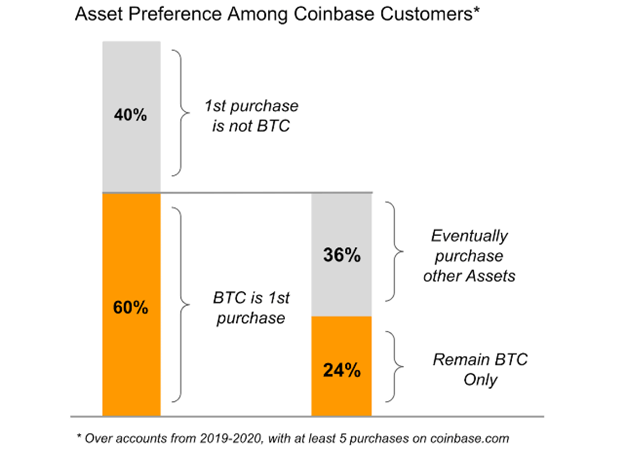

Investors who purchase their first digital asset on Coinbase buy Bitcoin, but a majority then move on to purchase other cryptocurrencies, a report by the US-based crypto exchange shows

Bitcoin provides a gateway to the altcoin market for a majority of investors who buy Bitcoin as their first digital asset, Coinbase has revealed in a new research report.

According to the report, about 60% of people buy Bitcoin as their first cryptocurrency. However, only 24% of these maintain their holdings entirely in the leading cryptocurrency. Most choose to venture into the altcoin market for other investment options.

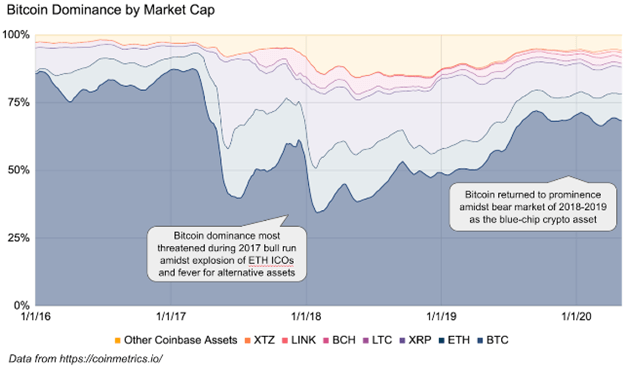

The report showed that most investors look to benefit from major price upswings, especially when altcoins have hit a bull run alongside Bitcoin. For instance, during the 2017 bull market, investors rushed to other leading crypto, with the ICO boom driving more volume to Ethereum.

The bull market saw most investors on Coinbase buy and trade Ethereum and Litecoin, with trading volumes reaching 70% to push Bitcoin’s dominance index on Coinbase below 30%.

The report also reveals that altcoins also spiked in December 2019 through to the early months of 2020, driving investors to Ethereum, Tezos, BAT, and Stellar.

Justin Mart notes that the behaviour (investors first buying Bitcoin and then venturing off to altcoins) could be due to a variety of reasons. It includes Coinbase’s increased listing of new currencies. However, he notes that the underlying reason could be a psychological:

“As people feel good about their initial crypto investments (into Bitcoin), they branch out to find other possible categorical winners…”

According to the blog report, Bitcoin’s dominance on Coinbase has consistently swung above 50% since dropping below 30% during the 2017 bull market. However, retail volumes show the penchant for alternative assets remains strong.

“Bitcoin is king, and likely to remain king for a long time. But it is also paving the way for a thousand flowers to bloom,” Mart adds.

The report appears to corroborate earlier takes on the topic, with other analysts suggesting that Bitcoin is being used like a ‘gateway drug’ that investors use to get into alternative digital currencies.