Retail investors are likely buying up supply to hedge against economic downturns

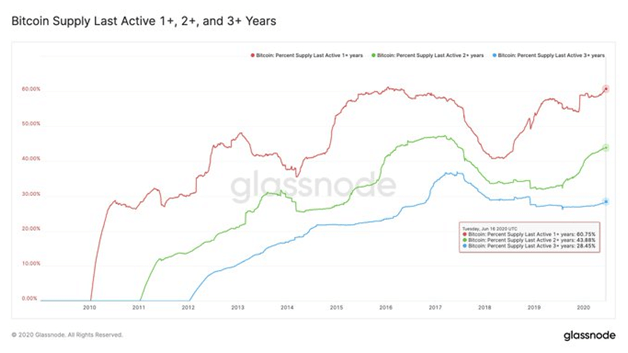

Over 60% of the Bitcoin supply has not been moved in over a year, data has shown.

According to on-chain analytics provider Glassnode, 42% of Bitcoin supply has remained in wallet addresses for the past two-plus years.

While Bitcoin’s price has failed to conquer $10.5k after several attempts this year, the data suggest holders of Bitcoin have looked at the cryptocurrency as a hedge in the wake of economic turmoil and market downturns.

Glassnode has also compiled data showing that a further 28% of the circulating supply has not moved in over three years.

Bitcoin seeing an influx of retail investors

Bitcoin’s price struggles below $10k in 2020 have also not been helped by the entry of new retail investors. The slip this week to lows of $8,900 has coincided with an influx of retail traders keen to make an entry into the cryptocurrency market.

According to on-chain data, the Bitcoin network has witnessed an increase in new wallet addresses. As per the statistics, the number of wallets that now hold at least 0.1 bitcoins (worth about $941 at prevailing prices), has topped three million.

Notably, Glassnode data also shows that the number of Ethereum addresses holding at least 0.1 Ether recently surpassed the three million mark. The growth represented a healthy 10.9% increase in 2020.

In an interview with Bloomberg TV recently, Kraken CEO Jesse Powell attributed the increase in accounts to “hedge funds, wealth managers, retail investors, and day traders.”

He added that the crypto space has “seen people taking their stimulus checks and rolling them into Bitcoin.”

Bitcoin price

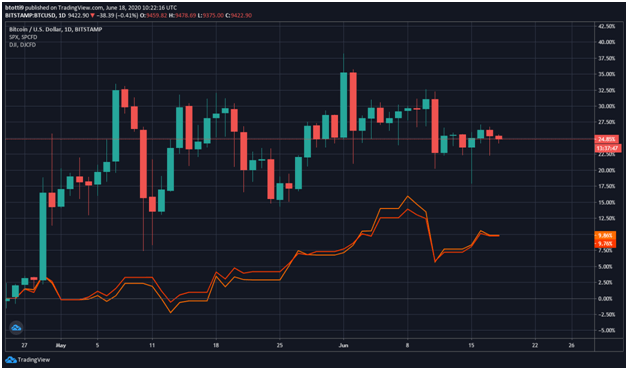

Bitcoin has slipped 0.3% as of writing, with the S&P 500 and other major stock indexes posting similar losses on the day. The S&P 500 is down 0.06% and the Dow -0.07% on the day.

The correlation, if it holds, suggests that a bull run for the stock market could see Bitcoin post similar rallies to what was seen in March, when crypto fell and rose in tandem with stocks.

However, since then, the stock markets are up 44% and 48% for S&P and the Dow respectively. With markets turning green, a flip to a bull market would also see major upsides in Bitcoin — which has surged over 140% since the March 12 lows of $3,800.

The Bitcoin price index is at $9,411 at the time of writing, as shown on Coin360.com