Next Cryptocurrency to Explode in 2025

Every crypto bull market produces new millionaires as people, armed with valuable information, invest in the next crypto to explode. But how do they know which coins will perform well and which will flop?

As much as there are stories of millionaires, there are also cautionary tales of people losing all their money.

This guide will walk you through the top 15 projects that are most likely to exponentially increase in value in 2023. We have scoured the Web3 for these hidden (and not so hidden) gems and have narrowed them down for you.

Now we unpack them in this comparative guide.

Top 15 Next Cryptocurrencies to Explode This Year

1. Ethereum (ETH) – Leading Blockchain with Growth Potential

2. Optimism (OP) – Ethereum Layer 2 with Institutional Participation

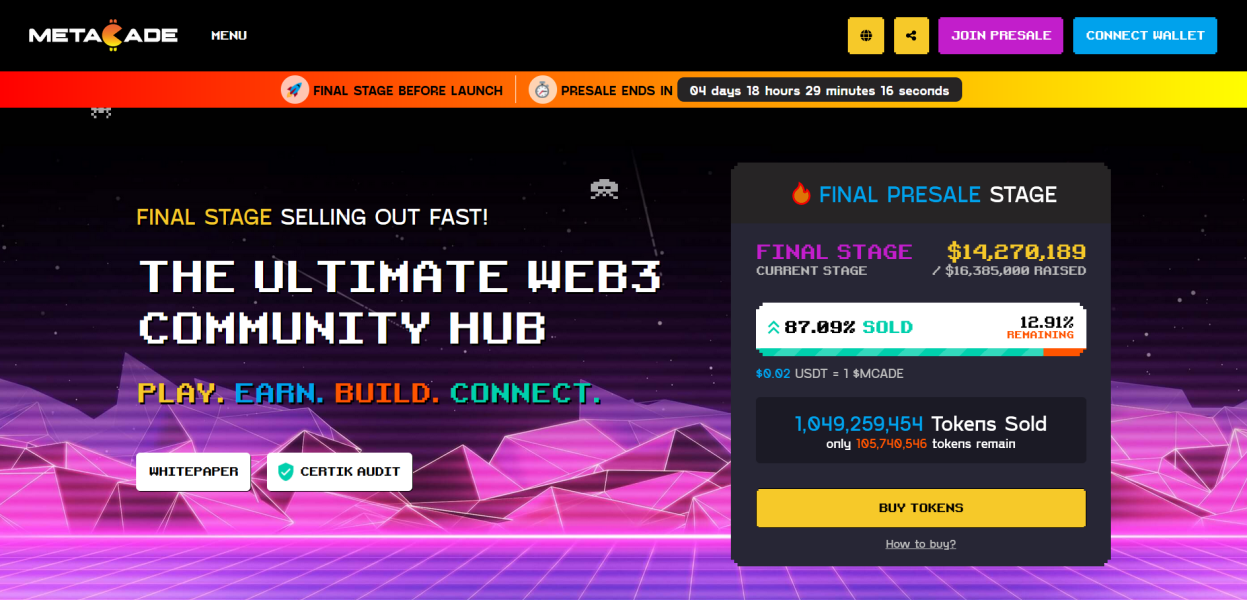

3. Metacade (MCADE) – Gaming Hub with High Potential

4. GMX – Most Used Decentralised Trading Protocol

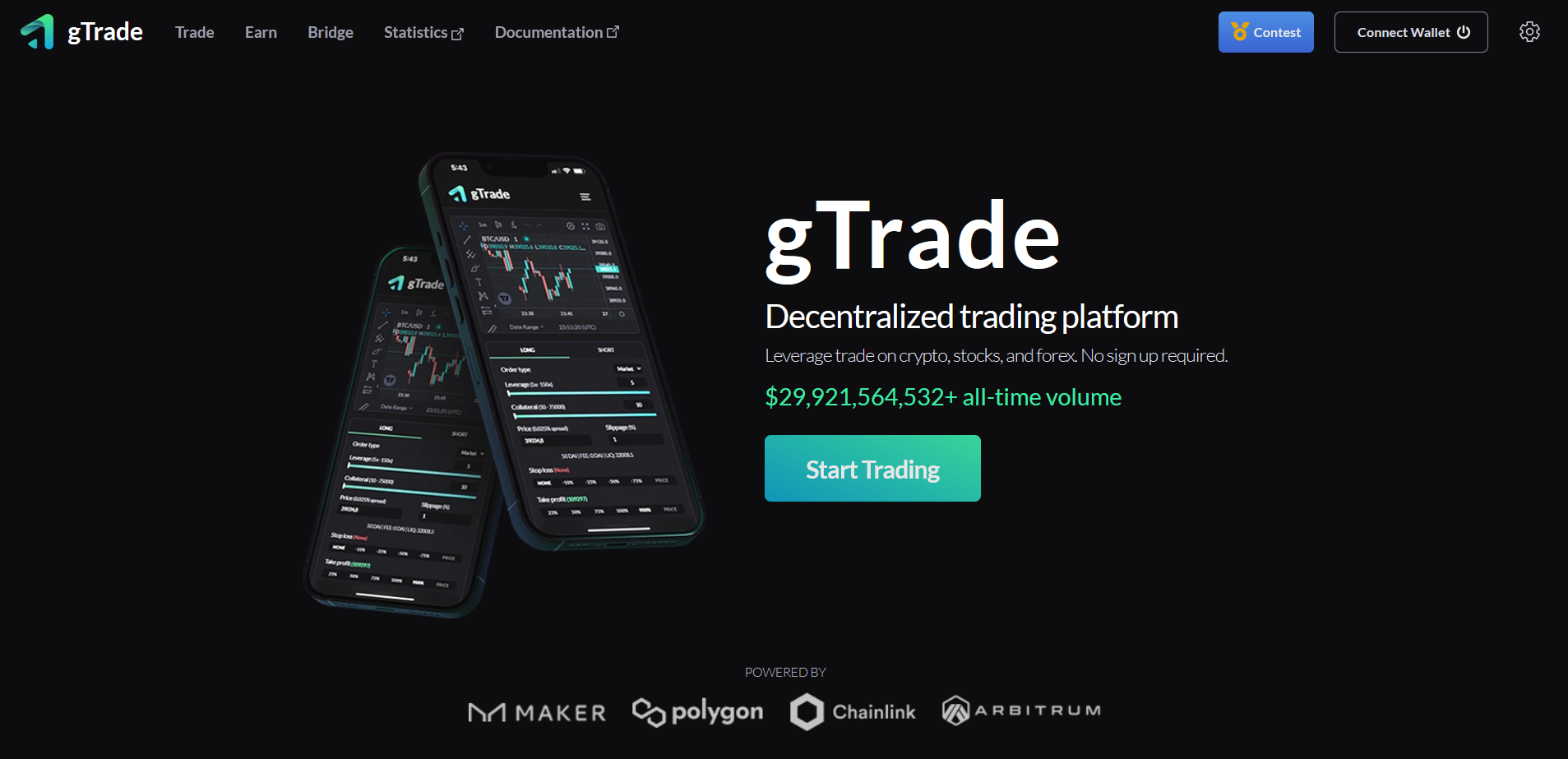

5. Gains Network (GNS) – Cross Chain Decentralised Perpetual Protocol

6. DYDX – Established Decentralised Trading Platform

7. Curve (CRV) – Largest Liquidity Pool Protocol

8. Fantom (FTM) – Blockchain Making a Comeback

9. Chainlink (LINK) – Leading Oracle Infrastructure

10. Ripple (XRP) – Potential in Traditional Banking

11. Biconomy (BICO) – Seamless Multichain Infrastructure

12. LIDO (LDO) – Leading Liquid Staking Protocol

13. Rocket Pool (RPL) – Upcoming Liquid Staking Protocol

14. Arweave – Leading Decentralised Storage

15. Floki Inu (FLOKI) – Upcoming Memecoin Ecosystem

Analysis of the Next Cryptocurrencies to Explode

1. Ethereum – Leading Blockchain with Growth Potential

Ethereum is a leading blockchain network infrastructure that powers thousands of decentralized applications and protocols. It is the largest blockchain network and is projected to grow further as several projects with potential are building on it.

As of writing, the network has $28.6 billion worth of value locked through the many financial protocols operating on the blockchain. While this number is lower than an all-time high of $109 billion, it is still significant considering that the industry has suffered many blows.

While the crypto network was once plagued by high gas fees, a series of upgrades, predominantly the move to Eth 2.0, a proof-of-stake network, has significantly lowered gas transaction costs, thereby opening the network to more participants.

The upgrade also affected some changes to Ethereum’s tokenomics. Ethereum’s coin, ETH, was once capped at 72 million coins, however, the EIIP 1559 upgrade removed the cap on token supply but also implemented a burn on tokens used for gas fees.

As it stands, more ETH is being burned than is being created, making the coin deflationary. You can visit our Ethereum guide to learn more about the network.

Ethereum is projected to grow as it continues with upgrades in its move to a faster, more energy-efficient PoS network. The more recent Shanghai update allows users who had previously locked their ETH to unstake it.

Also, new innovations in the DeFi space called real yield, where returns are paid in either ETH or a stablecoin, is drawing more users to the blockchain.

