5 Best Crypto Demo Accounts in 2024

If you’re new to trading crypto or just want to test out a new strategy, a crypto demo account is a great way to build confidence and experience—without risking any of your own money.

A number of brokers and crypto exchanges provide a demo version for virtual trading. To help you find the crypto demo account that best meets your needs, we’ve shortlisted the best options and reviewed each in depth below.

Best Crypto Demo Accounts - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended crypto demo accounts to use to practice buying and selling cryptocurrency.

Top 5 Crypto Demo Accounts Reviewed

Let’s take a look at some of the best crypto demo accounts in more detail.

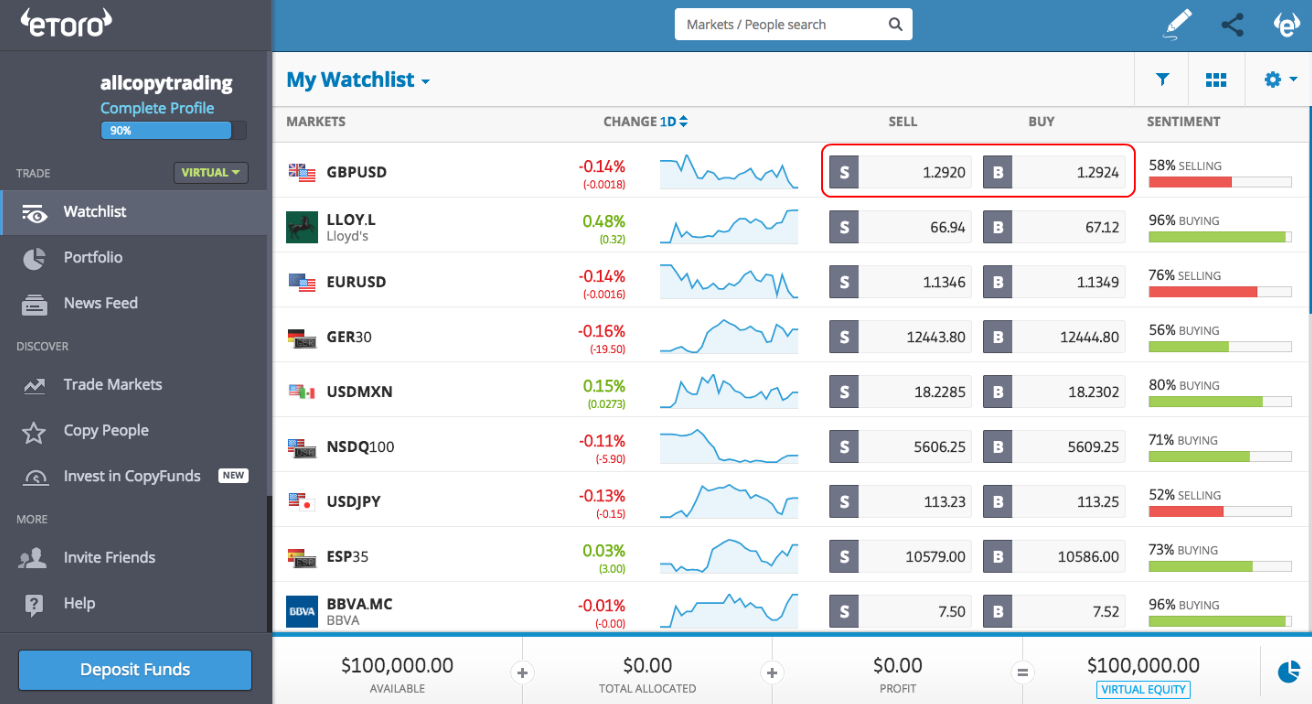

1. eToro – Best Overall

We believe eToro is the best place to practise investing and trading crypto. The demo account provides you with a virtual portfolio of $100,000 to develop your skills without any risk. It lets you experience all of eToro’s features so you’ll feel confident when you start trading for real.

We believe eToro is the best place to practise investing and trading crypto. The demo account provides you with a virtual portfolio of $100,000 to develop your skills without any risk. It lets you experience all of eToro’s features so you’ll feel confident when you start trading for real.

The clear interface makes it easy to follow real-time trends, try out advanced analysis tools, and experiment with leverage, stop losses, and take profits. You can increase your knowledge by connecting with and copying the best traders from around the world, and even have a go at demo trading other assets such as stocks, forex, and ETFs.

