The 10 Best Crypto ETFs and Funds to Buy in 2025 Reviewed

Crypto ETFs are investment instruments that grant exposure to cryptocurrency in a safe, legally compliant manner, and the best crypto ETFs usually offer significant upside while minimizing downside risks.

While there is virtually no risk of investing in a scam ETF, choosing one that matches your investment goals can still be tough. This is where we come in.

Our guide explores some of the best crypto ETFs trading on the markets right now. It outlines them, what they invest in, their pros and cons, and what type of investor they are suitable for.

The Best Crypto ETFs to Invest in in 2025

- CI Galaxy Bitcoin ETF (BTCX.B) – Best Bitcoin Spot ETF

- ProShares Bitcoin Strategy ETF (BITO) – Largest Bitcoin Futures Fund

- Valkyrie Bitcoin Miners ETF (WGMI) – ETF that Tracks Bitcoin Miners

- CI Galaxy Ethereum ETF (ETHX.B) – Best Ethereum Spot ETF

- Bitwise 10 Crypto Index Fund (BITW) – Best ETF For Diversified Crypto Exposure

- Global X Blockchain ETF (BKCH) – Best ETF for Blockchain Growth

- VanEck Digital Transformation ETF (DAPP) – High ROI Blockchain ETF

- Evolve Cryptocurrencies ETF (ETC.U) – Cheapest Crypto ETF

- Hashdex Bitcoin Futures ETF (DEFI) – Best ETF for Bitcoin Futures

- Simplify Bitcoin Strategy Plus Income ETF (MAXI) – Best Income Generating ETF

The Best Crypto ETFs Compared

| Fund | Expense Ratio | AUM | Investment Strategy |

| BTCX.B | 0.40% | $229.76 million | Passive |

| BITO | 0.95% | $1.07 billion | Active |

| WGMI | 0.75% | $19.36 million | Active |

| ETHX.B | 0.40% | $261.15 million | Passive |

| BITW | 2.50% | $554.00 million | Active |

| BKCH | 0.50% | $65.13 million | Active |

| DAPP | 0.65% | $52.50 million | Active |

| ETC.U | 0.00% | $22.70 million | Active |

| DEFI | 0.90% | $2.13 million | Active |

| MAXI | 0.95% | $25.90 million | Active |

Our Top 10 Best Crypto ETFs Reviewed

1. CI Galaxy Bitcoin ETF (BTCX.B) – Best Bitcoin Spot ETF

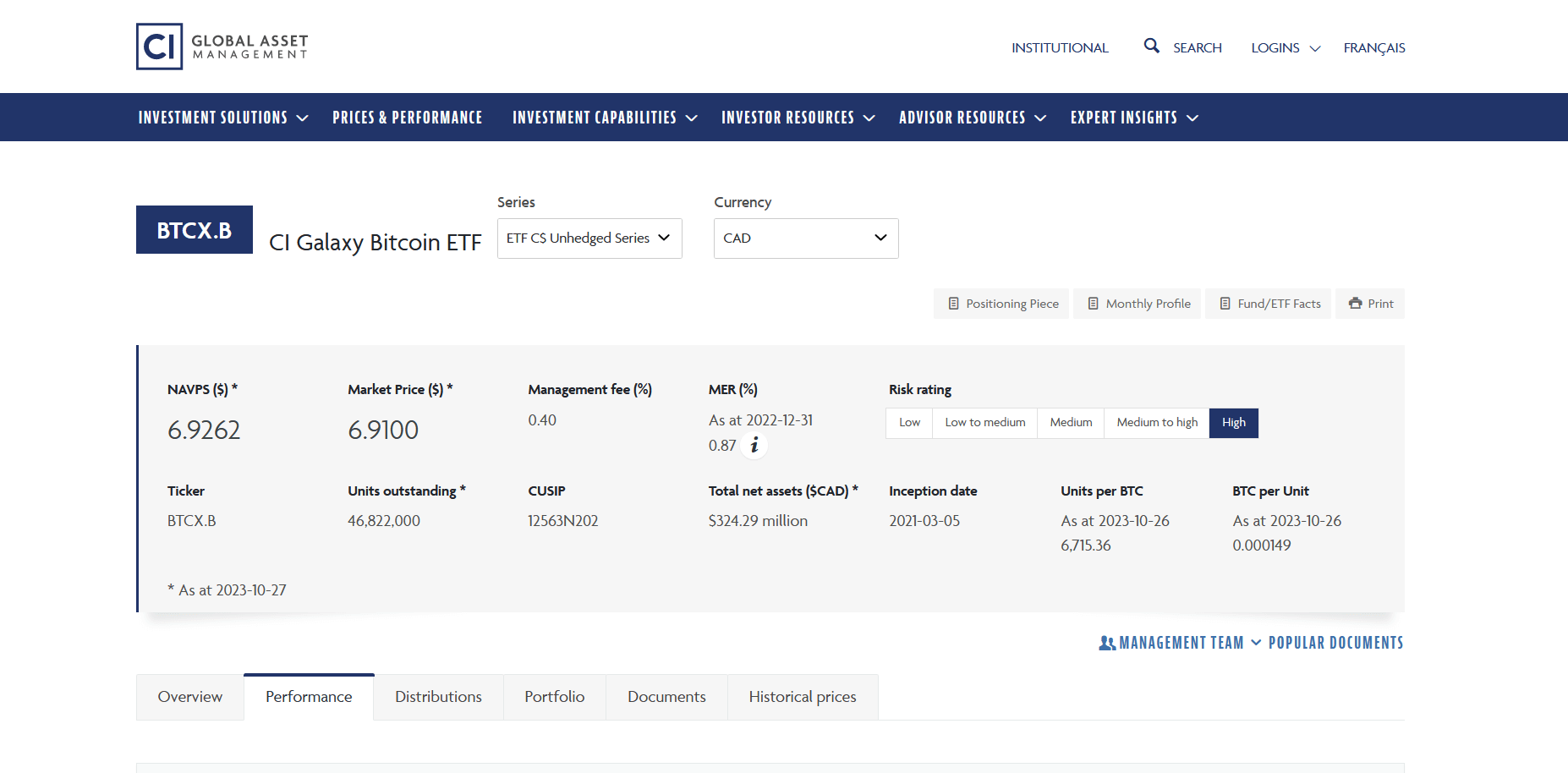

The CI Galaxy Bitcoin ETF (BTCX.B) is an exchange-traded mutual fund that is created and managed by CI Global Asset Management, one of Canada’s largest investment fund companies, and Galaxy Digital, a fast-growing crypto funds platform.

BTCX.B is a fund that invests in spot Bitcoin, which means that the fund buys and stores real Bitcoin, giving investors direct access to Bitcoin without the hassle of storage and management.

The fund was created in 2021 and is passively managed. Each unit simply tracks the net asset value of the Bitcoin in the fund’s custody. As of writing, the fund holds $229.76 million worth of assets and trades at $6.91 per unit.

Because actual Bitcoin backs each share, you can find out how many units of BTC each share represents. As of writing, one unit of BTCX.B represents 0.000149BTC.

BTCX.B trades on the Toronto Stock Exchange, however, the US and other global investors can access it through popular international brokers.

Before you get started, note that there are 46.82 million shares outstanding and that the management firm charges a 0.40% annual management fee.

Pros

- Fund holds actual Bitcoin

- Price per unit is cheap

- Management companies are large and reputable

Cons

- Not on a US exchange

- Risk rating is high

2. ProShares Bitcoin Strategy ETF (BITO) – Largest Bitcoin Futures Fund

The ProShares Bitcoin Strategy ETF is a fund that tracks Bitcoin’s price by investing in Bitcoin futures. These futures are contracts to buy Bitcoin at an agreed-upon price in the future.

The fund is managed by ProShares, which creates financial products that provide investors the opportunities to manage risk and enhance returns. It does this chiefly by creating exchange-traded funds of various kinds, types, and structures.

While BITO is just one of the ETFs in the company’s lineup, it is one of the most prominent in the crypto industry as it holds roughly $1.07 billion worth of assets. However, not all the funds are used to buy Bitcoin futures.

As of writing, the fund’s holdings are as follows:

- $669.59 million in the CME BITCOIN 24/NOV/2023 futures

- $401.89 million in the CME BITCOIN 29/DEC/2023 futures

- $573.23 million net others assets being held

- $499.26 in Treasury Bills

The fund is actively managed as professional fund managers must handle expiring futures contracts. As such, the yearly expense ratio is 0.95%, significantly higher than passive funds.

BITO trades on the NYSE Arca and can be purchased using a traditional broker like XTB. Its market price is $17.11 as of writing.

