There are no half attitudes when it comes to Ripple’s XRP; some seem almost fanatical, with a deep conviction for the need of XRP, while others are strong detractors of its core philosophy. The fact is that this cryptocurrency has managed to position itself among the top 3 on the market for a long time. The history of Ripple even precedes that of Bitcoin, and the aim of its creators was also to make a decentralized financial system that would offer financial sovereignty to individuals.

Despite the very positive data that the company has presented throughout 2019, the price has followed a more neutral and downward trend, so what is the expectation for the future? Discover here the possible scenarios and predictions of Ripple for 2020, according to various fundamental, technical analyses and expert opinions.

The Future of Ripple for 2020

In the boom of 2017, Ripple’s XRP proved to be one of the most relevant cryptocurrencies available. According to data reported by CoinMarketCap, XRP managed to accumulate gains of up to 10,000 % in 2017. However, after reaching record highs in January of the following year, the bearish season that affected the rest of the market proved Ripple just as susceptible. XRP lost more than 90 % that year and was placed at very low prices. Later that year, amidst the prevailing pessimistic sentiment, it recovered its price slightly, increasing by 140 % in September to catch up with Ethereum and position itself briefly as the second most valuable token, ranked in the CoinMarketCap.

During 2019, Ripple Labs’ quarterly reports showed good data regarding the acquisition of XRP for use in the large banking institutions, the growth of RippleNet and services such as xRapid. The year was also marked by a period of acquisitions, including major brands such as MoneyGram. Despite the excellent data reported, the XRP token was unable to cope with a number of players determined to break the market structure. This bearish breakout occurred after the very important 25 cent support was broken. In 2020, many bulls expect the cryptocurrency to rise above this level and finally respond to a clear oversold situation on several occasions. Will the banks’ crypto team manage to inject enough confidence for a breakout? This remains to be seen.

Events that Could Support a Ripple Boost in 2020

Firstly, the XRP is a cryptocurrency backed by a large company. The project is managed by Ripple Labs, a company that provides cross-border payment solutions to banks and other large financial institutions. Although many criticize this dependency which breaks with the original principles of decentralization, the architecture has only worked to make Ripple stronger, and the numbers prove it.

- Technologically speaking, XRP is a strong bet. Its network consistently handles 1500 transactions per second, working 24/7, and has the ability to scale. It is expected by many to catch up with systems like VISA.

- The acquisition season in 2019 was very lucrative for the company, which was clearly stated in its quarterly reports (e.g., Ripple’s report for Q2, 2019).

- According to its own management, 2019 left the best record in the company’s history at the contractual level. A number of key acquisitions were made, with MoneyGram standing out as having – in the opinion of CEO Brad Garlinghouse – a greater impact than Libra, Facebook’s crypto coin project.

- Ripple’s CEO says they are working to outperform SWIFT as a cross-border payments platform.

- Ripple’s business deals are key to the growth of the XRP. The company already has a system for cross-border payments (xCurrent), but the new key addition to XRP (xRapid) would make the current solution cheaper and faster. Thus, the success of the Ripple greatly depends on how willing the financial institutions are to adopt the use of xRapid.

- In an article on the official website, Ripple’s predictions for 2020 are given. Garlinghouse agrees with another group of experts that “3000 cryptocurrencies are not needed” and believes that the industry will shrink through a migration to “quality” with currencies that possess real use cases, like Ripple, thriving in the future. They are also confident about growth and believe that some underestimate the impact that technologies will have around this industry.

Technical Analysis of Ripple and Possible Scenarios for 2020

Although it is not possible to be precise about Ripple’s predictions, its historical volatility and the recording of these prices set the precedent for a future evaluation. Through a technical analysis, we can see some key areas for action in the price of Ripple and its possible projections. In addition, it is possible to see how fast it moves and how this volatility could affect your positions.

Consequently, we have decided to do a technical analysis over longer periods of time (1 day). We evaluate the price of Ripple against the US Dollar (XRP/USD); however, some investors trade directly against BTC. Both pairs work differently, and their behaviour is not necessarily correlated. Therefore, we have decided to include a new analysis on the XRP/BTC as well.

