In the last week or so, we have seen numerous high profile investors and technologists come out to make massive predictions regarding the future price of Bitcoin.

There are two aspects to these predictions that draw a lot of interest. First, because of the notable expertise each of these individuals have. Blockchain experts and billionaire CEO’s have opinions that are far more respected than your average investor who might not be making decisions with the same level of rationality and experience. Additionally, Bitcoin is currently in a massive bear market, and it is not necessarily “popular” for people to come out in support of the coin. For those reasons, these opinions can be seen to have a little bit more merit.

The Big Predictions

IBM’s Vice President of blockchain and digital technologies, Jesse Lund, has said he would not be surprised if Bitcoin hit a million dollars. This isn’t a near-term prediction, but it does say a lot about the upper end of the goals that people in the industry have.

One justification of this pricing is that it would give the whole network an overall market capitalization of $20 trillion, which is on a similar scale to that of the US dollar. Additionally, it would put the price of a satoshi on par with a cent.

This prediction comes from an interview with news platform Finder.com. In the shorter-term, Mr. Lund sees the end of 2019 bringing a price of around $5k.

Billionaire investor Tim Draper has also recently stated that he sees Bitcoin hitting a high of $250,000 by 2022. That is farther off, but still indicates a high trajectory for the biggest coin on the market.

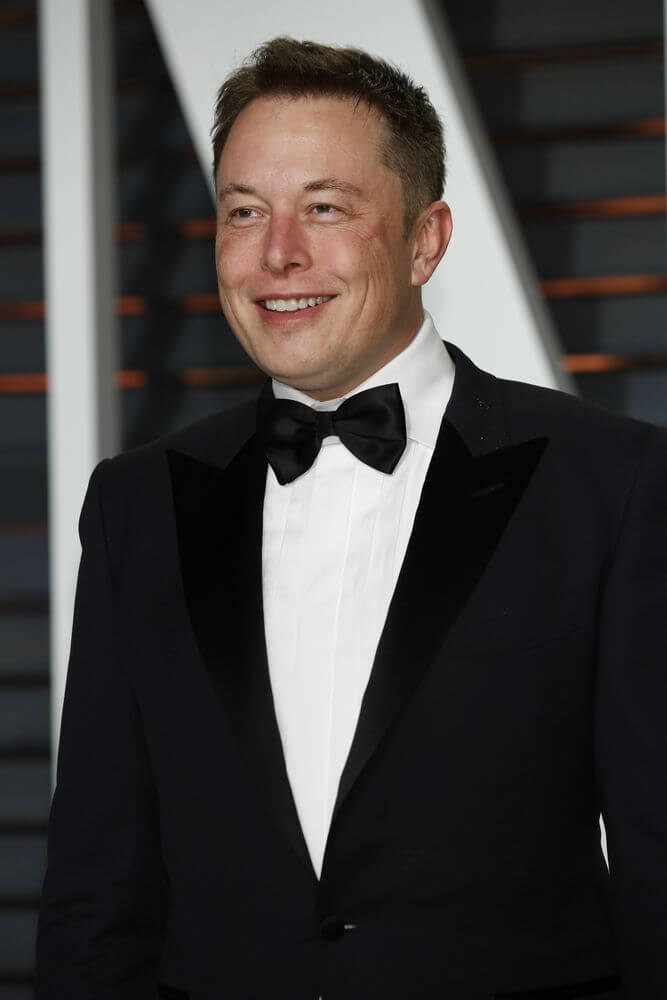

Around the same time, Elon Musk, explained how he believed Bitcoin’s design to be “a far better way to transfer value than pieces of paper.” The billionaire founder of Paypal, SpaceX, and Tesla may have a bias towards believing in far-fetched technologies, but this still can’t be ignored.

None of this is to say that Musk is going to be getting into Bitcoin. In fact, he only owns 0.25 BTC that a friend gifted to him a while back. But he does see the value in getting past currency controls and evolving away from paper money.

Bitcoin Maximalists

As we discussed a few weeks ago, Jack Dorsey (founder of Twitter) also has a very bullish view of crypto. Although part of this may originate from self-interest, since he owns a notable amount of Bitcoin.

If you talk to the layman or the Bitcoin critic, they believe that $20k Bitcoin was a fluke and it will never recover to that level again. In terms of the ways that bubbles tend to boom and bust, these types of doom-and-gloom predictions ignore the continuing increases Bitcoin has shown year over year.

Bitcoin maximalists are a funny type of cult, because they have an almost evangelical belief in the future of their cryptocurrency. They also tend to believe most altcoins have no merit whatsoever. However, it has also been found that most other cryptocurrencies trade on par with each other. Even in the recent deterioration in Ethereum’s fundamentals, ETH has still been trading relatively in line with BTC.