We might be seeing a shift in the market dynamics within the crypto world, as Ethereum and Ripple start diverging from Bitcoin’s price movements. XRP is now sitting above the $0.30 mark, and ETH is above $200, both of which are price markers that haven’t been present for a while.

Calls for a new “alt season” have been echoing around the crypto space for a while now, so this isn’t the first time traders have gotten excited. However, the hopes behind this type of a shift in the markets have been around for a while, so there’s no saying this is the time it catches on.

Another Perspective

One counterargument or differing perspective on this divergence is that it isn’t as cut and dry as altcoins doing better than Bitcoin. In fact, it could be that more money is going into Bitcoin, but that money was being moved into altcoins at the same time. Bitcoin still serves as a fiat gateway, so its price naturally trades based on a more complex interaction of factors than pure interest in the coin.

From this perspective, the low volatility Bitcoin is showing right now is the perfect indication that it is about to make a large price move. The general rule is that low volatility is a sign of a buildup that could either lead to immense downside or upside. In this case, technical traders are reading a bullish crossover based on stochastic indicators.

Some fundamental support for this prediction comes from the belief that Bitcoin is going to experience a significant uptick now that the Federal Reserve is gearing up for more quantitative easing. Being referred to as “QE4eva”, more quantitative easing would naturally lead to a devaluation of USD.

Arthur Hayes, the CEO of derivatives giant BitMEX, sees this bringing a price uptick to $20k at the very least. And if the European Central Bank continues down this path, then this price won’t be just the beginning in the next quarter.

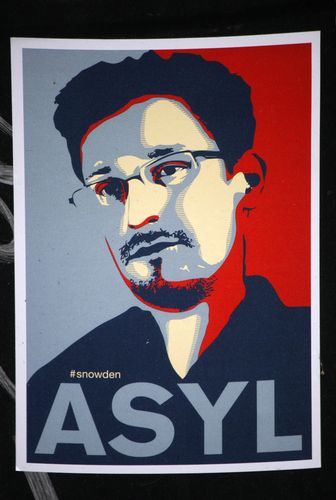

Snowden’s Comments a Relief

On a deeper level, Edward Snowden published some comments about how he would prefer to hold the earnings from his new book in Bitcoin. Now that the United States government is suing him for the contents of his new book, he would like to make sure his funds are safe from confiscation.

This is a key difference between Zcash and Bitcoin. Previously, Snowden expressed support for Zcash, due to the anonymous nature of the coin. But for him, the worry isn’t anonymity, but the strength of the network.

Bitcoin has scaled to the point where no government or corporation can compromise it. Because of that, he can hold his funds in plain sight without worry of the USA taking that money. The public ledger isn’t ideal, but the network is much stronger than a smaller player like Zcash.

The comments of traders and crypto-professionals are important, but what really matters for the future prices of altcoins and Bitcoin alike is the worldwide sentiment towards Bitcoin. With the comments above, many people are going to have a chance to read about and change their perception of the coin’s utility.