ETH reached an all-time high of roughly $4,600 in November 2021, but has since fallen. Its 52-week high is $3,520 while its 52-week low is around $995. More recent price movements hovers between $1,100 and $1,700.

You can buy ETH on exchanges like eToro.

2. Optimism (OP) – Ethereum Layer 2 with Institutional Participation

Optimism is a Layer 2 protocol on the Ethereum network that helps speed up transactions by processing them on a different computational layer and then batch uploading them to the Ethereum blockchain.

This helps to reduce transaction fees while increasing processing throughput. As such, layer 2 networks have become popular and are a hot trend in 2023. Optimism is a leading network that uses a technology called Optimistic rollups to increase transaction speed while reducing costs.

Note that optimistic rollups are not sidechains. Sidechains are responsible for their own security, validators, and block parameters, while optimistic rollups depend on Ethereum for security and only handle the computation layer of processing transactions.

Essentially, users get access to a faster network on their chosen blockchain. Optimism rose to popularity when Ethereum’s gas fees were a problem for retail users. And even though transaction costs are significantly lower, there is still a need for layer2 networks.

Furthermore, Coinbase, a large exchange, is now a contributor to the Optimism network and is building its own layer2 network, called Base, on Optimism technology.

Optimism already has at least 94 financial protocols holding about $981 million dollars in value, according to Defillama. Its native token, OP, has a total supply of 4.29 billion tokens, 214 million of which are in circulation.

OP reached an all-time high of $3.10 in February 2023 as it rallied 23% that month. Its price currently sits at $2.5 as it retreats from a resistance at the ATH (all-time high).

While future token release events could cause sell pressure to the token, we believe that Optimism has a bright future, being the second most used Ethereum layer2.

You can buy OP on exchanges like Binance.

3. Metacade (MCADE) – Gaming Hub with High Potential

Metacade is a hub for web3 gaming lovers. Gamers, builders, creatives, and thought leaders can all come together to build, explore, and expand web3. Although the company is new compared to others on this list, it is already making strides to become a destination for web3 wanderers.

Thanks to Metacade’s cross-chain functionality, you can play your favourite play-to-earn games on various blockchains, join and monitor leaderboards, discover the next big game and get valuable NFTs early, and publish reviews so others know the best games to play.

Furthermore, Metacade assists with the finance aspects of web3 gaming. GameFi is growing rapidly as most blockchain games have important financial components. If you understand how to devise strategies that take advantage of the financial component, you can make significant earnings while enjoying gameplay. If not, you may get left behind.

With Metacade, you can develop GameFi strategies to gather valuable resources and grow your wealth.

