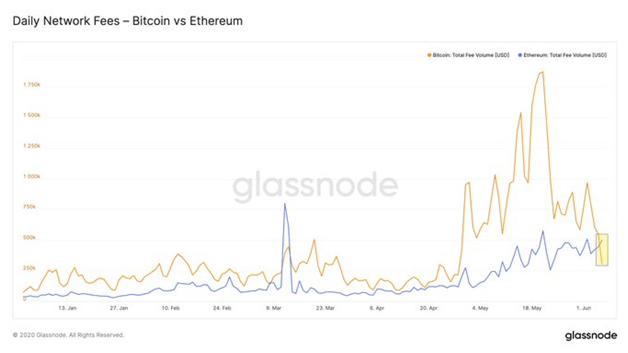

Ethereum network fees surpass Bitcoin’s

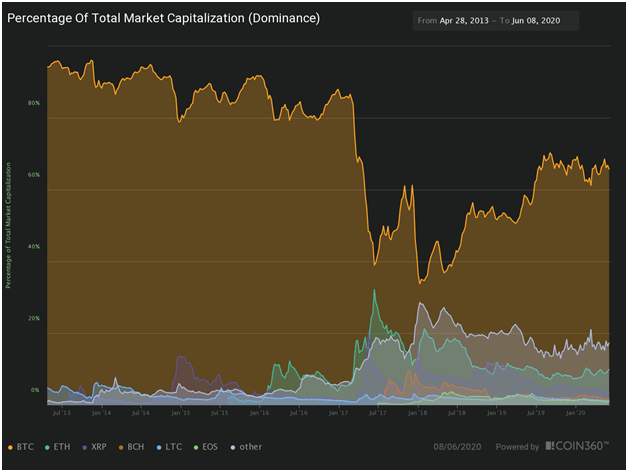

Bitcoin’s dominance in the crypto market remains above 64%, but the top altcoin Ethereum takes up the next largest market share.

Data shows that cryptocurrency takes up between 9.89% and 10% of the total market. However, increased activity means it is increasing its dominance, so topping 10.8% might swell buying pressure to support further upsides.

Ethereum’s technical picture aside, things have been looking positive for the leading altcoin for a while now. An improvement in fundamentals is adding to the bullish case for the cryptocurrency ahead of its transition to a new algorithm.

An analysis of on-chain data on the Ethereum network shows that June 7 saw the network fees on the platform surpass that of Bitcoin. Since Ethereum’s launch, network fees have only been higher than on the Bitcoin network for 8% of the duration.

Data on Etherscan also show unique addresses number more than 100 million. More than that, over 40 million of these addresses currently hold Ethereum tokens as more people hodl.