The cryptocurrency market hasn’t had a good start to the week, with Bitcoin and other major cryptos losing more than 10% of their value in the past few days

The cryptocurrency market continued its poor start to the week with yet more losses recorded by the leading cryptos. Bitcoin dropped below the $43,000 mark and it is now trading above $42,000 per coin. The leading cryptocurrency has lost nearly 2% of its value over the past 24 hours.

Ether’s losses are twice that of BTC as it is down by 4% during that period. ETH has finally dropped below the $3,000 level and could drop lower soon. Binance Coin, Solana, XRP and Dogecoin are also trading in the red zone.

Tron has underperformed in recent days and could slip below the $0.090 level in the coming hours as the market continues to record losses. The short-term outlook for the cryptocurrency market remains bearish following recent losses. However, some market experts and analysts are still confident that there could be a bullish performance before the end of the year.

Tron price outlook

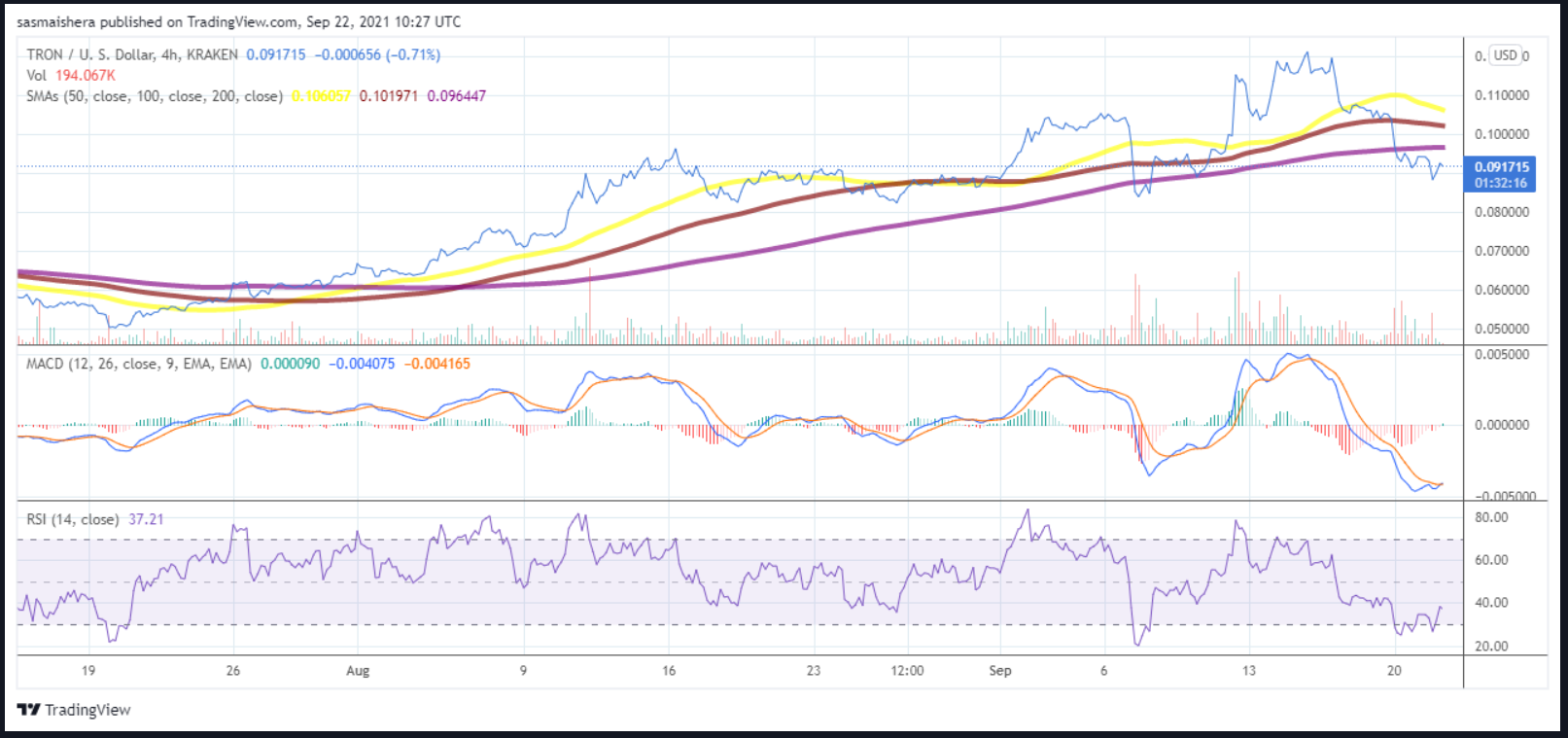

The TRX/USD 4-hour chart is currently bearish as the crypto market continues to lose more value. The MACD line is deep into the bearish territory following the coin’s recent losses. The RSI of 37 also means that TRX is currently oversold and could experience further losses in the coming hours.

TRX/USD 4-hour chart. Source: TradingView

If the current bearish conditions continue, then TRX could drop below the pivot level at $0.09015. This could lead to further losses, and the first major support level at $0.08446 will come into play. An extended bearish performance from the broader market could bring the second major support level at $0.08065 into play.

However, if TRX avoids dropping below the $0.09015 pivot, it has the chance of surpassing the first major resistance level at $0.09396. Support from the broader cryptocurrency market will be required if TRX wants to break past the $0.094 levels. Tuesday’s high of $0.09583 should cap the upside unless there is a massive rally in the market.