Besides access to great games, gamefi strategies, and a great community, Metacade members also get rewarded with the community’s native token, MCADE. Ecosystem contributors are rewarded for actions like posting reviews, playing games, and interacting with others in a way that grows the community.

Although MCADE has not yet been released, it will have a total supply of 2 billion, 70% of which was allocated to the presale (which took place in Q4 2022), 10% to development, 12.5% to centralised exchange listings and marketing, 5% to liquidity on decentralised exchanges, and 2.5% to competition winners.

MCADE will launch in the first quarter of 2023 with its first listing on Uniswap, a leading DEX. You can join the token presale or wait for it to be listed on Uniswap.

4. GMX – Most Used Decentralised Trading Protocol

GMX is a decentralised perpetual exchange built on the Arbitrum and Avalanche networks. It allows you trade ETH, BTC, LINK, UNI, AVAX, and WBTC against the US dollar. It is an industry leader in the decentralized trading space.

It differs from established exchanges like Uniswap in its crypto perpetuals offerings. With GMX, you can trade crypto perpetuals, which are futures contracts that do not have expiry dates i.e. they go on forever.

You can trade these contracts with leverage, and GMX offers up to 50x leverage on crypto pairs.

Before GMX, most perpetual trading was done on centralized exchanges like FTX and Binance. However, the crash of FTX in November 2022 highlighted many of the flaws that plague centralized exchanges and shed a light on decentralized perpetual exchanges.

GMX is a leader in decentralized perpetuals trading with the highest users, volume, and revenue via trading fees. It also has a sound staking program where it returns yields in USDT or ETH, not its own token.

This type of yield farming is called real yield Defi and is more sustainable than its predecessors.

So far, GMX’s 230,000 users have transacted a total of $107 billion, earning the protocol a total of $128 million in fees, a portion of which is distributed to GMX stakers. For context, the protocol earned $875,000 in fees in the first three days in March 2023.

The barrier for entry is low as the protocol doesn’t require you to sign up or pass KYC verification. All you need to start is a compatible crypto wallet like MetaMask or Trust.

GMX has a maximum supply of 13.2 million tokens, of which 8.5 million are in existence. All of the tokens in existence are in circulation. However, some sell pressure is possible if more tokens are created.

The token recently hit an all-time high of $82 in February 2023 but has fallen to $68. You can buy GMX on exchanges like Binance.

5. Gains Network (GNS) – Cross Chain Decentralised Perpetual Protocol

Gains Network is a decentralized trading platform that allows you to trade cryptos, stocks, and currency pairs. Like GMX, it is cross-platform, available on the Polygon and Arbitrum networks.

The platform boasts impressive statistics like a $30 billion total volume traded, 12,000 total traders, and roughly $22 million in total fees generated by the platform.

We like Gains because it transcends crypto trading. While GMX currently offers only a few crypto pairs, Gains offers several pairs along with major fiat currency pairs, US stocks, and even an index.

You can trade the EUR/USD pair, stocks like GOOGL, and the SPY which tracks the S&P 500 index. All you need to do to start trading is connect your compatible crypto wallet like MetaMask or Trust wallet, choose a market and set orders.

You can also trade with leverage, from 2x to 20x for currency pairs, stocks, and indices, and from 2x to 50x for cryptocurrencies.

If trading is not your thing, you can still profit from the platform by being a counterparty to all trades. This involves locking the stablecoin, DAI, in a vault to be used for liquidity in return for a cut of all trading fees generated on the platform.

As of writing, the return is 9.34% per year and a total of 30.6 million DAI have been locked in the vault.

Gains Network is the fourth largest perpetuals trading platform with a market capitalization of $220 million, but is one of the most popular and shows great upside potential. Its token, GNS, has a total supply of 30.3 million tokens, all of which are in circulation.

The token trades close to $7 at the time of writing with a 52-week high of $10.6 reached recently in February 2023 and a yearly low of $0.59 hit in May 2022.

You can buy GNS on exchanges like Coinbase.

6. DYDX – Established Decentralised Trading Platform

DYDX is another player in the perpetuals market that is projected to grow as the market for decentralized trading expands due to growing demand thanks to the fallout of major exchanges like FTX.

With DYDX, you can trade perpetual contracts for major cryptos on a decentralized platform that requires only a compatible wallet to trade. However, this trading setup is a bit more advanced than the likes of GMX and Gains Network.

DYDX’s platform comes with a portfolio management dashboard that displays an overview of your entire trading capital, your open positions, a history of your orders, trading fees you’ve paid, and a history of your transactions.

You also get dynamic orders including limit orders, time in force, and execution preferences like Post Only and Reduce Only, features that are unavailable on GMX.

The platform maintains an orderbook and trade history similar to those of centralized platforms with charts for market depth and funding rates.

If you’re one for social interactions, the platform holds competitions that reward winners with prizes like NFTs.

Since the beginning of 2023, DYDX has processed $30.7 billion in cumulative trades for over 4,000 weekly active traders. For now, the platform only offers Layer 1 coins and DeFi tokens.

When it comes to tokenomics, DYDX has a total supply of 1 billion tokens,151.9 million of which are in circulation. This could cause significant sell pressure at future token release dates.

The token, called DYDX, trades at $2.42 as of writing with a 52-week high of $6.92 in April 2022 and a 52-week low of $1.04 in December 2022. Unfortunately, it does not seem like DYDX has benefited from recent price spikes in the market.

You can buy DYDX on exchanges like Coinbase.

7. Curve (CRV) – Largest Liquidity Pool Protocol

Curve is a liquidity protocol that manages liquidity pools and allows anyone to create liquidity pools for their protocols. It is best known for some of the lowest swap fees on the market, which is why it houses some of the largest liquidity pools in all of crypto.

Retail investors, whales, institutions, and even entire protocols use Curve’s pools as a liquidity layer or to swap large volumes of stablecoins or various versions of ETH as many of Curve’s popular pools are quite large and have minimum slippage.

The largest pool on Curve is currently the ETH-stETH pool, which is a $1.3 billion pool that allows you swap between ETH and stETH (Lido ETH staking derivative).