Pros

-

$100k virtual trading portfolio

-

3000+ instruments to trade across various markets

-

Clean interface

-

Real-time trends

-

Advanced analysis tools

-

Copy trading

-

Discuss strategies

-

Access ready-made thematic portfolios

-

Regulated in many jurisdictions

Cons

-

Limited number of cryptocurrencies available

2. Plus500 – Best for Beginners

If you’re new to trading and investing, Plus500 is the ideal place to start. You can set up a demo account with just a few clicks and the user-friendly platform simulates real market conditions to make it easy to test out strategies.

If you’re new to trading and investing, Plus500 is the ideal place to start. You can set up a demo account with just a few clicks and the user-friendly platform simulates real market conditions to make it easy to test out strategies.

If you need some guidance, there are tutorials to help you and you can reach out to customer service at any time. The price alerts and risk management features will help you work out how to minimise your losses, and once you’re ready to trade for real, you can switch between your demo and real accounts at the click of a button.

Pros

-

Trade a range of asset types in simulated market conditions

-

Intuitive interface

-

Access guidance tutorials

-

No download required

-

Risk management tools

-

Strong security

-

Excellent customer service

-

Mobile app

Cons

-

Limited number of cryptocurrencies available

-

No leverage or advanced features

3. HitBTC – Best for Testing Strategies

If you’re looking for somewhere to hone your trading skills, HitBTC has everything you need. You can customise the trading chart and test out various instruments for technical analysis. There is a wide range of order types and you can trade with up to 5x leverage.

The platform also lets you experiment with futures and staking, and you can even use Demo HitBTC to test out trading bots. Educational content for all types of traders is available, and the demo platform gives you the opportunity to try out new features before they are implemented on HitBTC.

Pros

-

Range of order types and analysis instruments

-

Customisable charts

-

Futures and staking

-

Built-in notifications

-

Educational content

-

Try new features

-

Robot-friendly API

-

Secure

-

24/7 multilingual customer support

Cons

-

Only three cryptocurrencies

4. Binance – Best for Futures

If you want to move into crypto futures trading, Binance Futures’ Mock Trading platform is the perfect place to practise in real time without risking any money. You will be given a virtual starting balance of 3,000 USDT, and you can add more funds in any coin whenever you like.

You can gauge your risk tolerance by experimenting with up to 25x leverage, as well as take profit orders, stop losses, and trailing stops. The interface is clearly laid out in the same way as the real futures platform, so you can easily click the “Back to Live” button whenever you’re ready to trade for real.