Pros

- Available in the US

- ETF is liquid

- High AUM

- Holds some stable Treasury Bills

Cons

- Does hold real Bitcoin

- Expense ratio is high

3. Valkyrie Bitcoin Miners ETF (WGMI) – ETF that Tracks Bitcoin Miners

The Valkyrie Bitcoin Miners ETF (WGMI) is a public equity fund that tracks companies that are involved in Bitcoin mining operations either directly or indirectly, like companies that produce the tech that miners use.

This fund gives exposure to the Bitcoin mining sector which could be profitable, especially during periods of high demand. For example, Bitcoin miners earned up to $40 million daily during the Bitcoin Ordinal craze of February 2023 till May 2023.

WGMI was created in 2022 and is actively managed by US Bancorp Fund Services LLC, with Valkyrie Funds as the advisor. It trades on the NASDAQ at $9.51 as of writing.

The fund has $19.36 million in total net assets and comprises 22 companies. Some of its biggest holdings include:

- Cipher Mining ($2.87M in market value)

- Cleanspark Inc ($2.04M in market value)

- Marathon Digital Holdings ($2.00M in market value)

- Riot Platforms ($1.93M in market value)

- Iris Energy ($1.55M in market value)

- Hut 8 Mining ($1.02M in market value)

You can use a broker like Oanda to gain access to the NASDAQ and purchase the WGMI. Note that the fund has an expense ratio of 0.75%.

Pros

- Large fund

- Managed by reputable companies

- Available on a US stock market

- Holds public companies

Cons

- Doesn’t hold any actual cryptos

- High expense ratio

4. CI Galaxy Ethereum ETF (ETHX.B) – Best Spot Ethereum ETF

The CI Galaxy Ethereum ETF is an exchange-traded fund that invests solely in Ethereum on the spot market. This means that the fund buys and stores real Ethereum, making each unit equivalent to an amount of ETH.

CI Global Asset Management administers the fund. The same firm administers the CI Galaxy Bitcoin ETF, the first spot Bitcoin ETF on the Canadian market. ETHX.B is managed by Galaxy Digital, a company known for its crypto funds.

ETHX.B has $261.15 million in assets, 99% of which are in Ethereum which is kept in a cold wallet. One unit of the ETF costs $8.99 on the Toronto Exchange and is equivalent to 0.003637 units of ETH.

The fund’s net asset value (NAV) is $8.96 as of writing and changes based on the price of Ethereum on the spot market and the number of outstanding shares.

As with CI Global’s Bitcoin ETF, US and global investors can access ETHX.B through international brokers like Oando.

Before buying shares of this ETF, note that it has a high-risk rating and a management fee of 0.40%. Your broker may charge additional fees for purchasing this ETF.

Pros

- Holds actual Ethereum

- Low management fees

- Managed by reputable companies

Cons

- Not available in the US market

5. Bitwise 10 Crypto Index Fund (BITW) – Best ETF For Diversified Crypto Exposure

The Bitwise 10 Crypto Index Fund (BITW) is a crypto index fund that offers exposure to the top 10 most highly valued cryptocurrencies. This doesn’t necessarily mean the largest cryptos by market capitalisation, although the market cap is a consideration for selection.

BITW is perfect for investors looking for broad exposure to blue-chip cryptocurrencies. The fund holds well-funded cryptos with a strong track record that serves infrastructure provider functions, hence, they are less likely to crash completely.

The fund has $554 million in assets under management and 20.24 million shares as of writing. It is sponsored by Bitwise Investment Advisers and administered by Theorem Fund Services. All purchased cryptos are held in custody by Coinbase Custody Trust Company LLC.

The cryptos held by the fund include:

- Bitcoin (69.1% of the fund)

- Ethereum (22.3% of the fund)

- Ripple (3.2% of the fund)

- Solana (1.5% of the fund)

- Cardano (1.1% of the fund)

- Chainlink (0.6% of the fund)

- Polygon (0.6% of the fund)

- Polkadot (0.6% of the fund)

- Litecoin (0.5% of the fund)

- Bitcoin Cash (0.5% of the fund)

BITW is traded on the OTCQX market, an over-the-counter marketplace for securities that aren’t traded on an official stock or commodities exchange, at a market price of $17.74 as of writing.

Before buying into the fund, note that it comes with an expense ratio of 2.5% and that you’ll need a broker with access to OTC markets.