Curve has been around for a while and despite its usefulness to the crypto space, its pools are not why it made our list.

Regulatory agencies, in recent times, have begun to crack down on stablecoins by going after their issuers. BUSD, the third largest stablecoin by market capitalization, has already been shuttered as its issuer, Paxos, has been ordered to stop minting it.

Now more than ever, there is a need for fully decentralized stablecoins, and Curve is reportedly in the process of creating one.

Curve’s proposed stablecoin, called crvUSD will be governed by an algorithm called the Lending-Liquidating AMM (LLAMMA) which requires users to deposit collateral to mint crvUSD, but converts the stablecoin back to collateral in cases where the collateral price falls below liquidation level.

A decentralised stablecoin backed by curve’s liquidity pools and governed by the LLAMMA could boost the CRV token as people buy in for governance rights. This happened before during the famous Curve wars.

CRV has a maximum supply of 3.3 billion tokens, although only 1.1 billion are in existence. Of the tokens in existence, only 754 million are in circulation. The rest are either locked away or have been marked as emission rewards for liquidity providers.

While these tokenomics are quite inflationary, a huge chunk of CRV goes to protocols like Convex that hold them to maintain controlling interest in Curve’s governance proposals, similar to holding massive shares in a publicly traded company.

Provided Curve continues to provide value, its tokens will remain attractive to hold, which should work to offset some of the sell pressure from token emissions.

CRV’s price is at $0.93 at the time of writing with a 52-week high of $2.95 in April 2022 and a 52-week low of $0.50 in November 2022.

You can buy CRV on exchanges like eToro.

8. Fantom (FTM) – Blockchain Making a Comeback

Fantom rose to popularity in the bullrun of 2021 as an Ethereum Sidechain with solid technology and a growing ecosystem. It quickly became a hub of DeFi activities as the sector exploded.

Unfortunately, due to the crypto downtrend in 2022 and the departure of major contributor, Andre Cronje, from the Fanom DeFi space, the blockchain fell from grace. However, despite downturns, the Fantom blockchain still has $456 million in locked value.

The platform was a DeFi hub as several popular yield farming protocols operated on the Fantom blockchain.

Fantom made our list because the network is on the come-up despite turbulence in the crypto landscape. Also, the major developer that had previously left the project is returning, and the news has already drummed up positive sentiment.

Fantom’s native coin, FTM, has a total supply of 3.1 billion coins, 2.7 billion of which are already in circulation. Majority of the coins have been priced into the market so future coin unlocks will not have much of a negative effect on price.

The coin trades at $0.39 as of writing with a 52-week high of $1.62 and a yearly low of $0.18 in November 2022.

You can buy FTM on exchanges like eToro.

9. Chainlink (LINK) – Leading Oracle Infrastructure

Chainlink is a blockchain oracle that pulls data from outside a blockchain network and brings it on-chain in a secure, decentralized, and verifiable way. Decentralized oracles like Chainlink leverage a network of nodes to bring provable data from events or markets outside a blockchain.

For example, Chainlink can get the results of a race or the price of a stock and bring that data on-chain. The key with oracles is that data is provable, meaning that its authenticity can be determined by all parties involved. Oracles are especially important for DeFi applications like synthetics which mimic the price of real world securities, like stocks.

Chainlink is a leader in oracle technology and is the preferred choice for major projects. However, this is not why it is on our list. We are more focused on the coming applications of oracles.

A growing trend with regulators strong-arming stablecoins creates a need for fully decentralized non-algorithmic stablecoins (to avoid a repeat of the LUNA/UST debacle).

The stablecoins rising to fill this need all require oracles to maintain their pegs (so far, mainly TUSD and crvUSD). If stablecoins that require oracles grow in popularity, then providers like Chainlink will also grow in value.

Chainlink’s native token, LINK, has a total supply of 1 billion tokens, of which 495.1 million are in circulation. Less than half of the total supply has been priced into the market, so some sell pressure is to be expected at future release dates.

As of writing, LINK trades at $6.86 with a 52-week high of $18.08 in April 2022 and a yearly low of $5.47 in December 2022.

You can buy LINK on exchanges like Coinbase.

10. Ripple (XRP) – Potential in Traditional Banking

Ripple is a decentralized network that has been on the sidelines for quite a while. The company has been embroiled in a court case with the SEC which caused exchanges and investors to steer clear of its token.

Despite these negatives, Ripple has already achieved a good degree of institutional adoption by enabling fast and secure cross-border payments and settlements.

With Ripple, payment solutions, companies, and institutions that send and receive money internationally no longer have to wait several days for settlement or tie up capital in various markets.

Ripple is not like other crypto projects that use a blockchain to record transactions. However, it still leverages decentralized and secure technology to create on-demand liquidity for its institutional clients.

The network is still very much in use and has potential when blockchain technology becomes more mainstream in the payments settlement space. Its native coin, XRP, has a total supply of 100 billion tokens, 50.9 billion of which are in circulation.

XRP trades at $0.36 as of writing with a 52-week high of $0.85 reached in March 2022 and a low of $0.31 in June 2022.

If you reside in the US, you may not be able to buy XRP at the moment as the SEC is suing Ripple Labs for its XRP token sales, citing them as unregulated securities.

11. Biconomy (BICO) – Seamless Multichain Infrastructure

Biconomy is a protocol that allows developers to build decentralized seamless multichain applications. Its goal is to make Web3 applications as easy to use as their legacy counterparts.

Decentralized crypto applications are plagued with multiple steps and procedures that get in the way of usability and could lead to loss of funds for users who do not have sufficient knowledge of various blockchain standards.

For example, transferring tokens cross-chain could be complicated for the uninitiated, and could lead to a loss of funds if done incorrectly. You’ll need to select the correct chains, the correct assets, and ensure you have enough for gas fees.

If you send an asset to a blockchain that doesn’t support that asset, you could lose it permanently.

