The 10 Best Crypto Arbitrage Bots for Trading in 2025

Crypto arbitrage is a way to make money from the market without speculating. The trick is to buy low and sell high, but to do it across exchanges where prices are already set. Crypto arbitrage bots automate this process and has become a viable method to profit with low risk.

However, with many tools in the crypto market, there are scams and low-quality options that market themselves as the creme of the crop. Our guide walks you through 10 of the best crypto arbitrage bots on the market.

We highlight their functions, pros and cons, features, and render a verdict for where they are worth using.

The Best Crypto Arbitrage Bots in 2025

- 3Commas – Best Overall Choice

- Coinrule – Best Bot for Custom Trading Rules

- Bitsgap – Most Versatile Arbitrage Bot

- Cryptohopper – Crypto Bot with Powerful Features

- Quandency – Crypto Bot with Advanced AI

- HaaSOnline – Best Crypto Bot Scripting Platform

- Gimmer – Best Bot for Digital Wallets

- Gunbot – Best Bot with Privacy Features

- Pionex – Best Exchange with Arbitrage Bot

- Kryll – Best Crypto Arbitrage Bot with Mobile App

Best Crypto Arbitrage Bots - Our Top 3 Picks

Looking for a quick answer? Here are our picks for the best crypto arbitrage bots.

Our 10 Best Crypto Arbitrage Bots Comparison

| Bot | Price | Exchanges Supported | Platform |

| 3 Commas | From $4/month | 16+ | Web |

| Coinrule | From $29.99/month | 8+ | Web |

| Bitsgap | From $23/month | 19+ | Web |

| Cryptohopper | From $16.58/month | 17+ | Web |

| Quandency | Free for token holders | 6+ | Web |

| HaaSOnline | From $7.50/month | 22+ | Web |

| Gimmer | GMR tokens | 8+ | Desktop |

| Gunbot | From 0.014BTC | 10+ | Desktop |

| Pionex | 0.02% – 0.1% | 16+ | Web |

| Kryll | Dynamic | 9+ | Web, Mobile |

Our Top 10 Best Crypto Arbitrage Bots Reviewed

1. 3Commas – Best Overall Option

3Commas is one of the most popular trading bot providers in the crypto industry. The company provides trading bots that connect to more than 16 crypto exchanges and are useful for various market conditions.

There are bots that are built to trade specific coins, like the Ripple bot which allows you to set strategies to trade Ripple across all supported exchanges.

3Commas prides itself on being easy for beginners to use by offering a plug-and-play setup. All you need to do is sign up for an account, select the coins you wish to trade, select a strategy, select an exchange, and run the bot.

A library of strategy templates, learning materials, a crypto trade signal service, and even integrations with TradingView are available to use.

Pricing starts from $4/month for the beginner plan with limited functionality. The next tier is the pro plan at $37/month, and then the expert plan at $74/month.

Pros

- Powerful integrations

- Multiple exchange connections

- Cheap starting plan adequate for beginners

- Multiple types of bots for available for multiple strategies

- Easy-to-use platform

Cons

- Not free to use

- Could have a learning curve, especially for more complicated strategies

Features

- Trading terminal for automating trades

- TradingView integration for controlling bots using chart signals

- Integrations with 16+ major exchanges

2. Coinrule – Best Bot for CCustom Trading Rules

As the name suggests, Coinrule is a trading bot that allows users to create and deploy trading rules. A bot then executes these rules judiciously to generate profit. These rules could range from boilerplate ones like riding the trend to more sophisticated rules involving indicators.

The company was founded by a group of crypto enthusiasts who love bot trading and wanted to help retail traders compete with hedge funds. Coinrule is their solution.

The interface is quite easy to use and allows you to create strategies across multiple exchanges (great for arbitrage). If you are not sure how to create a rule, there are guides that walk you through the process.

If you still feel unsure, you can buy strategies from other users and test them before deploying them on the live market. To begin, open an account and register for a plan, which is free for starters but limited.

Paid plans start at $29.99/month and go up to $449.99/month for premium features.

Pros

- Flexible bots

- Free starter plan

- Connects to multiple exchanges

- One bot can be programmed to accommodate multiple coins

Cons

- Pro plan is expensive

Features

- Wide library of trading strategies

- Highly customizable

- Simple interface

- TradingView integration

3. Bitsgap – Most Versatile Arbitrage Bot

From automated trading to algorithmic orders and portfolio management, Bitsgap is a crypto trading bot that does it all. The bot has a user base of 500,000 users and 4.3 of 5 stars on TrustPilot.

