Ripple’s battle with the SEC could prove to be pivotal for June’s price action

Ripple (XRP) has proven to be one of the most profitable crypto assets for traders in 2021. Its price stood in the vicinity of $0.22 at the start of this year, and managed to climb up to a 90-day high of $1.96 on April 14.

After a tough May that wiped out a good chunk of these gains, June provides an opportunity for XRP to dig in its heels and kick-start a resumption of the bull run. Will today’s price of around $0.85 look like a bargain in a few weeks’ time?

Ripple Price Analysis

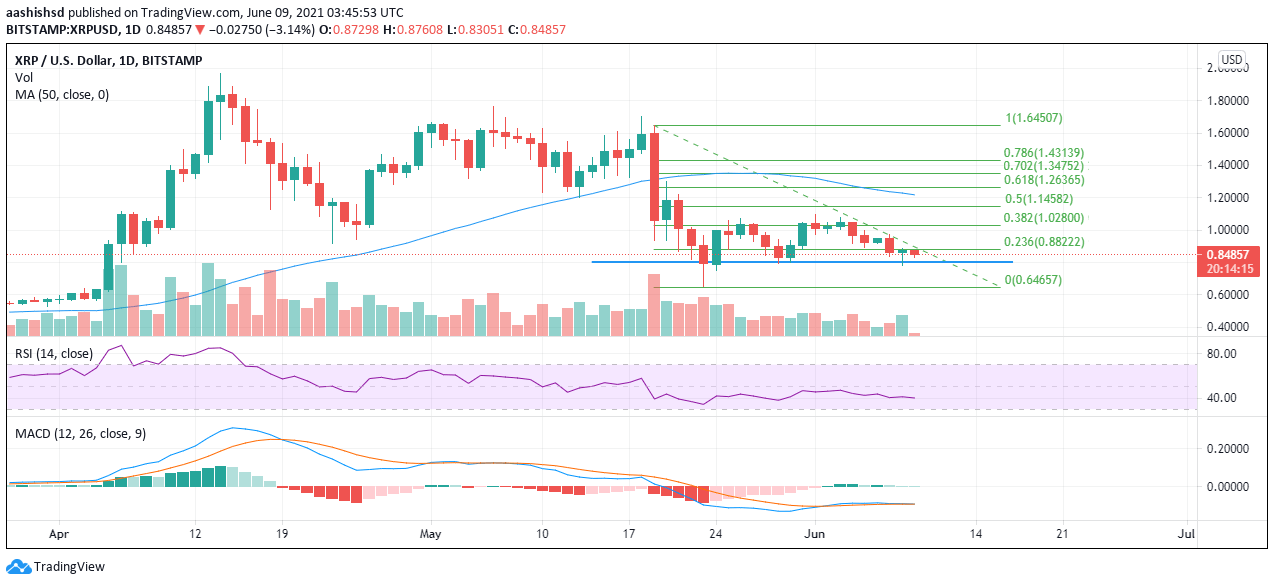

Ripple’s price was hovering at the $0.85 mark at the time of writing this piece, shadowing FIB 0.236 level at $0.88. After breaking out of its unimpressive run over the past couple of years, XRP touched the $1.96 point on April 14. It has been mired in a long-term regulatory controversy and legal concerns, but nevertheless was able to muster a solid bullish move alongside other cryptocurrencies, starting early February, achieving notable success by April’s end.

XRP/USD Daily Chart. Source: TradingView

XRP’s price came tumbling down from its May 18 high of $1.70 to a low of $0.93 the next day, owing to the crypto crackdown in China. The downside momentum pushed XRP to a 30-day low of $0.64 which was last seen on April 5, just before it broke into a bullish run.

XRP has struggled alongside most other cryptocurrencies over the past 3 weeks, traversing the $0.88 support level, close to values that haven’t been traded since the first week of April. It began the month of June near the resistance level at $1.02 (FIB 0.382). The bulls looked good for a breakout, seeking a fresh upside, and wanting to test the resistance at $1.26 (FIB 0.618).

