The 10 Best Crypto Exchanges

The past 10 to 15 years saw cryptocurrencies taking the world by storm, providing a whole host of investment opportunities to interested people. This phenomenon also led to the emergence of more and more crypto exchanges with each passing year.

Today, a great multitude of investors use these platforms to buy and sell their preferred cryptocurrencies including the biggest, Bitcoin.

This article will discuss what a cryptocurrency exchange is, the important aspects you must look for in one, how these exchange platforms work, their pros & cons, different types, and the best crypto exchanges in 2025.

Best Crypto Exchanges - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended crypto exchanges to use for buying and selling cryptocurrency.

The Best Cryptocurrency Exchanges - Key Metrics

Top 10 Crypto Exchanges Quickly Compared

Top 10 Cryptocurrency Exchanges Reviewed

What Is a Crypto Exchange?

A cryptocurrency exchange can be termed as an online marketplace where you can freely indulge in buying and selling cryptocurrency, in exchange for fiat currencies or other cryptocurrencies. The platform functions as an intermediary between the buyers and sellers and normally charges a commission for its services.

Unlike in the case of stock exchanges where traders buy/sell securities to profit from their changing prices (and sometimes dividends), on crypto exchange platforms people make use of fiat or crypto trading pairs to bank upon the volatility of cryptocurrencies.

How Do You Buy Cryptocurrency?

If you want to buy cryptocurrency, the first thing you need to do is sign up with a reliable platform, such as Open Account or any of the others reviewed on this page. You can find step-by-step instructions for buying crypto on eToro later in this guide.

On many exchanges, you will need to fund your account first, which you can do by heading to the deposit page, choosing one of the payment options available in your country, entering the amount, and providing your payment information.

Some platforms will have a quick buy feature, where you just need to choose a cryptocurrency and fill in how much you want to purchase. The other option is to open the spot trading platform, where you will have access to price charts and trading tools. There, you can create a market order to buy some crypto instantly or create a limit order if you want to buy the coin once it reaches a certain price.

Most crypto exchanges provide a custodial wallet, which is where your coins will be stored. If you want to keep them in a private wallet, you can go to the crypto withdrawal page and enter the address of your private wallet.

How Do Crypto Exchanges Work?

To use a crypto or bitcoin platform, you will need to register with it first and comply with its verification process to authenticate your identity.

The verification process might vary from one exchange to the other. While some crypto exchanges won’t ask you for anything more than your email ID, others might require you to complete stringent KYC (Know Your Customer) checks such as photo upload, id verification, address verification, etc. before onboarding you to their platform. This is basically to comply with their (Know Your Customer), CFT (Combating the Financing of Terrorism) and AML (Anti-Money Laundering) measures.

Please note, that even though it’s entirely up to you whether you use non-KYC or KYC exchanges, the latter can prevent you from dealing with antisocial elements and also reduce the risk of fraud.

Your account will get opened after completing the verification process. Thereafter, you can deposit funds into it, using a currency and payment method permitted by the platform. Many crypto exchanges normally allow multiple deposit/withdrawal methods including debit cards, credit cards, bank drafts, wire transfers, e-wallets, Paypal, wallet transfers, etc.

Once you’ve deposited funds into your exchange account, you can use them to trade cryptocurrencies available on the platform. The funds can be withdrawn anytime either in crypto or in fiat by placing a withdrawal request.

Most major crypto exchanges facilitate crypto trading via ‘Buy’ or ‘Sell’ orders that are matched by the platform’s software.

To sum it all up, a crypto exchange is essentially an online marketplace where you can buy and sell cryptocurrencies from/to other traders, based on their current crypto market price. The exchange works as an intermediary between the buyers and sellers and charges a fee for its services.

Different Types of Cryptocurrency & Bitcoin Exchanges

There are different types of cryptocurrency and Bitcoin exchanges catering to different trader types. Below are the four main types you will find in the market:

- Centralized Exchanges (CEX)

These work quite like conventional stock exchanges, with a central authority having complete control over the product, function and service. Interestingly, the concept of a centralized exchange is quite contradictory to why cryptocurrencies were invented in the first place, which was to free the financial world from the authoritative, and singular rule. The funds are held by the exchange and the available trades can be crypto-crypto, fiat-crypto or both.