The bot also has impressive stats like $300 billion in total volume traded, over $2 million in profit in each of its major bot types, and over 3.7 million bots started by users. It seems that Bitsgap truly does have something for everything.

Arbitrage traders can take advantage of the smart trading feature that can execute algorithmic orders across 16 major crypto exchanges, allowing them to take advantage of price discrepancies.

Traders who do not know how to get set up strategies can read through the site’s resource section for blogs and guides on how to get started building custom strategies.

Pricing starts at $23/month if you pay for a year upfront or $29/month for monthly plans and goes up to $119/month for pro plans. However, the basic plan includes unlimited smart orders which is what is needed for arbitrage.

Pros

- Affordable plan for arbitrage

- Has a mobile app

- Strategies are stored on the cloud and can be accessed from anywhere

- Has a demo mode for practice

- Supports crypto payments for plans

Cons

- Funds must be available on both exchanges to run arbitrage

Features

- Automatic portfolio management

- Email and live chat support

- TradingView integration

- Mobile app

4. Cryptohopper – Crypto Bot with Powerful Features

If you’re looking for a crypto arbitrage bot that allows you to connect to all your exchange accounts simultaneously, manage your portfolio across accounts as a whole, and even allows you to execute market-making trades, then Cryptohopper is a strong contender.

The bot offers pretty impressive features and integrations. Right off the bat, we noticed that the bot offered a social trading feature that allows you to copy the trades of other successful users.

We peeked into some pro tools and found its arbitrage feature that allowed us to execute arbitrage trades within one exchange and across multiple exchanges. Thanks to the bot’s advanced technology, you don’t need to withdraw from one exchange to sell on another, provided both exchanges are sufficiently funded.

Another great feature of Cryptohopper is its pricing structure. The basic package called the Pioneer plan, is free and allows you to open 20 positions per exchange. However, to execute arbitrage trades, you’ll need to upgrade to an Explorer plan which is $16.58/month if you pay for a yearly plan.

Pros

- Arbitrage capabilities across exchanges

- Market-making capabilities across markets

- Affordable pricing plans

- Portfolio management across multiple accounts

- Easy-to-use tools for beginners

- Sophisticated tools for professionals

Cons

- No arbitrage capabilities on the free plan

Features

- Single and cross-exchange arbitrage bots

- Social trading features

- Copy trading features

- AI bots that learn and adapt

- Portfolio management features

5. Quandency – Crypto Bot with Advanced AI

Quandency is a crypto trading bot with a smart order router that sources liquidity from both centralized and decentralized exchanges. It is a great option for traders who wish to execute orders at the best price.

Quandency has a list of features that make it attractive to both speculative and arbitrage traders. A good example is its AI trading platform called Cody which converts high-level text into trade instructions.

For example, you could tell Cody to buy Bitcoin if the supply is halved. Cody then listens for halving events and sets buy orders when Bitcoin is halved. This tool allows you to automate arbitrage by simply telling Cody what you want to do.

The platform is connected to major exchanges like Binance, Coinbase, OKX, Kraken, and KuCoin, and can execute trades on multiple crypto exchanges from one trading terminal.

Pros

- Advanced AI assistant

- Smart order routing helps get the best price

- Access decentralized liquidity sources

- One pricing plan

- Yearly yield on native token

Cons

- Not as many features as some others

Features

- Advanced AI assistant

- 24/7 email and live chat support

- Smart router for centralized and decentralized exchanges

- Yield-bearing native token

6. HaaSOnline – Best Crypto Bot Scripting Platform

HaaSOnline is a crypto trading platform with an impressive list of features and even more impressive stats. The platform has processed 35.9 million trade orders worth $2.7 billion, has 35,644 active traders, and is currently running 74,108 bots for its users.

Diving into its features, we found that the platform has a custom editor that allows you to build bots from scratch with programming flexibility thanks to its scripting language, called HaasScript.

Beginners can use the bots available to run strategies and automate trades from the terminal. The terminal seamlessly connects to 22 major exchanges and can run strategies across them.

Where pricing is concerned, HaaSOnline offers three packages, the Lite+ which is $7.50/month if you pay annually, the $40.83/month Standard plan, and the $82.50/month Pro plan.