Resultantly, XRP touched a high of $1.08 on June 3, but this was just before Elon Musk’s late-night tweet the same day, regarding his fallout with Bitcoin, which pulled back many cryptocurrencies including Ripple. On the whole, it has been in a bull-bear battle since the May crash, moving back and forth between the $1 and $0.80 price points.

Where to buy Ripple (XRP) today

Ripple Price Factors for June

There are several fundamental factors that could influence the price of XRP this month. Let’s have a look at a few.

SEC Losing the Upper Hand

How Ripple’s ongoing legal battle against US Securities and Exchange Commission (SEC) unfolds could be key to XRP’s price. In December 2020, SEC had sued Ripple and two of its main executives for selling XRP tokens, which as per them were unregistered securities. The last we heard Ripple had accused the SEC of noncompliance by sharing communications related to Ether, Bitcoin and XRP. It had also started seeking pertinent documents from 15 different exchanges, in relation to this lawsuit.

If Ripple does come out on top in its battle against the SEC, we can expect a significant uptrend in the XRP/USD market, with the scope of discovering new highs. In fact, PrimeXBT has gone as far as claiming that XRP may climb up to $20 in that eventuality, correcting back to a $3-4 range within the next couple of years.

The Bigger Picture

Other than the above, Ripple recently announced that it will add NFT support on the XRP ledger, thereby minimising the gas fees associated with NFT transactions. Given the astonishing growth of the NFT space during the 2020/2021 bull market, there is a strong possibility that this development will also impact XRP’s price in the coming weeks.

Additionally, the US Consumer Price Index (CPI), Fed’s outlook towards the US economy, the unfolding of crypto regulatory restrictions in China and Elon Musk’s love-hate relationship with crypto, especially Bitcoin, are all going to potentially impact XRP’s price for the remaining part of June 2021. Keep your eyes not just on Ripple, but on the wider world too.

Ripple Price Forecast

Going by how the XRP/USD chart looks right now, the $0.80 and $1 junctures seem extremely important in determining where the price will be headed towards the end of June. Traders should be closely monitoring this price range, to see if either of the levels is breached.

At the time of writing, XRP/USD hadn’t yet entered its February/March 2021 price band, but had broken the $0.88 support (FIB 0.236), and was closing in on the new-found support at $0.80. Please note, if the downward trend continues, the lower support level of $0.64 may also come into play, and get tested for the first time since early April. That will certainly also test the bulls’ and holders’ sentiments, amidst fears of another leg down.

Combined with a poor technical perspective, such negative sentiment may lead to further selling pressure, possibly bringing the early April figures (near $0.57) within range. At the moment, XRP/USD is in a bearish trend and you won’t be faulted if you pursue the lower rungs of the current price range. That being said, it may be wise to sell during small reversals, in the knowledge that present resistance levels may likely prevail.

XRP/USD 4-Hour Chart. Source: TradingView

On the other hand, it is clearly evident that with the XRP/USD oscillating between $0.80 and $1 over the past couple of weeks, it has led to the creation of a symmetrical triangle, which may potentially cause a rebound upwards soon, leading to a bullish uptrend. The first resistance level to get tested would be the FIB 0.382 near $1.02, which if crossed may make traders comfortable with the idea of a bullish reversal. It may then potentially lead to a bull rally, challenging further resistance levels at $1.26 (FIB 0.618) and $1.43 (FIB 0.786).

As of now, with the RSI at 40, the MACD overlapping the signal line, and the past few weeks’ candles being well under the 50 SMA, there is a case to be made for both bullish and bearish action. Those who believe the crypto market will turn around this month can target the $1 region, whereas the pessimists among us may be looking to short XRP down to $0.80 or even lower.

A bullish scenario could certainly play out if Ripple’s SEC case continues to churn out favourable news, and this might sway investors to lean towards a long position and that elusive $1 target.

Please keep in mind, the details offered in this piece are entirely a personal opinion of the author, derived from the pertinent market data. These shouldn’t be perceived as direct investment advice.