Wrapped Bitcoin saw its value increase by over 900% in the space of two months

Last month, for the first time, the total value locked of all Bitcoin tokenized on the ETH network topped the one billion dollar mark. This was followed by the latest milestone achievement for Wrapped Bitcoin — the ERC-20 that is backed by bitcoins 1:1 and provides liquidity to Ethereum’s network.

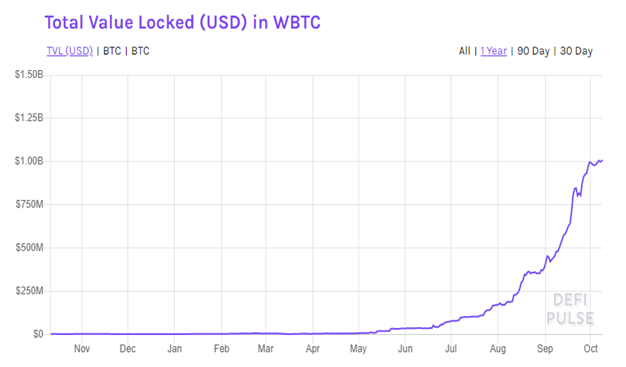

Over the last two months, about $900 million worth of Bitcoin has been tokenized using Wrapped Bitcoin (WBTC). This bullish run has resulted in the total value locked of Wrapped Bitcoin shooting up by 900% to top the $1 billion mark. Wrapped Bitcoin’s total value also hit $100 million back in early July.

Currently, the total value of tokenized bitcoin is in the range of $1.5 billion, with Wrapped Bitcoin occupying about a third of this figure. In terms of total value locked, Wrapped Bitcoin has moved to fifth place on the list of largest DeFi protocols. It currently constitutes almost 10% of the locked capital in the sector.

The growth of Wrapped Bitcoin’s total locked value between January and July highlights the overwhelming increase in the demand for DeFi over the past few months. In the first six months of the year, the value increased from around $4 million to $36 million. In the third quarter of the year, however, the increase in total value locked has been meteoric.

Beyond WBTC, the DeFi hype has also impacted other BTC tokenization protocols, including REN VM. The total value locked in Ren’s VM has soared to over $300 million this month from $40 million at the beginning of August.

The total value locked of PieDAO has gone down in the same period. It hit its highest level in mid-July almost getting to $5 million but has since been on a general downward trend with a brief spike in early August. Currently, its TVL stands at $1 million moving away from the under $1 million spell between mid-August and early October.