10 Best Crypto Exchanges With Low Fees in 2025

The cost of trading goes beyond conversion fees to include other costs like financing and even account maintenance. The best crypto exchange with lowest fees are those that reduce the cost of buying crypto, ensuring that you keep more of your capital.

This guide explores the exchanges with the lowest fees that we found. Note that we mean the lowest overall cost of using that exchange, so while some trading fees may seem higher than others, we consider other fees in our review.

Best Crypto Exchanges With Low Fees - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 crypto exchanges with the lowest fees.

Best Crypto Exchanges With Low Fees - Key Metrics

Best Crypto Exchanges With Low Fees - Why They Made the Cut

Best Crypto Exchanges With Low Fees Reviewed

Key Things to Consider When Choosing a Low Fee Crypto Exchange

Security

Despite the focus being on crypto exchange fees, security is the first concern. The cryptocurrency trading exchange you choose should first be secure, then cheap. Ensure that you are aware of the security measures they take by looking out for security certifications like the ISO.

On your end, also use strong passwords to reduce the likelihood of an attacker figuring it out. Lastly, look out for two-factor authentication (2FA) which helps to prevent people from accessing your account even when they have your password.

Payment Methods

The best crypto exchanges funding methods have an impact on the total cost of using it. Cryptocurrency exchanges that incorporate local funding methods like local bank transfers in the regions they operate are usually cheaper than those global crypto exchanges that rely on international methods like wire transfers and credit card payments.

Also check whether the crypto exchange charges fees for using certain funding methods. For example, Binance charges 1.8% for credit card deposits. If you also get charged by the credit card company, you’ll have to pay twice any time you wish to deposit.

Asset Selection

Asset selections are important because a crypto exchange with a wide collection will be cheaper in the long run, especially if it lines up with other considerations. Most crypto exchanges usually have the major cryptocurrencies like Bitcoin, Ethereum, and Ripple.

However, global crypto exchanges usually offer more coins than regional ones. The trick here would be finding a global exchange with at least one cheap funding method that you can always use. Usually, one that has the major coins and some exotics.

Alternatively, you can check local crypto exchanges to see if they have the coins you want and get exotics on decentralized exchanges.

Trading Fees

While all the centralized exchanges and decentralized exchanges on this list have low fees, some are lower than others. For example, Binance charges 0.10% per trade while Binance alternatives like eToro charges 1%. However, deposits on the latter are free while the former are not.

This comparison shows that while cheap trading fees are important, they shouldn’t be considered alone. Also, the type of crypto exchanges you go for should be in line with your goals.

For example, if you’re an investor who buys crypto once in a while and holds by storing crypto, you may not be worried about a 1% conversion fee. The main concern may be the transaction fees from transferring funds in and out of your exchange. In this case, eToro works for you.

If you plan to deposit a lump sum and trade frequently with a large trading volume, then crypto exchanges like Binance may be more suitable for you.

KYC Requirements

This goes hand-in-hand with security. If the security and 2FA features are the technical aspects, then KYC is the legal aspect. Money Transfer Businesses and other forms of electronic money services are required by law to carry out KYC.

The only cryptocurrency exchange services that do not do this are decentralized exchanges because they only use your crypto wallet address. Provided the exchange is a centralized exchange, operates bank accounts, and stores crypto assets on your behalf, they must have KYC procedures.

What Are the Different Types of Crypto Exchanges?

There are various types of crypto exchanges in categories like geographical coverage, custody, and digital assets offered

Custodial Framework

Centralized Exchanges

Centralized exchanges are exchanges that work like a bank, asset management firm or broker. Also called custodial exchanges, they hold your crypto for you and allow you trade crypto them on their platform.

These are the exchanges you usually hear about because they are the first point of contact between people and the crypto market. A centralized exchange operates under the jurisdiction of regulatory agencies and usually offer a smooth trading/investing experience without technical or blockchain know-how.

Decentralized Exchanges

Decentralized exchanges are blockchain-native exchanges that do not hold user funds or require them to pass KYC requirements. They are currently not under any governmental jurisdiction, at least not in the way their CEX counterparts are.

A decentralized exchange will stay true to the ethos of decentralization and privacy by allowing anyone with a compatible blockchain wallet to trade cryptos. As such, they are not bound by local or regional laws and barriers.

These crypto exchanges are powered by smart contracts, which are immutable lines of code that perpetually run once deployed on a blockchain. Usually, everyone can see the code and determine if it is honest and secure. However, only those with the technical know-how can understand what they read.

