The Top 15 Fastest Growing Cryptocurrencies to Buy in 2025

To maximize your gains from the crypto market, you need to invest in the fastest-growing cryptocurrencies in whichever year or season you find yourself. While most cryptos grow during bull markets, there are those whose growth is faster than the market average.

Even in bear markets, these cryptos may easily bounce back from price declines because of the value their ecosystems provide or due to hype in the crypto market. Whatever the reason for a crypto’s growth, fast-growing cryptos offer investors an opportunity to profit relatively quickly.

We have created a guide for 20 of these cryptos which dives into what they are and why they are good investments.

The Top Fastest Growing Cryptocurrencies in 2025

The Fastest Growing Cryptocurrencies Reviewed

What is the Fastest Growing Cryptocurrency?

The fastest growing cryptocurrency on our list is iDEGEN. We are interested in this token because it taps into community meta narratives and offers the opportunity for truly viral growth.

Of source, iDEGEN’s growth potential does not eliminate the fact that it is still a new and largely untested project. You should not invest without being aware of the risks involved with both new projects and projects in the gambling space.

How to Pick the Fastest Growing Cryptocurrencies

Start With the Fastest Growing Sectors

The easiest way to find the fastest-growing cryptos is to monitor the fastest-growing sectors. Logically, sectors that are growing quickly will have cryptos that are as well. When searching, keep popular trends in mind, both global and crypto-specific.

For example, AI technology is a big global trend this year and we’ve seen AI cryptos rally. Layer 2 scaling has also been a big crypto-specific trend and we’ve seen tremendous growth in projects like Arbitrum, Optimism, and even the rise of zk networks.

Finding fast-growing sectors and selecting the top projects in them is a good start.

Monitor Growth Metrics

Because a sector is growing doesn’t mean that all cryptos in it will grow. There are only so many blockchain platforms one can build on. There are only so many applications people can use. In the end, most cryptos will fade into obscurity.

Keep an eye on growth metrics like daily active wallet addresses, developer activities, transaction volume, and even social media buzz.

Remember Where the Market is

The crypto market moves in cycles. Bull periods are characterized by increasing prices of cryptos and participation from retail and institutional investors, while bear markets are characterized by declining prices of tokens and scaled-down participation.

If you decide to invest in a bear market (which could have its merits), growth metrics may be skewed to the low end because of the market cycle. If you make decisions based on the toned-down metrics in a bear market, you may miss out on gems.

The Benefits of Investing in the Fastest Growing Crypto

Profit Potential

The fastest-growing cryptos are more likely to return profit sooner rather than later, which is appealing for most investors. The speed of growth could also mean a first-mover advantage which could help cement a cryptos’ position as the leader of a sector.

Dry Powder

Dry powder is a term used in finance to refer to cash reserves ready to be deployed into assets when opportunities arise. Because investments can span a long horizon (anything above a year is long-term), investors need to keep track of their dry powder so they don’t end up deploying all their funds in one go.

Fast-growing cryptos are more likely to yield profit faster and can consolidate investor’s dry powder in the short-mid term, enabling them to store up enough to focus on long-term crypto investments in their cold wallets.

The Potential Drawbacks of Investing in the Fastest Growing Crypto

Volatility

The speed of a crypto’s growth can be reflected in its price which could run up very quickly, creating an imbalance that must be corrected by an equally quick fall. Investors who do not understand this could inadvertently buy these cryptos at the wrong time.

Pump And Dump Schemes

Not all fast-moving cryptos are good investment options. Remember that investing and trading are not the same. Cryptos with no utility, like many meme coins, can run up quickly (the pump) and fall even farther than when it drops (the dump).

While the cryptos on our list belong to projects that are fundamentally sound, not all fast-growing cryptos out there do.

How to Buy the Fastest Growing Crypto Now

This guide shows you how to buy the fastest-growing cryptos on an exchange.

1. Open an Account

Navigate to the exchange’s website and open an account. You can also download the app from the Play store or App store. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Set up your profile and submit KYC documents like a valid government ID and proof of residency like a utility bill.

3. Deposit Funds

Once your account has been verified, deposit funds by using any of the available payment methods. Choose a convenient method and set the amount you’d like to deposit.

