XLM/USD price is approaching psychological $0.1 as analyst points to potential rally in the altcoin

Several digital assets have seen their respective prices surge in the past few days, with standout tokens being those in the DeFi field, as well as Cardano and Dogecoin.

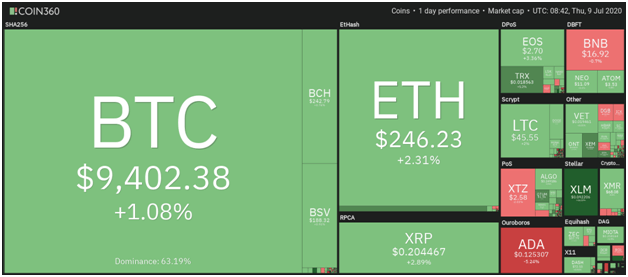

While Bitcoin’s price has come close to breaching $9,500 on the day, its performance has been dwarfed by surprise moves that saw Dogecoin spike over 50% on July 8. Other coins like Chainlink and Cardano posted huge gains, although the latter has hit resistance and is likely to dip short term.

This has caused Bitcoin’s dominance index to fall due to growing altcoin prices.

Total market capitalisation is $276 billion with $173 billion taken up by Bitcoin, causing its dominance to drop to 62.7%.

According to Nicholas Marten of DataDash, altcoins have now crossed the resistance line in the dominance metric; the first time this has happened in more than two years. It is indicative of the growing strength in the altcoin market, with most digital assets seeing increased bullishness over the past several days.

As of writing, Ethereum, Ripple, Litecoin, Bitcoin Cash, EOS, Bitcoin SV and TRON are all trading in the green. Stellar is by far the biggest gainer among the top cryptocurrencies earning double-digit gains in the past 24 hours.

Notably, Cardano and Tezos are trending south but are still positive in weekly performance due to their tremendous price surges over the past few weeks.

Stellar soar 16% to lead top altcoins

The price of Stellar Lumens has surged more than 16% in the past 24 hours; more than 30% over just two days.

XLM/USD has been showing consistent signs of turning bullish with what appears to be taking concrete shape given the pair is now approaching $0.1.

The token’s uptrend began materialising in late June after bulls rallied from a low of $0.06 on the back of strong rejection at $0.09.

On the daily charts, XLM/USD is well above the 50 and 100-day MA, with healthy support provided by the 200-day MA.

Stellar is currently exchanging hands at $0.092, meaning that holding support above this level will be key to keeping upside momentum. As noted, a fierce rejection will likely find buyer support at $0.06