- Decentralized Exchanges (DEX)

A decentralized exchange is an exchange that facilitates peer-to-peer trading of cryptocurrencies. All functions of the crypto exchange, including crypto assets exchanges, order matching, order books and capital deposits are decentralized, in the true spirit of cryptocurrency. There is no central server and no possibility of a single point of failure.

- Local Exchanges

These are websites that function more like local dealers that can buy/sell cryptocurrencies from/to you against your local currency. Whilst many of them provide automatic buy/sell orders, they don’t offer cryptocurrency trading facilities.

- Fiat vs Pure Exchanges

Fiat-Crypto exchanges are the ones where you can purchase a cryptocurrency using a fiat currency. Extremely popular amongst starting-out crypto investors, these enable easy access to cryptocurrencies to the general populace. On the contrary, Crypto-Crypto or Pure Exchanges are the kinds where you can trade only in cryptocurrencies, with no provision for fiat-crypto exchange.

- Hybrid Exchanges

Hybrid exchanges combine useful components of centralized exchanges and decentralized exchanges. They take the security of a decentralized exchange and the scalability of centralized exchanges into a single platform. They are still a growing development.

Centralized Vs. Decentralized Crypto Exchanges

Centralized and decentralized crypto exchanges perform the same functions in very different ways. A single entity governs one, while a democratized group regulates the other.

Centralized crypto exchanges are straightforward. They incorporate elements of regular exchanges that anyone with some finance exposure is familiar with. They are run by corporations, licensed by government agencies, and are subject to anti-money laundering laws.

On the other hand, decentralized exchanges are not owned by one entity, even though they may be built by one. They run on perpetual pieces of code, called smart contracts, that cannot be stopped once executed.

They are not licensed, and thanks to their codebase, they do not require their users to adhere to anti-money laundering laws. However, this does not make them inherently wrong. It just means they provide a level of freedom unavailable in centralized markets.

Decentralized exchanges are usually managed by Decentralised Autonomous Organisations, which are groups of people who vote on the best ways to run and maintain exchanges. Anyone can join a DAO by simply purchasing its tokens.

| Centralized Exchanges | Decentralized Exchanges |

| Managed and run by an entity | Not owned by any entity. Run by code |

| Subject to regulation | Not subject to regulation |

| Faster transaction speeds | Slower transaction speeds |

| Higher transaction fees | Lower transaction fees |

| The firm handles Crypto custody | Crypto custody remains with the users |

| Easy for beginners to use and understand | It can be tricky for beginners |

What are the Benefits of Using a Cryptocurrency Exchange?

Easy Access

Cryptocurrency exchanges make accessing the cryptocurrency market easy for investors and traders. You can get set up and start investing and trading in a few easy steps (perhaps more for institutions).

Most crypto exchanges also provide tools for users to take advantage of various opportunities and market conditions. For example, exchanges like Binance offer trading bots that allow users to take advantage of ranging markets.

Other exchanges offer derivatives for traders to take advantage of crypto price action and maximize their exposure with leverage.

Deep Liquidity

Major exchanges have deep liquidity for major cryptos. For example, Coinbse processes about $2 billion in daily trade volume while Binance does closer to $7 billion, enough liquidity for large institutions to trade without moving the market.

However, note that a large trading volume is a hallmark of global exchanges. Local exchanges will naturally process significantly fewer volumes.

Proper Regulations

Major exchanges are sticklers for rules, more so than smaller ones. Institutional investors emphasize compliance with regulations, especially in the tightly regulated finance industry. Most large exchanges follow the rules and usually register with local regulators before offering services to customers within a region.

What are the Challenges of Using a Crypto Exchange?

Regulatory Issues

While many exchanges try to comply with local laws, some still get caught in regulators’ crosshairs. The 2023 saga of lawsuits in the US is an excellent example, as various crypto exchanges believed to be compliant were dragged to court by the SEC for offering unregulated securities.