4. Buy A Fast Growing Crypto

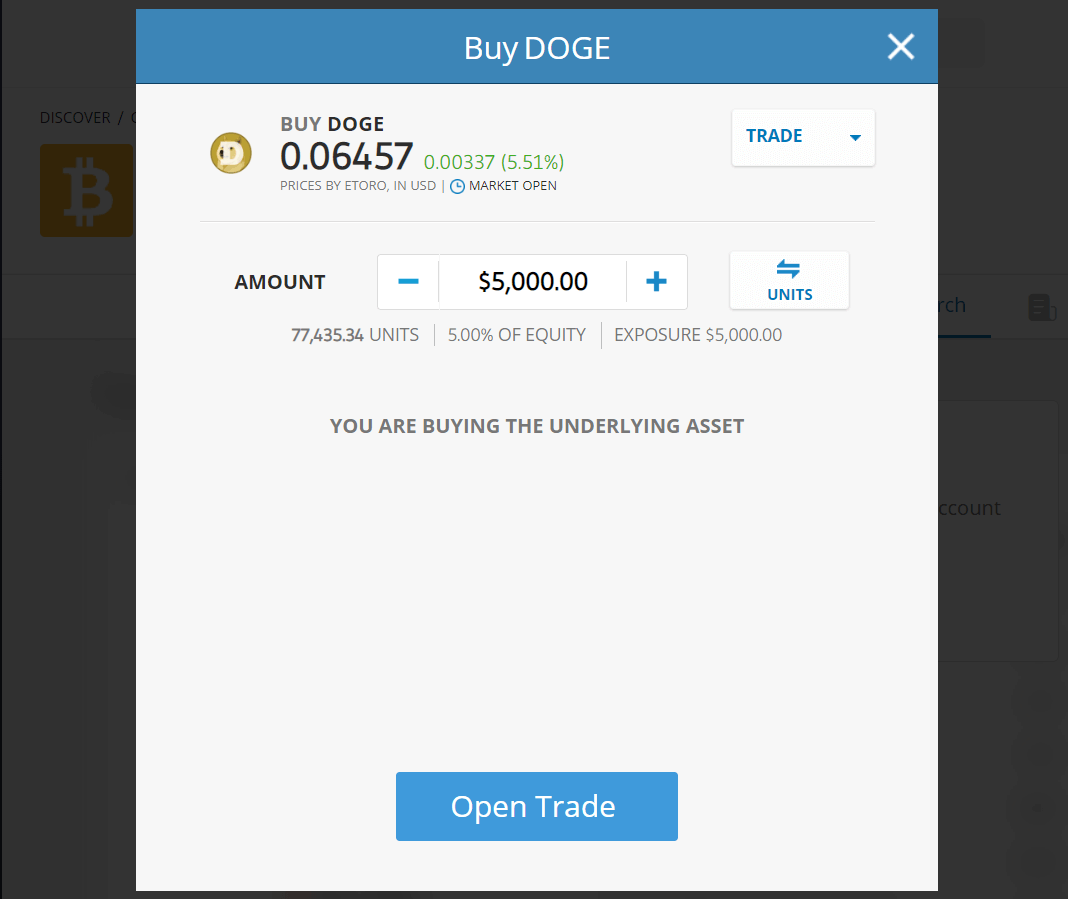

Once your account is funded, search for any of the cryptos mentioned in the Discover tab (or anyone you like). An interface like the one below should load. You can then set your parameters and buy.

Where to Buy the Fastest Growing Crypto Coins

To get your hands on new fast growing cryptos like Solciety you’ll have to purchase them directly on their websites using a crypto wallet. We created a guide to help you do that.

Step 1: Download a Wallet

We used the MetaMask wallet for this guide. Download the wallet app on your phone or use the web platform via a browser extension on your laptop. Create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need Solana to buy new Solciety tokens. Buy some on an exchange like eToro and transfer to your wallet, or use a fiat onramp on the wallet app. You can connect to a merchant on the Binance p2p market directly from the wallet app.

Step 3: Connect Wallet

Navigate to Solciety’s website and connect your wallet to join the presale. You can do this from the in-built browser on the mobile app. Buy SLCTY tokens using Solana. Ensure you have enough to pay for gas fees.

Step 4: Wait to Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest Fastest Growing Cryptos News

- Chainlink integrates price feeds with Celo blockchain as the data provider continues to expand its services.

- Otherside metaverse set to launch a beta game in 2023 called The Persistent World which will be a virtual universe where players can program and play games.

- Blockchain payments integration is being pushed forward thanks to a new wave of applications that run on layer 2 networks like Arbitrum.

Final Thoughts on the Fastest Growing Cryptocurrency

We explored the fastest growing cryptocurrencies in 2024 and chose iDEGEN as our top choice because of its potential for a truly viral growth trajectory.

Nonetheless, all the cryptos mentioned are fast growing, although some are growing faster than others due to major trends.

Remember to watch for volatility when choosing which crypto to invest in and to avoid pump and dump tokens with no utility.

To invest in cryptos now, visit an exchange like eToro.

Methodology - How We Picked The Fastest Growing Cryptos

The cryptos covered in this guide were chosen through rigorous research. We paid attention to utility, reputation, hype, and growth potential.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Treasure as the fastest-growing gaming infrastructure because it is the largest gaming crypto on Arbitrum and its platform experiences quarter-on-quarter growth.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos