XRP climbed to $0.2425 to hit a monthly high as bulls established control with a 10% upside

Ripple’s price has pumped for a fifth day in a row after long-term resistance at $0.20. After breaching resistance at $0.22 and $0.23, XRP jumped above $0.24 to see it come within touching distance of $0.243.

Crucially, the uptrend means bulls have breathing space above the $0.23 level and can now target the three-month high of $0.2428, and above that, the psychologically significant $0.25.

The next target after this would be February highs at around $0.34.

Ripple gains as Bitcoin pumps above $11k

The upturn in the price trajectory of the Ripple token comes as Bitcoin hit an uptrend that has seen analysts project a run to highs of $14k within the quarter.

Over the past five days, the price of Bitcoin has spiked from around $9,600 to highs of $11k, adding about 16% to its trading value. Ripple has also surged over the period, rising nearly 9% in the past 24 hours and more than 20% in the past week.

Notably, the uptick in Ripple price also coincided with news of payments giant Visa revealing plans to support cryptocurrency payments for Bitcoin, Ethereum and Ripple’s XRP.

Ripple’s market cap has risen to $10.8 billion to see the cryptocurrency retake the third spot among the largest cryptocurrencies by that metric. XRP is now above Tether which has a market cap of $10.0 billion according to data from CoinMarketCap.

Ripple price analysis

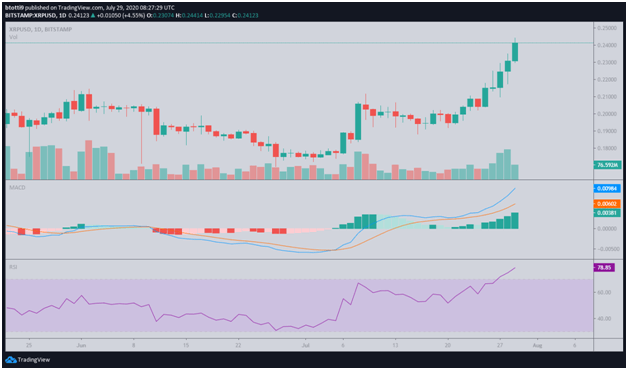

As of writing, the technical outlook for Ripple suggests a strongly bullish market. The Relative Strength Index is in overbought territory but shows no sign of slowing down, while the MACD is printing a strong bullish divergence.

The XRP/USD pair is also sitting above the upper curve of the Bollinger Band after breaking seller resistance at $0.22 and $0.23. A consolidation phase is likely, with prices swinging within the upper range of the $0.217- $0.242 level. The area is marked by the 23.6% and 50% Fibonacci retracement level that highlights the upswing from lows of $0.20 to highs of $0.2425.

Should price settle above the $0.2428 level, another leg on the swing high could see bulls target a close above $0.25 and set up a fight with the bears for a retest of pre-March 2020 price levels.

Trading volumes have however reduced from levels seen on July 27 and July 28. If bulls run into a major hurdle above $0.24, the downside is well supported at the 200, 50 and 20 simple moving averages at $0.2098, $0.2062 and $0.1945.