Biconomy uses modules that are chainless in the sense that they do not rely on one single blockchain. They can make calls to various chains depending on what the developer wants to do.

This way, complex actions can be accomplished in a few clicks while the modules handle the underlying processes. With Biconomy. Developers can build gasless applications where users do not have to pay gas.

Instead, the dapp will have a gas tank and gas fees will be paid from that tank. The native token for this ecosystem is the BICO token which will be used to pay gas fees on the Biconomy blockchain and for governance.

BICO has a total supply of 1 billion units, 490.28 million of which are already in circulation. This is less than half of the total supply, so some sell pressure is expected at future token release dates.

As of writing, BICO trades at $0.32 with a 52-week high of $2.01 in April 2022 and yearly low of $0.26 in December 2022. You can buy BICO on Binance.

12. LIDO (LDO) – Leading Liquid Staking Protocol

Lido is a decentralized liquid staking platform that allows users to stake Ethereum, Polygon, Polkadot, Kusama, and Solana and earn rewards while retaining the liquidity that unstaked coins provide.

Liquid staking is a method of staking where locked tokens are made liquid through staking derivatives. Usually, staked tokens are locked in a contract for a period, thereby reducing supply, i.e. liquidity, as less tokens are available in circulation.

This liquidity could be used for other profitable ventures like lending. To get around this, liquid staking was invented. Staked coins are represented by derivative tokens that take on their properties, thereby retaining liquidity.

These derivatives represent the staked coins and can be used for virtually the same activities.

This method of unlocking liquidity became popular with the rise of PoS blockchains, especially when Ethereum made the first major leap to a PoS network. Over 8 million Ether was locked up and, as a result, there was less ETH in circulation to use for DeFi activities. Hence, liquid derivatives became necessary.

Here’s an example of how it works. When you stake ETH with Lido, you get a derivative token called stETH. So 1ETH equals 1stETH.

This derivative then takes on the value of the ETH that it represents and can be used as collateral for lending and participating in decentralised finance activities.

Lido is one of the largest liquid staking platforms as it holds $8 billion worth of ETH and its derivative, stETH, is one of the most recognised staking derivatives.

We must mention the Ethereum Shanghai update which unlocks the ETH2.0 contract, allowing people to withdraw their previously staked ETH. However, this should not affect the viability of platforms like Lido as people will always need to stake their ETH since the entire network is now proof-of-stake.

ETH holders will still want the rewards of staking ETH while being able to deploy their coins in other yield generating ventures. Hence, liquid staking has a bright future and so does Lido.

Lido’s native token, LDO, has a total supply of 1 billion tokens, 851 million of which are already in circulation. While some sell pressure is to be expected at future unlock dates, the majority of the tokens are already priced in.

LDO trades at $2.33 as of writing with a 52-week high of $4.93 in April 2022 and yearly low of $0.44 in June 2022. You can buy LDO on exchanges like Coinbase.

13. Rocket Pool (RPL) – Upcoming Liquid Staking Protocol

Rocket Pool is a liquidity staking platform with a lot of potential. It is an upcoming protocol in a growing space, so it has a lot of room to flourish.

The platform follows all the same rules and principles that we explained for Lido, however, it has healthier tokenomics and offers an opportunity to earn higher staking rewards by becoming a validator.

Rocket Pool has around 422,000 ETH staked and around 2,177 node operators. Like Lido, its staking reward is at 4.32% per year, based on a 7-day average.

However, Rocket Pool differentiates itself by allowing users to join its staking network by running a node. Unlike running a regular ETH node which requires at least 32 ETH, you can run a Rocket Pool node with only 16 ETH. When you do this, your reward increases to 7.14% per annum.

Rocket Pool has a native token called RPL with a total supply of 19.1 million tokens, all of which are in circulation. It trades at $36.89 as of writing with a 52-week high of $53.60 reached in February 2023 and a yearly low of $8.03 hit in June 2022.

You can buy RLP on exchanges like Binance.

14. Arweave (AR) – Leading Decentralized Storage

Arweave is a leading decentralized storage solution that allows you to store files on its blockchain-powered cloud, called the Permaweb. The project differs from other storage solutions by allowing people to store files permanently for a one-time fee.

However, it’s much more than a decentralized blob storage solution. Arweave’s network also acts as a data storage layer for decentralized applications, enterprise applications, websites, and even decentralized domains.

The Permaweb is blockchain agnostic. While it is built on its own blockchain, applications from other blockchains can use it as a data solution. As Web3 continues to grow, developers will ditch centralized data storage solutions for decentralized ones.

Arweave is the current leader in the space and has tremendous growth potential. Its native token, AR, has a maximum theoretical supply of 66 million units, 65.4 million of which are in existence.

The difference between maximum and total supply is that the maximum supply is the most coins that can theoretically be created on a blockchain while the total supply is the number of coins that exists.

However, because a token exists does not mean it is in circulation, which is why the circulating supply is always listed.

As of writing, 50.1 million AR tokens are in circulation which is about 77% of the total supply. This means that while some sell pressure is to be expected in the future due to token unlocks, it will not be strong enough to push prices lower.

This does not mean that prices cannot go lower. A downtrend in the market could pull prices below its current levels. However, major price declines due solely to more AR tokens entering the market is less likely.

AR trades at $7.88 as of writing with a 52-week high of $40.85 in April 2022 and yearly low of $ $6.18 in January 2023.

You can buy AR on exchanges like OKX.

15. Floki Inu (FLOKI) – Upcoming Memecoin Ecosystem

In the last two years, memecoins have grown beyond just being a gag or parody of more “serious” coins to a thing of a social phenomenon. Now, every blockchain ecosystem has a major memecoin.

Memecoin developers are also making strides towards creating ecosystems that provide more utility than great memes and social engagement. We’ve seen memecoins adopt yield generating tokenomics models (like Levi Inu), and even build layer 2 solutions, like Shiba Inu’s Shibarium.

Floki Inu started out as a meme coin but is now growing into a gaming and NFT ecosystem with a metaverse called Valhalla, an NFT marketplace called FlokiPlaces, and a DeFi platform called FlokiFi.