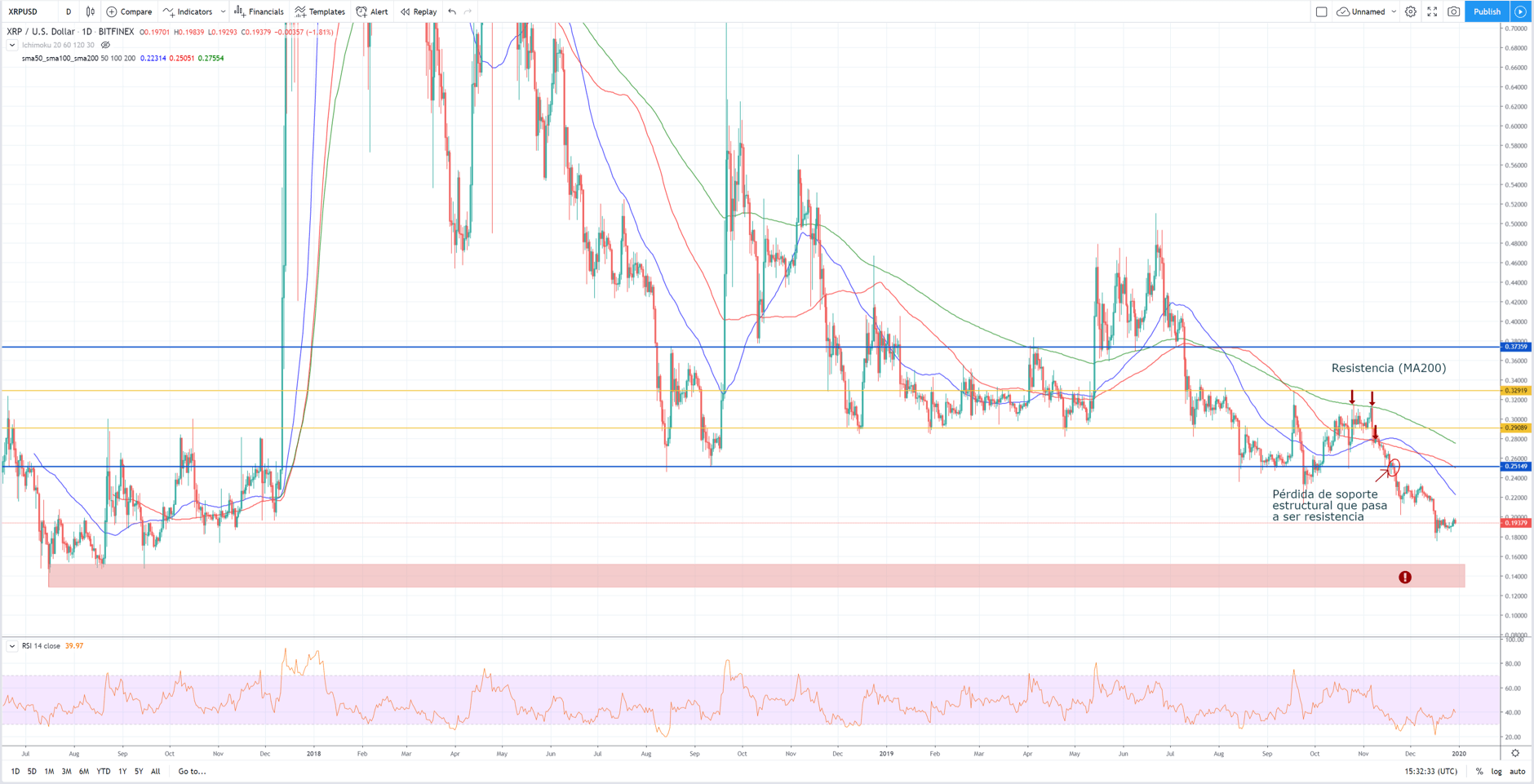

XRP/USD: Important Observations and Areas of Interest

The graph shows us several really interesting elements that we try to summarize below:

- As a premise, the analysis has been done with relatively large intervals (1 day) to evaluate medium-term scenarios.

- For the time being, the scenario is eminently bearish, especially after the loss of structural support around 25 cents, which sustained the price of Ripple for almost 2 years. Before this break, we can see how XRP was unable to overcome key resistances during the bearish season, which led to its continuity.

- One of the clearest is the 200-day moving average, as shown in the graph. This MA200 curve will be one of the indicators to follow in case of a price recovery and could mark a potential trend change.

- The RSI shows that the XRP reached low levels of being oversold versus the dollar. Some believe that the XRP has entered a “capitulation” phase, which is characterized by volatility and a total exhaustion of the bearish market, leading to a new bullish season.

- However, there could still be a next support to be tested, between $0.13 – $0.15 USD. In this “danger zone” there could be great buying intention and it should be watched.

- On the upside, in addition to the MA200, there are several key resistances, marked by clear lines on the chart. The yellow lines have been accumulating for several months over the last year and a half, with resistance above $0.329. If these resistances are broken, Ripple could enter a bullish streak. Historically, these have been fast and volatile, so caution and proper management is suggested.

