BTC/USD and ETH/USD have broken above crucial hurdles and will look to pump further to strengthen footing above $9,500 and $260 respectively

Bitcoin has climbed above $9,500 while Ethereum has soared to $269, with the crypto market green on Thursday morning.

This represented Ethereum’s highest price level since the mid-March price collapse — a period that saw bears restrict prices below $246.

Other top coins to see a significant pump in the past 24 hours include XRP (+3.6%), Bitcoin Cash (+4.5%), Litecoin (+3.9%), IOTA (6%) and TRON (+3%). ChainLink also surged by more than 7% to continue its remarkable market performance.

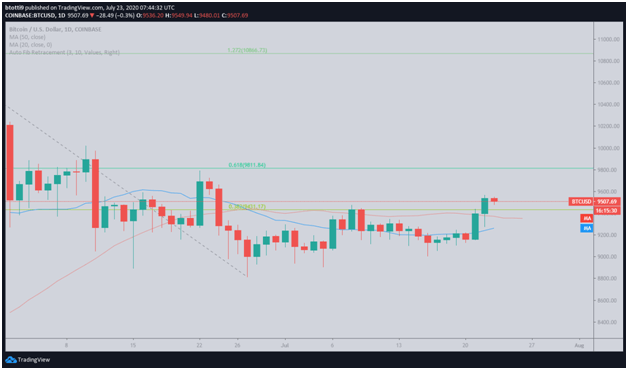

Bitcoin price movements

The price of BTC/USD has broken above $9,500 for the first time in weeks and optimism is back regarding attempts to break $10,000 once more.

The spike from $9,391 to $9,529 means bulls can eye up a run to $9,700, with a potential break above $9,780 setting bulls for a retest of prices near the psychologically significant $10k. However, the upside faces a major hurdle as the 61.8% Fibonacci is at $9,811.84

It is likely, therefore, that bulls may initially fail to consolidate and move into the aforementioned price zone.

If that happens, subsequent downsides for BTC/USD have immediate support at the 38.2% Fibonacci retracement level and the SMA 50 and SMA 20 found at $9,263 and $9,372.

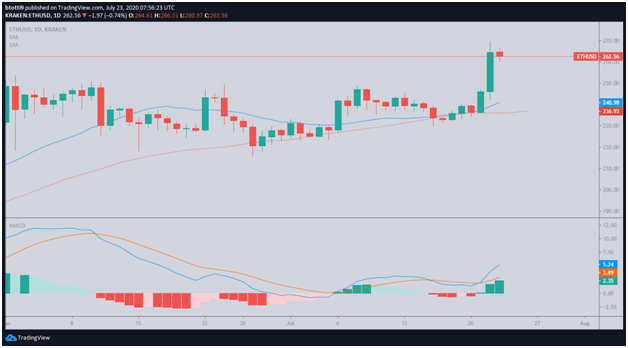

Ethereum price analysis

The price of ETH/USD has surged by more than 9% in the past 24 hours and currently trades around $263 after coming close to $270.

Ethereum bulls have been trying to build momentum for a rally above $246 and yesterday’s pump presented that opportunity; ETH/USD went past two key barriers — the psychological $250 and major resistance at $260.

As of writing, Ethereum bulls are in control with prices poised above $264. A revisit of $280, therefore, will be achievable in the coming trading sessions.

The area might prove difficult to surmount, but buyers might be encouraged by the MACD that is printing a bullish divergence on the daily chart.

The RSI is in slight decline, turning away from its overbought territory. Buyers will, therefore, be keen to establish a foothold above $260. An immediate reversal will see buyers look to defend $250 as this means they retain the opportunity to break higher in the next few trading sessions. A dip at this level means prices could tank to lows of $245.