Without clear frameworks, the regulatory landscape can easily change, placing exchanges at a disadvantage and user funds at risk.

Hacks and Breaches

History has shown that even behemoth exchanges like Binance are not impervious to breaches and hacks. Their ability to bounce back from these breaches separates great exchanges from mediocre ones.

Exchanges like Binance set aside recovery funds to repay customers in cases of hacks.

However, the availability of these funds does not excuse hacks. Exchanges that fall victim to multiple hacks are a red flag as they show gaps in their security systems.

Jurisdictional Issues

Centralized crypto exchanges must adhere to local regulations wherever they operate. Unfortunately, this means they may be unable to access some countries or provide some services.

For example, Binance Global cannot access the US market, so another entity, Binance US, was created solely for the US market.

Unfortunately, Binance US does not offer nearly as many cryptos or services as the global company, so US users do not get the same options and opportunities.

Key Things to Consider When Choosing the Best Crypto Exchange

Opting for the right crypto-swapping platform can be the most critical step you take as a beginner cryptocurrency investor. It’s very important to understand your expectations from a platform and how you wish to trade cryptocurrencies. We can’t stress enough the significance of thoroughly examining the unique offerings of every exchange you shortlist. Let’s look at some of the key points you should keep in mind:

Customer Support

It should offer 24/7 (preferably) customer support through all popular communication channels including email, phone, social media, and live chat. However, most exchanges offer 24/5 service, which is still acceptable.

One area that should be a must is live chat or phone support. The best exchanges we came across offer live support. The alternative is email threads that could slow down service delivery.

Fees

Fees include trading fees, deposit and withdrawal fees, transaction fees, and fees charged for other services like lines of credit and staking. These fees differ with platforms but should be within a certain range.

Deposit and withdrawal fees are usually around 2% for transactions in both directions. This percentage should be for credit card transactions as they tend to be the more expensive option. Bank deposits are usually free on top platforms while electronic wallets may carry a small charge.

Some exchanges charge a flat withdrawal fee. eToro charges a $5 flat withdrawal fee on all withdrawals regardless of volume.

Trading fees should never be above 1% of the transaction volume. The highest we’ve come across is about 0.75% of the transaction value as taker fees for spot trading and 1% for crypto CFDs.

While transaction fees vary with the platform, they should never be a significant chunk of the returns generated or of the value of the transaction.

Security Features

The exchange should use all possible and updated security measures, including two-factor authentication (2FA), crypto assets insurance, ID verifications, etc. to safeguard the investors’ interests.

The top crypto exchanges we came across also have a track record of tight security. While hacks are endemic to the crypto space and breaches occur, there should be a contingency plan to safeguard users’ funds and replace them if necessary.

Binance is a good example of an exchange that bounced back from a breach in 2019 by maintaining a Secure Asset Fund for Users which was used to replenish lost funds.

Ease of Use

The cryptocurrency exchange shouldn’t be very difficult to use and have a straightforward UI (user interface). Users should be able to navigate through the various features and services relatively easily. Complicated features should come with comprehensive guides and images, that should be sufficient to unblock even the most novice users.

Payment Methods

A cryptocurrency exchange platform would be of no use to you if it doesn’t offer a deposit/withdrawal method of your choice. Make sure it does before signing up with any. Deposit funds can be both fiat currency or crypto.

The top platforms we’ve come across accept bank deposits in local currencies for all jurisdictions they operate in. For jurisdictions where bank deposits are unfeasible, like Nigeria where banks don’t process crypto transactions, third-party options like electronic wallets should be made available.

The ultimate third-party deposit method is a p2p marketplace. Not all major exchanges have p2p markets, which makes those that do more desirable as these marketplaces have a wide range of payment methods

Supported Coins

All reputed exchanges offer a large variety of cryptocurrencies to cater to all types of investors. Ensure that the exchange you have in mind allows crypto trading in the cryptocurrency that you are interested in.