Pros

- Straightforward platform that is easy to use

- HaasScript brings flexibility and powerful customization capabilities

- Wide exchange integration great for cross-exchange arbitrage

- 3-day free trial period

Cons

- Not as many features as some others

Features

- Live chat and email support

- Scripting language for programming bots

- Backtesting and paper trading support

- Market research and insights

7. Gimmer – Best Bot for Digital Wallets

Gimmer is a crypto trading bot that takes a unique approach to building and buying bots. The platform does not use a subscription-based model, instead, it uses a native token, called GMR, to buy bots.

You can use a free bot with limited functions like one indicator and one crypto pair, or you can use GMR to buy a bot and customize it to work with your strategy, including arbitrage.

The platform is integrated with major exchanges so arbitrage trading can be executed seamlessly, and if you do not know how to program bots, you can rent an arbitrage bot on the platform’s marketplace, called the Bot Store.

Finally, the bot platform is somewhat decentralized and requires you to download the application on your computer. Once done, you can connect your crypto wallet to your bot to trade.

Pros

- Decentralized features aid security

- GMR tokens can easily be bought on decentralized exchanges

- Multiple exchange integration makes arbitrage execution easy

- Crypto wallet integration makes funding easy

Cons

- Setup may be more complicated than others

Features

- Crypto wallet integration

- Multiple exchange integration

- Bot strategy store

- Backtesting features

- Social features

8. Gunbot – Best Bot with Privacy Features

Gunbot is an advanced bot platform that is multi-platform, secure, crypto native, and has the versatility to run strategies. The bot is suitable for users from all experience categories, from plug-and-play strategies for beginners to custom code for advanced users.

The platform runs on MacOS, Windows, Linux, and Raspberry Pi and stores API keys on your device so your bot remains secure.

Bots can connect to 10 major exchanges and manage multiple accounts simultaneously. You can access preset strategies or create your own. Gunbot’s bots are capable of trading an almost limitless number of pairs simultaneously.

Pricing is unique on Gunbot as tiers are not subscription-based. Instead, they are one-time lifetime licensing fees. The cheapest is the Gunbot Standard tier which is 0.014 BTC as of writing. The next is the Gunbot Pro which is 0.025BTC, and then the Gunbot Ultimate which is 0.02BTC.

Pros

- Locally run bots enhance privacy

- 20+ presets available

- Pricing is for life, making it potentially cheaper

- Unlimited customization for bots

- Integrated with 10 major exchanges

Cons

- Setup can be more complicated than cloud-based versions

Features

- Privacy features

- DeFi integration

- Email support

- Unlimited trading pairs

9. Pionex – Best Exchange with Arbitrage Bot

Pionex is a crypto exchange with a global reach thanks to its users in 100 countries that contribute a monthly volume of $50 billion through 100 million daily transactions across 379 cryptos.

The exchange offers a suite of trading bots with specialized functions. There are DCA bots that buy crypto on the way down to reduce acquisition costs, rebalancing bots that create and rebalance custom-built indices, and arbitrage bots that execute arbitrage trades.

Pionex’s arbitrage bot uses ETH to perform arbitrage activities, but not between exchanges. Instead, it uses the Spot and Futures markets to take advantage of funding fees. To learn more, read about Pionex’s arbitrage bot.

Pros

- Easy to set up

- AI tool for creating custom arbitrage strategies

- Wide global reach

- Can trade Spot and Futures markets for arbitrage

- Offers 16 free trading bots

Cons

- You may need to create a custom strategy for spatial arbitrage

Features

- AI tool for creating trading strategies

- Live chat and email support

- Mobile app support

- Futures contract support

- Email and live chat support

10. Kryll – Best Crypto Arbitrage Bot with Mobile App

Kryll is a crypto trading bot with a host of features that make it attractive, not just for the arbitrage trader, but also for various types of crypto traders. The bot is quite versatile with connections to external triggers and signals.

The bot is integrated with nine major crypto exchanges, more than enough for spatial arbitrage strategies, and maintains a marketplace of 250+ strategies that newbies can buy instead of having to build one.

If you wish to create a custom trading strategy to beat the market and other arbitrage traders, you can do so with the no-code trading bot editor and use webhooks to enhance your bot with external market data.