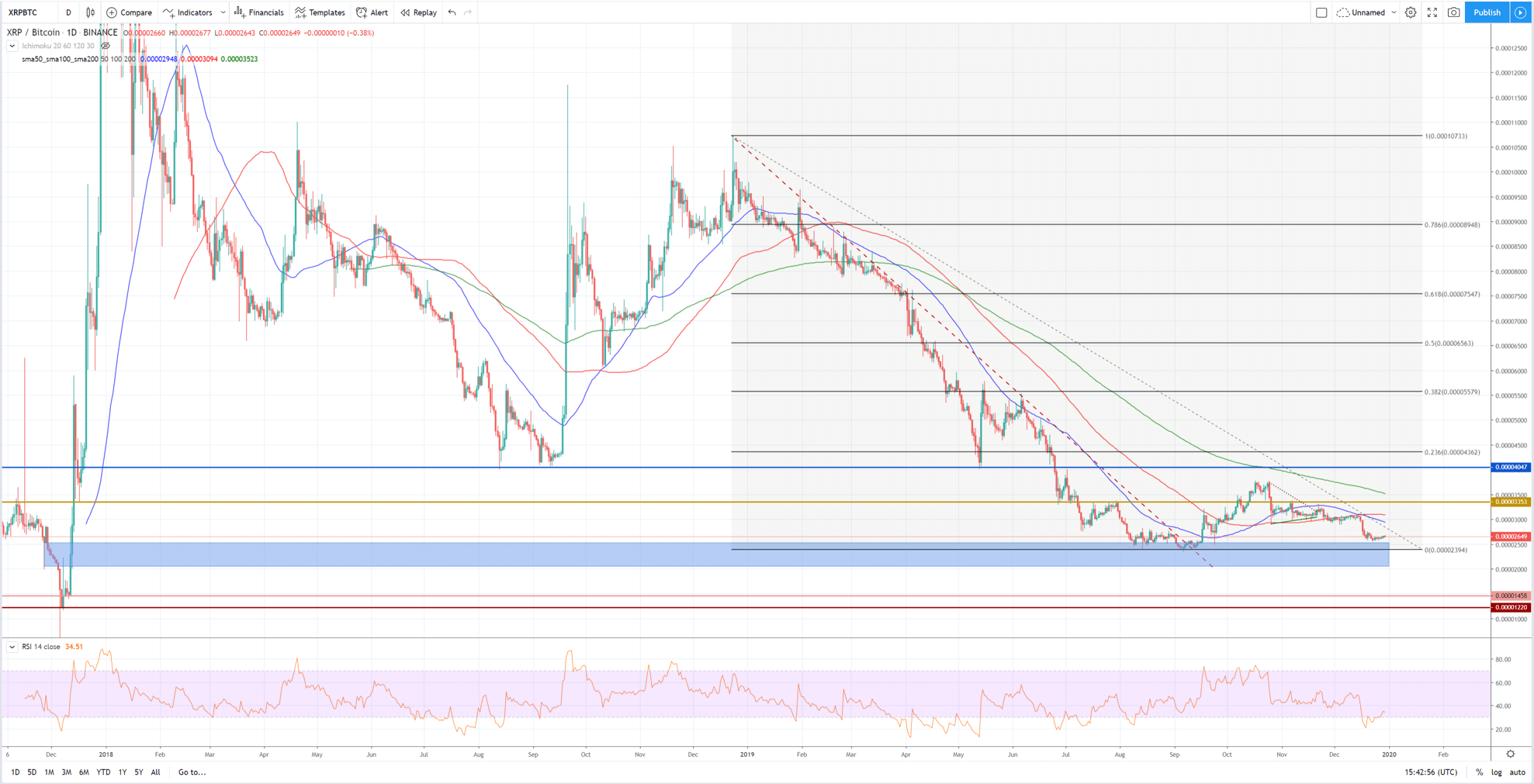

XRP/BTC: Important Observations and Areas of Interest

Another pair with several opportunities is the XRP/BTC, with a different and more volatile behaviour, so we recommend proper risk management.

- The intervals are also 1 day. It is clear that in September 2019 the bearish channel that had reigned throughout that year will be broken. Although the breakout is clear, the bulls have not yet managed to overcome several key resistances before gaining a change of trend, so we are currently trading in a consolidation side channel.

- On the downward path, the blue support zone could be challenged to confirm the intention of the bulls to buy Ripple. A breakout of that range could lead us to even lower lows, around 0.00001220 BTC, although the probability of this scenario is more remote.

- However, for an upward momentum and a breakout in this direction, several elements will need to be confirmed. The amount of intermediate resistance before reaching the first level of interest bounded by Fibonacci retracements makes the path less simple. First, there are the 50, 100- and 200-day moving averages, which impose significant resistance to the evolution of this price (especially the MA100).

- Outside of these curves, the reference S/R levels drawn on the chart (blue and yellow lines) can be used. These are around 0.00003350 BTC and 0.00004045 BTC. The latter marks a level of importance for the market structure of the XRP/BTC and could mark the beginning of a trend change, although other confirming elements will be required.