Exchanges domiciled in the US usually have a limited collection of coins compared to their global peers. While an exchange that offers 65 cryptos may be considered limited by global standards, it is an appropriate number for a US-based exchange, although Coinbase which is US-based, offers 193 cryptos.

All the exchanges on our list also offer fiat-to-crypto pairs like BTC/USD and crypto-to-crypto pairs, also called crypto crosses, like ETH/AAVE. For global crypto exchanges, fiat-to-crypto pairs should exist for major currencies (USD, GBP, EUR, AUD, CAD).

For crypto crosses, major cryptos should cross with USDT, USDC, or stablecoins that are native to certain platforms, like BUSD for Binance, e.g. BTC/USDT, ETH/USDC, AVAX/BUSD.

Privacy

If you’re someone who desires a high degree of anonymity, you should go with an anonymous exchange that doesn’t ask for a lot of personal details.

Centralized exchanges are not the best option for anonymity as they require users to pass KYC before operating a fully functional account. Nevertheless, security on these platforms should be airtight.

Your platform of choice should also conform to cybersecurity best practices and have certifications like the ISO 27001:2013 to prove it.

Reputation

Before signing up for an exchange, always read peer-written reviews. Sites like G2 and Trustpilot are great for finding independent third-party reviews. Some exchanges work well in certain regions but perform lackluster in others.

A good example is Binance. Reviews on G2 are positive with an overall rating of 3.8 of 5.0 while Trustpilot reviews are mainly negative with an overall rating of 2.0 of 5.0. Comparing both reviews, we found that Binance doesn’t work well in the Middle East.

Another place to monitor reputation is the news. Some crypto exchanges are constantly embroiled in regulatory issues. These exchanges are high risk as they could be smacked with restrictions that affect your ability to withdraw your funds.

Finally, skim through the platform’s operating history. Do they have a history of suddenly suspending withdrawals due to legal issues? Have any C-level executives gotten into trouble with the law? If so, then you want to tread carefully.

Regulation

Regulated platforms are more legitimate in the eyes of the law than their unregulated peers. You are less likely to lose your funds with regulated platforms. Each country has its regulatory agencies. Here are some of the popular ones in various countries:

In the US, there is no concrete legal framework for regulating cryptocurrencies, so exchanges do not fall directly under the purview of the SEC, however, they are regulated by the Bank Secrecy Act (BSA), must register with the Financial Crimes Enforcement Network (FinCEN), and must comply with Anti-Money Laundering (AML) laws.

Cryptocurrency exchanges like eToro, on the other hand, fall under the SEC and must be registered with the SEC and fall under their purview. eToro is fully registered with the SEC.

In the UK, exchanges are regulated by the Financial Conduct Authority and are beholden to AML and Combating the Financing of Terrorism (CFT) laws. Crypto exchanges are not allowed to offer crypto derivatives to citizens.

In Canada, exchanges operate under the domain of provincial regulators. Crypto investment firms like Nexo must register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Australia is friendly towards crypto exchanges and only requires them to register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and meet clear-cut AML/CTF obligations.

In the Eurozone, cryptocurrency is currently legal, however, authorities have been pushing a Markets in Crypto Assets (MiCA) regulation that is said to bring the same transparency and credibility that the traditional finance sector enjoys. In the meantime, exchanges must adhere to AML and CFT laws.

In Japan, cryptocurrencies are considered legal property and are regulated by the Payments Service Act (PSA). Exchanges must register with the Financial Services Agency (FSA) and adhere to AML and CFT guidelines.

Wallets

Most exchanges on our list offer secure web wallets associated with their accounts. This type of crypto wallet comes with certain limitations. For example, you can only withdraw and deposit from them. You cannot use them to qualify for external airdrops or purchase activities. You do not hold their private keys and are not in control of the wallet, hence, you are entrusting your funds to the exchange.

If you must leave your crypto holdings and other digital assets on an exchange, ensure that it is regulated in your region. Exchanges like eToro are safe because they are regulated by several agencies in numerous jurisdictions.