Finally, you can run strategies on the go with the mobile app which is available on the App Store and the Play Store. Pricing is unique as there is no monthly or yearly subscription fee. Instead, the platform adopts a pay-as-you-go model where you can calculate the cost by inputting into a calculator the amount you wish to trade and for how long.

If you hold KRL, the platform’s native token, you get discounts.

Pros

- Easy-to-use platform

- No code editor allows you to build custom strategies

- Pricing is as you use, so money isn’t wasted

- Mobile app for remote access

Cons

- May need to create an arbitrage strategy

Features

- Mobile app

- Native cryptocurrency

- Email customer support

- No-code trading editor

What is Crypto Arbitrage as a Method of Investment?

Crypto arbitrage is a method of profiting from price discrepancies across various exchanges or markets. It is, however, not a method of investment. In truth, it is a method of trading that takes advantage of gaps in prices in the same crypto across various exchanges.

While crypto prices are generally within the same range across all exchanges, there are slight differences due to the balance of cryptos in each exchange’s liquidity pools. These differences can be as little as $0.5 or as large as $2,000.

Arbitrage is the act of finding opportunities where the price of a specific crypto is higher on one exchange than others. You can then buy the crypto on the exchange where it is cheaper, transfer it to the exchange where it is more expensive and sell it for a small profit.

Some traders are able to do this multiple times or for large amounts of money, which translates to substantial profit.

What is a Cryptocurrency Arbitrage Bot?

A crypto arbitrage bot is an algorithm that scans the prices of cryptos across various exchanges, spots when the prices differ, and, if programmed to, buys on the cheaper exchange and sells on the more expensive exchange.

The point of cryptocurrency arbitrage bots is to automate the process of checking for price discrepancies and executing trades with superhuman speed and accuracy. These bots are usually plugged into multiple exchanges simultaneously and can easily move funds.

The Increase in Popularity of Using Crypto Arbitrage Bot Trading

The use of bots for trading in general has increased as people believe that they provide an easier way to take advantage of the markets. Arbitrage is an even safer mode of trading as you are not speculating, but simply taking advantage of opportunities that already exist.

Most arbitrage bots can calculate the amount of profit you’ll make before executing a trade, so you know the outcome of your endeavors before executing them. Depending on the degree of disparity, you could make a significant profit before the market corrects.

Does a Trader Need a Crypto Arbitrage Bot to be Profitable?

A trader does not need a crypto arbitrage bot to be successful, but it sure does help. Traders can compare prices across exchanges manually and move funds from cheaper to more expensive exchanges, however, this can be time-consuming and physically tasking.

Bots automate this process. And because they can be programmed to watch prices around the clock, they unearth more opportunities and execute with more precision.

Why Choose Crypto Arbitrage Bots Over Traditional Crypto Arbitrage??

Speed

One of the main reasons why people use arbitrage bots is because they can execute trades faster than humans. Because many of them are plugged into multiple exchanges, they can bundle trades and execute them as one trade so that you can profit before price moves.

Automation

With arbitrage bots, you can automate parts (if not all) of the arbitrage process. The bot can be programmed to constantly watch cryptos for price discrepancies and calculate projected profit and cost beforehand.

The Different Methods of Crypto Arbitrage

Spatial Arbitrage

Spatial arbitrage is a method of arbitrage that involves searching for price discrepancies in different geographical regions. The price discrepancies can be a result of regional factors affecting prices on an exchange.

For example, say the price of Bitcoin is $26,000 in the US, but $27,000 in Japan due to low liquidity or a new policy that limits the number of exchanges that can sell Bitcoin within the country.

In this scenario, you could buy one Bitcoin for $26,000 in the US, send it to Japan, and sell it for $27,000, thereby profiting $1,000. Of course, this requires that you have access to Japanese exchanges.

Triangular Arbitrage

Triangular arbitrage takes advantage of exchange rate discrepancies between three currencies. In crypto, it usually involves the differences in exchange rates between cryptos and fiat or stablecoins.

An example is swapping between USDT, BTC, and ETH. You’d swap between USDT and BTC, then from BTC to ETH, and then ETH to USDT. The goal is to take advantage of any price discrepancies in exchange rates that will net a profit.

Triangular arbitrage traders usually use computers and sophisticated algorithms to achieve this type of trading, hence where bots can come in.

Statistical Arbitrage

Statistical arbitrage involves using statistical and probability models, mean reversion, and computational power to run algorithms that invest in a diverse portfolio of assets for a very short period.