- The relative strength index shows a rebound after falling into oversold territory.

Other Important Data and Technical Projections for XRP

- Ripple’s last year low: Ripple fell sharply to 0.175 USD in December 2019, recording its lowest level in two years. With respect to bitcoin, it did the same in September of the same year, hitting around 0.00002390 BTC.

- XRP highs in the last year: despite the bullish rally in the first half of 2019, Ripple did not manage to rise as much as other cryptocurrencies did. It reached highs of around 51 cents in June 2019, while BTC highs are near 9600 SATS (in January 2019).

The characteristics of this graph are far from conclusive, but they can help us make decisions according to what happens in the next few days. The downward break would give the bears room to open short positions with a goal close to the previous year’s lows. But the possibility of a bullish break for each could be closer and closer if Ripple manages to overcome the build-up of resistance at the lower levels.

Expert Predictions on the Future of Ripple

Cory Johnson, Ripple’s Chief Marketer, says he has long followed cryptocurrency and the blockchain industry, but became particularly interested in November when most of the major digital assets rose in price.

“From my point of view that moment, which is now completely biased, says the intrinsic value in these coins, or in these assets, is not there. I just hope someone else finds it there…

But what I saw in Ripple was something different from what I see in some of these other currencies, and certainly in many of these ICOs: that the software company’s activities create value in the asset, an underlying intrinsic value. I think Ripple is going to be able to demonstrate an intrinsic value to XRP that some of these outgoing currencies and assets don’t and won’t have.”

In the vision of Chris Larsen, founder of Ripple, large banks like Citi, JPMorgan Chase, PayPal and Alipay will continue to exist. But the “Ripple Network” will be the system they use to communicate with each other, just as the Internet’s interoperability protocols now link the world’s email networks. It is a collaborative scheme rather than a zero-sum game competition.

Cointelegraph writer Joseph Young expressed on his Twitter account about Ripple:

“Is Ripple blocking $14 billion of his native “currency” to control its price? Blocking funds in itself is bad. The intent is even worse.”

By 2020, executives expect the market to mature, with a reduction in the number of cryptocurrencies and a migration of money to those that have more relevant, future use.

Website Predictions: Future of XRP Made in 2019

Despite the fact that the bullish side expects a remarkable growth, some websites based on historical data and forecasting systems, agree that the XRP will not exceed the dollar by 2020. For example, WalletInvestor has a bearish projection for Ripple, assuring that it will close 2020 near to $0.0110 USD (94% loss from current level).

In a bullish perspective we have sites like The Oofy, which predicts that Ripple will trade around $0.5 – $0.6 during 2020, for a period of consolidation that would see highs near $0.90.

The technical forecasting website, LongForecast also releases its Ripple forecasts for 2020. This website leans towards the bearish side of the balance and considers that XRP could close 2020 at $0.13.

Although we have found few bullish projections for Ripple in 2020, John Isige, author of the FXStreet portal, published a recent analysis in which he claims that the XRP could consolidate between 30 and 50 cents in 2020, shooting up to parity with the dollar by the end of that year. His goal is for the XRP to return to historical highs near $3 in the future, although he conditions this rise on the behaviour of the leading Bitcoin.

Ripple’s Detractors: “Ripple’s a Bubble”

Many consider cryptocurrencies to be a speculative bubble; Ripple has been no exception. After reaching highs of $3.65 USD, to experience a decline, Ripple’s low figures may be due to the fact that Coinmarketcap does not include information from some South Korean stock exchanges, where this currency has had great acceptance, but there are other concerns going on.

Erik Voorhees, CEO of the ShapeShift digital asset exchange, and a strong supporter of Bitcoin as a way to separate money and state, is quoted as saying:

“The reason why Ripple is growing so much is that it’s a bubble. Trying out cryptocurrency with the banks doesn’t make sense. The idea of cryptocurrencies is that you don’t need a bank.”

What do these Predictions Conclude about Ripple?

The future of Ripple’s price remains unpredictable, but it should be considered one of the most widely adopted cryptocurrencies. While there is little favouritism for XRP as a large private company working with banks, this has been precisely the component for its success. The network is useful for banks that want exposure to the cryptocurrency world while making their existing cross-border transaction systems, faster and cheaper. The solution presented by Ripple is highly scalable and its success could be further consolidated in the future.

However, it is important to be aware of exaggerated projections for XRP in the future. It is crucial to understand that there are over 44 billion XRP coins in circulation. Thus, a $100 quote, for example, would require the XRP to capitalize about $4 trillion, more than any other existing financial asset. Consequently, one must maintain realistic expectations and continuously monitor a constantly changing market.