If you are unsure about the regulatory status of your chosen exchange and they seem to obscure that information, you may not want to leave your funds on their platform.

Unique Features

Buying and selling cryptos is a base feature that all exchanges possess. To stand out, they include other unique features and services. For example, Nexo extends crypto-backed loans that do not require a maintenance fee, and eToro has a Copy Trader feature that allows newbies to copy the trades of more experienced users.

For investors looking to grow their funds, Binance offers flexible saving pools that generate returns anywhere in the range of 2% – 30% per year. This return is higher for locked funds.

What is one of the most important things to look out for when choosing a crypto platform to sign up to?

"Security, check if an exchange has had any previous incidents and how these incidents were resolved. Also be sure to check what the recourse is for you if your funds in your wallet have been compromised. It is also helpful to check the liquidity of the exchange and possible issues faced in the past or ongoing with regard to liquidity Very closely aligned to this is to check if the platform has a verification or Know Your Customer (KYC) process - which serves to protect against fraudulent account creation by verifying that account holders are who they say they are."Paolo Ardoino

CTO of Bitfinex

How to Use a Crypto Exchange

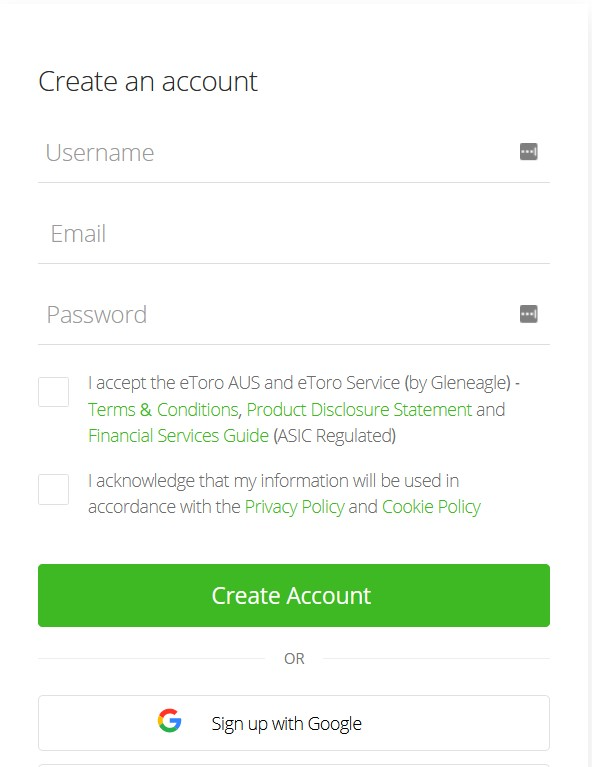

1. Open an account

Download the eToro app from the Play Store or the App Store and click on Sign up or go to the eToro website and click on the Start investing icon on the homepage. Enter your full name, email address, and password.