The Floki community is already 440,000 strong and could grow during the next bull run as funds flow back into crypto.

Floki Inu’s native token, FLOKI, has a total supply of 10 trillion tokens, 9.7 trillion of which are already in circulation. We must warn that tokenomics like this are usually a red flag, but in this case, 97.8% of the tokens are already in circulation and 42% of that has been burned.

We checked the Floki Inu coin contract on Etherscan and saw that 42.88% of the supply was in a dead wallet, i.e., they have been removed from circulation forever.

FLOKI trades at $0.00003728 as of writing with a 52-week high of $0.00005608 in February 2023 and a yearly low of $0.0000053 in June 2022.

You can buy FLOKI on decentralized exchanges like Uniswap.

How to Find the Next Cryptocurrency to Explode

Finding the next crypto to explode requires significant research, an understanding of the cryptocurrency market, and a finger on the pulse of developments in the space.

The best projects to consider are those that solve real problems in the crypto space or best replace legacy applications or processes with blockchain-powered solutions. This is the approach we’ve adopted.

Our list of the next cryptos to explode is quite different from what you’ll find on several other sites because we look past the hype to projects with solid fundamentals and sustainable business models.

Use Case

The first aspect of cryptos we consider is the problems that the project solves. We only consider projects that tackle important problems that are profitable to solve.

We’ve found that projects solving issues like adoption, value creation, liquidity efficiency, payments, and scalability perform better than others in the long term.

The market is also driven by narratives. Projects and platforms that are at the centre of a growing narrative tend to increase in value faster than their counterparts, and that often reflects in the price of their tokens. A good example is the AI narrative at the start of 2023.

AI projects like SingularityNet (AGIX) rose over 1000% between January and February 2023 because it was a major player in the blockchain AI space.

However, blockchain-powered artificial intelligence is not a narrative we see being sustainable, at least not now. So we turned our attention to more sustainable areas and narratives.

Four that are prominent this year are layer 2 networks, real-yield DeFi, decentralised trading and futures, and liquid staking. Compare these narratives to the popular problems areas we listed earlier and you’ll find that these narratives fall under one or more of value creation, liquidity efficiency, and scalability.

In essence, determine the major narratives and find either the top projects in that space or upcoming projects with potential.

Fundamental Qualities

The next aspect we look at are the fundamental qualities of the projects we narrow down. This includes their tech stack, how they solve problems, the people on the team, and how much funding they have.

As much as we love self-funded projects, VC-funded projects tend to perform better because they have the funds needed to scale quickly as well as the network needed to acquire clients or users.

We’ve come across situations where a project seems innovative but does not offer sustainable solutions. A good example of this is Terra whose solution to a decentralized stablecoin failed woefully.

On another hand, the way TUSD plans to solve the decentralized stablecoin problem is a lot more sustainable long term.

Tokenomics

When dealing with tokenomics, you must consider how many tokens the project has i.e. max or total supply, how those tokens are allocated, and how well they capture the value created by the ecosystem.

Projects with trillions of tokens are a red flag off the bat. Only memecoins are known to create so many tokens, and we all know that most memecoins are just shitcoins in disguise.

Next, how much of the tokens are allocated to the development team. Anything above 20% is a red flag, especially when the total supply numbers in the billions. If there is a fair deal of ecosystem development to be done, then the majority of tokens should be allocated to that.

Some projects create tokens for the sole purpose of governance. The value of the token is tied to the perceived value of the project. On another hand, some projects create tokens mainly for the purpose of raising funds. Again, this isn’t wrong, provided the token has more utility within the ecosystem.

Lastly, you need to determine if the tokens are inflationary or deflationary. Right off the bat, projects with a fixed token supply are deflationary while those with an infinite supply are inflationary.

The general rule is that inflationary tokens lose value over time while deflationary tokens increase in value over time. However, this is not always the case.

Projects with an infinite token supply can still exhibit deflationary mechanics if they can remove tokens from circulation faster than they mint new tokens.

For example, if a project with an infinite token supply decides to mint 50,000 new tokens every year, its mechanics are inflationary. However, if the project burns tokens used for gas fees, and is able to burn 60,000 tokens per year, then the number of tokens leaving circulation is more than the ones coming in.

Hence, the ecosystem experiences deflationary mechanics and, all things being equal, the value of the token should increase over time.