Pros

- Actively managed by reputable companies

- Available in the US

- Provides diverse exposure

Cons

- High expense ratio

- Not on an official exchange

6. Global X Blockchain ETF (BKCH) – Best ETF for Blockchain Growth

The Global X Blockchain ETF (BKCH) is an exchange-traded fund that invests in companies that use blockchain technologies, build them, interact with them directly or indirectly, and are positioned to benefit significantly from the widespread adoption of blockchain technology.

The ETF doesn’t invest in any actual crypto. Instead, it holds shares in companies with positive long-term prospects in the blockchain space. It is suitable for investors who believe in the future of blockchain but are not sold on its cryptocurrency implementations.

We like this ETF because banks, governments, and institutions in various industries worldwide are waking up to the benefits of blockchain technology and are beginning to adopt it.

The verdict may still be out for many cryptos, but blockchain technology is taking root, and it makes sense to invest in the growth of the infrastructure.

The fund is managed by Global X, an ETF provider headquartered in New York, USA. The firm creates and manages a lineup of ETFs that provide access to various markets and investment opportunities.

BKCH trades on the Nasdaq and can be accessed through a broker. It has $65.13 million in net assets, which it invests in Its 25 holdings.

The top five companies in its portfolio are:

- Coinbase (16.73% of the fund)

- Hut 8 Mining (10.37% of the fund)

- Marathon Digital (10.24% of the fund)

- Riot Platforms (9.87% of the fund)

- Galaxy Digital Holdings (5.85% of the fund)

Before buying the BKCH, keep in mind that it is actively managed, comes with a 0.50% expense ratio, pays dividends semi-annually, and has a market price of $24.09 as of writing.

Pros

- Trades on the Nasdaq

- Invests in top crypto companies

- Is not exposed to crypto volatility

Cons

- Does not hold crypto

7. VanEck Digital Transformation ETF (DAPP) – High ROI Blockchain ETF

The VanEck Digital Transformation ETF (DAPP) provides a means of investing in companies that are using blockchain technologies to drive change in finance, technology, and other sectors.

The ETF is managed by VanEck, an asset management firm that creates products to help strengthen investors’ portfolios. The company has a lineup of ETFs across various themes and sectors.

DAPP is one of the firm’s blockchain-focused ETFs. We believe it is suitable for investors who are more interested in the ways established companies are using blockchain tech to move their industries forward.

The ETF trades on the Nasdaq, is custodied by State Street, and trades at $5.70 per share as of writing.

The fund holds 20 companies, the top five are:

- Coinbase Global (8.64% of the fund)

- Microstrategy Inc (7.36% of the fund)

- Block Inc (6.90% of the fund)

- Northern Data AG (6.23% of the fund)

- Riot Platforms Inc (5.59% of the fund)

Before buying into this fund, keep in mind that it has $52.5 million in net assets, is actively managed, comes with a 0.65% expense ratio, and is cumulative (i.e., does not pay dividends).

Pros

- Trades on the Nasdaq

- Is not exposed to crypto’s volatility

- Managed by a top-tier firm

- Great performance so far

Cons

Does not pay dividend

8. Evolve Cryptocurrencies ETF (ETC.U) – Cheapest ETF

The Evolve Cryptocurrencies ETF (ETC.U) is an exchange traded fund on the Toronto stock exchange that gives investors exposure to Bitcoin and Ethereum’s price movements.

The fund is managed by Evolve ETFs, a Canadian ETF provider with over $7 billion in assets under management. The firm has a lineup of ETFs across various themes, markets and risk profiles that allow investors to access index-based income strategies.

We like ETC.U in particular because it provides a simple way for investors to easily track the price of the top two cryptos, which accounts for over 50% of the total market capitalisation of the entire industry.

We also like that the fund does not charge any management fees. The fees are handled by the other funds it holds.

ETC.U does not hold Bitcoin and Ethereum directly, but rather holds a Bitcoin spot ETF and an Ethereum spot ETF. The underlying ETFs pay ETC.U’s management fees, so the fund remains free for all investors.

The fund holds $22.7 million in assets and trades at $6.94 as of writing. While ETC.U trades in Canada, US and global users can access it with a popular broker like Oanda.

Pros

- Tracks crypto prices

- Based on spot ETFs

- Does not charge management fees

Cons

- Does not hold crypto directly

9. Hashdex Bitcoin Futures ETF (DEFI) – Best ETF for Bitcoin Futures

The Hashdex Bitcoin Futures ETF (DEFI) is an exchange traded fund that provides investors exposure to Bitcoin’s price action from an official marketplace. The fund is relatively new as it was created in September 2022, and is quite small compared to several others.