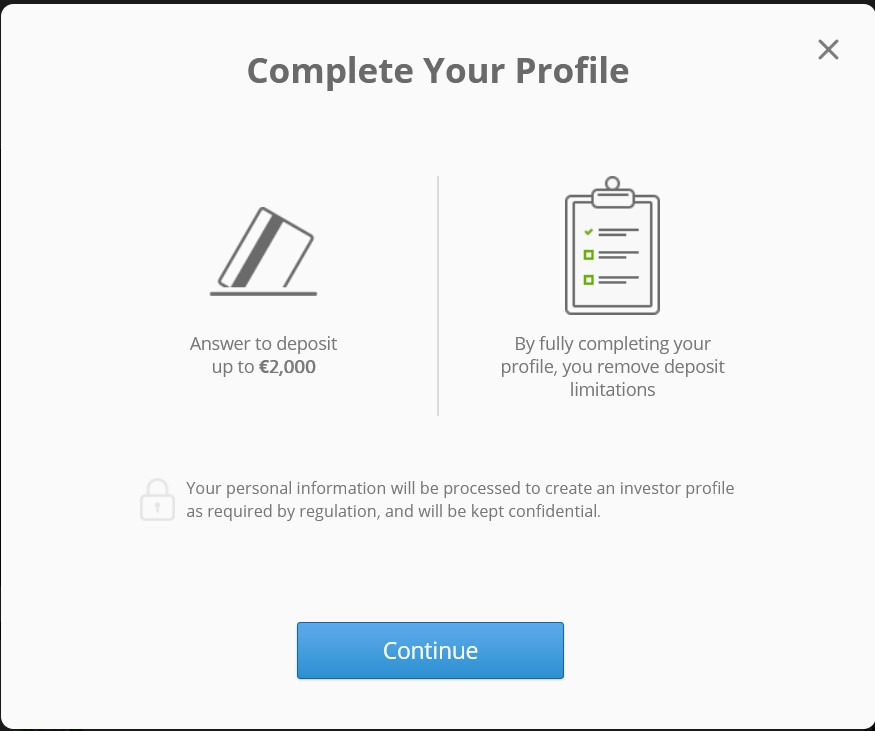

2. Verify your account

After creating an account, you’ll immediately be prompted to verify it by providing personal details like your date of birth and a passport photo before being asked to submit KYC documents. These documents include proof of ID (National ID or driver’s licence) and proof of residence (bank statement or utility bill)

