Bulls are fighting to keep the bears at bay as they target consolidation above gains made on Monday

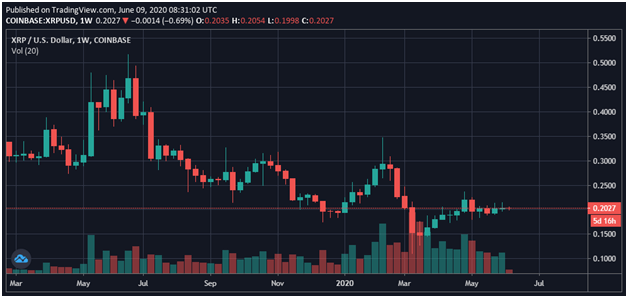

XRP/USD remains lethargic despite attempts by the bulls to maintain some momentum in Tuesday’s early morning trades. After opening the last session at $0.203, buyers rallied to an intraday high of $0.2043. Trading in the Asian markets however threatened to allow bears back into the picture.

A close at $0.204 looked great for XRP before bears pushed the price down by a percentage point to around $0.2029. That slight setback means that the pair is perched on a key inflection point near its SMA 50 curve. On an upside traders will watch the MACD, which at press time is painting bullishness.

At the moment, Ripple (XRP) is in a consolidation phase above $0.2000, the main support area that buyers have defended for a while now. Looking at the 4-hour charts, XRP price against the US dollar is likely to rally to $0.2100 if bulls retain control above the 100 SMA.

A flip to clear bullish momentum is unlikely if these levels are not cleared and if the XRP market faces strong resistance at $0.244 and $0.283.

A bearish flip makes support at the SMA 50 and SMA 20 more critical given they bring into view $0.192 and $0.181.

800 million XRP moved

In the past few hours, @Whale_Alert has observed that transactions involving 800 million XRP have been “transferred from the Ripple OTC Distribution to unknown wallet.” according to the analytics service, the large transactions were in four batches of 200 million XRP with each worth about $40.5 million to total around $162 million.

With price action likely to print higher, the Ripple community has been quick to speculate that it could be an institutional investor readying themselves for an XRP sell-off. Or it could be Ripple moving the funds into another escrow account.

The large transaction comes even as Ripple revealed it continues to work with major global banks and payment firms through its On-Demand Liquidity (ODL) offering.

Speaking in a recent discussion of the platform, Asheesh Birla, SVP of Product at Ripple, noted that the company has worked on pilot projects for XRP with the Saudi Arabia Monetary Authority (SAMA), as well as the Bank of England. He added that the firm started these pilots five years ago.

Meanwhile, XRP adoption could get a boost given the move by Swiss bank Maerki Baumann & Co AG to add the Ripple token to its portfolio. It makes buying XRP easy for investors in Switzerland. Other digital assets added include Bitcoin, Ethereum and Bitcoin Cash.