Nonetheless, we like DEFI because it has returned sizable gains since its inception thanks to Bitcoin’s price rally in 2023. The fund is administered by the US Bank Global Fund Services and distributed by Foreside Fund Services, LLC.

Unlike spot ETFs that hold Bitcoin or industry themed ones that hold companies that use blockchain technology, DEFI tracks Bitcoin’s price by holding Bitcoin futures contracts on the Chicago Mercantile Exchange.

DEFI is an actively managed fund that trades on the NYSE at $43.23 per share as of writing. It has $2.13 million in net assets and costs 0.90% per year.

Pros

- Trades on a major US exchange

- A lot of room for growth

- Impressive returns since inception

Cons

- Small size may deter some investors

10. Simplify Bitcoin Strategy Plus Income ETF (MAXI) – Best Income Generating ETF

The Simplify Bitcoin Strategy Plus Income ETF (MAXI) is an exchange traded fund that provides investors with access to Bitcoin’s price movements on an official exchange while also generating dividends for its holders.

We like MAXI because of its monthly distributions which means that it pays out dividends to holders on a monthly basis. This makes it a good investment option for people who want both capital appreciation and income generation.

The actively managed fund has $25.9 million in assets, 1.5 million shares outstanding, and a current distribution yield of 11.74% per year (this means the dividends amount to 11.74% of your holdings).

MAXI is managed by Simplify, a US ETF provider and is distributed by Foreside Financial Services, LLC. It tracks Bitcoin’s price by holding futures contracts and generates revenue by using covered call options.

The fund can be traded on the Nasdaq exchange at $19.68 per share as of writing. However, Note that the fund comes with a 0.97% expense ratio.

Pros

- Trades on the Nasdaq

- Generates Income

- Impressive performance since inception

- Monthly distributions

Cons

- Doesn’t hold Bitcoin

- Covered calls strategy is risky

What are Crypto ETFs?

Crypto ETFs are exchange-traded funds that invest in the crypto space in one way or the other. An exchange-traded fund is a type of mutual fund whose shares are traded on an official exchange like the NYSE, Nasdaq, or the FTSE.

These funds can invest in a variety of assets, granting investors exposure to asset classes that may have previously been out of reach, and allowing investors to diversify their investments without holding too many assets.

Crypto ETFs center their investments in the crypto industry. Some invest in cryptos, others in crypto companies, and some in futures contracts.

The main appeal of Crypto ETFs is that they provide a way for investors to get in on crypto without having to store coins. It also provides an SEC-compliant method of investing in cryptos, which is attractive to institutional investors.

Which Crypto Coins do ETFs Track?

Crypto ETFs can track pretty much any coin the management company wants. However, most ETFs center around Bitcoin, Ethereum, a mixture of both, or a combination of the top 10 most valuable cryptos like the case of the Bitwise 10 Crypto Index Fund ETF.

The reason for this is that Bitcoin and Ethereum are the two largest coins by market capitalization. They are also the most desired by institutional investors who are often the largest ETF investors.

Also, ETFs need market makers and distributors to function properly, and these firms usually have requirements for ETFs that they choose to distribute, administer, or manage.

The Different Types of Crypto ETFs

- Spot ETFs: A spot ETF is an exchange-traded fund that holds cryptos on the spot market. This means that the fund buys and stores actual coins, most probably in a cold wallet or with a custodian.

- Futures ETFs: Futures ETFs do not buy coins, instead they hold futures contracts from major markets like the Chicago Mercantile Exchange. Futures contracts are agreements to buy (or sell) crypto at an agreed-upon price at a specified point in the future.

- Blockchain ETFs: Blockchain ETFs provide exposure to blockchain companies, not coins or futures contracts. These ETFs are built on the premise that the top companies providing crypto services will grow alongside the industry.

How Does a Crypto ETF Fund Work?

The workings of a crypto ETF depend on the type of fund, its holdings, and its structure. Nonetheless, all types of crypto ETFs have some overlapping functions and techniques for achieving their investment goals.

When you buy shares in a fund, the money is used to purchase the assets listed in the fund’s fact sheet in the specified proportions. In this case, it could be cryptos, futures, options, or crypto companies.