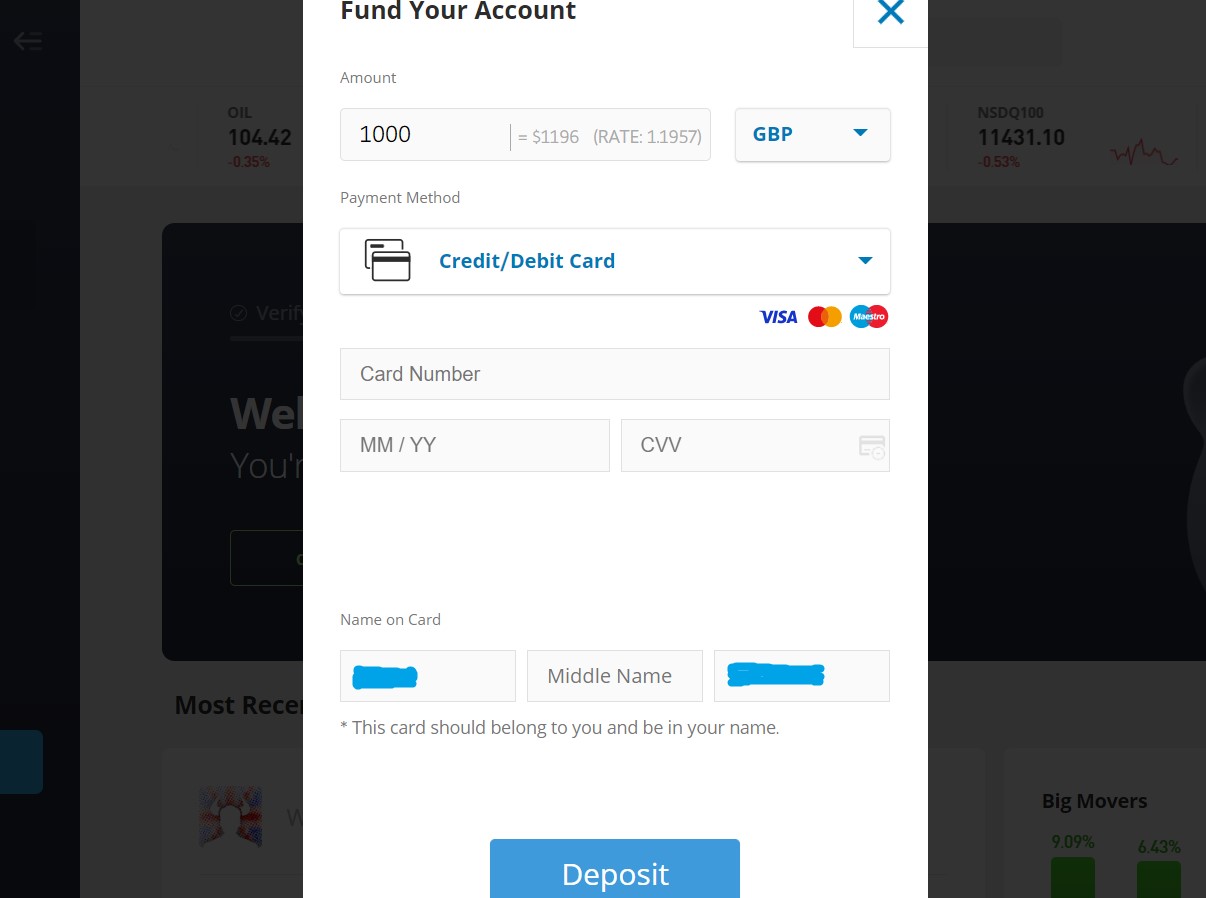

3. Make a deposit

After verifying your account, click on the Deposit funds icon on the left pane of the page. The deposit options available to you will be displayed. Choose one and set the amount you’d like to deposit.

