Less than 6 years ago, Vitalik Buterin started the development of Ethereum, as an open-souce and decentralized platform that allows for the creation of intelligent smart contract agreements between peers, with blockchain technology as a backbone. Today Ether – the cryptocurrency that supports this ecosystem – continues to position itself as the 2nd most prolific cryptocurrency by market capitalization. However, ETH has experienced a sharp drop from which it has not been able to recover since the bearish break of 2018. Thus, launching Ethereum’s predictions for 2020 is not an easy task, considering also the highly volatile environment of the crypto markets. However, in this article we address the issue through various technical and fundamental analyses and expert opinions. Find out where Ethereum can be headed in 2020.

The Future of Ethereum: 2020 Could be a Key Year

Ethereum’s reign in the arena of decentralized development has been indisputable, and the same corollary is valid for its 2nd place in the ranking of cryptocurrencies by market capitalization, a position which ETH has been maintained for several years, except for a brief period when Ripple dethroned it. However, in spite of all the success of Ethereum, the platform is also facing tough competition in the field, with the emergence of several similar platforms that allow for the hosting and development of decentralized applications (dApps), and also improve on the scalability problem that Ether has struggled with since its inception.

However, the future is far from bleak for the crypto giant. In 2020, Ethereum could undergo several significant changes at the code level. The appearance of the new version Ethereum 2.0 (Serenity) could soon be a reality and even the last Istanbul upgrade could open the door for the implementation of a fragmentation solution in the blockchain (known as ‘sharding’). This could raise the network level, increasing its capacity to 3000 transactions per second. Thus, we suggest that readers keep an eye on our news section for updates on the Ethereum network during this year, as this will be a key factor for determining its future price.

Key Reasons for Ethereum’s Growth in 2020

Here are some of the arguments that could support a recovery of Ether in the year 2020. Remember that other external factors such as macroeconomic data and regulations could change Ethereum’s outlook and predictions, so we suggest keeping up to date with the cryptocurrency news and following the basic indicators in the technical analysis.

- Ethereum co-founder Vitalik Buterin said at the Consensus event: “Ethereum 1.0 is a disorganized attempt by a couple of people to build the world’s computer. Ethereum 2.0 (with the PoS participation test) will really be the world’s computer”.

- According to the research site on the development of the platform, ethhub.io, the first stage for the deployment of sharding on the network will occur in 2020.

- BTC‘s halving will occur next year. Historically, the period has been surrounded by positive movements in Bitcoin, which are generally replicated in the main altcoins.

- In the long-term charts, Ethereum started to show some signs of overselling towards the end of 2019.

Technical Analysis of Ethereum and Possible Scenarios for 2020

First of all, it is crucial to mention that the analyses shown below were conducted as of December 27, 2019. Although they may show some perspectives and levels of interest, it is not possible to predict exactly what the behaviour or trend of Ethereum will be in 2020. However, some indicators can help us see the picture more clearly. Historical data contributes to a more complete analysis with target prices and helps determine significant S/R levels.

We provide a price comparison of Ethereum against the US dollar (ETH/USD), and also, a second analysis for ETH vs. BTC, as this pair could also provide lucrative investment opportunities.

