Tezos is exchanging hands for $3.05 while Ontology has dipped 6% in the past 24 hours to trade at $0.69

Tezos and Ontology are both trading lower by 6% and 1.4% as of press time and could turn bearish if bulls fail to hold crucial support areas over the weekend.

This will be especially true if Bitcoin and Ethereum witness another setback as this will likely impact the rest of the market.

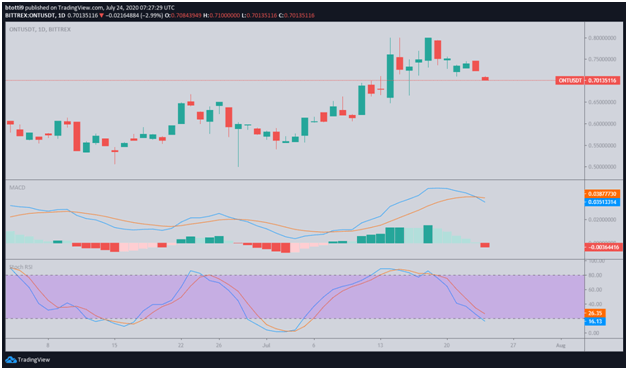

Ontology price analysis

Ontology has traded on the cusp of a major retracement over the past few trading sessions. The ONT/USD pair broke several resistances on its way to hitting a high of $0.795 after trading at around $0.54 on July 2.

Bulls have twice failed to break above resistance at $0.79, with a decline of 6% in the past 24 hours pushing prices to lows of $0.69. ONT/USD might retrace to $0.65 if seller rejection intensifies over the weekend.

The picture is supported by the Stochastic RSI that has turned oversold and a bearish divergence formed by the MACD.

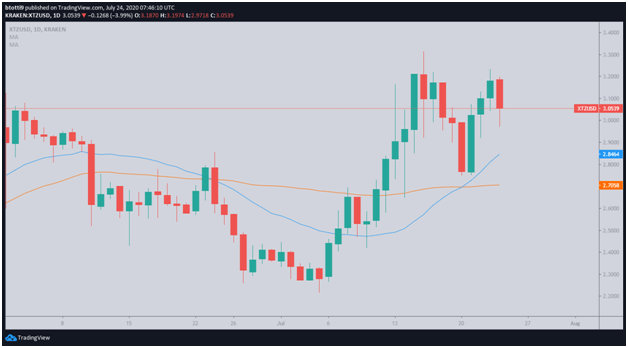

Tezos price analysis

Tezos has established a three-day bearish trend to see its price against the US dollar drop by more than 4% in the past 48 hours.

As of writing, the price of Tezos was trading at $3.05, down by about 1.4% in the past 24 hours. The 13th ranked token has been one of the best performing altcoins in July, but yesterday’s price dip means its value is now off weekly highs by about 1.6%.

The technical picture suggests that XTZ/USD might struggle to sustain gains made during the recent upside. There is a bearish divergence of the RSI and the MACD also points to a potential bearish crossover.

While Tezos buyers remain largely in control, a bearish breakdown could see the coin slip to support areas around the 20-day MA and 50-day MA. Such a breakdown would flip the immediate support area at $3.0 into a resistance zone.

Wall Street slide could be an opportunity for Bitcoin

The major US stock indexes S&P 500 and Dow closed lower on Thursday soured by rising Sino-US tensions and a seemingly worsening COVID-19 scenario.

The collapse on Wall Street might yet temper Bitcoin’s chances of testing prices near $10,000 going into the weekend.

For traders looking for other digital assets to rotate their profits into, a well-positioned Ethereum and the DeFi space offer opportunities. Similarly, a rally in Bitcoin could see several altcoins benefit, including Tezos and Ontology that have both traded lower despite a resurgence in the broader crypto market.