How to Buy the Next Crypto to Explode - Step-by-Step Tutorial

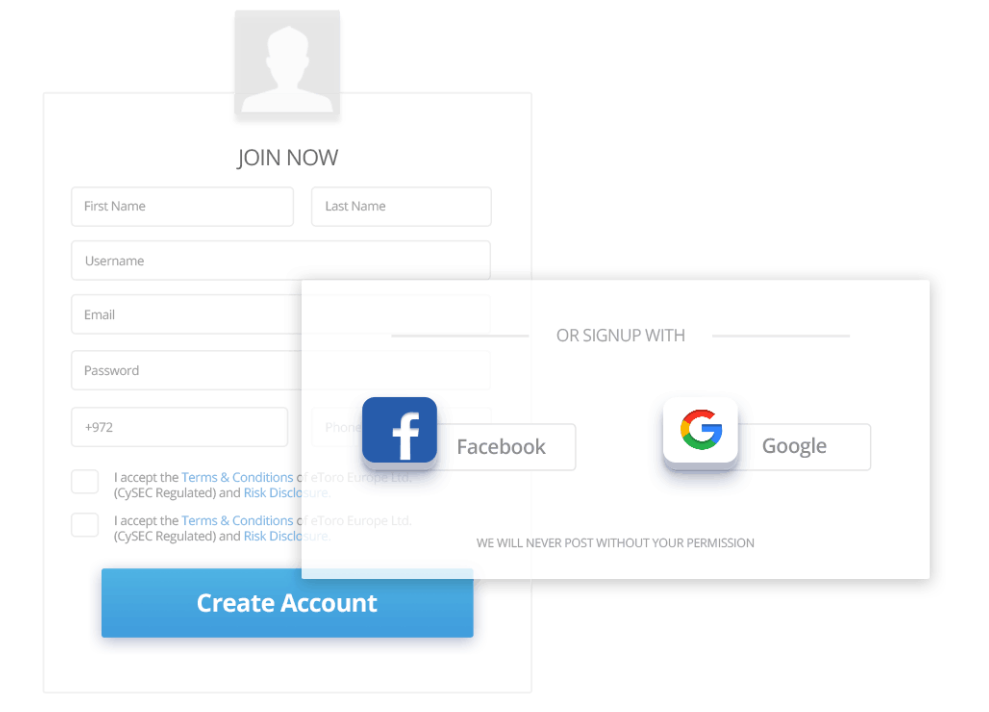

1. Open an account

Go to an exchange or broker like eToro and create an account. In the case of eToro, click on the Start investing icon. Alternatively, you can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

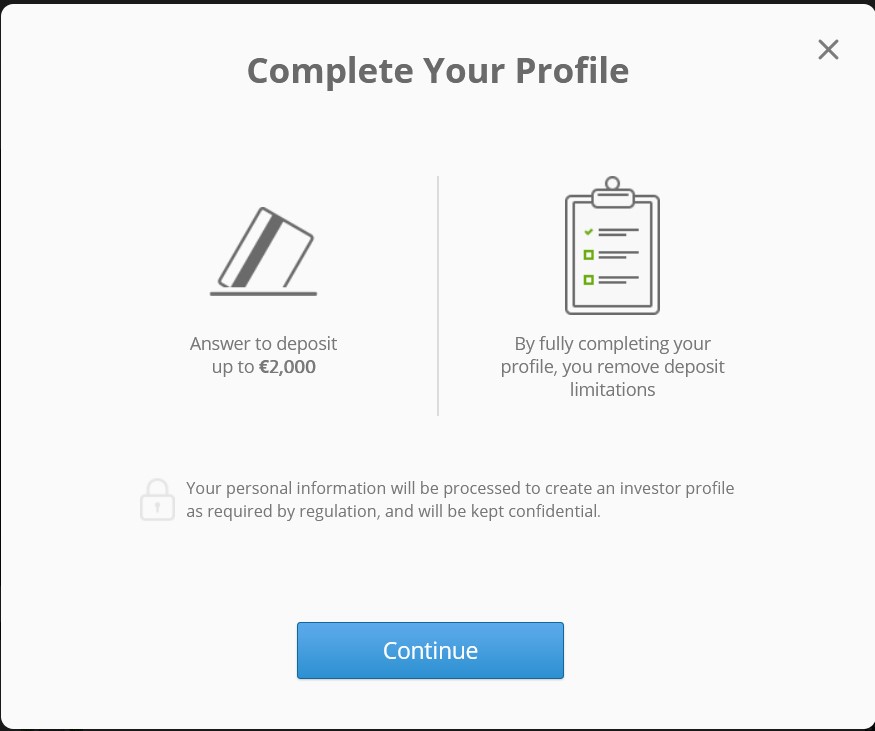

2. Verify your account

Next, verify your account with personal details like your date of birth and a passport photo. Then complete KYC by submitting an ID document like a driver’s licence, national ID, or voter’s card and proof of residence like a utility bill.