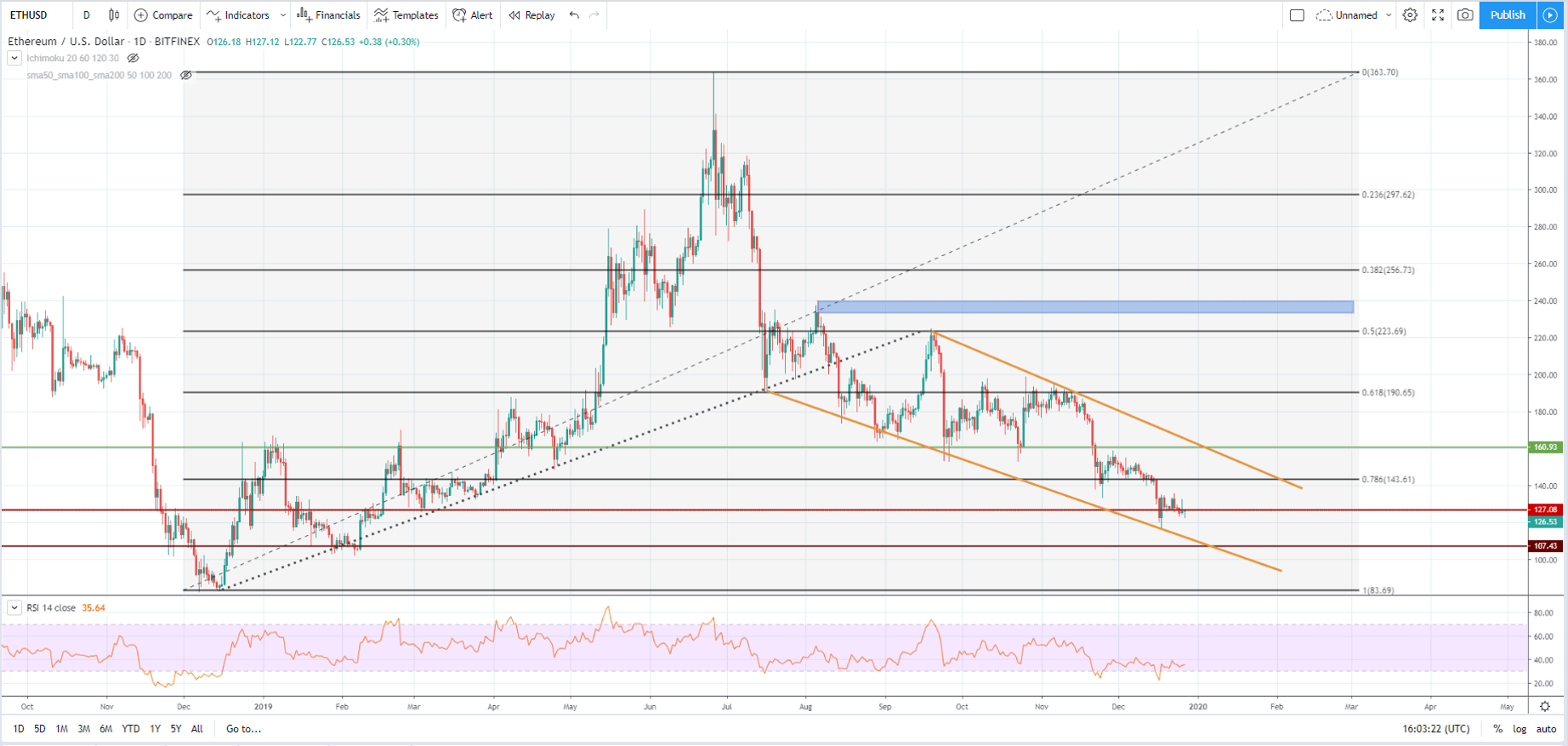

ETH/USD: Important Observations and Areas of Interest

The graph shows several interesting elements that should be followed carefully:

- As a premise, the analysis has been done with relatively large intervals (1 day) to evaluate medium-term scenarios.

- The bullish side took an upward hit when buying Ethereum in early 2019, a situation that is clearly reflected in the graph above. The behaviour was maintained during the first half of the year, until the bullish guideline (grey dotted line) is broken in the month of August.

- The Fibonacci retracements clearly show some of the medium-term interest levels. However, we have marked other significant resistance and intermediate supports.

- The level around USD 143 stands out as one of the most important levels along with USD 160, which have been marked with lines on the chart. This could act as support/resistance as appropriate.

- The USD 190 level has served as a key resistance level over the last year and could be one of the most important references when looking for a bullish breakout.

- From there on, ETH could test various resistance levels. The FIB levels could work as a reference. The target would be between 330-360 USD, where it marked highs in 2019. If these levels are exceeded, ETH could look for a more bullish outlook.

- If the bulls do not act, then ETH could fall around USD 105 and then test the 2019 lows, near USD 83. This hypothetical scenario could put you in oversold territory.

- At the time of writing, the relative strength index is recovering from the oversold level. Beacons would be exhausted, but several elements of confirmation will be needed before the current trend can be reversed. A breakout of the yellow channel would be one of the first elements to be considered.

