The 2nd most important cryptocurrency on the market by market capitalization is very close to what some consider to be the great leap in its technology. The decentralized development arena has advanced noticeably since the Ethereum blockchain launched in 2015, opening the door for dozens of competitors who have proposed different implementations to build dApps. This article addresses tips and ideas for getting ready for the release of Ethereum 2.0, a new version of ether that could silence criticism of scalability on this cryptocurrency.

Ethereum 2.0 release: What are the estimated dates?

Although it is one of the most eagerly anticipated events in the cryptocurrency industry in recent months, the release of Ethereum 2.0 has been delayed on several occasions, but could finally arrive in the coming weeks. The development team has not given a specific date for the launch of this upgrade to the Ethereum network, however we list the most recent clues about its launch:

- In May, the headline dichotomy created confusion over the release of Ethereum 2.0. Ethereum co-founder Vitalik Buterin said July was still the month on the roadmap for the upgrade. However, after the coordinator for the testing network – Afri Schoedon – denied the information, Buterin confirmed that it was a confusion.

- According to multiple sources, information on social media and the open source repositories themselves, “bug hunting” in the code has slowed the release.

- Although it is unclear whether the team will achieve deployment in July, testing finally began on June 10th. Blockchain firm Prysmatic Labs announced the launch of a test network for the ether 2.0 blockchain.

Ethereum 2.0 Staking: The changes that the new version of ether will bring

The years after Ethereum launched brought multiple competitors to the table trying to get around the ecosystem’s main hurdle: scalability. Despite the power and capacity of Ethereum’s network to process transactions, requests, and other rules of its smart contracts, its initial design did not foresee such an exponential rapid growth, which today leaves limiting traces on its network.

ETH is not only cryptocurrency per se, but it houses a large percentage of the tokens that make up the crypto sphere. According to Etherscan, there are more than 1,000 different tokens under the ERC20 protocol and more than 5,000 using the ERC721 protocol. This has forced the development team to implement more powerful solutions that allow taking network processing capacity to the next level.

One of the innovations that it will bring will be the fragmentation of data on the blockchain, a technique known as sharding, which is already implemented by other cryptocurrencies such as Zilliqa. In simple words, sharding breaks the entire network into smaller “shards” (shard chains) that operate in parallel and synchronously. Thus, the network becomes more efficient as it grows.

This adds a large layer of complexity that has slowed down faster deployment on the network, as a very robust protocol design is needed for securing the network and transaction validation.

But the cornerstone of Ethereum 2.0 will be absolute staking. The network will gradually migrate any Proof of Work (PoW) mechanism and become an ecosystem based solely on Proof of Stake network (PoS). Currently, the network is based on a combination of both. Some experts believe that this will be beneficial for the future of ETH.

Predictions and opinions on the release of ETH 2.0

- In the same line of staking in Ethereum 2.0, the investor Osho Jha expressed his enthusiasm about the implementation of this model on the network. In an analysis published by CoinDesk, Jha analyses how the implementation of collective participation will be the trick for ETH to be a reserve of functional value. “Staking incentivizes holding ETH in a node that can then be used by the network to verify transactions.”

- Other analysts are of the opinion that some psychological aspects of the market – such as the “fear of missing out” (FOMO) – and the possible support of platforms such as Coinbase to earn passive income by staking ETH could sustain a rally in the price of Ethereum.

- However, other experts consider that the staking competitor will be another decentralized technology; DeFI. Lending protocols under decentralized finance technology would be Ethereum 2.0’s new competitors.

Brief technical analysis of ETHUSD

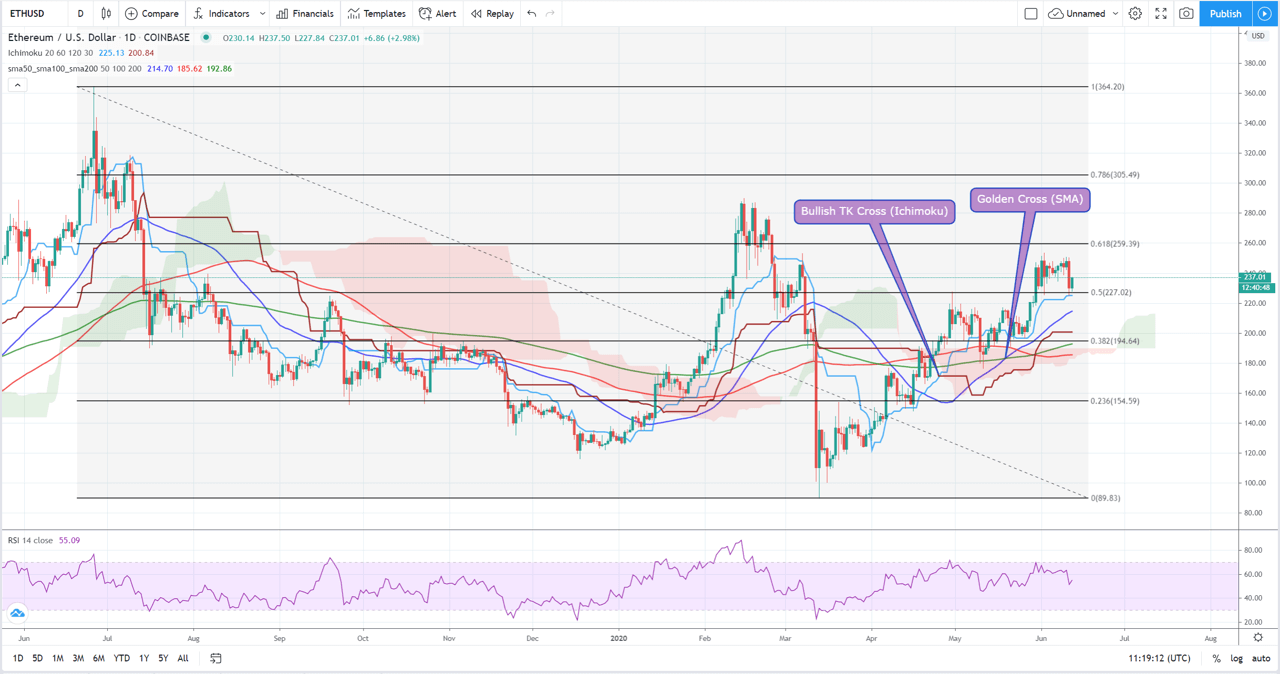

Although many experts point out that it is an ideal time to buy Ethereum before the launch of the upgrade, it is always important to see what the different technical scenarios pose. When taking a look at the graph, several interesting indicators are observed:

- A clear golden crossover is observed in the moving averages (SMA50 – SMA200) in mid-May. This indicator has managed to consolidate for 3 weeks and could point to a positive price bias in the medium term.

- Another bullish crossover is evidenced by the upside break of the conversion curve (Tenkan-Sen) from the base curve (Kijun-Sen) in the Ichimoku cloud. However, when happening below the Kumo cloud, the bullish indicator is less strong.

- Relative to interest levels, ETH is currently supporting around $225, a level clearly marked by Fibonacci retracements. The next support would be located near the psychological line of $200, with a target range between $190 – $200.

- On the bullish path, ether could test resistance around $260, before traveling to the next levels around $285, $305, and a very volatile range between $330 and $360.

- The daily RSI shows a healthy condition without falling in the vicinity of overbought or oversold.