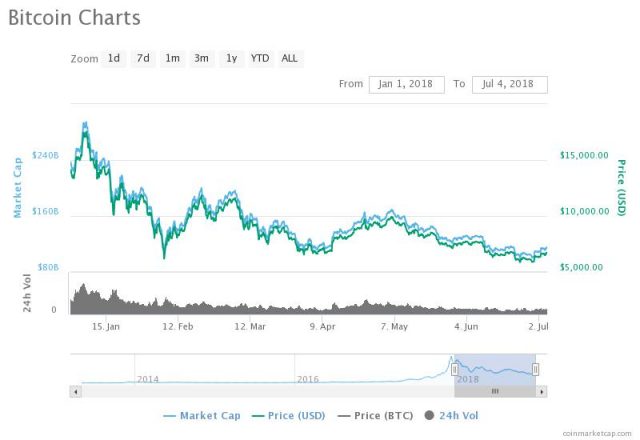

For much of this year, bitcoin and other cryptocurrency investors have been treated to a rollercoaster of sorts. Dreams have been fulfilled and shattered with the rise and fall in prices. From a peak of nearly $20,000 in mid-December 2017, Bitcoin is now hovering around $6500 and in need of a serious buying momentum to break through the upper support of $7600.

The rest of the crypto market which is heavily dependent on bitcoin’s price is stuck in the same hole. Overall, the market is just a third of its value in January this year. This from a very bullish 2017 which saw the leading virtual currency adding about 1000%. Others like Ripple gained an astronomical 39,000% in the same period.

So, how did we get here? Before we get far, bitcoin and other cryptocurrencies were never meant to be quick money minting schemes. At the most basic level, it was meant to fundamentally change the way we transact with each other and give you more control over your money. There is no doubt that much of the inefficiencies is down to bureaucratic red tape.

For the staunchest followers, bitcoin presents a possible escape from what they see as oppressive government control and a glimpse at a libertarian paradise.

This group often detests centralisation and artificial inflation of fiat.

Nevertheless, there is no denying that the growth of cryptocurrencies has largely been due to wild speculation and the promise of instant wealth.

Again, in the midst of all this, there is some genuine curiosity we might be onto something revolutionary. People are naturally curious about new technologies. We can also see some level of excitement around 2000 about the internet. Despite the initial scepticism, it has grown to fundamentally change the way we live.

It’s still early days and we are only getting to know the true potential of crypto and other blockchain technologies-like transferring value across the world in a few minutes without having to go through some central control.

Threat to authority?

Naturally, this threatens government’s need for control. As cryptocurrencies have flourished, so have government warnings against the sector grown louder. Initially, the approach was to wait and see and hopefully let the industry die a natural death. It did not happen.

From an initial view that cryptocurrencies were inconsequential, governments soon saw a threat. In places like China, cryptocurrencies were banned altogether in 2017. Despite initial shocks, it did little to dampen the march. By December, market capitalisation was edging towards $1 trillion and people were joining in by their thousands. In some places, there were more people with crypto wallets than with bank accounts.

Financial institutions were taking notice and wanted part of the action. From instant loans to fast transactions, what was taking shape could fundamentally shake their business.

Bitcoin Futures

Then the downswing started, deepening to new lows in February. Several things happened leading to and during the slump? Let’s look at a few.

One of them was the introduction of bitcoin futures contracts by the CBOE and CME. A report has argued that this brought in the more pessimistic traders who shorted the market. It is important to note that bitcoin’s growth in 2017 was largely driven by novice traders with lots of optimism.

Bitcoin futures helped introduce a different kind of investor, driving the market in the opposite direction.

Recent trends show that bitcoin falls in value a few days to the expiry of bitcoin futures.

Manipulation

Then there were reports of market manipulation. The most prominent one was levelled against Tether, the stable coin pegged on the US dollar. Tether (USDT) is issued by Tether, the parent company that also owns Bitfinex exchange.

The claim was that Tether had artificially been created without dollar reserves therefore artificially inflating the price of bitcoin. While the claim has not been proved, it nevertheless served to dampen the market. The company has always asserted the existence of dollar reserves. For others who were seeking answers, it was a way to explain the sliding fortunes.

Then there were allegations of internal trading around the time Bitcoin Cash was introduced centred around Coinbase.

Government Crackdown

Governments around the world came down rather heavily on the sector. The news was punctuated with bans on cryptocurrencies in one location or the other.

It started in China were authorities banned almost every crypto related activity. A government official even predicted bitcoin’s demise. “There’s only one thing you can do: Sit by the river bank and one day you’ll see bitcoin’s body float.”

Even search engines were all swept clean of cryptocurrencies.

Japan and South Korea, both global trading hubs dominated the news for their many measures to curb trading and wild speculation.

Agencies like the SEC also issued warnings and subpoenas against various operators in the space.

Banks also jumped in, refusing to deal with cryptocurrency related transactions. Some of the larger ones even banned their customers from using their credit cards to make purchases.

Prominent heads of financial institutions soon joined in to pour cold water on the industry. One of them was JP Morgan Chase’s Jamie Dimon who termed cryptocurrency trading as stupid. He was later to regret the comments. However, this and many others only served to create some fear from an industry fighting on several fronts.

Bodies like the IMF also issued warnings and called for more collaboration to fight vices like money laundering. Groupings like the G20 also discussed the issue.

The sum of all these was to create panic in the community.

Lack of regulation

The lack of regulation was also seen as a major impediment for the sector. As more money poured in, the need for a regulatory framework became apparent, or was it?

According to some, it was the only way to inspire confidence among investors. It would also be a prerequisite to taking the sector to the next level e.g. by bringing in institutional investors.

For others, this goes against the principles of decentralisation.

Cyber Thefts

High profile hackings such as the one involving Coincheck also happened in this period. This further emboldened authorities to want to take more control. Much of the crackdowns in Japan are done under this premise.

Bitcoin Whales

The 2014 heist at Mt Gox in which 750,000 bitcoins were lost still haunts the market. The lawyer who has custody over the remainder of the bitcoins in the now bankrupt exchange has once in a while been dumping large amounts in the market to compensate customers, stirring panic and further sell-offs in the process.

Crypto Ads Bans

There were, of course, the crypto ads ban by leading tech firms Facebook, Twitter, Google and Microsoft. Of course there were concerns about ICO scams and all. These bans did not, however, sound proportional.

As expected, the effect on the market was far reaching. Was it a ploy for the tech firms to introduce their own cryptocurrencies?

Self Correction?

Of course, there is a case to be made about the market self correcting. Perhaps, there was a sudden realisation about the true value of the sector.

However, by and large, these events have played a major part in the evolution of the industry thus far.

Despite these, there has been some positive news in the recent past. Japan and South Korea somehow recognise cryptocurrencies and the SEC has recently said bitcoin and ethereum are not securities. For now, the market remains green and set to go up.