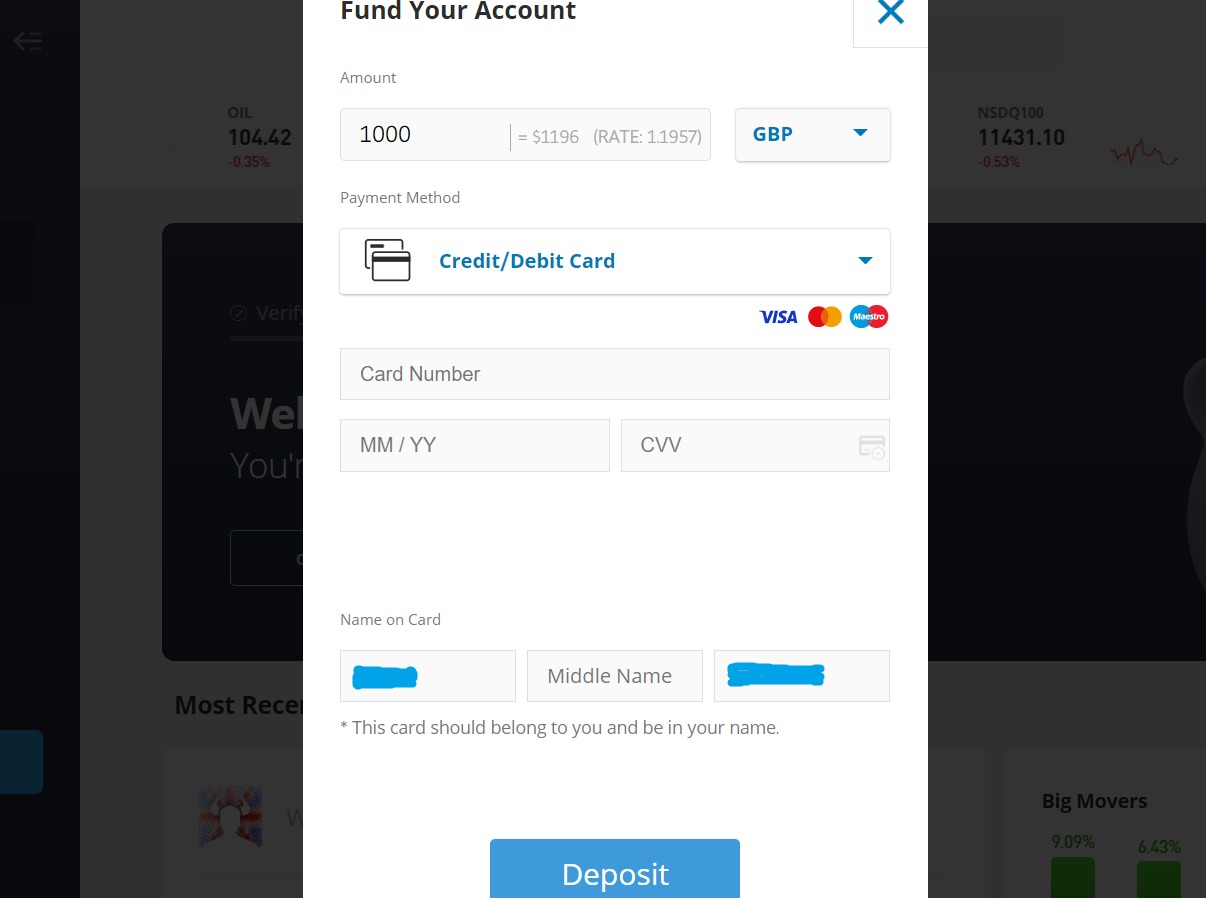

3. Make a deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose a convenient method from the drop-down menu and set the amount you’d like to deposit.

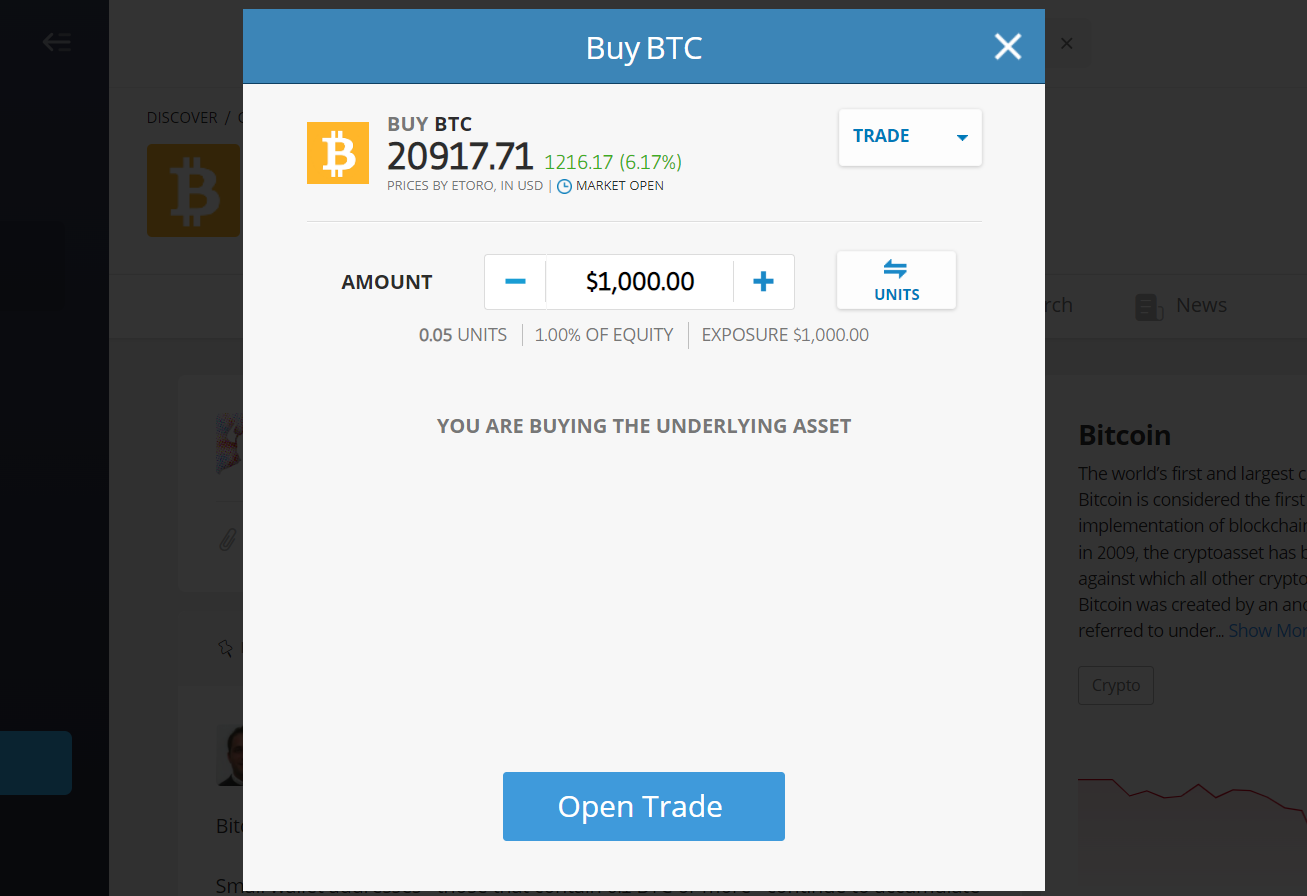

4. Buy crypto

Once your account is funded, search for any of the cryptos mentioned in the Discover tab. An interface like the one below should load. You can then set your parameters and buy.

Final Thoughts

We explored 15 of the most promising crypto projects that we believe could explode in 2023 and Ethereum was our top choice because it provides the infrastructure for most of the other cryptos listed.

It is also the largest ecosystem in the industry and has the highest total locked value around $26.2 billion as of writing. We do not see Ethereum going away anytime soon, and years in the industry have shown that the blockchain is not just another novelty.

We must also mention that Ethereum’s price may not explode as much as some others on our list. However, while we can only speculate on the sustainability of other projects, Ethereum runs a provably sustainable model.

To buy Ethereum, you can sign up on eToro or check out our best Ethereum exchanges page to inform your decision.

Methodology - How We Picked the Best Metaverse Coins

The tokens covered in this guide were chosen through rigorous research and reviews. We paid attention to security, transparency, reputation, tokenomics, and competitive edge.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Chainlink as the leading oracle infrastructure because it is the most used and most capitalised oracle provider in crypto.

Check out our why trust us and how we test pages for more information on our testing process.