For example, a spot ETF would buy only Bitcoin, while a futures one would buy futures contracts and perhaps some Treasury Bills. In either case, when an investor buys shares, the money is used to purchase the listed assets.

The fund has a net asset value (NAV) which is the intrinsic value of each share. It is calculated by dividing the market value of the total net assets by the number of shares. The NAV may differ from the market price depending on investor sentiment.

Depending on the fund’s structure, it may distribute earnings or dividends to shareholders or accumulate them into the fund to increase the NAV.

Investors can sell their shares or redeem them at the NAV anytime they wish.

Stock ETFs Vs. Crypto ETFs

The major differences between stock and crypto ETFs are in the assets they invest in. As the name suggests, stock ETFs only invest in equities, either on the spot or futures market. On the other hand, crypto ETFs can invest in a range of assets, including stocks, however, it is limited to those of companies that create, integrate, or work with blockchain technology.

| Stock ETFs | Crypto ETFs |

| Tracks/holds only equities | Holds crypto or crypto-related equities |

| Trades on official exchanges | Could sometimes trade on OTC markets |

| Are usually actively managed | Could be passively or actively managed |

Crypto Presales Vs. Crypto ETFs

| Crypto Presales | Crypto ETFs |

| Involves purchasing tokens | Involves purchasing financial instruments |

| Occurs on the blockchain | Occurs on official exchanges |

| Usually offered by crypto companies | Usually offered by finance firms |

| Cryptos have not yet been released | Cryptos are already in circulation |

Why You Should Invest in Crypto ETFs

Easy Access

Crypto ETFs grant investors access to crypto price movements without the hassle of buying coins and storing them. Spot funds usually have a custodian that stores crypto holdings in a cold wallet.

This way, investors can focus on the ETF itself and reap the benefits of owning crypto without holding it.

Expertise

Actively managed funds employ the services of finance professionals and market experts to choose the assets that the fund holds. For example, the Simplify Bitcoin Strategy Plus Income ETF (MAXI) holds futures contracts and covered calls, two complex financial instruments that can be highly profitable, but usually beyond the area of competence for regular investors.

Liquidity

Crypto ETFs trade like regular shares on official exchanges. This means that they have liquidity providers and market makers that help fulfill transactions quickly at efficient prices. The shares can also be redeemed for cash (usually the current NAV).

Compliance

For a crypto ETF to trade on an approved market, it must be given the go-ahead by a prevalent securities agency. This means that investors can freely invest and trade without worry of legal repercussions either to the ETF in question or its management company based on the unregulated crypto.

How to Invest in Cryptocurrency With ETFs

1. Open an account

Go to the eToro website and click on the Start Investing icon to create an account. Alternatively, you can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

2. Verify your account

Next, verify your account with personal details like your date of birth and a passport photo, after which submit KYC documents. These documents include proof of ID (National ID or driver’s license) and proof of residence (utility bill).

3. Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose your preferred method from the drop-down menu and set the amount you’d like to deposit.

4. Buy ETFs

Scroll to the ETF section of the market by clicking on all markets in the left pane. Select ETFs and check if your selected ETF is available.

Latest Crypto ETF News

- Crypto data platform, CoinGecko, estimates that $4.16 billion in global assets are in spot bitcoin ETFs

- DWS Group, a German asset management giant with $900B in assets, is exploring crypto ETFs amid internal deliberations on Bitcoin’s potential.

Final Thoughts on the Best Crypto ETFs

We explored the best crypto ETFs on the market and found the CI Digital Bitcoin ETF to be the most desired because it holds Bitcoin, is passively managed (i.e. cheaper), and is available on the Toronto Exchange as well as on international brokers.

Nonetheless, all the ETFs on our list are great options depending on the markets you have access to, your investment goals, and the assets that the ETFs hold.

Remember to use legitimate brokers when buying crypto ETFs, and that all ETFs come with varying levels of risk depending on the assets held. To begin investing in ETFs, sign up with a broker like eToro.

Methodology - How We Picked the Best Crypto ETFs

The ETFs covered in this guide were chosen through rigorous research and performance reviews. We paid attention to holdings, structure, expense ratios, and relevance.

The ETFs listed are the best we found in the various categories we listed them. For example, we listed the Simplify Bitcoin Strategy Plus Income ETF (MAXI) as the best income-generating ETF because its distributions yield 11.74% per year.

Check out our why trust us and how we test pages for more information on our testing process.