Bitcoin’s surge above $10k is spelling bad news for the DeFi boom as the market cap of some tokens tank double digits

Several tokens within the decentralized finance industry are seeing an extended downtrend even as Bitcoin and other top cryptocurrencies continue to surge. For most of June and July, leading cryptocurrencies sank into extended sideways trading, while a new craze hit the crypto market in the form of a DeFi boom.

Are these tokens being pushed aside for Bitcoin? According to one analyst, that appears to be the case and that the monstrous gains posted by some of the tokens were nothing other than “overhype”.

Bitcoin’s surge exposes DeFi

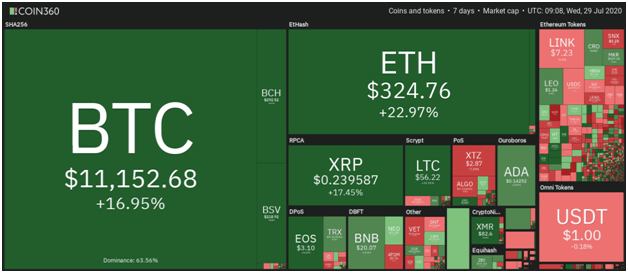

Bitcoin, Ethereum, and Ripple have spiked over 16%, 22.5% and 17% respectively over the past week to break above major price hurdle levels. There is a similar bullish case for top cryptocurrencies like Litecoin, Bitcoin Cash, Cardano and EOS.

But while these coins continue to pump amid a new uptrend, most DeFi tokens are seeing red.

Kelvin Koh, a former partner at Goldman Sachs, has observed that a “small move” in Bitcoin has “created ruptures in several speculative DeFi assets with some falling over 20% in a day.”

As Bitcoin spiked above $10k on its way to prices near $11,400, traders are likely to have begun to cash in their DeFi gains back into Bitcoin.

According to data from Messari, 31 DeFi tokens have traded lower over the past week. The market cap of tokens like Compound, Aave and Synthetix — that had all gone parabolic over the past month — are now down against Bitcoin ranging from 8% to 32% in the past seven days.

According to Kelvin Koh:

“A further rotation of capital into $BTC and $ETH will likely expose some of the DeFi projects that are overhyped.”

The analyst also notes that the space could experience a “downward spiral” given the tendency by people to look for the exit door “when asset prices go down.”

However, Mr. Koh also noted that several top DeFi projects offering real value propositions are likely going to survive even as overhyped ones fade off.

Maker is the biggest gainer among the top DeFi tokens with a 24-hour change of 5%. Other top projects like Chainlink, Aave, Augur, Synthetix Network, Balancer, Curve Finance and Kyber Network are all trading lower at the time of writing.