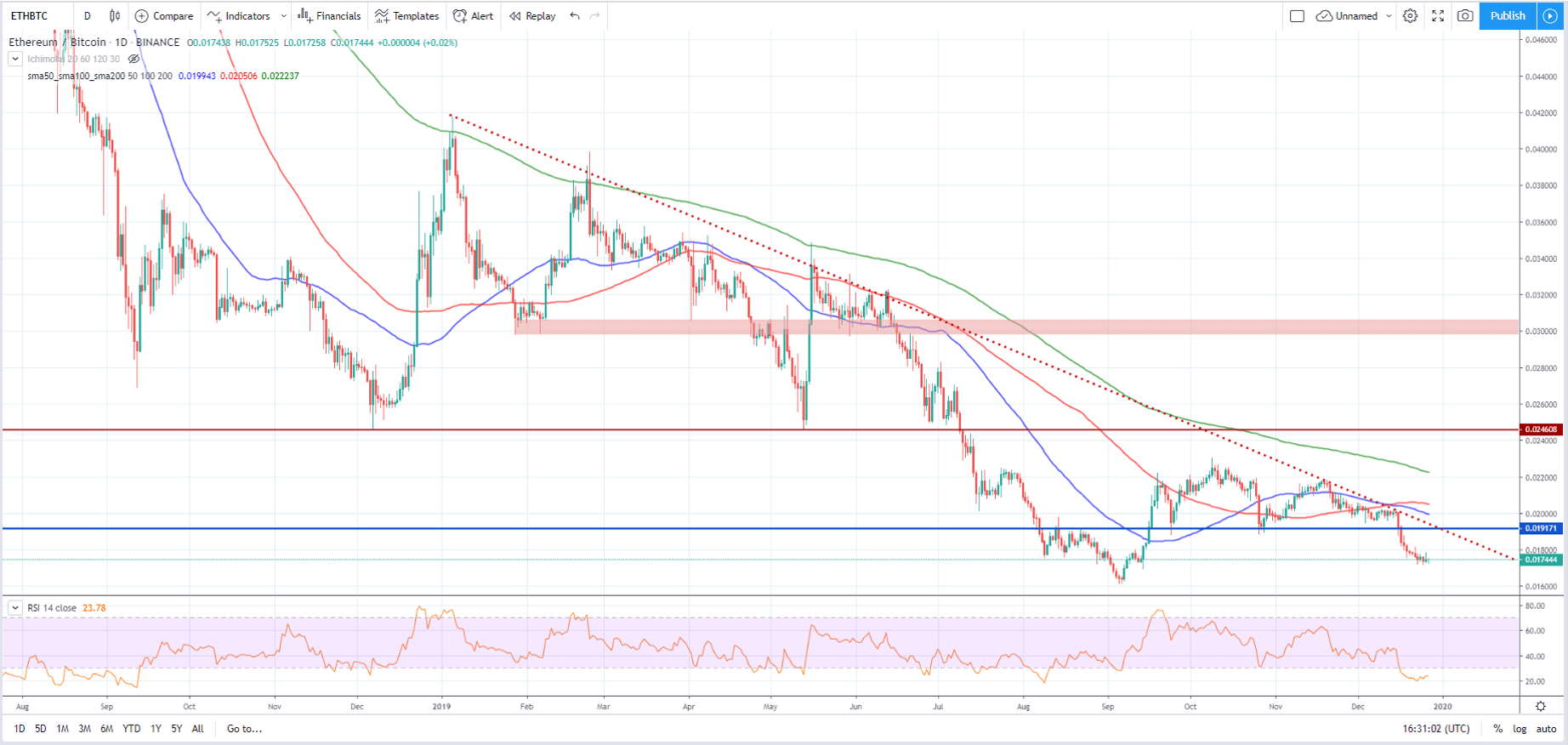

ETH/BTC: Important Observations and Areas of Interest

Another pair with several opportunities is ETH vs. BTC; however, it is even more volatile and difficult to trade, so proper risk management is advised.

- These intervals are also 1 day. It is clear that we are approaching the lows since September of this year, when the ETH/BTC pair hit bottom. There could be a rebound from this level if the bulls do not inject buy level soon and if the BTC continues to gain dominance.

- The decline has been continuous throughout 2019, which is clear from the downward direction of the highs (red dotted line). For an upward breakout, this would be one of the first indicators to follow.

- This continuous decline has driven the ETH/BTC pair to oversold levels on the Relative Strength Index (RSI). These are, in fact, the oversold lows since September 2018.

- In addition to the lows on the downward path, the 50, 100- and 200-day moving averages have served as resistance levels over the past year. Thus, they are also functional for assessing upward breaks.

- A key S/R level is around 0.0246 BTC.

Other Technical Considerations and Projections for Ethereum

- ETH lows in the last year: The cryptocurrency fell to about $82 last December. Its lows with respect to Bitcoin were recorded in September 2019, when the Ether fell to 0.016 BTC.

- Historic highs for Ethereum: ETH marked an impressive upward rally in 2017, reaching highs above $1,420. Its highs vs. Bitcoin were at the beginning of last year, where the ETH/BTC tripled the lows mentioned in the previous paragraph.

According to both analyses, it is possible to see that Ethereum is approaching areas crucial to its future. If the bulls want to take control, they will have to do it with strength soon to change the bearish perspectives that are still marked in the main studies.

Ethereum Predictions for 2020: Expert and Amateur Opinions

In this section we present some expert and enthusiastic opinions on predictions of Ethereum for 2020, some very different and all, highly speculative. These Ethereum price forecasts sometimes cause euphoria, but it is important to maintain realistic expectations and monitor market trends. The cryptocurrency market is inexorably volatile, and prices move often and dramatically. Readers should carefully consider this information and weigh it against their own analysis.

A CoinComments publication predicts that the price of Ether in 2020 could recover to $200 – $300 USD.

Longforecast.com is a website that specializes in providing long term financial forecasts using technical analysis. According to this website, Ethereum’s price forecast for 2020 is in the range of $77 to $124. Thus, this website puts the balance on the downward side of the equation.

Meanwhile, the CoinSwitch portal projects a maximum of $2100 for 2020. But not everyone has such a bullish outlook. The automated projection site WalletInvestor indicates that ETH could fall to $159.07 in 2020. However, none of the above-mentioned media is highly reliable or registered as a financial institution.

One of the few serious studies we have seen recently was conducted by SatisGroup. According to the analysis, the estimate is bullish for ETH by August 2021. These experts expect the price of Ether to reach $788 USD. In the very long term, stability is expected around $500 USD.

What do these Predictions about the Future of the Ethereum Conclude?

Despite the correction season, Ethereum remains one of the strongest projects in the crypto sphere, especially in the field of decentralized development. Thus, bullish players are taking control of ETH’s price rise quickly when the rest of the market gains confidence. The next updates in the Ethereum network could improve the fundamental perspectives of the project, which would also be reflected in its price. However, these markets are always facing handicaps and junctures that are impossible to predict, so it is crucial to keep abreast of all developments and monitor the price technically.