It is the most complex and mathematically intensive of the three methods and is not usually carried out by retail traders.

Pros and Cons of Using a Crypto Arbitrage bot?

Pros

- Ease: Crypto arbitrage bots simplify the process of arbitrage. They can automatically spot price discrepancies, calculate the profit and cost involved and notify users or execute trades when programmed to. Hence, these bots allow traders who have little to no experience with arbitrage to start earning from it relatively quickly and easily without putting in as much effort as one who does it manually.

- Accuracy: Crypto arbitrage bots are more accurate than humans, especially in their calculations and executions. They can spot small fluctuations in price and constantly update their models to accommodate these changes. Because of the speed at which they execute trades, crypto arbitrage bots can calculate, to the third decimal place, the profit margins on opportunities.

- Profitability: Crypto arbitrage bots are becoming popular because they can be wildly profitable, although the amount depends on the size of price discrepancies and the volume being traded. Still, bots are generally profitable as arbitrage is said to be a low risk venture.

Cons

- Oversaturation: Oversaturation could happen when multiple arbitrage bots are running similar strategies thereby closing up price discrepancies at a much faster rate. For example, if multiple bots run spatial arbitrage between the same two countries, supply in the country where price is higher will rise to match demand, thereby closing the price gap.

- Flash Crash Vulnerabilities: Crypto arbitrage bots can also be susceptible to flash crashes. While this occurrence is rare, it can be devastating, depending on the volume of funds traded and the extent of the crash.

- Volatility: Crypto arbitrage depends on volatility because stable markets are efficient, so price discrepancies are more likely to show up in volatile markets. While markets can (and do) become volatile periodically, it is not guaranteed that every volatile market will present opportunities.

What Crypto Coins can be Traded with a Crypto Arbitrage Bot?

The coins that can be traded depend on the bot being used. Crypto arbitrage bots usually have a range of cryptos that they can trade which usually cover the major coins that have sufficient daily trading volumes and are available in various markets.

Some crypto coins that can be traded include:

Is This Method of Crypto Trading Legal?

Crypto arbitrage is legal wherever crypto trading is legal. There are no special laws that govern crypto arbitrage, however, you need to be sure what type of securities your chosen bot trades.

For example, crypto trading is legal in the UK, but crypto CFD trading is not. Hence, if your bot uses CFDs to execute arbitrage trades, you may be infringing on the law.

Some Pointers on How to Do Crypto Arbitrage Bot Trading

- Focus on coins with high liquidity: The best coins to use for arbitrage are popular ones that have lots of liquidity so you can trade high volumes easily without causing too much of an impact on price.

- Avoid overly volatile markets: In times of high volatility, prices can move erratically. While bots can execute trades instantly, you may want to exercise caution.

- Be aware of fees: Crypto arbitrage bots use market orders which attract higher fees than limit orders. These fees often make up the base standard for profitability, so you need to know how much you must exceed to be profitable.