DEXes are much riskier than centralized exchanges as they do not take steps towards user protection asides the security that blockchain applications provide. However, these cryptocurrency exchanges are also free from much of the ethical issues that plague centralized finance.

Geographical Reach

Regional and Global Exchanges

Regional exchanges are crypto exchanges that serve a particular country or region. They are usually characterized by a smaller coin selection, usually below 300 cryptos and limited support for international fiat currencies.

For example, Bitpanda caters mostly to users within Europe. Middle Eastern, African, and Asian countries cannot access the service.

On the other hand, global cryptocurrency exchanges offer services to users in various counties. They may not reach every country, but they are usually widely used. For example, Coinbase offers services to over 150 countries, while Binance reaches even more.

Assets Offered

When it comes to assets offered, we have the best crypto exchanges and brokers. Exchanges offer crypto assets like coins while most brokers offer crypto derivatives like contracts for differences (CFDs), Futures, or Options.

While some exchanges, like Binance, also offer derivatives, the major difference is that brokers do not offer the crypto asset, only the derivative. Some good examples are Capital.com and Skilling.

These brokers are geared more towards core traders who wish to buy crypto for short term, profit from crypto’s volatility but are not interested in owning them for the long term.

What Fees Are Involved?

The major fees involved with crypto exchanges are trading fees and financing fees.

Trading fees could be commissions, spreads, or both. For example, Binance charges a flat 0.1% commission for exchanges while Capital.com charges a 60 pip spread. In this case, Binance has the lower fee as it charges $1 for a $1000 trade while Capital.com charges $6 for the same amount.

However, Capital.com’s standardised lot sizing may be appealing to more traditional traders. Some brokers use raw spreads and charge a commission, which is usually popular among traditional traders.

Financing fees are the charges levied on deposits and withdrawals. While some exchanges have low trading fees, their deposit fees make them more expensive overall. For example, while Capital.com may charge higher trading fees than Binance, they also offer free deposits and no withdrawal fees while Binance does not.

Service providers also play an important role in financing fees. While Capital.com may not charge for deposits, your credit card company might. In this scenario, regional cryptocurrency exchanges may have an advantage over global brokers as they usually offer local transfer options which could be free.

How to Use a Crypto Exchange With Low Fees - Step-by-Step Tutorial

1. Open an Account

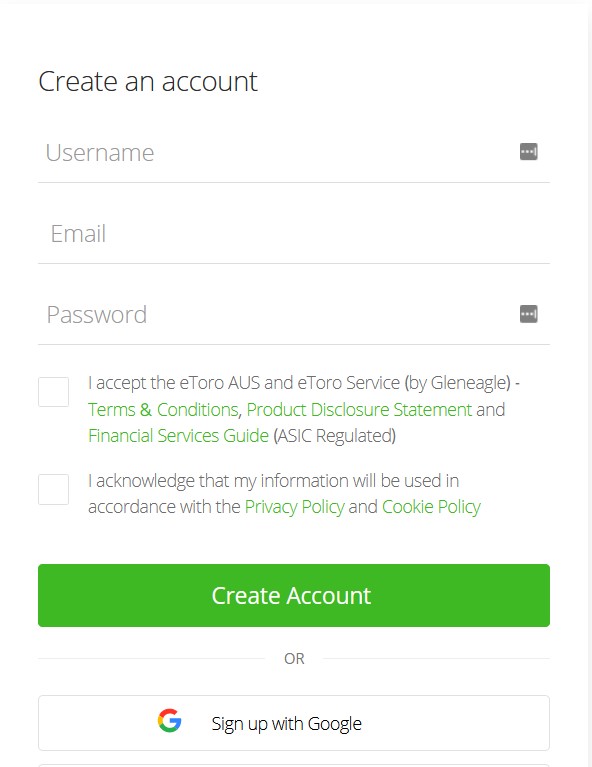

Navigate to the eToro website and click on Start investing. Fill out the form with your full name, email address, and password.