Pros

-

Mock trade futures with up to 25x leverage

-

Wide range of cryptocurrencies available

-

Customisable charts with a range of indicators

-

Variety of order types

-

Add virtual funds in any cryptocurrency

-

Educational material

-

Mobile app

-

24/7 chat support

Cons

-

No demo account for spot trading

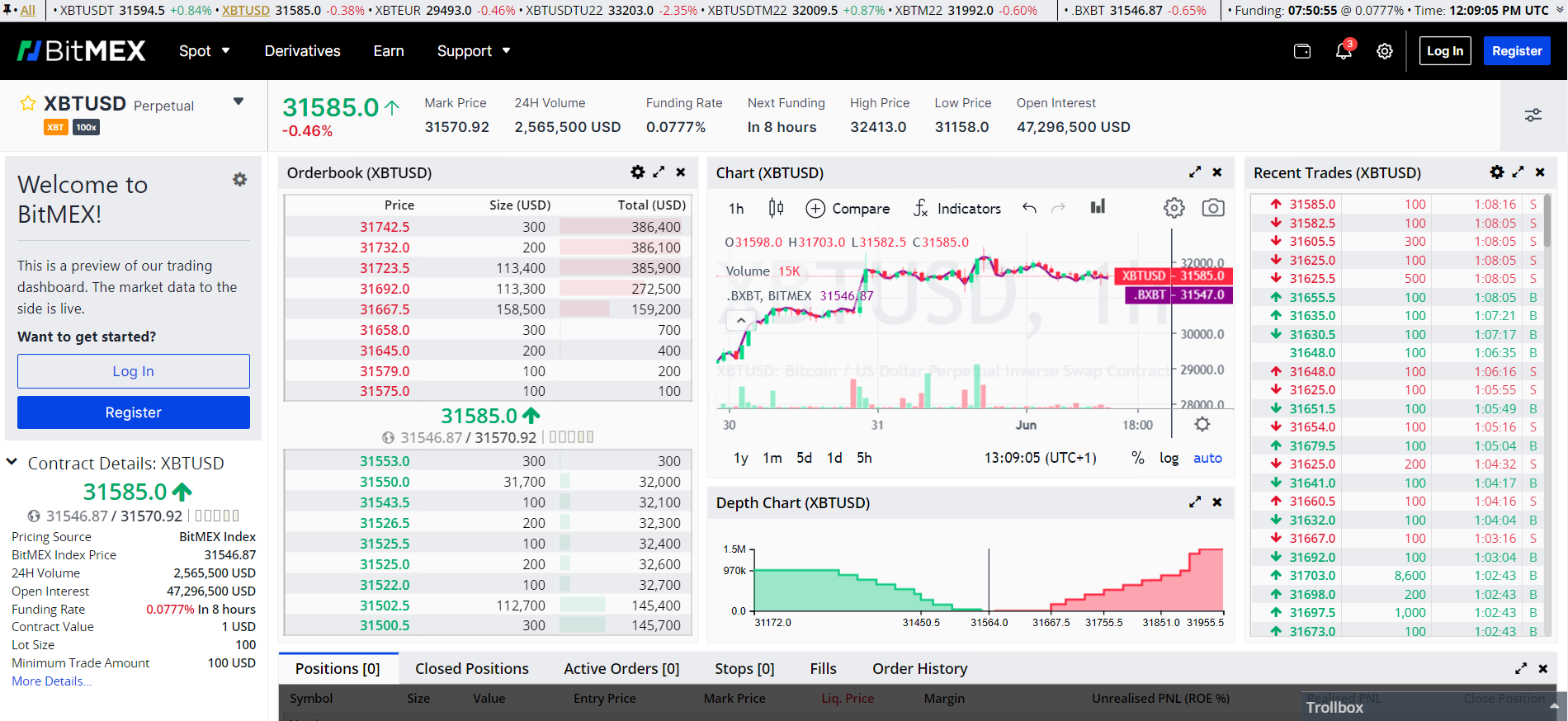

5. BitMEX – Best for Traders

The broad functionality offered by the BitMEX demo account makes it suitable for a wide range of traders looking to build skills and confidence. As well as spot trading, users have access to virtual derivatives trading and earning products.

Traders will benefit from customisable charts and a range of indicators, while they can experiment with up to 100x leverage. The platform also employs industry-leading security and has a 100% verified customer base.

Pros

-

Wide range of coins available

-

Virtual spot trading, derivatives, and earning products

-

Customisable charts and indicators

-

Up to 100x leverage

-

Industry-leading security

Cons

-

A bit technical for beginners

-

Limited number of trading pairs for virtual spot trading

What Is a Crypto Demo Account?

A crypto demo account is a demo version of a broker or exchange that lets you trade with virtual funds. They tend to simulate real market conditions and have the same layout and features as the actual trading platform.

This makes demo accounts a great way for those who are new to crypto trading to build some experience without risking any capital. They’re also useful for more experienced traders who want to test out new strategies and those who simply want to get comfortable with using a new platform.

How to Use a Crypto Demo Account

You can follow this simple guide to get started with a crypto demo account.

1. Choose a crypto demo account

Find a platform that provides all the features you want. The safest option is a secure and regulated platform, such as our top recommendation, which you can sign up for using the link below.

2. Create an account

Fill in the registration form to create an account. You will need to provide a photo ID and/or proof of address to verify your account. If you wish to make a deposit at this point, you can do so on the deposit page.

3. Start virtual trading

Switch to the demo version of the platform (eg by selecting “Virtual Portfolio” from the menu under your username on eToro). You can now make trades with the virtual funds in your demo account.

How to Choose a Crypto Demo Account

There are lots of things to consider when choosing the right demo account. Here are details about some of the most important factors.

-

Features – Think about what kind of trading activities you’d like to try out in demo mode. Some demo accounts will have all the same features as the real platform, while others will only let you demo select activities.

-

Strategies – If you have particular strategies you want to test out, check whether this will be possible in the demo version. This could mean checking whether certain order types are available or checking for compatibility with robots.

-

Fees – Check whether there will be any fees for opening an account. You won’t have to pay commission or trading fees for demo trading, but if you want to move on to real trading at some point, it’s worth finding out how much these will be.

-

Security – Find a demo account that will keep your personal information safe. If you switch to real trading, you will want a platform that will also keep your funds secure. Things to look for include 2-factor authentication and cold storage.

-

User experience – A good platform is clearly laid out and easy to navigate. However, using a demo account will give you an opportunity to get comfortable with using the platform before trading for real.

-

Coins available – Check which coins are available for trading on a platform before signing up. It’s also worth finding out whether the demo version offers all the same coins as the real platform or just a limited selection.

-

Customer support – If you run into problems with your demo account, customer support can be helpful. Support offered may include web chat, phone, or email support.

Final Thoughts

Demo accounts are a great place for risk-free experimentation—whether you’re an experienced trader testing out a new strategy or a newbie just starting out on your crypto journey.

The different demo accounts available vary greatly in the assets, trading activities, features, and order types that they offer, but this guide should help you find the demo account that’s best for you.