Bitcoin (BTC)

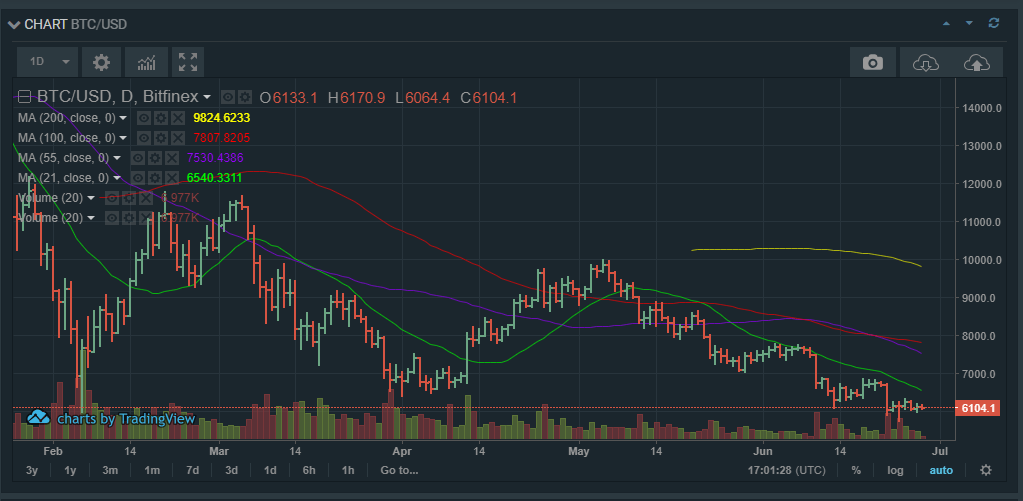

Bitcoin’s weekly momentum is still bearish. Volumes are still low, and bitcoin is trading south of last week’s close. In the near term, Bitcoin could be headed lower and is likely to test $4600 along the 100-day moving average.

The day charts point to low volumes at the moment, and this will be a major hindrance to bitcoin’s upside potential in the short-term. This is down to the fact that in last 4 days, bitcoin has been trading in a tight range of between $6200 and $5900.

This range is on the lower side of the major bearish candle of the 22nd of June.

This range is on the lower side of the major bearish candle of the 22nd of June.

This range is most likely a consolidation phase before the price drops further. A drop below $5900, in the next 12 hours and it could be headed lower and test $5700.

However, one needs to look at the 12-hour chart to determine how bitcoin has been performing intra-day.

In the period, volumes seem to have dried up, with the price stagnant between $6100 and $6080. That’s an indicator that a downside break is highly likely in the next 12 hours. Nonetheless, a sudden increase in volumes could see the market turn bullish, though this is highly unlikely.

Ethereum (ETH)

Like bitcoin, all indications are that Ethereum (ETH)’s long-term value is headed lower. In the weekly charts, it has broken below last week’s low close, a pointer that there is very little buying momentum in the market.

In the day charts, Ethereum (ETH) has been breaking lower for the last 4 days.

That’s an indicator that bears have the market even though volumes are low at the moment.

Going by this trend, Ethereum (ETH) is likely to test new lows as it trends towards the long-term support level at $375. For a more refined entry, it is best to check out the 12-hour charts. On this chart, Ethereum is trading lower and has broken below yesterday’s low of $440.

A short entry at these price levels would be ideal, with $420 as the first exit point to the downside.

However, if there is an upsurge in volumes in this period, Ethereum could easily break to the upside and most likely test $461.

However, this looks highly unlikely given that volumes in the overall crypto market are quite low at the moment.

Vechain (VEN)

Vechain is one of the most powerful projects in the crypto market, and looks set to transform the global supply chain. However, its price has been heavily affected by the crypto market’s recent downturn.

In the weekly chart’s Vechain (VEN) is very bearish, and might hit a low of $2 in the near-term. In the day, it has been trading in a range between $2.6 and $2.4.

In the weekly chart’s Vechain (VEN) is very bearish, and might hit a low of $2 in the near-term. In the day, it has been trading in a range between $2.6 and $2.4.

That’s an indicator that it is heavily tied to bitcoin, and bitcoin’s low volumes are affecting Vechain volumes too. Therefore, a short entry at current price levels offers a good entry with $2.2 as the target.

Disclaimer: This content is for information purposes only and is not intended as financial advice or any other advice. It is not an offer or solicitation to buy or sell nor is it meant as an endorsement or recommendation for any security. The information is general in nature and does not take into account your individual financial position. You should seek advice from a registered professional investment adviser and undertake due diligence before making investment decisions.