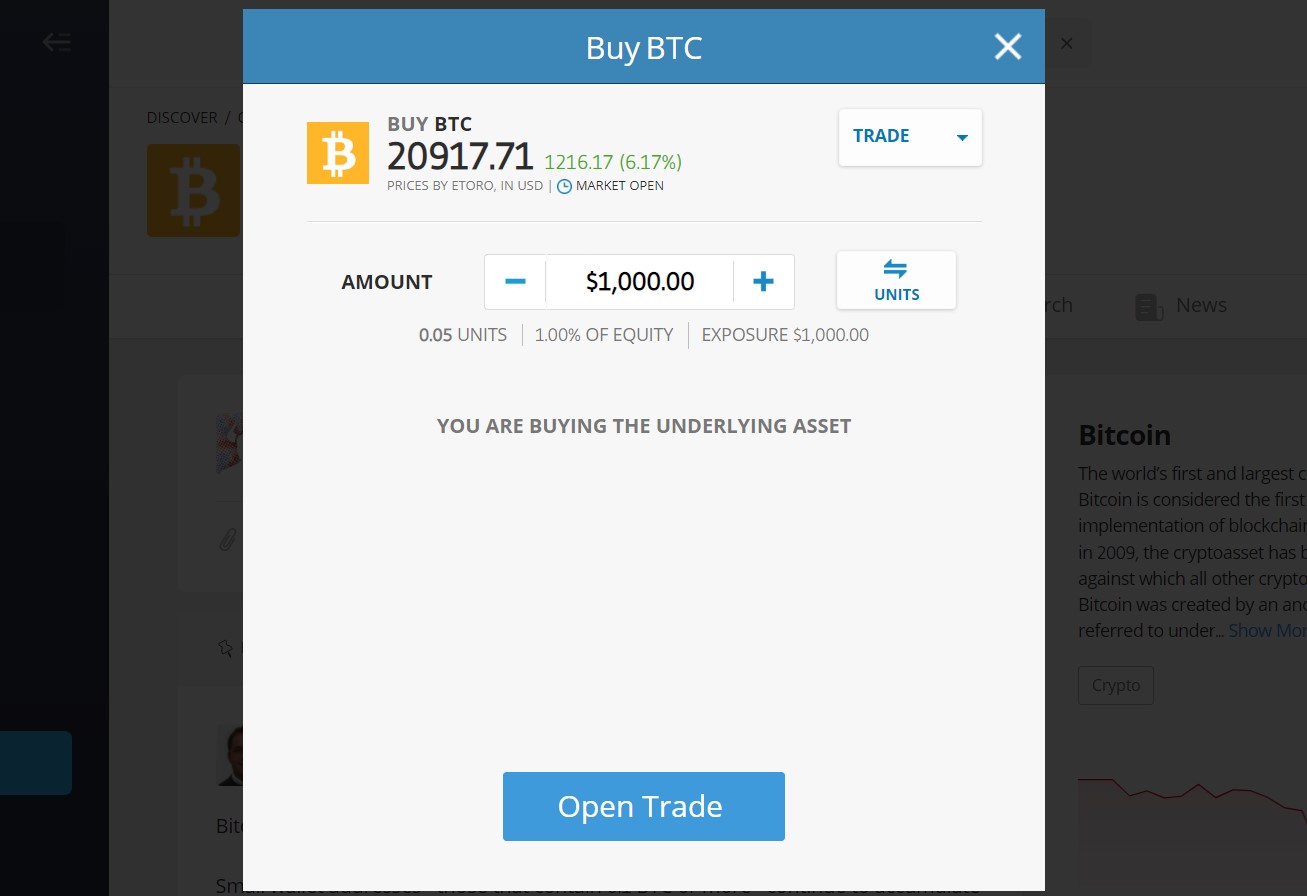

4. Buy cryptocurrency

Once your account is funded, you can buy crypto by going to the Discover tab and clicking on the crypto you want to trade. An interface like the one below should load. You can then set your parameters and buy.

Pros and Cons of Using an Exchange to Buy Cryptocurrency

Pros

- Many cryptocurrency exchanges are user-friendly and prove ideal for new crypto investors.

- Owing to the stringent KYC measures adopted by some of these platforms, they’re able to offer a higher degree of security.

- You are allowed to purchase cryptocurrencies immediately after registration.

- You get to own the cryptocurrency, rather than simply speculating its price movements.

- Decentralised exchanges are often able to offer a high degree of anonymity.

Cons

- Irrespective of their safety measures, crypto exchanges are not considered secure enough for storing coins after purchase.

- The KYC process can be very tiresome on some platforms

Are Cryptocurrency Exchanges Worth it?

Cryptocurrency exchanges are not only worth it; they are essential for crypto trading because major traditional exchanges like the NYSE, Nasdaq, or FTSE do not list cryptocurrencies, and it does not seem like they will in their current form.

While decentralized exchanges are a good alternative, most need more liquidity, transaction speed, and regulations than institutional investors require, leaving centralized exchanges as the ideal choice for most traders and investors.

Top centralized exchanges are licensed, well regulated, have deep liquidity, and support institutional trading, making them a worthy venture and trading tool for retail and institutional investors.

Final Thoughts on the Best Cryptocurrency Exchanges

The best crypto exchanges make it extremely easy to buy/sell cryptocurrencies and are contributing greatly to the world’s changing perception of cryptocurrency, money and finance as a whole. Furthermore, these crypto trading platforms continue to be the most preferred means for buying and selling coins for the majority of people.

is the best crypto exchange overall as its vibrant community of users and social features create an environment where users can learn from more experienced peers. Its CopyTrading feature also makes it easy for new traders to get a leg up on investing.

It also supports several deposit methods like bank transfers, credit/debit cards, electronic wallets like Neteller, and the eToro Money account. Deposit limits are favorable at a minimum of $10 while withdrawal fees remain flat at $5 regardless of the amount withdrawn.

Trading fees remain affordable at a 0.75% – 1% markup to raw spreads which applies to both spot trading and crypto CFDs.

Every cryptocurrency exchange in our guide is the best at a specific function which represents areas that customers should look out for. This guide has also noted key points and factors you should keep in mind when choosing the best cryptocurrency exchange in 2024 for you.

Best Crypto Exchanges Review Methodology

We decided which cryptocurrency platforms were best by first testing them individually. Our criteria for assessment include fees, deposit and withdrawal methods, reputation, credibility, security, ease of use, trading features, coin selection, and competitive edge.

The platforms listed on this page are ones that we have tested and found to be the best at the features we listed them under e.g. best platform for altcoin selection. All platforms have a track record of providing value for their users.

We also placed an onus on security and credibility. These platforms have millions of users and employ some of the highest security measures in the industry.

Finally, we considered fees and limits. These platforms have various fees and deposit/withdrawal limits, however, they are all within reasonable limits.

To learn more about how we test and choose platforms, visit our How We Test page.