How to Open an Account to Start Crypto Arbitrage Trading

1. Create an account

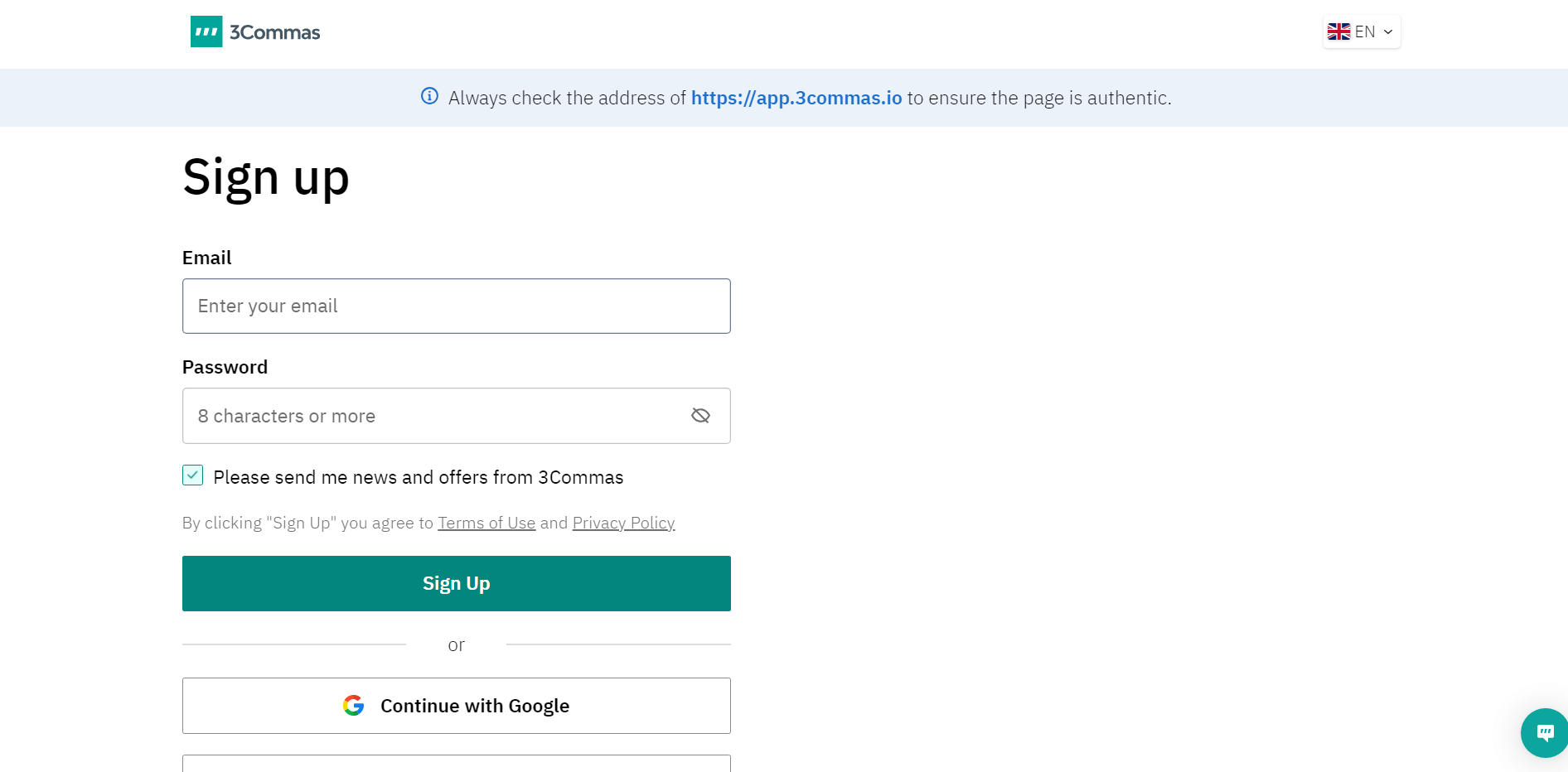

Navigate to the solution of your choice (we used 3Commas) and create an account. For some bots like Gunbots, you may need to download the software first. Enter your name and password as shown above.

2. Verify your account

Verify your account by first confirming it and then completing the profile section with information like an ID and proof of address document. Some bots may not require this process.

3. Create a bot

You can choose a bot from the ready-made ones available, buy a template from a marketplace, or create yours.

4. Connect an exchange

You can connect an exchange or two if you plan to execute spatial arbitrage trades.

5. Execute trades

You can test your strategy beforehand or execute trades.

Latest Crypto Arbitrage Bot News

- 3Commas trading platform is on ‘heightened alert’ after several user accounts were hacked and trades were executed without owners’ knowledge.

- A $10 million Pionex Brave Fund has been launched to Invest in education in Web3.

- Automated crypto strategies building platform Kryll.io surpasses 100,000 registered users.

Final Thoughts on Crypto Arbitrage Bots

We explored 10 of the best bots for executing crypto arbitrage trades and selected 3Commas as our top choice because of the platform’s popularity. It can connect to 16 crypto exchanges and trade multiple cryptos simultaneously.

However, if you do not want to use 3Commas, you can try out any of the other nine bots on our list. Some of them are big on privacy, have native cryptos, or use Futures contracts to execute delta-neutral strategies.

To get started, sign up for a 3Commas account.

Methodology - How We Picked the Best Crypto Arbitrage Bots

The bots covered in this guide were chosen through rigorous research and reviews. We paid attention to security, features, reputation, price, and competitive edge.

The bots listed are the best we found in the various categories we listed them. For example, we listed Gimmer as the best bot for digital wallets because it connects to your crypto wallet as a funding source.

Check out our why trust us and how we test pages for more information on our testing process.