NEO price had declined to lows of $71 after heavy selling hit the broader crypto market

The price of NEO is looking to climb above $90 as bulls recovered from last week’s 33% drop that followed a widespread pullback in the crypto market. Having traded as high as $134 on 19 April, NEO’s price plummeted to lows of $72 as altcoins crashed in a bloodbath triggered by Bitcoin’s plunge below $50k.

The overall market is trading green at the time of writing, which has seen the digital asset’s 10% gains in the past 24 hours push its price to intraday highs of $90. The potential for an uptrend towards $100 and higher is there, especially if the broader crypto market continues on an upward trajectory.

According to popular technical analyst, Michael van de Poppe, the crypto market is likely to see some euphoric buying after today’s bounce. Per the analyst, the rebound BTC and major altcoins like Ethereum and XRP have dashed expectations of a further decline.

If the positive sentiment holds, the general market could register some significant gains, with NEO/USD likely to be among the major gainers of the week.

During the weekend; the mass was in panic.

During today and after the bounce; euphoria is back.People want to buy back in, while yesterday's expectations were that markets would go lower.

People sold the low, to hopefully buy back lower. Now they have FOMO.

Welcome to crypto

— Michaël van de Poppe (@CryptoMichNL) April 26, 2021

NEO price outlook

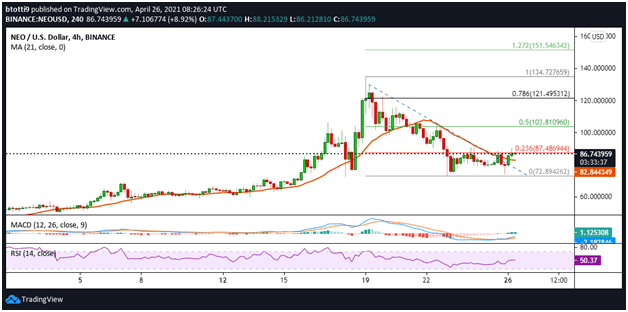

NEO/USD has moved above the 50 SMA on the 4-hour chart after breaking above a key bearish trend line formed since 19 April.

Although prices remain range-bound below $88, bulls are likely to break the immediate resistance and seek fresh gains towards $100. As of writing, there is an intraday high formed at $90, which increases the possibility of an upswing over the short term.

The chart also shows technical indicators are flipping north. The MACD features a bullish crossover and is increasing, while the RSI is above the equilibrium mark to give bulls a slight advantage.

If NEO’s price breaks above immediate resistance at the 0.236 Fib level ($87.48), upside momentum might push it above $90.

A clear move north of this level could see buyers target the next major barrier at the 0.5 Fib level ($103). In the short term, other key price targets lie at $112 and the 0.786 Fib level ($121) and $150.

On the flip side, a dip across the market could influence NEO’s short-term outlook. In this case, the main support levels are at the 50 SMA near $82.84, and the horizontal line at $72.89.