2. Verify Your Account

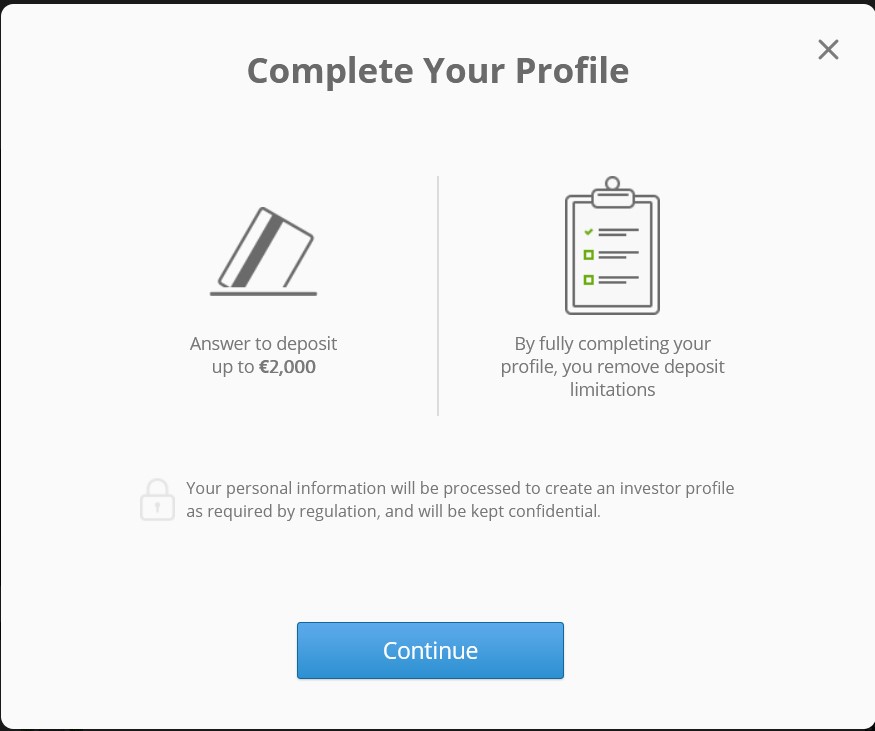

Verify your account by submitting KYC documents like a proof of ID (National ID or driver’s licence) and proof of residency (utility bill). Then, finish setting up your profile.

3. Make a Deposit

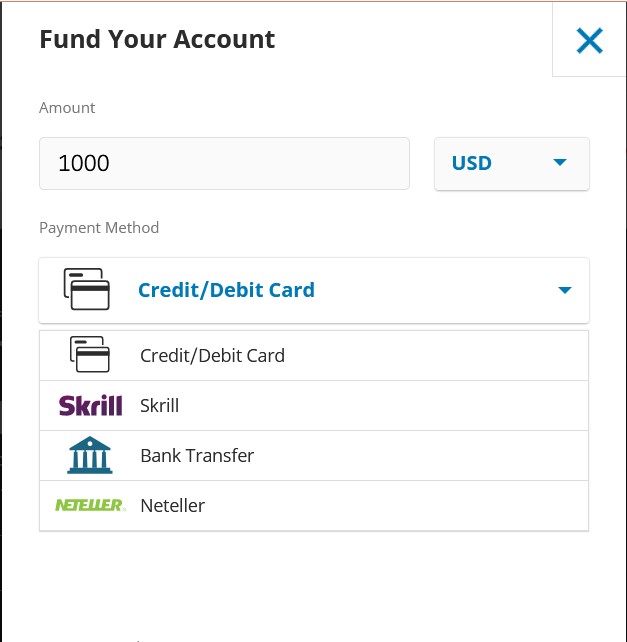

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose one and set the amount you’d like to deposit. The minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software. Set your parameters, like a buy or sell price and set your order.

Final Thoughts on the Best Crypto Exchange With Lowest Fees

We explored the lowest fees crypto exchanges and chose eToro as our overall best choice because it has one of the best overall user interfaces and transparent fee structures.

Exchange fees on eToro are 1%, deposits are free, while withdrawals under $30 are free.

The exchange is more directed to investors which happens to be a majority of crypto users.

Nonetheless, all exchanges on our list offer low fees overall. Some worthy mentions are Binance with the lowest exchange fees at 0.1%, Capital.com with free deposits and withdrawals, and Bitstamp that doesn’t charge for trades under $1000.

To start trading with cheap exchanges, sign up with eToro.

Methodology - How We Picked the Best Crypto Exchanges With Lowest Fees

The platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, trading fees, deposit and withdrawal methods, coin selection, and trading facilities.

The platforms listed are the best we found in the various categories we listed them. For example, we found that Bitpanda had the lowest fees for limit orders and hence named it the best option for limit orders.

Check out our why trust us and how we test pages for more information on our testing process.