Tezos and Cardano have been some of the top-performing altcoins in May/June and have battled for the top 10 spot on CoinMarketCap

Bitcoin’s break below $9,000 comes at a time when cryptocurrencies have struggled to sustain recent gains. This week begins with all the major digital assets trading in the red following dips over the weekend that saw the crypto market suffer mirror losses.

In the short-term, it’s a fight between the bulls and bears, with any let-up by the latter likely to offer initiative to the sellers. Here is a look at some of the top altcoins to keep on eye on this week.

Tezos

Tezos dove below its ascending channel heading into the weekend, with bears taking charge to push prices further south.

Bears hold the advantage as the coin is trading below the 50-day SMA with a bearish crossover imminent. A breakdown below $2.52 could affirm a short term flip that brings prices back to $2.24. The bears have already repelled moves at the 10-EMA, and shorts are likely to be more aggressive at prices between $2.58 and $2.52.

For the bulls, defending the aforementioned levels means the potential for an upside remains, with consolidation potentially preceding a breakout to $2.70.

Cardano

Cardano is trading near the 38.2% Fibonacci retracement level at $0.075 after a 7% pullback that has taken its price to lows of $0.0715. An uptrend is likely given the decline has cut the overbought levels and its 50-day simple moving average is pointing lower.

Ranked 10th-ranked among the largest cryptocurrencies, Cardano has been one of the standout performers as its holders anticipate the launch of its Shelley mainnet.

As of press time, the token is trading at $0.0717 and a rebound to previous support zone at $0.072 remains achievable. However, if bears hold their ground, a drop to $0.0659658 is possible.

Litecoin

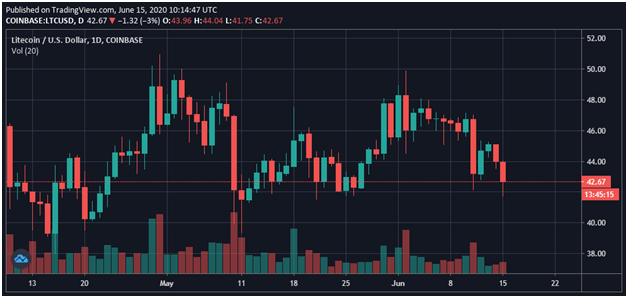

Litecoin dipped towards the end of last week to see its price break below its moving averages. However, bulls have prevented a plunge past major support areas at around $41.72 as buyers bought the dip.

As of press time, the LTC/USD pair is exchanging hands above $42.70. Upside momentum is nonetheless capped by the general flip in sentiment in the broader market. Prices can only benefit from a breakout above the moving averages.

If it corrects higher, the pair could move closer to $51, with extended gains signalling the return to a bullish outlook for a retest of prices above $63. With the RSI below 50, LTC/USD is set to trade within a range if bears keep the buyers off.

But if the price of Litecoin dips below major support at $39, then the bears will seize the initiative and try to push for lower lows.