Ethereum now holds more daily active addresses than Bitcoin, according to Weiss Crypto Ratings

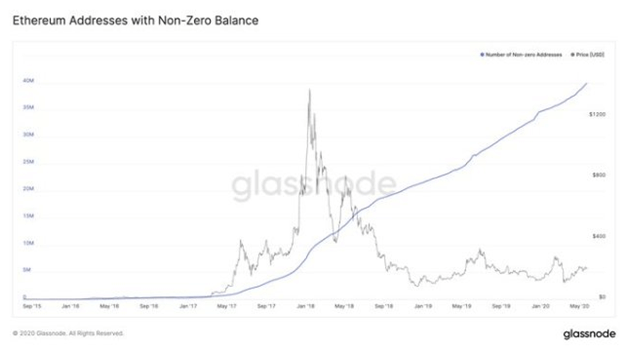

The number of Ethereum wallets holding Ether has spiked over the past two years to hit 40 million, according to crypto data provider Glassnode.

According to the data collected by the company, the number of Ethereum addresses being used has increased by more than 350% and now numbers more than 40 million.

Ethereum’s price boom accelerated uptake

The surge in the number of addresses holding the cryptocurrency, the second largest in the crypto space by market cap, has come despite a clear decline in its price.

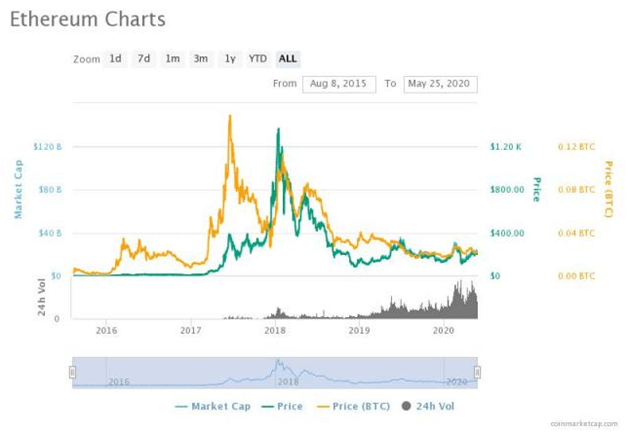

Like Bitcoin’s price rally in 2017, the price of Ethereum also experienced a boom that rode on the momentum it gained through its initial coin offering (ICOs) to hit prices over $1,400. That all-time high was reached in January 2018, before the bearish run that saw cryptocurrencies lose almost 90% of their value in 2018 and early 2019.

Ethereum’s latest struggles are at prices below $210, with the crypto’s value falling over 3% on the day and more than 7% in the past week.

Ethereum traded at lows of $130 on January 1, 2020, and is thus up by almost 50% this time last year. However, compared to its all-time high price in January 2018, Ethereum is more than 85% off that value.

A tanking in price has evidently not hampered nor affected increased interest in Ethereum. As per the address growth data, the number of holders has now reached an all-time high, with those holding balances above zero at more than 40 million.

Weiss Crypto Ratings says that Ethereum has more “addresses with a positive balance in them than Bitcoin.” The platform notes that although Bitcoin’s daily active wallet addresses outnumber XRP by 140 to 1, Ethereum boasts “better user numbers [than Bitcoin] on several key metrics.”

Overall, the rating platform notes that Ripple’s cryptocurrency has continued to fall behind both Bitcoin and Ethereum.

A recent report by Coinbase showed that while most investors buy Bitcoin as their first crypto, a majority go on to purchase altcoins. Most investors use Bitcoin as a gateway to altcoins, including Ethereum in many cases, according to the report.

The interest in Ethereum has also been noted in the number of institutional investors betting on the cryptocurrency. As well as a record number of Ethereum longs seen since February, a major boost was revealed by Grayscale Investments.

According to data, the digital asset management company has bought shares for institutional investors equivalent to almost 50% of all the Ethereum mined 2020. Ethereum miners generated 1,563,245.875 new coins by April 24. Greyscale bought 756,239.777 of these for its investors, at 0.09427052 Ether per share.

Ethereum is moving towards the implementation of its Ethereum 2.0 blockchain version, which will see it shift from proof-of-work to proof-of-stake. It is one of the reasons optimism for the cryptocurrency is so high, despite falling prices.